Score

Heying Group

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://www.heyingcorp.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed Heying Group also viewed..

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

heyingcorp.com

Server Location

Hong Kong

Website Domain Name

heyingcorp.com

Server IP

45.94.40.27

Company Summary

Due to Heying Group official website (https://www.heyingcorp.com/) is temporarily closed, we can only collect related information from other sites, having a general understanding of this broker.

| Aspect | Information |

| Company Name | Heying Group |

| Registered Country/Area | China |

| Founded Year | Within 1 year |

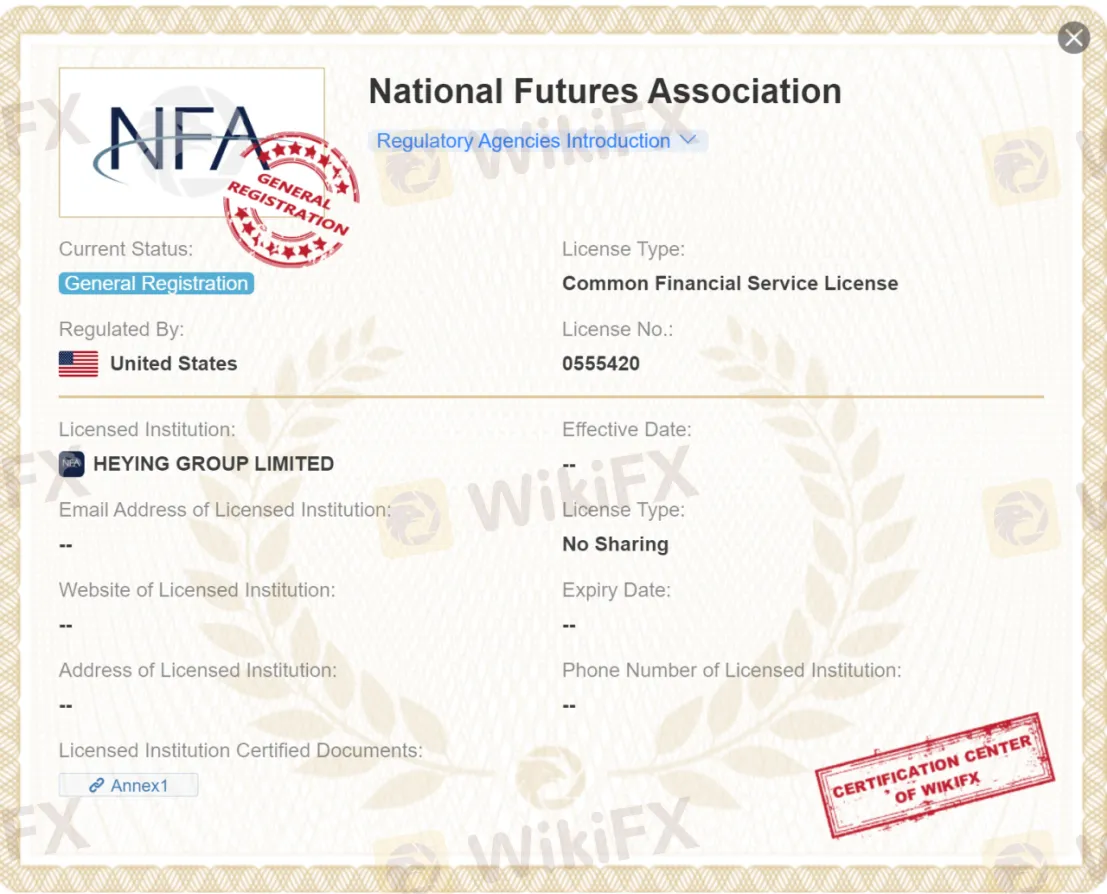

| Regulation | National Futures Association (NFA) |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Trading Platforms | Not specified |

| Tradable Assets | Forex currency pairs, indices, commodities, stocks, futures |

| Account Types | Not specified |

| Demo Account | Not available |

| Customer Support | Email, phone (limited contact information) |

| Deposit & Withdrawal | Accepts e-wallets and local bank wire transfers |

| Educational Resources | Not specified |

Overview of Heying Group

Heying Group is a Chinese brokerage firm founded within the past year. It is regulated by the National Futures Association (NFA). Specific details such as the minimum deposit, maximum leverage, spreads, trading platforms, account types, and educational resources are not specified. The company offers a range of tradable assets including forex currency pairs, indices, commodities, stocks, and futures. They do not provide a demo account for traders. Customer support is available through email and phone, although contact information is limited. Deposits and withdrawals can be made through e-wallets and local bank wire transfers.

Is Heying Group legit or a scam?

It is indeed crucial to consider the regulatory status of a broker when assessing its legitimacy and the safety of funds.

The National Futures Association (NFA) is a self-regulatory organization in the United States that oversees the activities of firms and individuals that engage in futures and derivatives trading. Being regulated by the NFA and holding a license number (in this case, 0555420) indicates that Heying Group has met certain regulatory requirements in the United States.

While regulatory oversight can provide some level of confidence, it's still advisable to exercise caution and conduct thorough due diligence when dealing with any financial institution or investment opportunity. It's a good practice to research the broker further, read reviews from other users or investors, and consider seeking professional advice if needed.

Pros and cons

Heying Group has some notable pros based on the available information. Firstly, the company is regulated by the National Futures Association (NFA), which provides a level of oversight and can instill confidence in the legitimacy and safety of the broker. Additionally, Heying Group offers a diverse range of tradable assets, including forex currency pairs, indices, commodities, stocks, and futures. This variety allows traders to explore different markets and potentially diversify their investment portfolios. The acceptance of e-wallets and local bank wire transfers for deposits provides convenient and flexible options for funding trading accounts.

On the other hand, Heying Group has some cons that should be considered. One significant drawback is the limited contact information provided by the company. With only email and phone support available, traders may face challenges in reaching out for assistance or resolving issues in a timely manner. Another concern is the difficulty in accessing the official website, which can be inconvenient and potentially hinder traders from obtaining necessary information or utilizing the platform effectively. Furthermore, there is a lack of specific details regarding minimum deposit requirements, spreads, leverage, trading platforms, account types, and educational resources. This lack of transparency makes it difficult for potential traders to fully assess the features and conditions offered by Heying Group.

| Pros | Cons |

| Regulated by the National Futures Association (NFA) | Limited contact information provided |

| Offers a range of tradable assets including forex, indices, | Difficulty accessing the official website |

| commodities, stocks, and futures | Lack of information on minimum deposit, spreads, and leverage |

| Accepts e-wallets and local bank wire transfers for deposits | No specified trading platforms, account types, or educational resources |

Market Instruments

Thank you for providing more specific information about the trading products offered by Heying Group. As you mentioned, Heying Group offers a range of tradable financial instruments on its platform, including:

1. Foreign Exchange (Forex) pairs: Forex trading involves the buying and selling of currency pairs, allowing traders to speculate on the exchange rate movements between different currencies.

2. Indices: Indices represent a basket of stocks that track the performance of a specific market or sector. Trading indices allows investors to speculate on the overall performance of a group of stocks rather than individual stocks.

3. Commodities: Commodities are raw materials or primary agricultural products that can be traded. Examples of commodities include gold, silver, crude oil, natural gas, agricultural products, and more.

4. Stocks: Stocks, also known as equities, represent ownership shares in publicly traded companies. Traders can speculate on the price movements of individual stocks and potentially profit from changes in their value.

5. Futures: Futures contracts are agreements to buy or sell an asset at a predetermined price and date in the future. Futures can be based on various underlying assets such as commodities, indices, currencies, and more.

It's worth noting that while Heying Group offers a diverse range of trading products, the specific details, availability, and trading conditions may vary. Traders interested in utilizing Heying Group's platform should refer to the company's official website or contact their customer support for more precise information about the available products, trading features, and any associated fees or requirements. Some of the common products offered by other traders, which can serve as a reference, include:

| Currency | Stocks | Indices | Crypto | Commodities | |

| Funda Markets | √ | √ | √ | √ | √ |

| FXTM | √ | √ | √ | √ | √ |

| FP Markets | √ | √ | √ | √ | √ |

| XM | √ | √ | √ | √ | √ |

Account Types

Heying Group does not provide information about the types of trading accounts they offer. In comparison, brokers like Global Trading247 and AMarkets offer multiple account options, catering to diverse trader needs. These account types may vary in terms of minimum deposits, features, and account structures. It is important to note that Heying Group does not offer a demo account for traders to test their trading conditions before investing real funds. To obtain precise details about Heying Group's account options, it is advisable to visit their official website or contact their customer support.

Leverage

Because his website is temporarily inaccessible, it is difficult to get information about the maximum leverage. The leverage offered by a brokerage firm can vary based on factors such as regulatory requirements and the type of financial instruments being traded. It is crucial to consult the official website of Heying Group or contact their customer support for up-to-date and precise information about the maximum leverage they offer to their clients.

Spreads & Commissions

The spreads and commissions offered by a brokerage can vary based on various factors such as the trading account type, financial instruments, and market conditions.

In general, the spread refers to the difference between the bid (selling) and ask (buying) prices of a financial instrument. It represents the cost of executing a trade and can vary depending on the liquidity and volatility of the market.

Commissions, on the other hand, are fees charged by the broker for facilitating trades. They can be based on a fixed amount per trade or a percentage of the trade's value.

To obtain accurate and up-to-date information about Heying Group's spreads and commissions, it is recommended to visit their official website or contact their customer support. They will be able to provide detailed information about the specific costs and fees associated with trading on their platform.

Since its official website is currently difficult to access, we can only collect network information for reference only.

Trading Platform

Many brokers commonly offer either MetaTrader4 (MT4) or MetaTrader5 (MT5) as trading platforms. MT4 is known for its user-friendly interface, robust charting capabilities, and the option to automate trading through Expert Advisors (EAs). It has been widely adopted in the industry and is favored by many traders.

MT5, on the other hand, is the newer version of the platform and comes with additional features compared to MT4. It offers more advanced charting tools, a broader range of financial instruments that can be traded, and enhanced functionality for certain types of trading strategies.

While MT4 remains popular due to its familiarity and extensive library of EAs and indicators, MT5 provides a more comprehensive set of tools for traders who require advanced analysis and access to a wider range of markets.

It's worth noting that the availability of MT4 or MT5 on Heying Group's platform cannot be confirmed, as specific information about their trading platform is not provided. Traders interested in utilizing Heying Group's services should refer to their official website or contact their customer support for accurate and up-to-date information on the trading platforms they offer.

Deposit and Withdrawal Methods and Fees

Heying Group says to accept deposits with e-wallets and local bank wire transfers, without giving any further details. And because Heying Group does not elaborate on what their minimum deposit requirement might be either, just bear in mind that most brokers will allow you to open a trading account with about 250 USD and even less.

Customer Support

Heying Group's limited contact information, offering only email or phone support, raises concerns about the accessibility and responsiveness of their customer service. Effective communication channels are vital for a trustworthy broker, allowing traders to seek assistance and resolve issues promptly. It is advisable for traders to consider brokers that prioritize transparent and accessible communication, providing reliable channels for support and assistance.

Risk Warning

While Heying Group is regulated by the National Futures Association (NFA), it is unfortunate that their official website's difficulty in logging in can create inconvenience for traders. In such a situation, traders may opt to consider alternative brokers to conduct their trading activities, which can help mitigate potential risks and ensure a smoother trading experience. It is crucial for traders to prioritize accessibility and user-friendly platforms when selecting a broker to facilitate their investment activities.

Conclusion

In conclusion, Heying Group, a regulated brokerage firm, offers a diverse range of tradable assets and accepts convenient deposit methods. However, the company has some notable disadvantages, including limited contact information, difficulty accessing the official website, and a lack of specific details on key aspects such as minimum deposits, spreads, leverage, and trading platforms. The absence of a demo account further restricts traders from experiencing the platform firsthand. While the regulatory oversight and asset variety are advantageous, the mentioned drawbacks should be carefully considered before making a decision. Thorough research and due diligence are essential to ensure a satisfactory and secure trading experience.

FAQs

Q: What regulatory authority oversees Heying Group?

A: Heying Group is regulated by the National Futures Association (NFA), ensuring compliance with regulatory standards and providing oversight.

Q: What are the available tradable assets on Heying Group's platform?

A: Heying Group offers a diverse range of tradable assets, including forex currency pairs, indices, commodities, stocks, and futures.

Q: Can I access a demo account on Heying Group's platform?

A: Unfortunately, Heying Group does not offer a demo account for traders to test the platform before investing real funds.

Q: What are the available deposit and withdrawal methods supported by Heying Group?

A: Heying Group accepts e-wallets and local bank wire transfers as deposit and withdrawal methods, providing flexible options for traders.

Q: How can I contact Heying Group's customer support?

A: Heying Group can be reached through email or phone for any inquiries or trading-related issues. However, it is important to note that the availability and responsiveness of customer support may not be 24/7.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

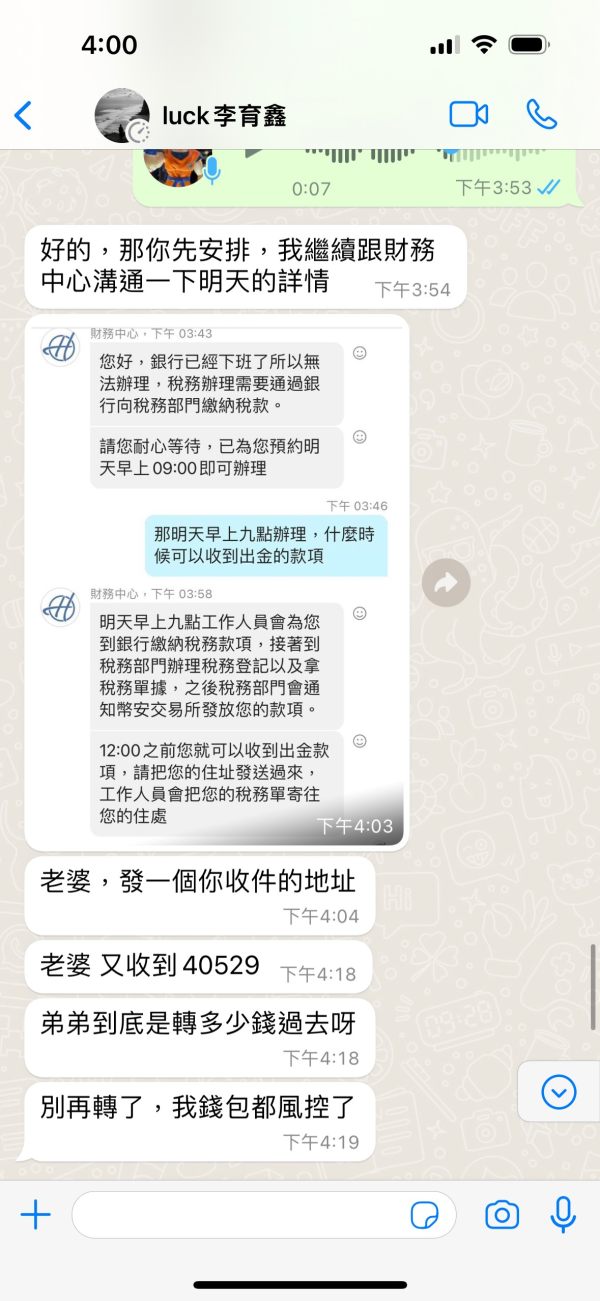

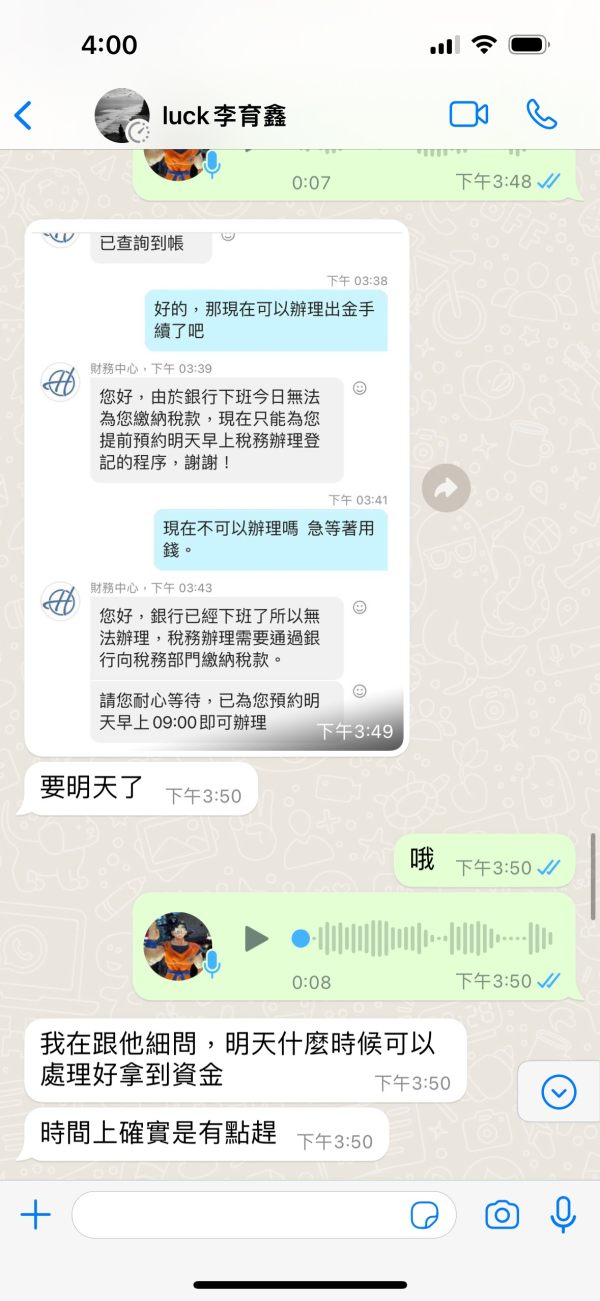

luciawong

Hong Kong

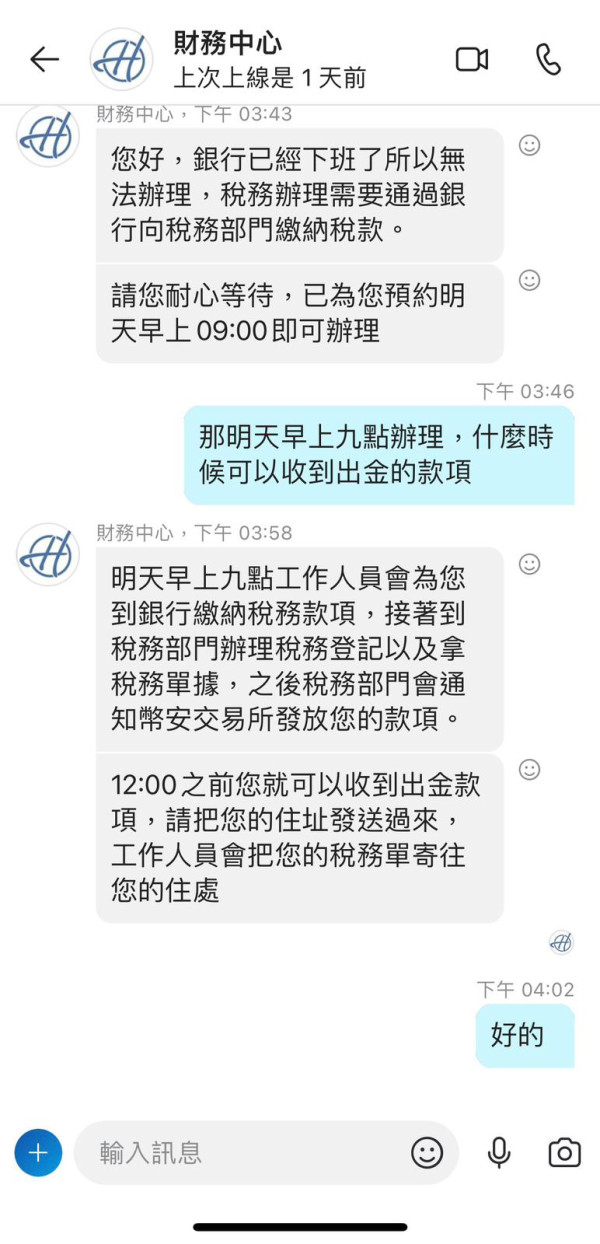

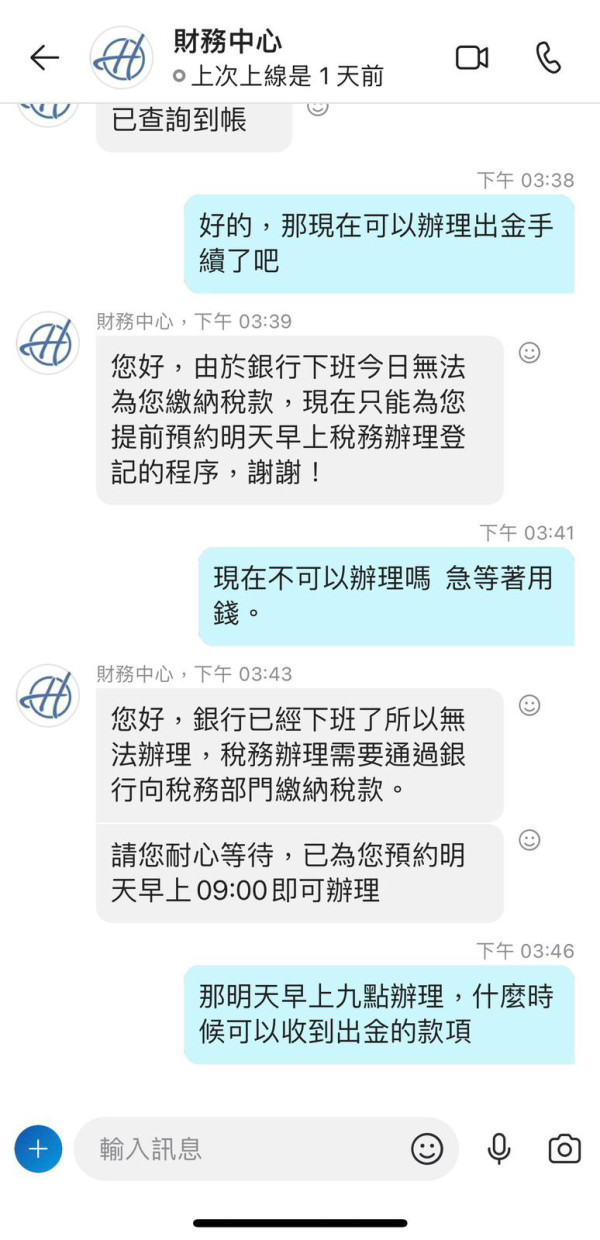

I was scammed! The loss is about 500,000 US dollars, please be careful!

Exposure

2023-11-04

Evangeliner

Netherlands

On finding out about Heying Group, I was initially pleased as it offered a variety of trading options and seemed to have reliable oversight. However, my enthusiasm was quickly dampened by their lack of transparency on crucial aspects. The unavailability of a demo account and detailed description on account types, trading platform and minimal deposit requirement, has become a major deterrent for me. With no clear cut information, how am I to confidently invest my money?

Neutral

2023-12-07

Theophilus

Peru

I find Heying Group to be an intriguing option for my trading needs due to its diverse offering of trading products, such as forex, indices, commodities, stocks, and futures. Also, it being regulated by the National Futures Association gives me confidence in its legitimacy. However, the lack of specifics in terms of minimum deposit, trading platforms, and account types hasn't allowed me to fully assess the company against other potential trading platforms. The absence of a demo account also hinders me as a beginning trader looking to familiarize myself risk-free.

Neutral

2023-12-06

Archibald Kensington

Ecuador

I have some concerns about Heying Group. Firstly, the limited contact information, with only email and phone support available, is quite frustrating. It makes it difficult to get timely assistance or resolve issues effectively. Moreover, the difficulty accessing their official website is a major drawback, as it hinders access to necessary information and the platform itself. The lack of specific details on key aspects such as minimum deposits, spreads, leverage, trading platforms, and account types raises doubts about their transparency and reliability. Additionally, the absence of a demo account makes it challenging to test the platform before investing real money. These factors make me hesitant to fully trust and engage with Heying Group as a broker.

Neutral

2023-06-27

kinkill

Belarus

Heying Group is a decent broker, especially considering its regulation by the National Futures Association (NFA). Their diverse range of tradable assets, including forex, indices, commodities, stocks, and futures, provides ample options for traders. I appreciate the acceptance of e-wallets and local bank wire transfers for deposits, which offers convenient funding methods. Although the specific details about minimum deposits, spreads, leverage, and trading platforms are lacking, the NFA regulation brings some level of trustworthiness to the table. Overall, Heying Group seems like a promising broker for those looking to explore different markets.

Positive

2023-06-27