Score

MFG

Ireland|2-5 years|

Ireland|2-5 years| https://www.mfg-forex.com/us/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Ireland

IrelandUsers who viewed MFG also viewed..

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

mfg-forex.com

Server Location

United States

Website Domain Name

mfg-forex.com

Server IP

47.242.86.165

Company Summary

Note: MFGs official site – https://www.mfg-forex.com/us/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| MFG Review Summary in 10 Points | |

| Founded | 2-5 years |

| Registered Country/Region | United States |

| Regulation | Not regulated |

| Market Instruments | Forex, CFDs on precious metals, energy commodities and indices |

| Demo Account | Not disclosed |

| Leverage | 1:100 |

| EUR/USD Spread | Not disclosed |

| Trading Platforms | MT5 |

| Minimum Deposit | $1000 |

| Customer Support | Email, Phone |

What is MFG?

MFG, short for MFG Financial Limited, is a global brokerage firm based in the United States with offices in London and Hong Kong as well. It offers market instruments including Forex, CFDs on precious metals, energy commodities and indices to traders. However, it is important to note MFG is currently not regulated by any recognized financial authorities which raises concerns when trading.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Wide range of trading instruments across multiple asset classes | • Not regulated |

| • MT5 platform | • Lack of transparency |

| • Multiple payment methods supported | • Website unfunctional |

| • High minimum deposit | |

| • Report of scams |

MFG Alternative Brokers

There are many alternative brokers to MFG depending on the specific needs and preferences of the trader. Some popular options include:

Admiral Markets - Admiral Markets offers a user-friendly platform and a diverse range of instruments, making it a solid option for traders of all experience levels.

CMC Markets - CMC Markets is a reputable broker offering a comprehensive range of financial instruments and advanced trading tools, making it an excellent choice for traders seeking a reliable and feature-rich platform.

Rakuten Securities - Rakuten Securities provides a user-friendly trading environment and a diverse selection of trading products, making it a solid option for traders looking for a broker with a good balance of accessibility and variety.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is MFG Safe or Scam?

When considering the safety of a brokerage like MFG or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: It is not regulated by any major financial authorities,which means that there is no guarantee that it is a safe platform to trade with.

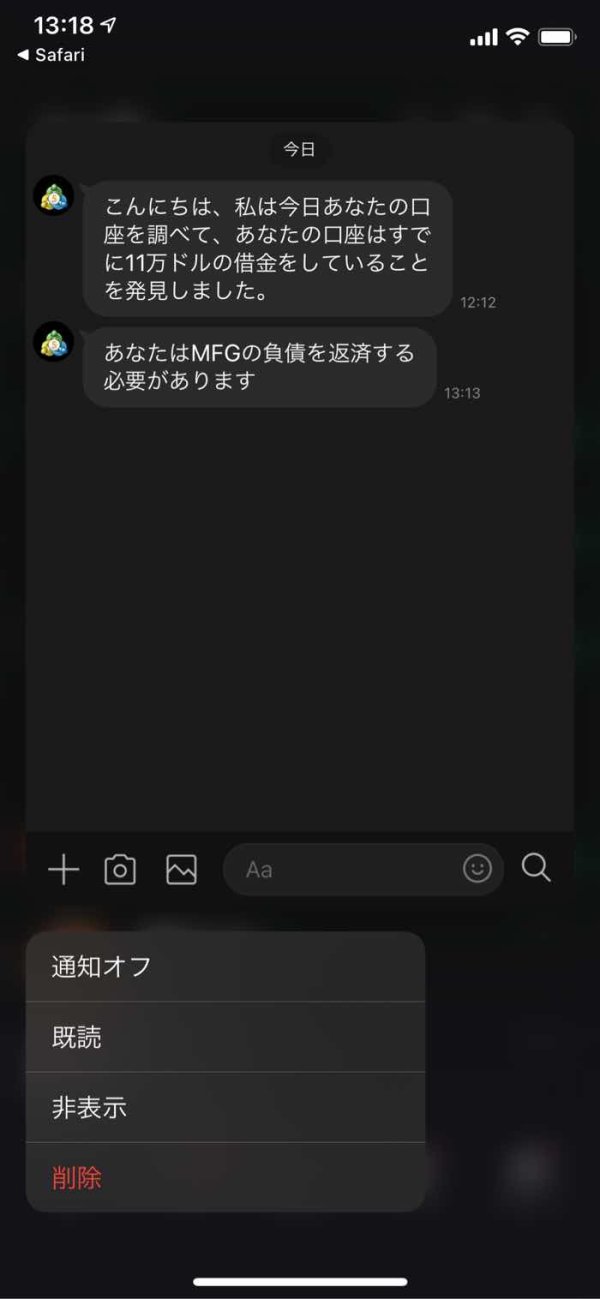

User feedback: 2 reports of scams on WikiFX should be taken into consideration as potential red flags. It is recommended to conduct thorough research and due diligence before engaging with any financial institution or investment platform.

Security measures: So far we cannot find any security measures info on Internet for this broker.

Ultimately, the decision of whether or not to trade with MFG is a personal one. You should weigh the risks and benefits carefully before making a decision.

Market Instruments

MFG offers a diverse range of market instruments to cater to the trading needs of its clients.

Traders can access the dynamic and liquid Forex market, allowing them to trade major and minor currency pairs and capitalize on fluctuations in global exchange rates.

Additionally, MFG provides opportunities to trade Contracts for Difference (CFDs) on precious metals like gold and silver, allowing investors to participate in the precious metals market without physically owning the assets.

Traders can also engage in CFDs on energy commodities, enabling them to speculate on the price movements of crude oil and natural gas.

Furthermore, CFDs on indices allow traders to gain exposure to the performance of various stock market indices, providing an avenue for diversified investment opportunities.

Accounts

MFG offers two distinct account types, the Standard and Professional Accounts, with a minimum deposit requirement of USD 1000. This minimum deposit amount may be perceived as relatively high compared to some other brokers in the market. While the higher entry threshold might require a more substantial initial investment, potential clients should carefully evaluate the features, services, and benefits provided by MFG to determine if the offering aligns with their trading preferences and financial capabilities.

Leverage

MFG provides leverage of up to 1:100to its traders. Leverage can amplify both potential profits and losses in trading. While higher leverage allows traders to control larger positions with a smaller amount of capital, it also increases the level of risk involved. Traders should exercise caution and carefully manage their risk exposure when utilizing high leverage. It is important to fully understand how leverage works and its potential impact on trading positions before engaging in any trading activities. Traders should consider their risk tolerance and financial situation before deciding on an appropriate leverage level for their trading activities.

Trading Platforms

MFG provides the widely recognized MetaTrader 5 (MT5) trading platform, offering traders a powerful and versatile platform to engage in various financial markets. MT5 is known for its advanced trading features, sophisticated charting tools, and an extensive range of technical indicators, empowering traders to conduct in-depth analysis and execute trades with precision. The platform's user-friendly interface and customizable layout cater to traders of all levels, from beginners to seasoned professionals. With access to a diverse range of market instruments, including Forex, CFDs on precious metals, energy commodities, and indices, traders can efficiently navigate the financial markets and pursue their trading strategies with confidence using the MT5 platform.

Overall, MFGs trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | Trading Platforms |

| MFG | MT5 |

| Admiral Markets | MT4, MT5, Webtrader |

| CMC Markets | MT4 and own platform |

| Rakuten Securities | MT4 |

Deposits & Withdrawals

MFG is said to offer a convenient and diverse range of payment options to facilitate smooth and secure transactions for its clients.

Traders can choose to fund their accounts using traditional bank transfers, ensuring straightforward and reliable fund transfers directly from their bank accounts.

Additionally, MFG accepts payments through major credit card providers, such as VISA and MasterCard, providing a convenient and widely used method for clients to deposit funds.

For those based in China or holding UnionPay cards, MFG supports payments through China Unionpay, catering to a broader international clientele.

Furthermore, MFG accepts payments through USD Tether, offering clients an alternative and digital means to fund their accounts.

User Exposure on WikiFX

On our website, you can see 2 reports of scams on WikiFX. Traders are encouraged to carefully review the available information. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

MFG provides multiple customer service options to assist its clients. Customers can reach out to MFG through various channels to address their queries and concerns as below:

Email: services@mfg-forex.com.

Phone: +1 6266080886

Conclusion

According to available information, MFG is a non-regulated US -based brokerage firm. While the firm might offer Forex, CFDs on precious metals, energy commodities and indices as market instruments to its clients, it is important to consider certain factors such as lack of regulations that raises concerns. The lack of transparency also increases confusions and reliability issues. Besides, 2 reports of scams on WikiFX are also a red flag that can not be ignored. It is critical that potential clients exercise caution, conduct thorough research and seek up-to-date information directly from MFG before making any investment decisions.

Frequently Asked Questions (FAQs)

| Q 1: | Is MFG regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | Is MFG a good broker for beginners? |

| A 2: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of the lack of transparency. |

| Q 3: | What is the minimum deposit for MFG? |

| A 3: | The minimum initial deposit to open an account is $1000. |

| Q 4: | Does MFG offer the industry leading MT4 & MT5? |

| A 4: | Yes. It offers MT5 trading platform. |

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now