简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How Bond Yields Affect Currency Movements

Abstract:A bond is an “IOU” issued by an entity when it needs to borrow money. An IOU, a phonetic acronym of the words "I owe you," is a document that acknowledges the existence of a debt. Yields do reflect growth expectations, which eventually drives the inflation trend. Yields matters in forex market, when the broad currency moves are driven by the expectations of central bank financial policy stances.

A bond is an “IOU” issued by an entity when it needs to borrow money. An IOU, a phonetic acronym of the words “I owe you,” is a document that acknowledges the existence of a debt. Yields do reflect growth expectations, which eventually drives the inflation trend. Yields matters in forex market, when the broad currency moves are driven by the expectations of central bank financial policy stances. These entities, like governments, municipalities, or multinational companies, need a lot of funds in order to operate so they often need to borrow from banks or separate person just like you .

Assuming you own a government bond, in effect, then the government has borrowed money from you. You can be wondering, “Isnt that the same like having stocks?”. Actually there is a difference and One great difference is that bonds in forex trading have a normally defined term to maturity, since the owner gets paid back the money he loaned, called the lead at a predetermined set date. Similarly, when an investor collects a Marketing bond from a company, he gets paid at a designated percentage of return, this is popularly called the bond yield, while at a certain time intervals. These periodical interest payments are commonly called coupon payments.

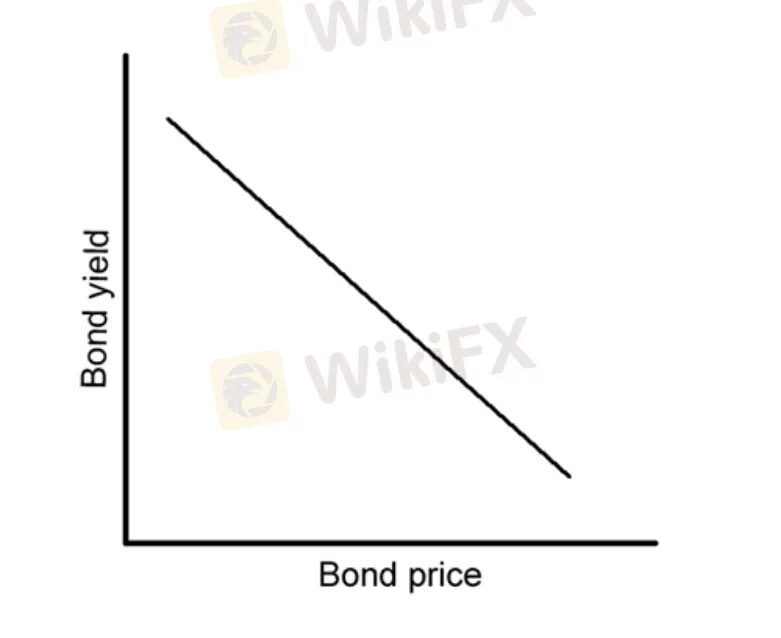

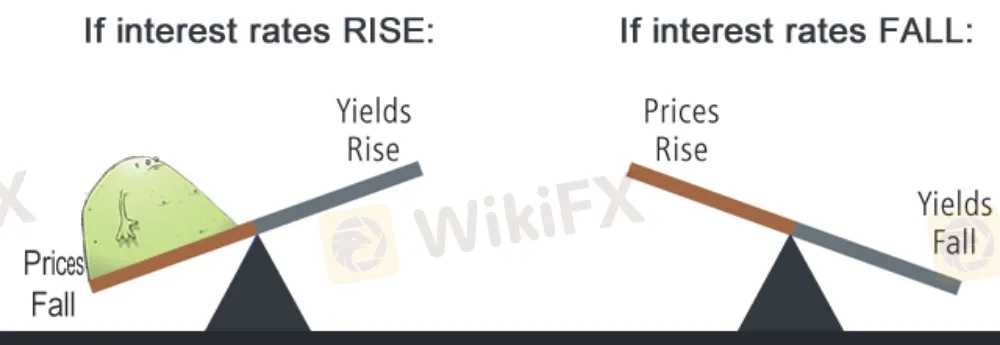

Therefore can explain Bond Yields as the amount of return or interest paid to the bondholder while the bond price is the sum of money the bondholder pays for the bond. Now, bond prices and bond yields are matched in opposition. When bond prices rise, bond yields fall and vice-versa. Let's look at a simple illustration to help you understand and to be able to recall:

How about this one?

Relax a bit.Does this have something to do with the currency market?!! Let‘s jut skip that question for now. Always bear in mind that inter-market relationships leads currency price action. Generally, the fact about the yield is that, it works perfectly and still taken as the count of the strength of a nation’s stock market, and by this the demand for the nations currency gets enlarged.

Let's take an example, U.S. bond results has compute the performance of the U.S. stock market, thereby reflecting the demand for the U.S. dollar. Let's take Look at one scenario: Demand for bonds usually increases when investors are cared much about the safety of their stock investments. Their concern over the safety drives bond prices higher and, by virtue of their reversed relationship, pushes bond down. As more and more investors keep themselves away from stocks and other high-risk investments, and increased demand for “less-risky instruments” like U.S. bonds and the safe-haven U.S. dollar pushes their prices higher. Government bond use it to be indicator of the overall direction of the countrys interest rates and expectations.

For example, in the U.S., you would Centre yourself on the 10-year Treasury note. A yield that is progressing is dollar bullish. Otherwise is dollar bearish. It‘s considered crucial to know the Primary changes of why a bond’s Results is rising or falling. And this can be based on expectations from the gain amount it can depends on market uncertainty and a “flight to safety” with capital flowing from the property that are risky like stocks to less sensitive property, Like say a bonds. After understanding how rising bond usually cause a nations currency to rise, probably you are now anxious to find out how this can be applied to forex trading. Alright, cool young man...

Remember that one of our goals in forex trading (apart from catching plenty of pips!), is to pair up a strong currency with a weak one by first comparing their respective economies. Now How can we use their bond yield to do that?

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator