Score

Cowtrading Wealth

United States|2-5 years|

United States|2-5 years| https://cowgloballtd.com/en

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesUsers who viewed Cowtrading Wealth also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

BlackBull

- 5-10 years |

- Regulated in New Zealand |

- Market Making(MM) |

- MT4 Full License

Website

cowgloballtd.com

Server Location

United States

Website Domain Name

cowgloballtd.com

Server IP

34.233.14.55

Company Summary

| Aspect | Information |

| Registered Country/Area | United States |

| Founded year | 1-2 years |

| Company Name | Cowtrading Wealth |

| Regulation | Suspicious Regulatory License |

| Minimum Deposit | $100 (Standard account), $300 (Professional account) |

| Maximum Leverage | 500:1 (Standard and Professional accounts) |

| Spreads | Varies by account type and market |

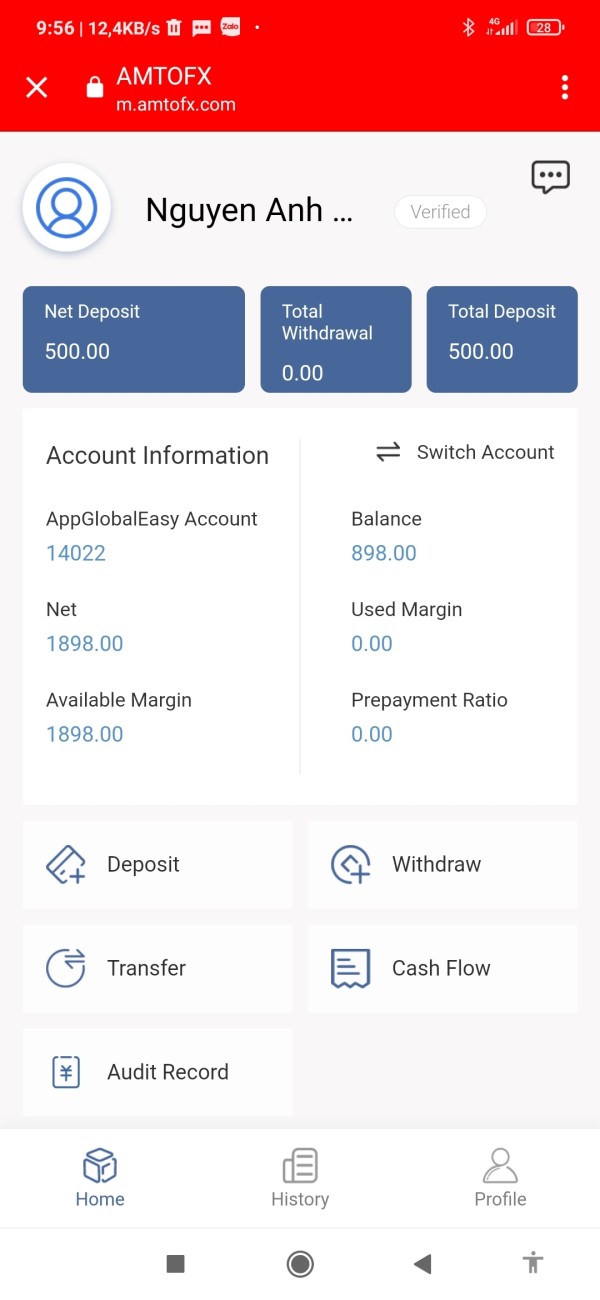

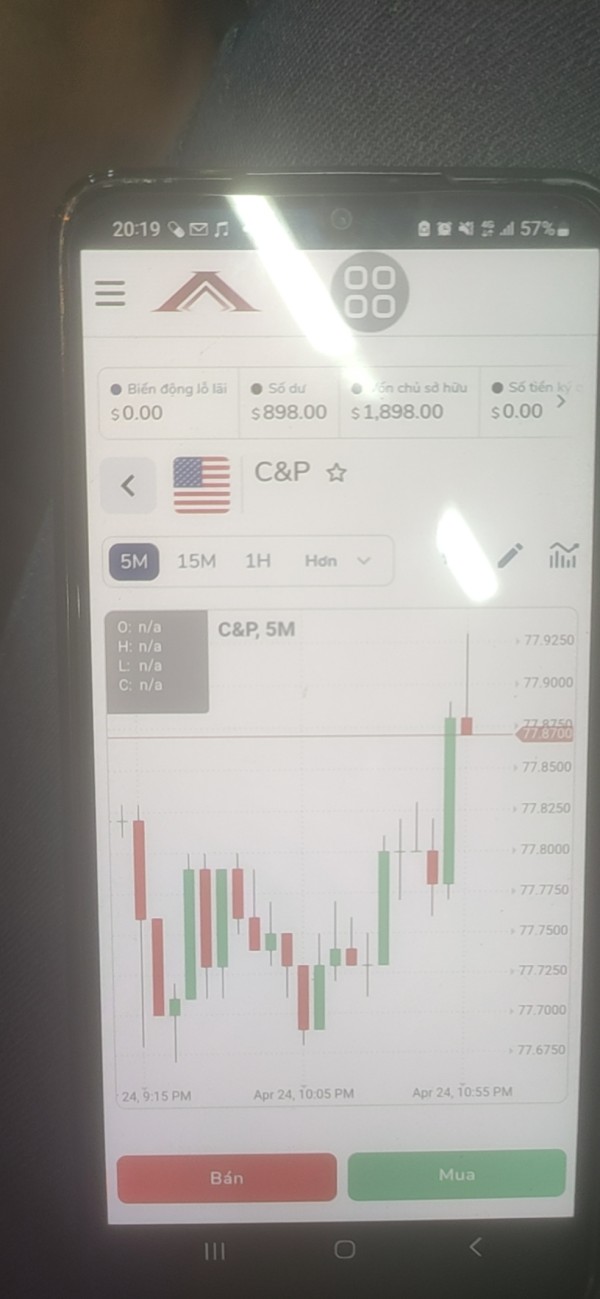

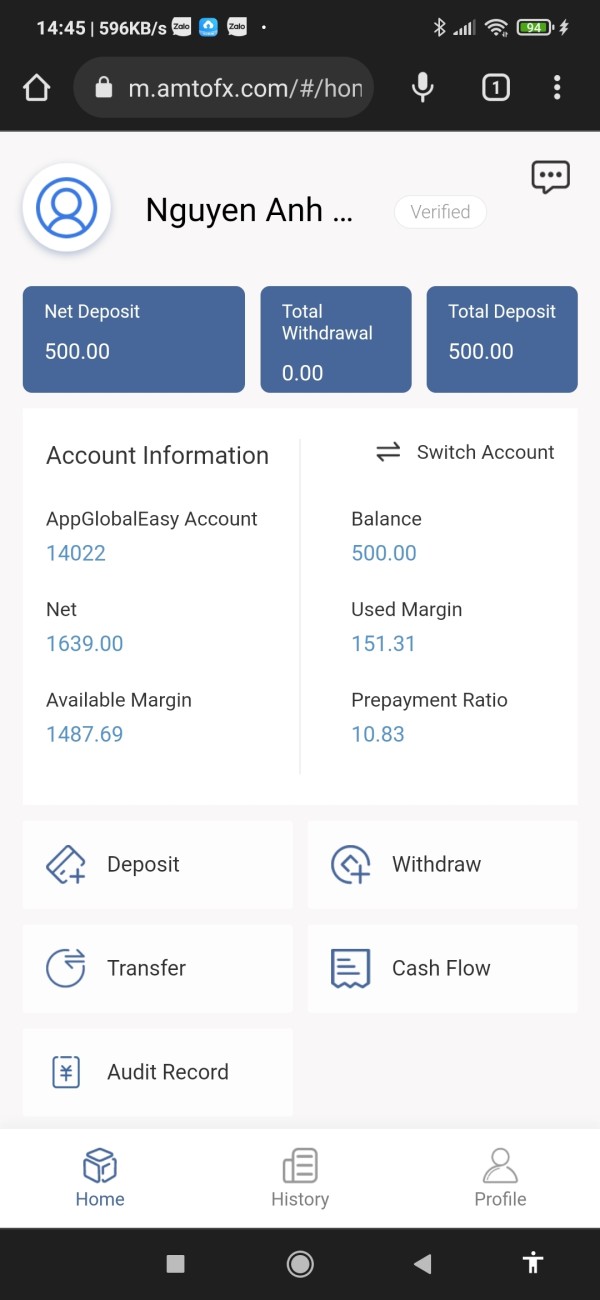

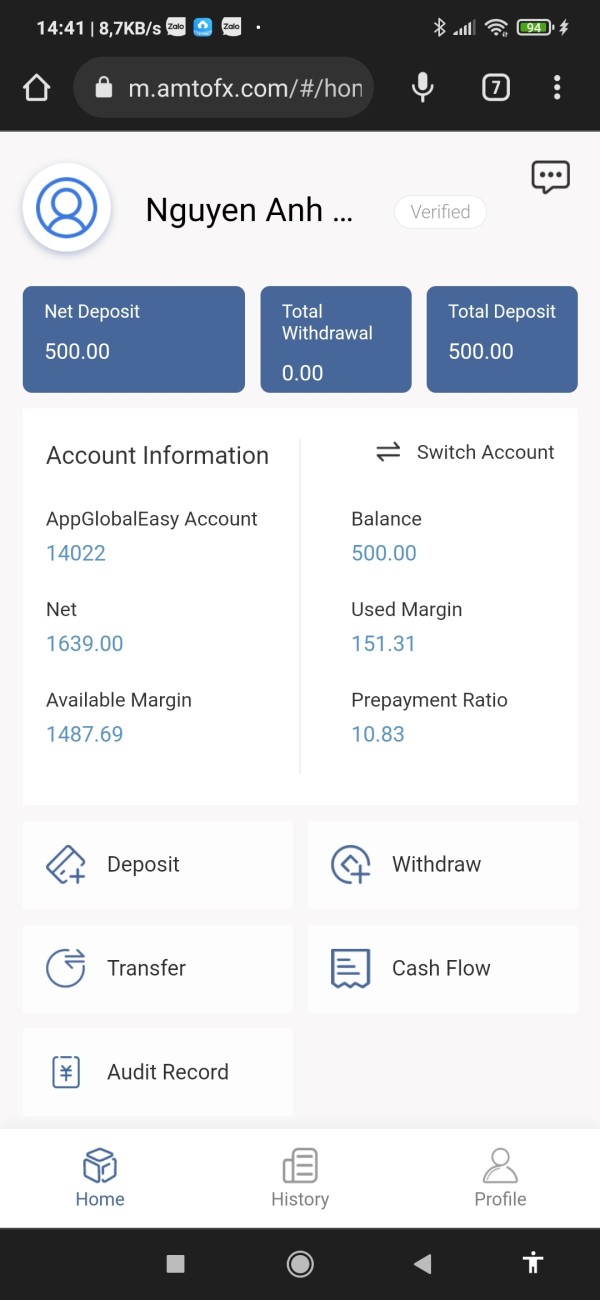

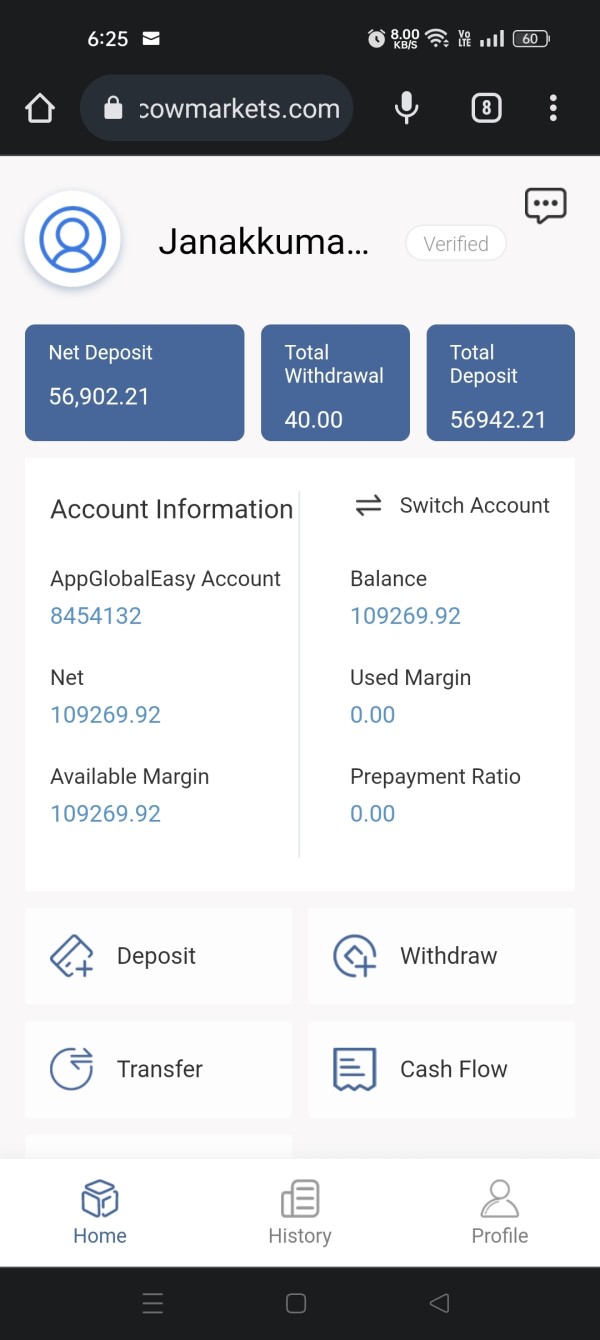

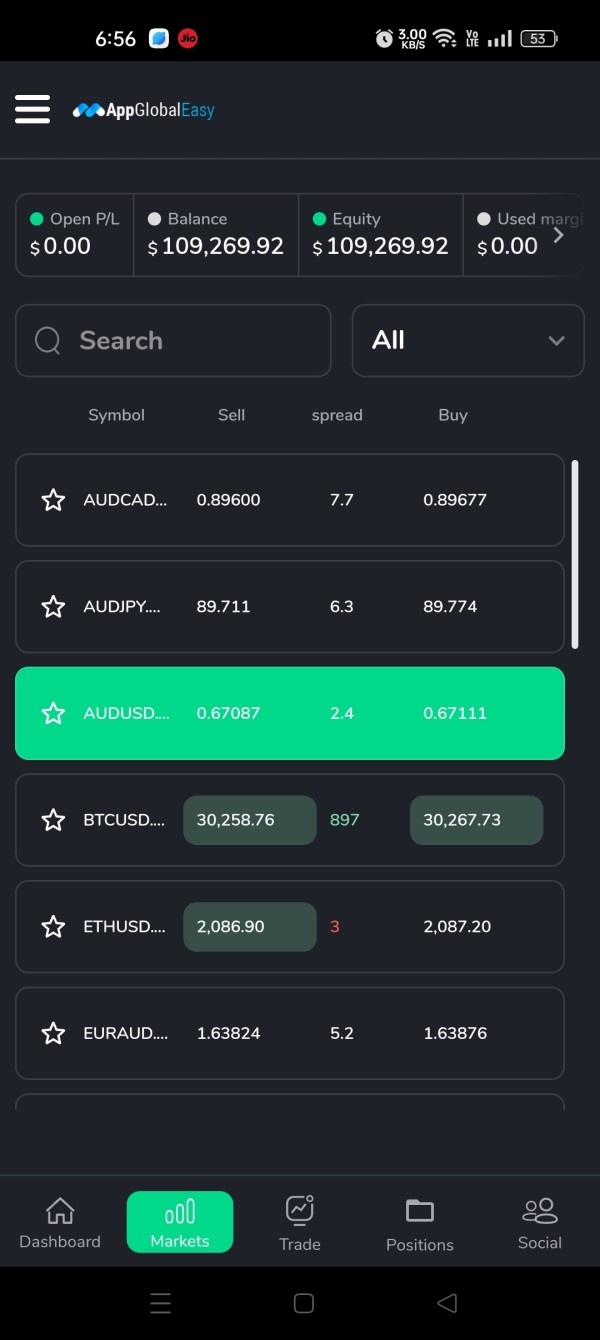

| Trading Platforms | AppGlobalEasy trading platform (desktop and mobile) |

| Tradable assets | Stocks, Commodities, Currencies, Indices |

| Account Types | Standard, Professional |

| Demo Account | Not mentioned |

| Islamic Account | Not mentioned |

| Customer Support | Email: support@cowgloballtd.com |

| Payment Methods | Bank transfer, credit/debit card, e-wallets |

Overview of Cowtrading Wealth

Cowtrading Wealth, based in the United States and in operation for 1-2 years, raises suspicion due to its lack of proper regulatory licensing. This absence of regulatory oversight poses a potential risk to investors, necessitating caution when dealing with this brokerage to safeguard financial interests. The platform offers a range of market instruments, including stocks, commodities, currencies, and indices, providing exposure to various segments of the global market.

Cowtrading Wealth offers two account types, Standard and Professional, with varying minimum deposit requirements and maximum leverage options of up to 500:1. Spreads and commissions depend on the account type and the market being traded. The brokerage facilitates deposit and withdrawal processes through various methods, but withdrawal fees apply. The trading platform is designed to be user-friendly and accessible to both novice and experienced traders. However, it's important to note that concerns have been raised about Cowtrading Wealth's legitimacy and practices, with reviews citing withdrawal difficulties and potential pyramid schemes. These reviews highlight potential issues, emphasizing the need for caution when considering Cowtrading Wealth as a brokerage option.

Pros and Cons

Cowtrading Wealth offers several advantages, including access to a diverse range of market instruments, high leverage options of up to 500:1, multiple deposit and withdrawal methods, a user-friendly trading platform, and no deposit fees. However, it faces notable drawbacks, such as the lack of proper regulation, potential risks associated with negative reviews and exposure cases, withdrawal fees for certain methods, a suspicious regulatory license, concerns about legitimacy and safety, and the main website not being available.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

Is Cowtrading Wealth Legit?

Cowtrading Wealth lacks proper regulation, posing a potential risk to investors. It is essential to exercise caution when dealing with unregulated brokers to protect your financial interests.

Market Instruments

Stocks: Cowtrading Wealth provides access to an array of stocks, including those from multinational corporations like Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), and Tesla (TSLA), as well as stocks from smaller enterprises and emerging markets.

Commodities: The platform offers commodities such as oil (WTI), gas (NG), precious metals like gold (XAUUSD) and silver (XAGUSD), base metals such as copper (XCUUSD), and agricultural products like wheat (ZW).

Currencies: Cowtrading Wealth features a diverse range of currencies, encompassing major ones like the US dollar (USD), euro (EUR), and British pound (GBP), in addition to minor currencies and those from emerging markets.

Indices: Cowtrading Wealth includes various indices like the S&P 500 (SPX), Dow Jones Industrial Average (DJI), and Nasdaq 100 (NDX) in its portfolio, providing exposure to different segments of the global market.

| Pros | Cons |

| Access to a diverse range of stocks | Lack of proper regulation (potential risk) |

| Wide variety of commodities and currencies | Negative reviews and exposure cases |

| Inclusion of various global market indices | Concerns about legitimacy and safety |

Account Types

The Standard account at Cowtrading Wealth requires a minimum deposit of $100, with a maximum leverage of 500:1. The default maximum order size per trade is 100 lots, and it utilizes a floating point spread type.

The Professional account option entails a minimum deposit of $300 and offers a maximum leverage of 500:1. It maintains a default maximum order size of 100 lots and employs a floating point spread type.

| Pros | Cons |

| Accessible minimum deposit of $100 | Higher minimum deposit for Professional account ($300) |

| High maximum leverage of 500:1 | Default maximum order size limited to 100 lots |

| Utilizes a floating point spread type | Limited diversity in default maximum order size |

Leverage

Cowtrading Wealth provides leverage options of up to 500:1 for both its Standard and Professional account types, allowing traders to amplify their positions with a ratio of up to 500 times their initial capital.

Spreads & Commissions

owtrading Wealth offers a variety of spreads and commissions, depending on the account type and the market being traded. For example, the EUR/USD spread on the Standard account is 1.8 pips, while the spread on the Premium account is 1.5 pips. The commission on the Standard account is $0.10 per trade, while the commission on the Premium account is $0.05 per trade.

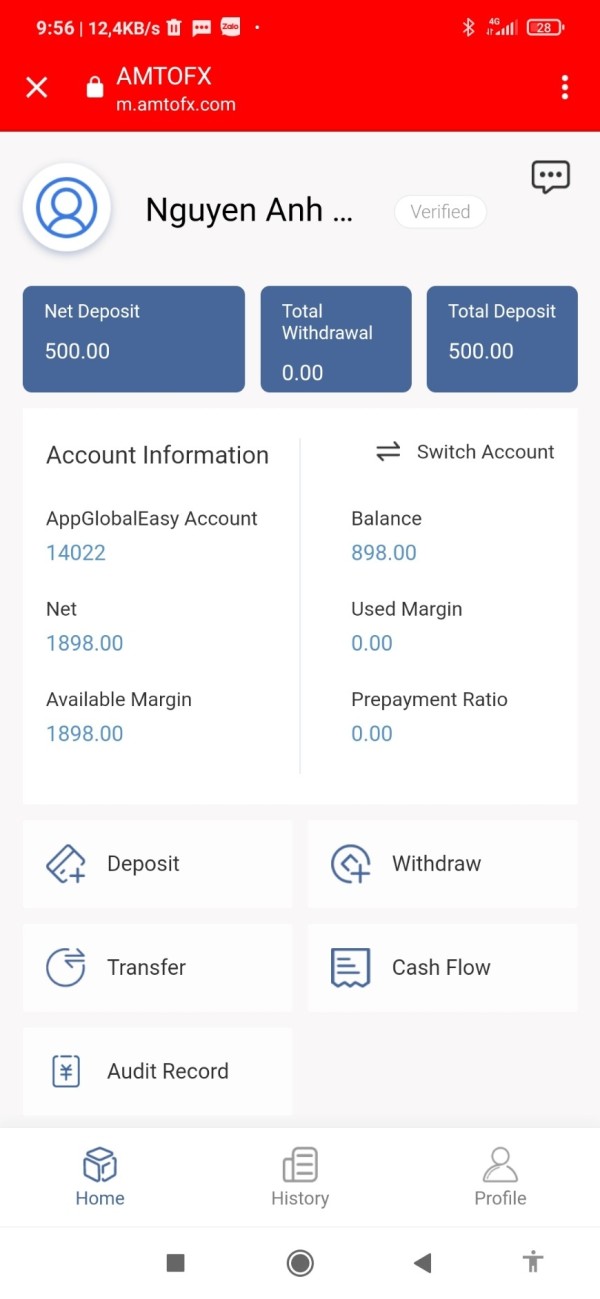

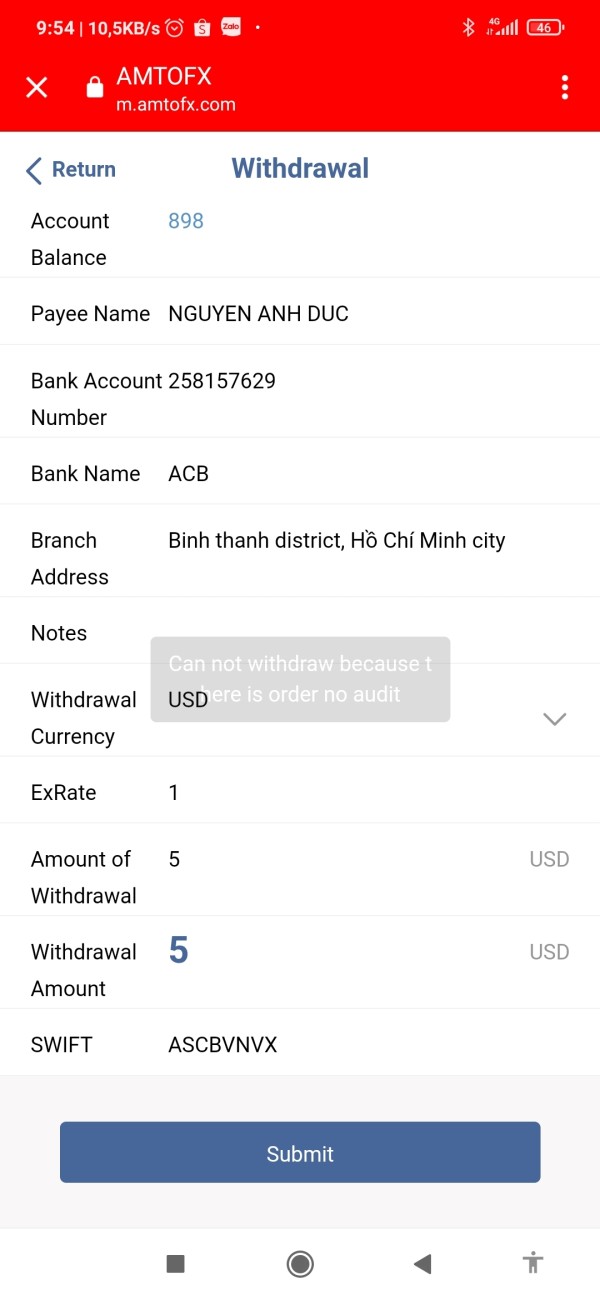

Deposit & Withdrawal

Cowtrading Wealth offers a variety of deposit and withdrawal methods, including bank transfer, credit/debit card, and e-wallets. Deposits are processed instantly (except for bank transfers) and withdrawals are processed within 1-5 business days. There is a minimum deposit of $250 and a minimum withdrawal of $100. The maximum withdrawal is $10,000 per day, $50,000 per week, and $200,000 per month. There are no deposit fees, but there are withdrawal fees that vary depending on the method used.

| Pros | Cons |

| Multiple deposit methods available | Withdrawal fees vary by method |

| Deposits processed instantly (except for bank transfers) | Minimum withdrawal amount of $100 |

| Generous maximum withdrawal limits | Longer withdrawal processing times (1-5 business days) |

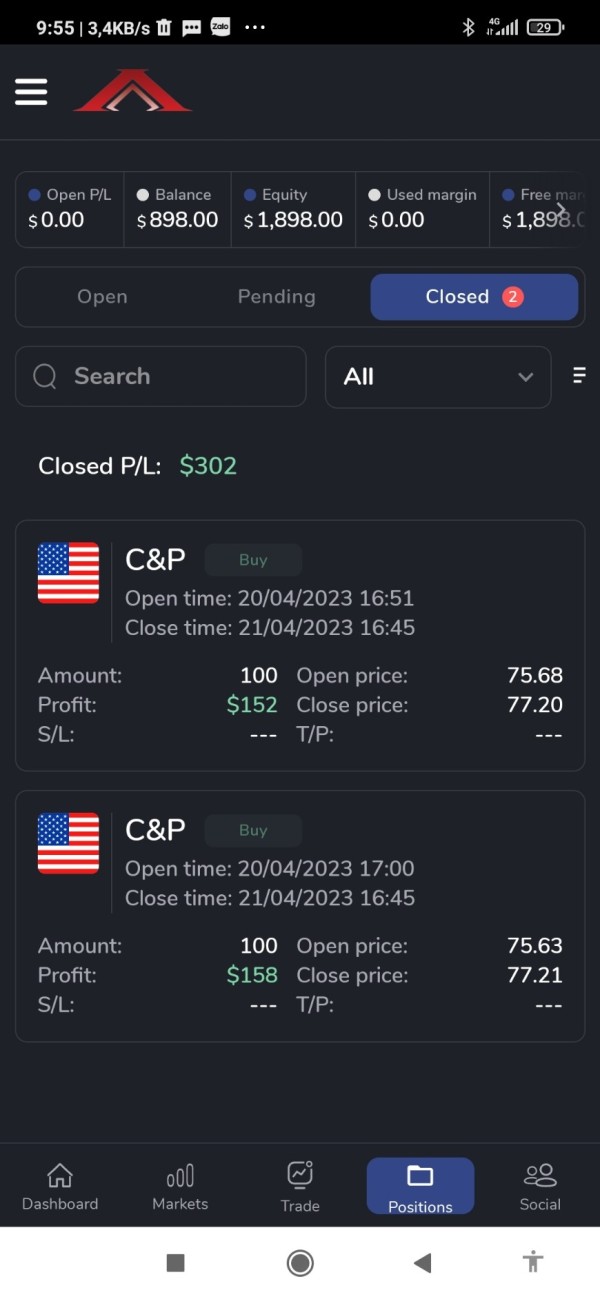

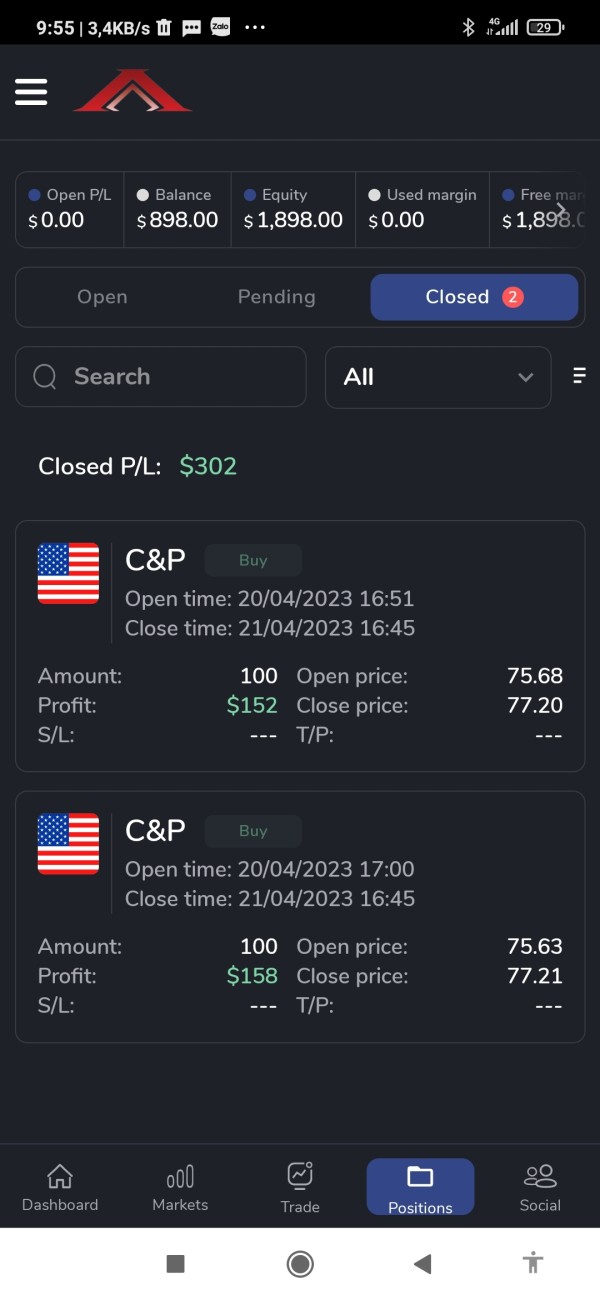

Trading Platforms

The AppGlobalEasy trading platform is a desktop and mobile platform that offers traders access to a variety of markets, including FX, indices, and CFDs, all through a single account and platform. The platform is designed to be user-friendly and easy to navigate, even for beginner traders.

| Pros | Cons |

| Access to various markets (FX, indices, CFDs) | Lack of proper regulation (potential risk) |

| User-friendly and easy-to-navigate platform | Negative reviews and exposure cases |

| Available for both desktop and mobile | Suspicious regulatory license |

Customer Support

Customer support at Cowtrading Wealth can be reached via email at support@cowgloballtd.com.

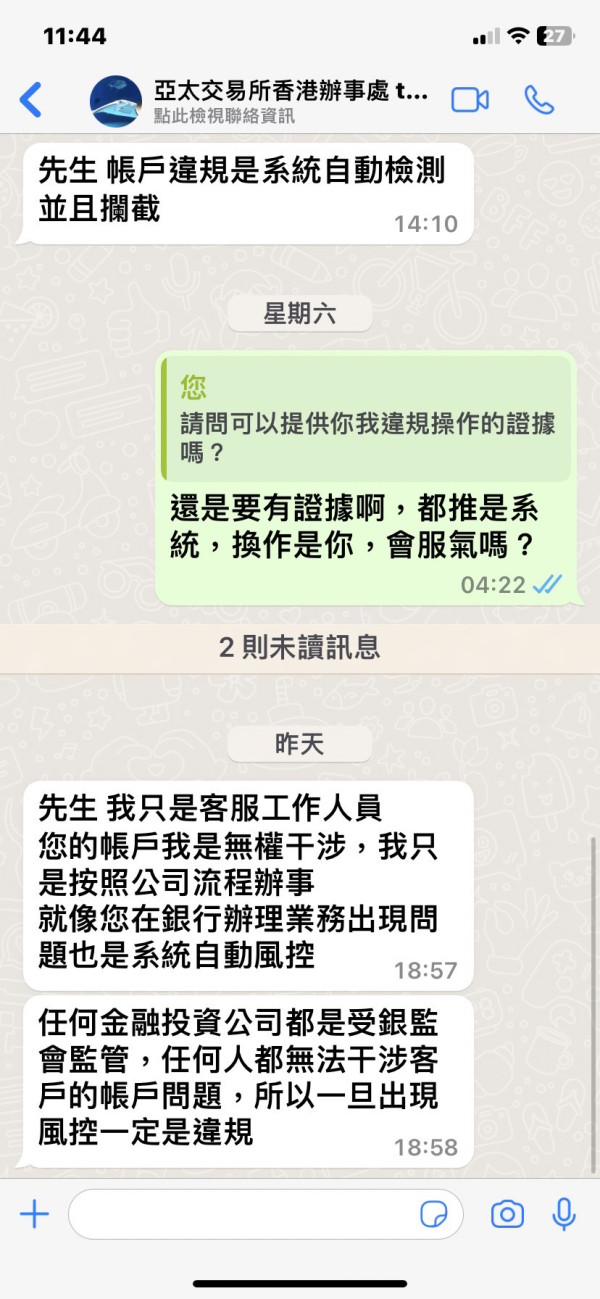

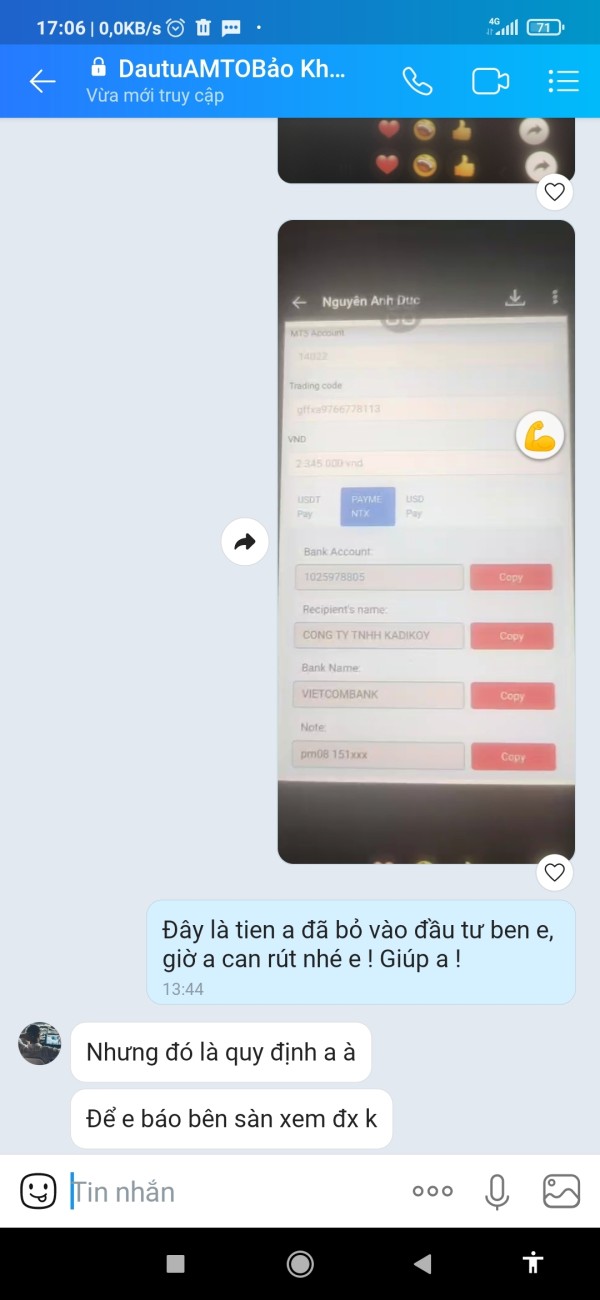

Reviews

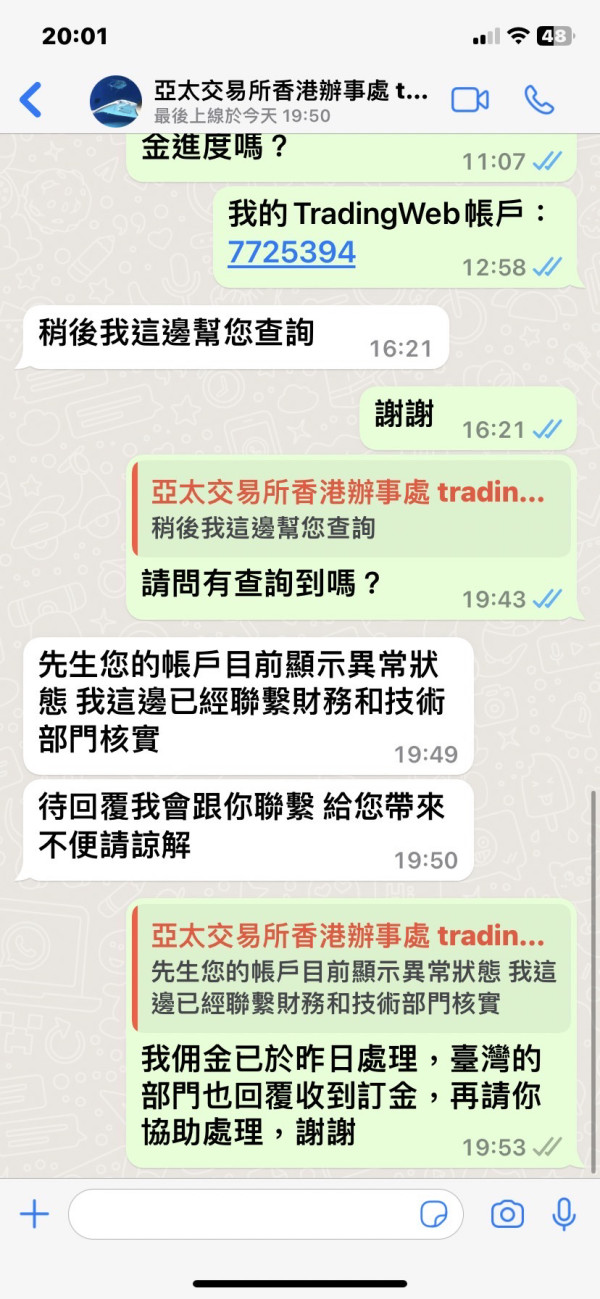

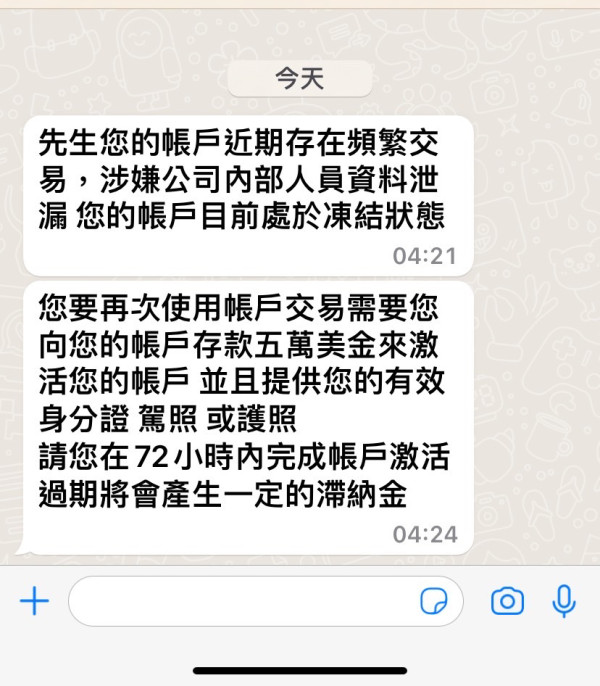

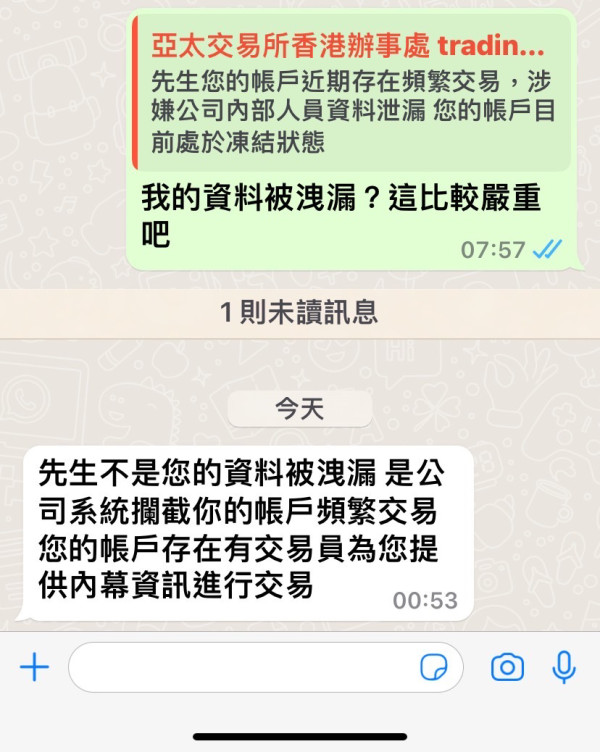

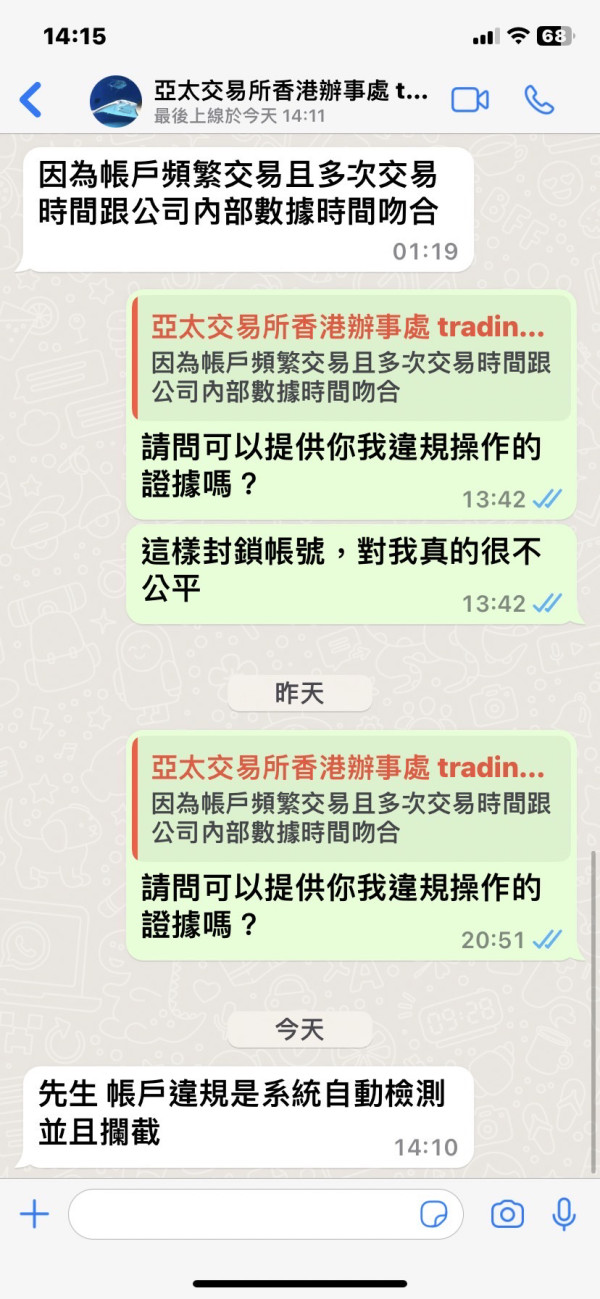

Wikifx has posted three exposure cases related to Cowtrading Wealth. The reviews mention issues with withdrawal, with one user unable to withdraw their funds and raising concerns about the legitimacy of the broker. Another user reported falling victim to a potential pyramid scheme and faced difficulties when attempting to withdraw funds, while the third review details a case where a user was locked out of their account due to alleged insider trading suspicions, demanding a substantial fee for account unlocking. These reviews highlight potential concerns regarding the broker's services and practices.

Conclusion

In conclusion, Cowtrading Wealth, operating in the United States for 1-2 years, raises concerns due to its suspicious regulatory license. This lack of proper regulation poses a potential risk to investors, necessitating caution when dealing with unregulated brokers. Cowtrading Wealth offers a variety of market instruments, including stocks, commodities, currencies, and indices, and provides options for different account types with leverage of up to 500:1. The platform's spreads and commissions vary based on the account type and market, and it supports multiple deposit and withdrawal methods. The AppGlobalEasy trading platform is user-friendly, but it is essential to note that Wikifx has posted exposure cases highlighting issues related to withdrawal, potential pyramid schemes, and account lockouts due to insider trading suspicions. These reviews raise legitimate concerns about the broker's services and practices.

FAQs

Q: Is Cowtrading Wealth a legitimate brokerage?

A: Cowtrading Wealth lacks proper regulation, which raises concerns about its legitimacy. Caution is advised when dealing with unregulated brokers to protect your financial interests.

Q: What market instruments does Cowtrading Wealth offer?

A: Cowtrading Wealth provides access to a wide range of market instruments, including stocks, commodities, currencies, and indices.

Q: What are the different account types at Cowtrading Wealth?

A: Cowtrading Wealth offers Standard and Professional accounts with varying minimum deposit requirements, leverage options, and spreads.

Q: What is the maximum leverage offered by Cowtrading Wealth?

A: Cowtrading Wealth offers leverage options of up to 500:1 for both its Standard and Professional account types, allowing traders to amplify their positions significantly.

Q: How does Cowtrading Wealth handle deposits and withdrawals?

A: Cowtrading Wealth offers various deposit and withdrawal methods, with different processing times and limits. There are no deposit fees, but withdrawal fees vary depending on the method used.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 3

Content you want to comment

Please enter...

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now