Score

Haitong

Hong Kong|Above 20 years|

Hong Kong|Above 20 years| http://www.htisec.com/en-us

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Hong Kong 5.35

Hong Kong 5.35Contact

Single Core

1G

40G

1M*ADSL

- This broker exceeds the business scope regulated by China Hong Kong SFC(license number: AAF806)SFC-UNFX/FC Non-Forex License. Please be aware of the risk!

Basic information

Hong Kong

Hong KongUsers who viewed Haitong also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Hong Kong

Philippines

htisec.com

Server Location

Hong Kong

Most visited countries/areas

Philippines

Website Domain Name

htisec.com

Website

WHOIS.8HY.CN

Company

HU YI GLOBAL INFORMATION HONG KONG LIMITED

Domain Effective Date

0001-01-01

Server IP

202.22.244.33

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

| Haitong Review Summary | |

| Founded | 1988 |

| Registered Country/Region | Hong Kong |

| Regulation | Local Regulated |

| Market Instruments | Equities, fixed income products, commodities etc. |

| Demo Account | Available |

| Leverage | 1:30-1:500 (Forex) / 1:5-1:20 (Stocks) |

| Trading Platforms | eHaitong PC |

| Customer Support | Phone, email |

What is Haitong?

Founded in 1988, Haitong Securities has cemented its reputation as one of China's foremost securities firms, boasting over three decades of expertise in the financial domain. Locally regulated, Haitong ensures a reliable and compliant trading environment for its users. Investors can delve into a vast array of market instruments offered, encompassing Equities, fixed income products, commodities, and more. Furthermore, with the eHaitong PC trading platform, users are provided a robust and user-friendly interface to facilitate their trading endeavors, underlining Haitong's dedication to technological excellence and client satisfaction.

Pros & Cons

| Pros | Cons |

| • Established Legacy (Founded in 1988) | • Specific Regulation License Not Available |

| • Diverse Market Instruments | • Concentrated Local Focus |

| • Locally Regulated | • Limited Global Reach |

| • Robust Trading Platform (eHaitong PC) |

Pros:

Established Legacy (Founded in 1988): Haitong's extensive history demonstrates its staying power and experience in the financial market.

Diverse Market Instruments: Offering a vast array of instruments, including equities, fixed income products, and commodities, Haitong caters to a wide array of investor needs.

Locally Regulated: Its status as a regulated entity in its home country signifies adherence to stringent financial standards and protocols, instilling trust among its clientele.

Robust Trading Platform (eHaitong PC): The eHaitong PC platform is indicative of Haitong's commitment to technological advancement, ensuring a user-friendly and efficient trading experience.

Cons:

Specific Regulation License Not Available: Without clear details on its specific regulatory license, potential clients might be uncertain about the exact regulatory framework Haitong operates under.

Concentrated Local Focus: While Haitong has a strong presence in China, this concentrated focus might limit its adaptability or offerings for international markets.

Limited Global Reach : If Haitong's primary operations are centered in China, global investors might feel the platform is less tailored to their needs.

Is HaitongSafe or Scam?

Haitong, despite its emergence in the financial scene, operates without regulatory oversight, a fact that potential users should approach with caution. The absence of regulation means that Haitong isn't bound by the standard protocols, guidelines, or safeguards that are enforced by regulatory bodies to protect consumers. Such a status can entail higher risks related to security, transparency, and the overall reliability of the platform, as there is no external body monitoring or ensuring its adherence to typical industry standards. As a result, users might face unforeseen vulnerabilities and challenges while using an unregulated platform like Tungtai.

However, as with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

Market Instruments

Equity Investment

Haitong directly engages in the management of private equity investment funds in the primary market. Its investment directions cover TMT, big consumption, finance (Fintech), eco-friendly renewable energy, aerospace, new material, integrated circuit, cultural creativity, advanced manufacturing and a number of other fields, as well as the key state-supported industries and new technologies, new industries, new formats and new modes with increasing prospects.

Alternative Investment

Haitong directly makes equity investment in the primary market, and conducts registration-based follow-up investment and investment in financial products in accordance with regulations, The investment direction covers the sci-tech innovation fields of information technology, biomedicine, new energy, new material, high-end equipment manufacturing and environmental protection.

Futures

Haitong Futures specializes in six sectors: macro finance, energy and chemicals, ferrous and non-ferrous metals, agriculture, and shipping. Their approach is fundamentally driven, adopting a top-down perspective with a focus on broad supply-demand cycles and seasonal nuances. With a highly recognized research team, over half of whom are distinguished analysts, they have an elite talent pool—90% with postgraduate degrees and 50% with international education. Besides standard research, Haitong offers customized services tailored to client needs in areas like data, strategy, and training.

Fixed Income

The Fixed lncome Division works as a 'product factory' and as a distribution platform for debt products and OTC derivatives, bringing strong local knowledge to an international platform level and capturing the flow between clients in different regions, whilst remaining an important player in Haitong Bank's relevant markets (lberia, Poland, Brazil and the UK).

Accounts

They provide live trading accounts for their users, allowing them to engage in real-time trading activities. And opening an account with Haitong is free of charge.

Haitongalso provides demo accounts for traders who want to practice and familiarize themselves with the platform before trading with real funds. Demo accounts simulate real market conditions, allowing traders to execute trades using virtual funds.

Leverage

Haitong Securities, in alignment with common practices in the financial industry, provides leverage to its clients to enhance trading opportunities. In many global markets, for instruments like forex, leverage can range from 1:30 to 1:500, depending on the broker and the jurisdiction. For stocks, the leverage often sits between 1:5 to 1:20. While Haitong's specific ratios might vary, leveraging, although a potent tool for amplifying potential returns, also comes with heightened risks. Therefore, while Haitong's leverage offerings underscore its alignment with global trading tools, it also serves as a reminder of the importance of cautious and informed trading.

Fees

Haitong Securities has a structured fee system tailored to various financial instruments and transaction types:

A-shares and Preferred Shares: Fees are capped at 0.3% of the transaction amount, with a minimum fee of 5 CNY.

B-shares: Fees are capped at 0.3% of the transaction amount. The minimum fee is set at 1 USD for Shanghai markets and 5 HKD for Shenzhen markets.

Securities Investment Funds:

For closed-end funds, ETFs, and LOF funds: Fees do not exceed 0.3% of the transaction amount, with a starting fee of 5 CNY.

Bonds (including government bonds, corporate bonds, asset-backed securities, etc.):

For Shanghai markets: Fees do not exceed 0.02% of the transaction amount, starting at 1 CNY.

Convertible Corporate Bonds and Separately Traded Convertible Corporate Bonds:

For Shanghai markets: Fees do not exceed 0.02% of the transaction amount, with a starting point of 1 CNY.

For Shenzhen markets: Fees are capped at 0.1% of the transaction amount.

Convertible Bond Swap Shares: Fees are capped at 0.3% of the transaction amount, with a minimum fee of 5 CNY.

For open-end fund subscriptions and redemptions: Specific fees are detailed in announcements by individual fund companies.

For ETF subscriptions and redemptions: Fees are capped at 0.5% of the subscription/redemption units.

For ETF options: Each contract is capped at 10.1 CNY/contract. Selling options (including covered opening) currently has no commission.

For Shenzhen markets: Fees are capped at 0.02% of the transaction amount.

Trading Platforms

eHaitong PC is a newly developed market trading terminal by Haitong Securities, offering panoramic market data and ultra-fast trading across a complete range of products. It encompasses various investment tools and services such as intelligent stock selection, accelerated Level2 market data, conditional orders, and lightning-fast trades, catering to the comprehensive and multi-tiered investment needs of clients.

Trading Hours

Haitong Securities operates within the Chinese securities market, so its trading hours would typically align with the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE) hours, as well as any other exchanges or markets they operate in.

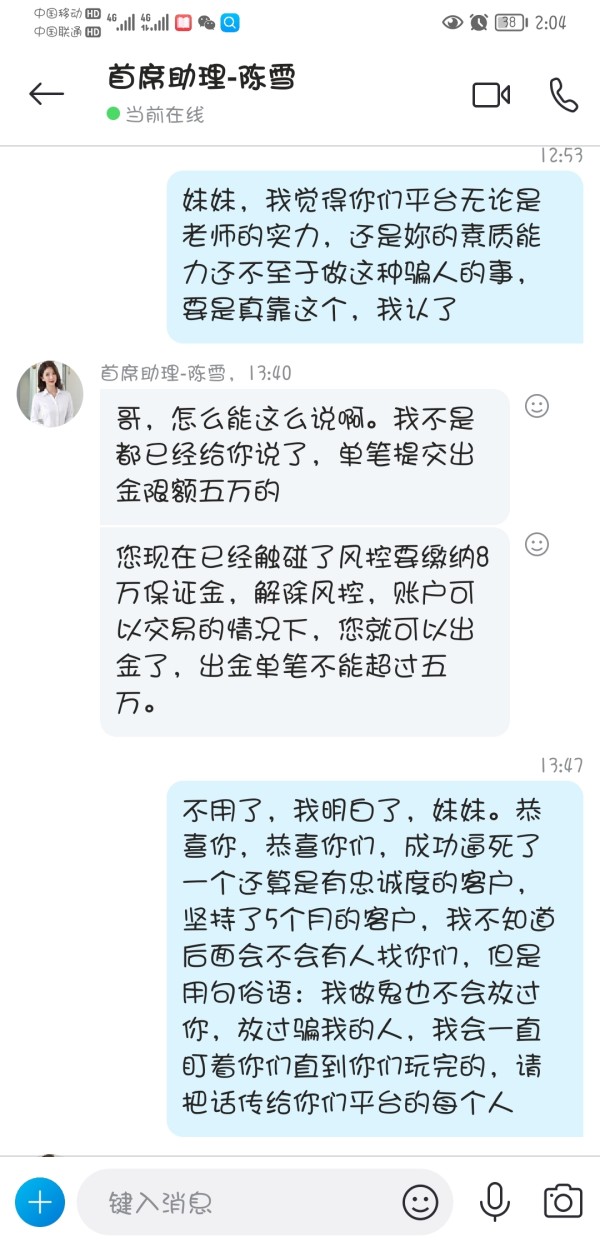

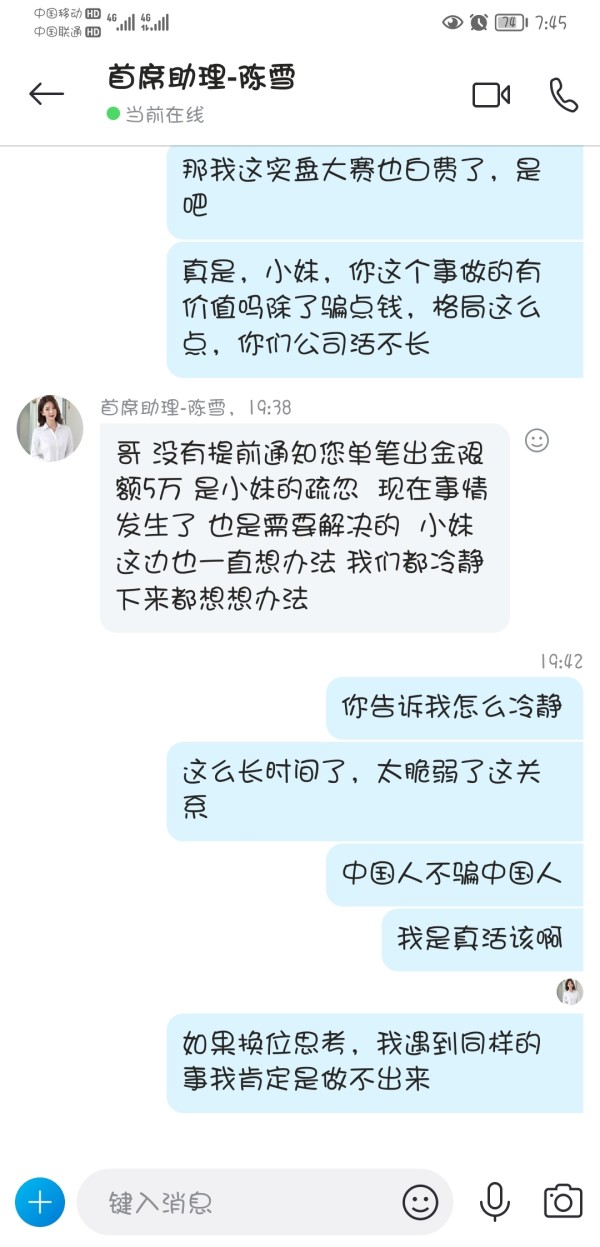

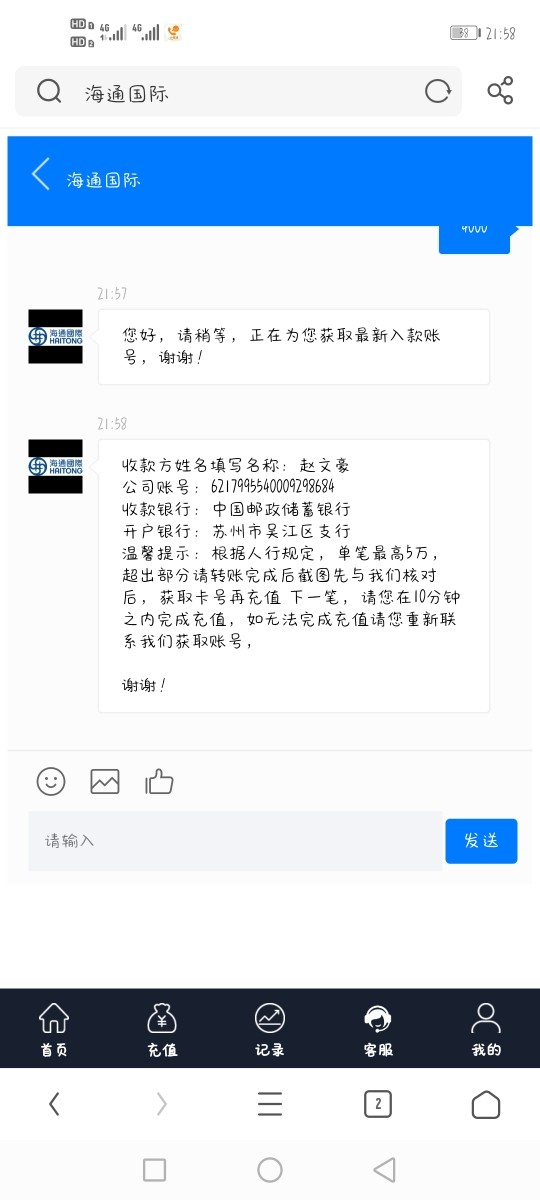

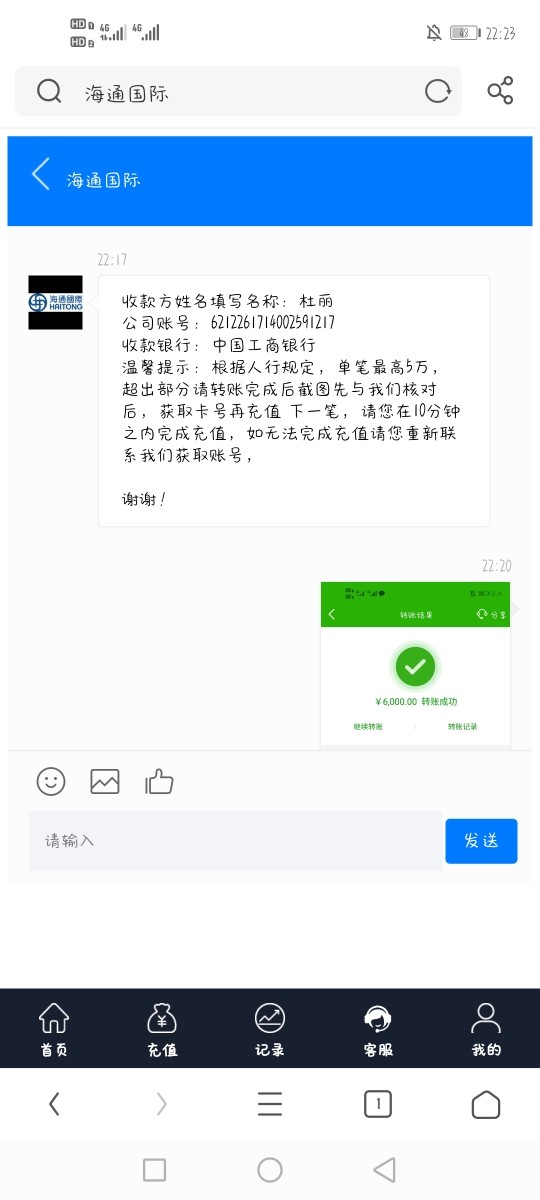

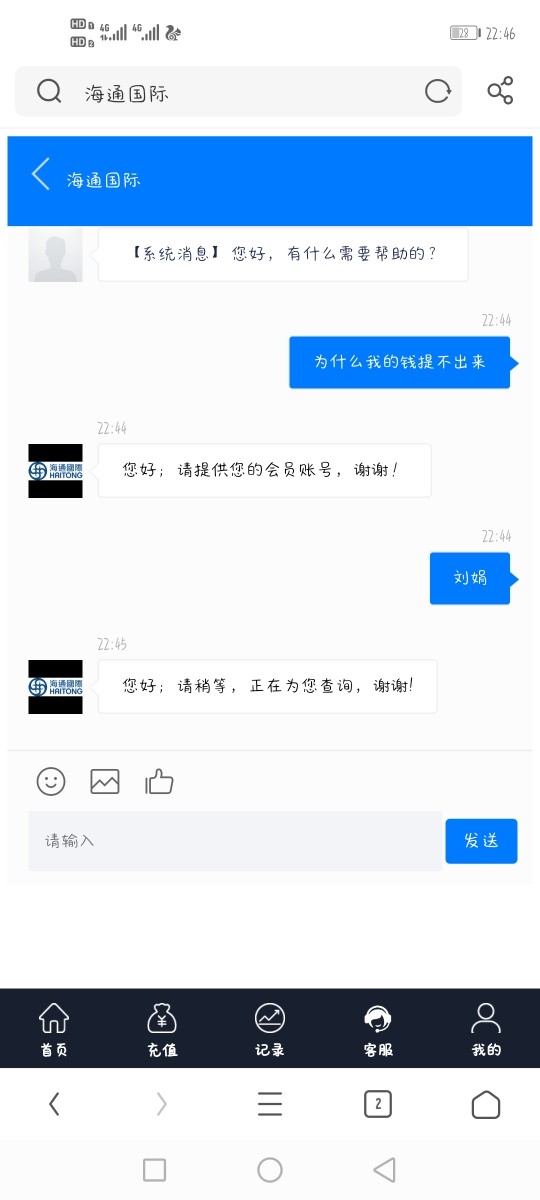

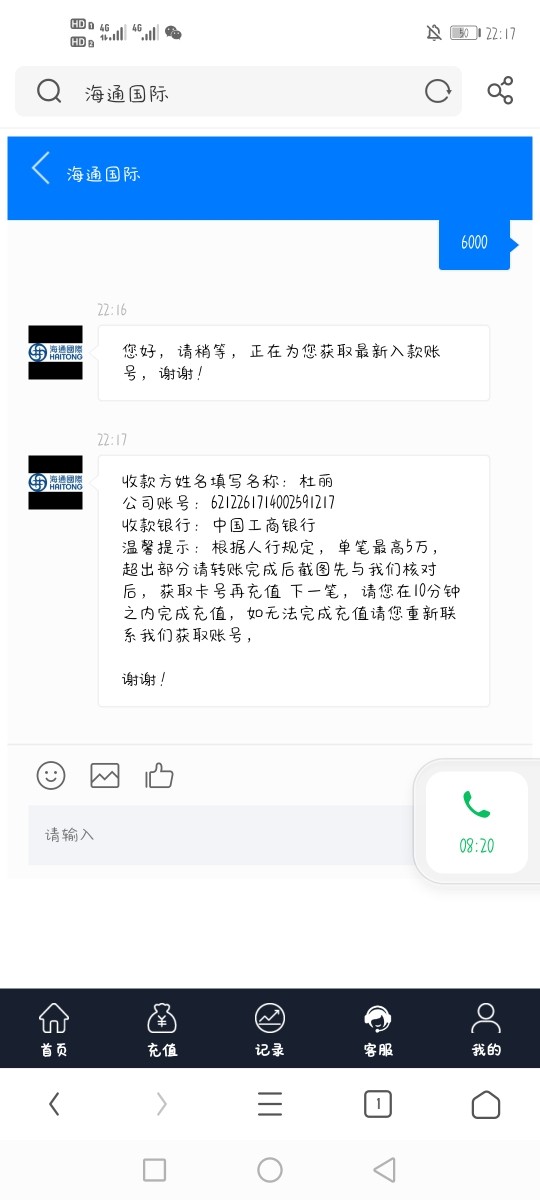

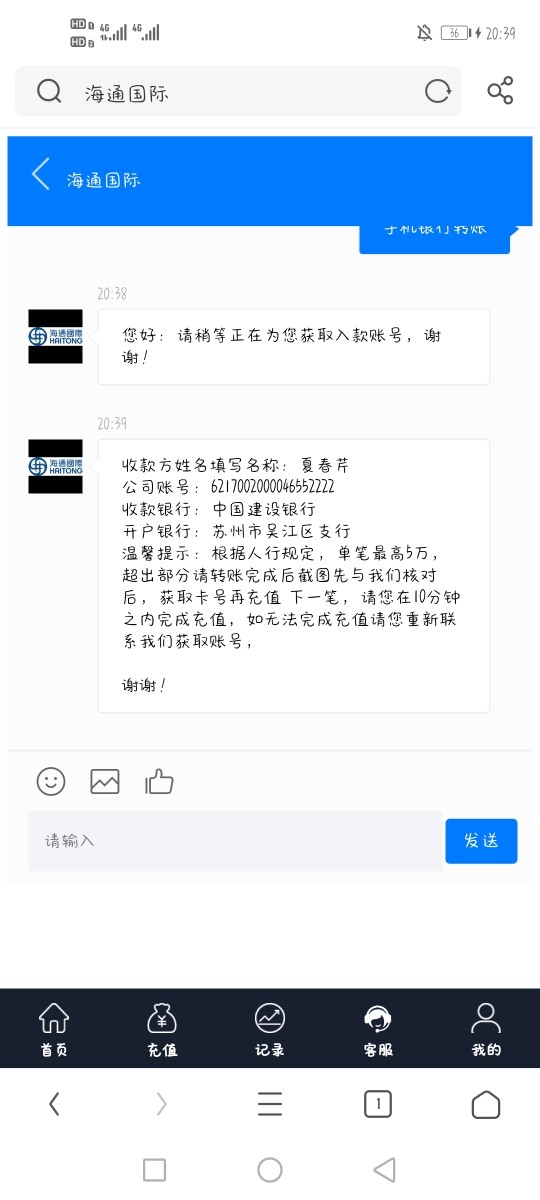

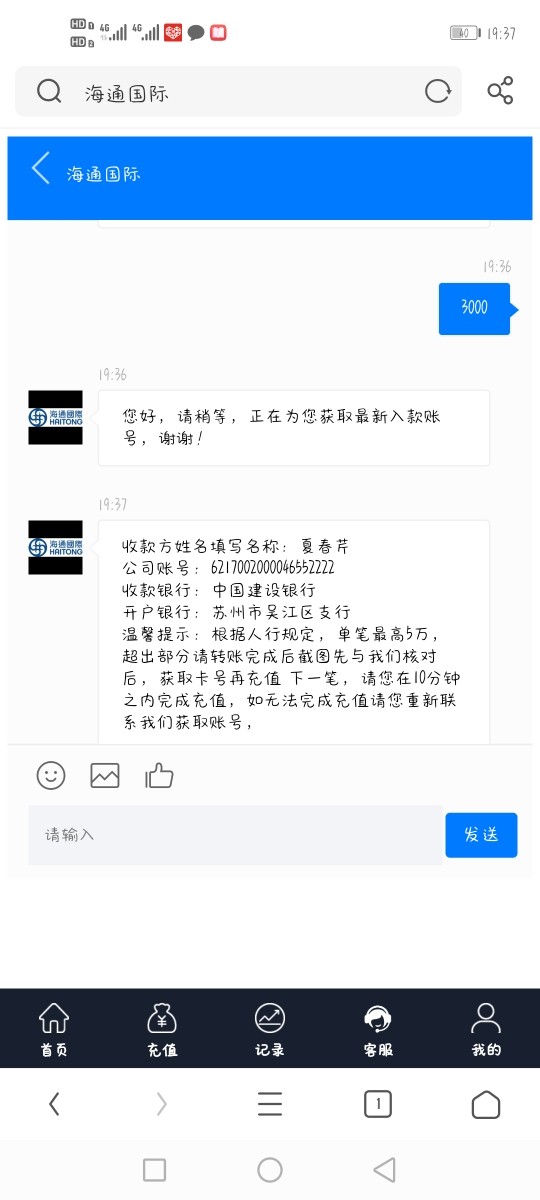

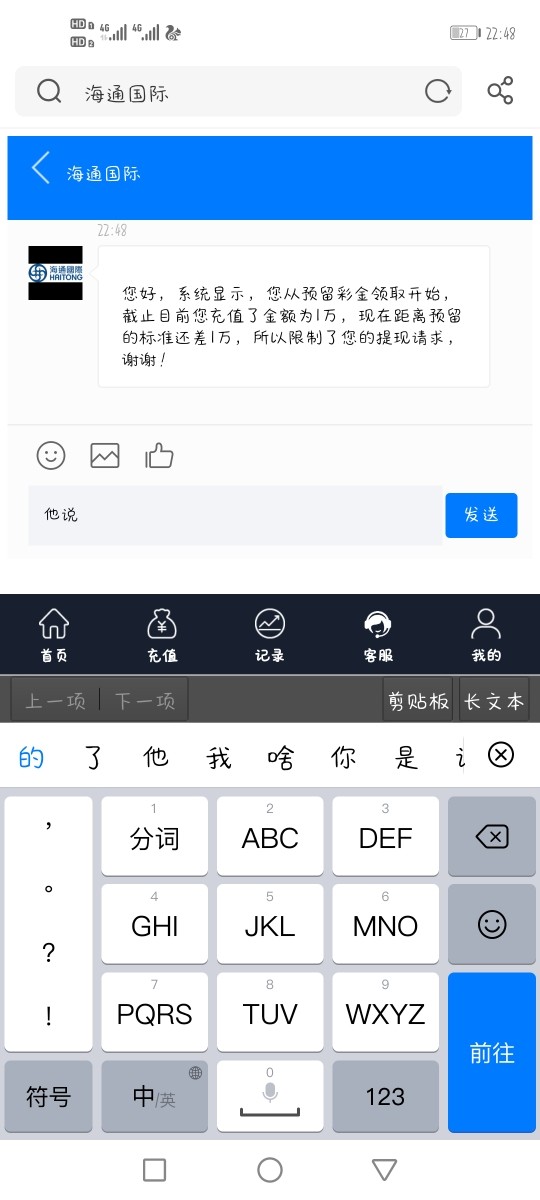

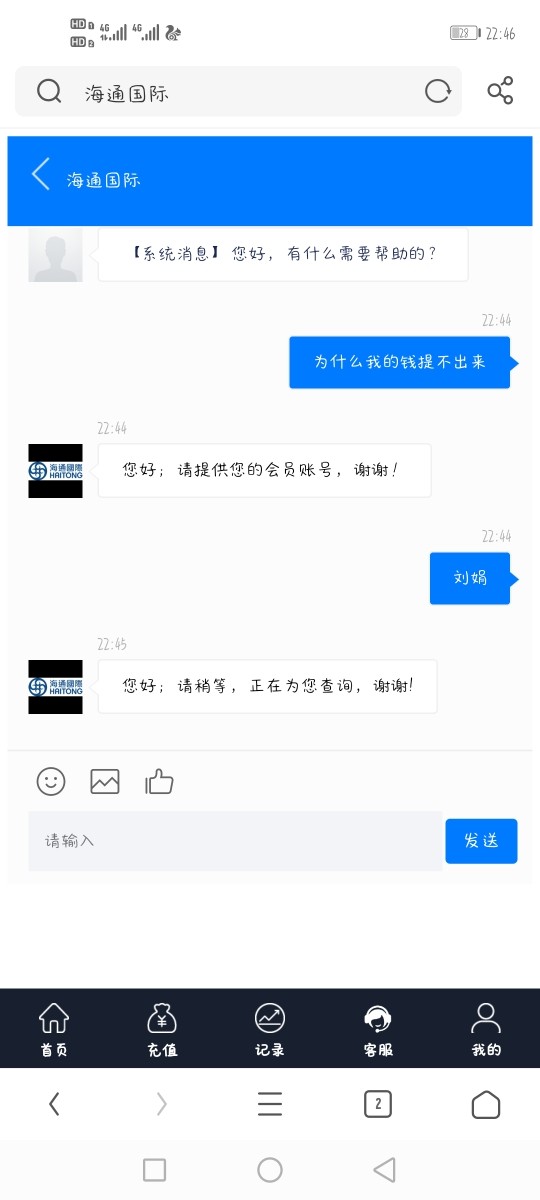

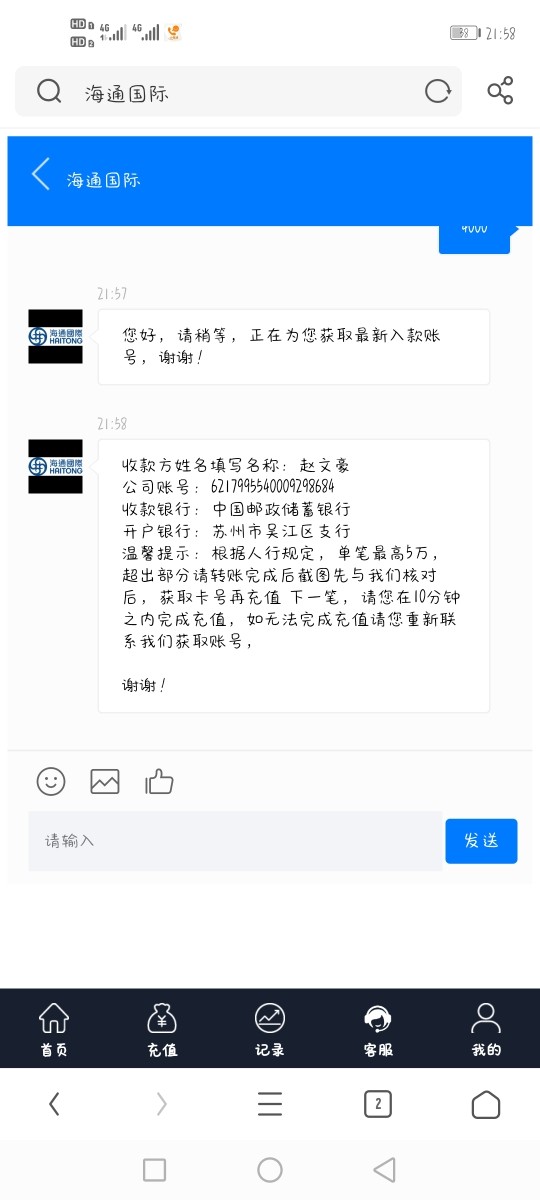

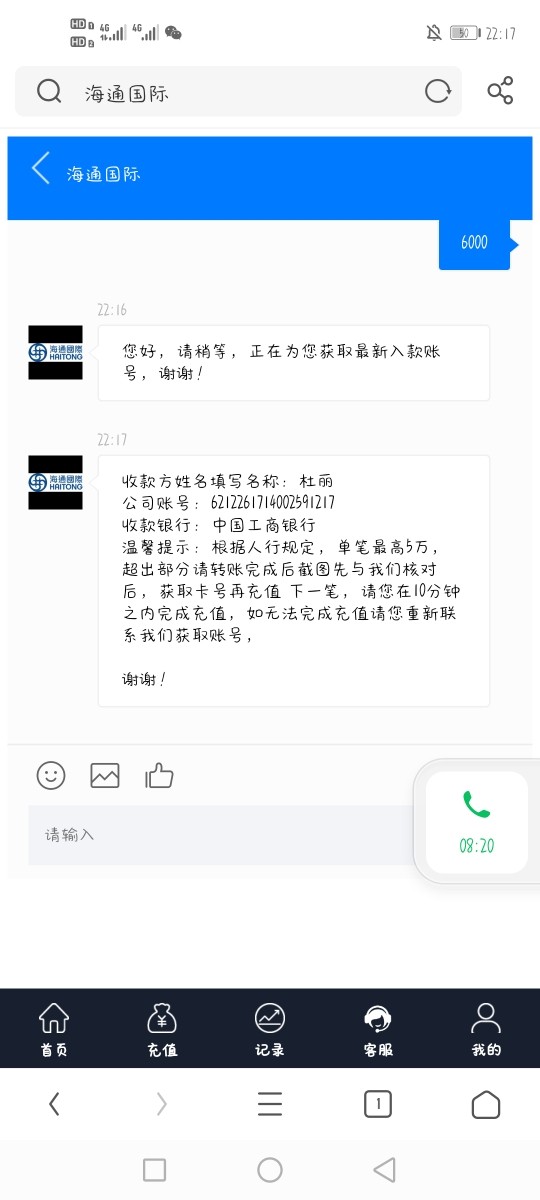

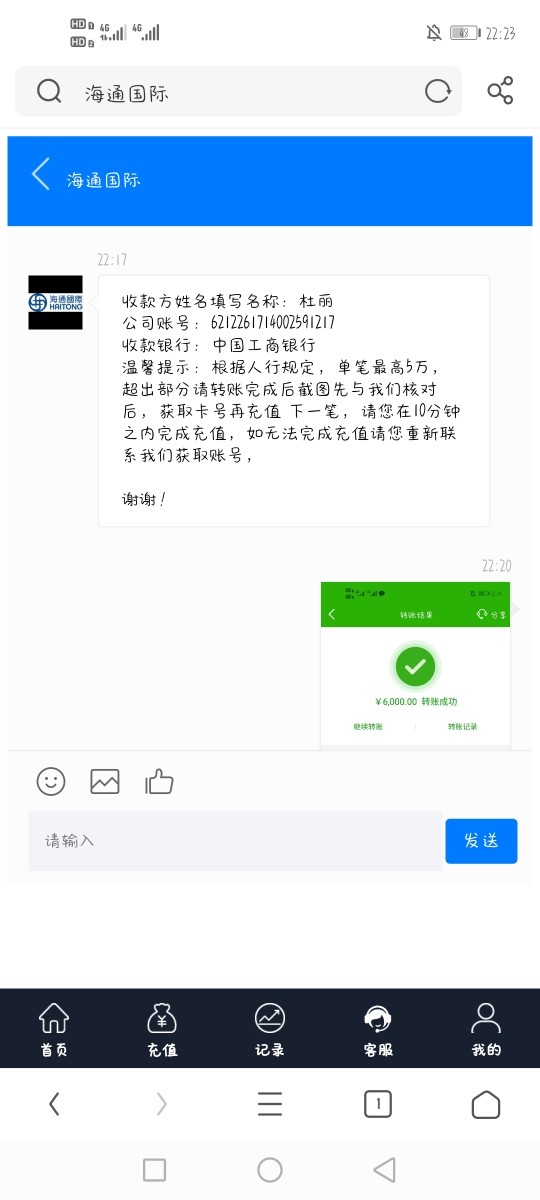

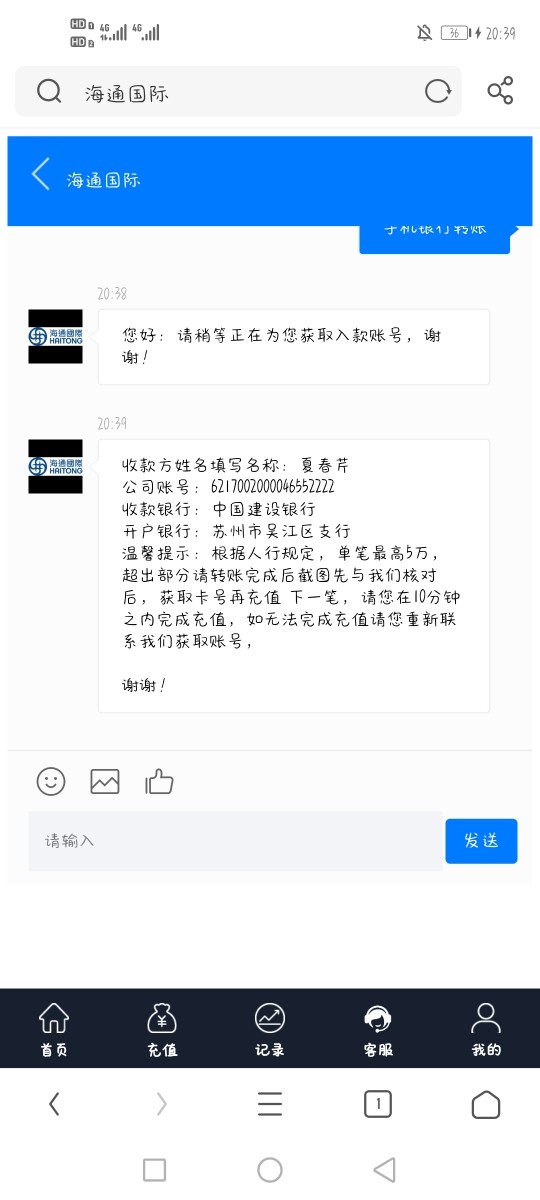

User Exposure on WikiFX

On our website, you can see reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +852 3583 3388

Email: csdept@htisec.com

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Linkedin and YouTube.

Conclusion

In conclusion, Haitong Securities extends a diverse array of services and tools tailored to elevate the investment experience for its clientele. The firm allows a comprehensive range of financial instruments, ensuring clients have varied avenues for their investment strategies. Opening an account is a seamless process, and they provide real-time trading capabilities. Their signature platform, HaitongPro, is equipped with cutting-edge features and is accessible across multiple devices, ensuring that investors have a versatile and efficient trading environment. All in all, Haitong Securities aims to deliver a holistic investment environment catering to both beginners and seasoned market participants.

Frequently Asked Questions (FAQs)

| Q 1: | When can I open an account online via mobile? |

| A 1: | The service is available 24/7 from Monday to Sunday. |

| Q 2: | How can I contact the customer support team at Haitong? |

| A 2: | You can contact via telephone, +852 3583 3388 and email, csdept@htisec.com. |

| Q 3: | How to search for commission fees rate? |

| A 3: | The commission is charged at a rate of not more than 0.3% of the transaction amount, starting from $5. |

| Q 4: | Does Haitong offer industry leading MT4 & MT5? |

| A 4: | No. Instead, it offers eHaitong PC. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- Above 20 years

- Regulated in Hong Kong

- Dealing in futures contracts

- Common Financial Service License

- Suspicious Overrun

- Medium potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

冯海乾RH

Hong Kong

On August 29, 2022, I made a deposit of 150,000. The customer service said that I could withdraw after 3 days, but I couldn't get a single penny. When I withdraw, it said that it was risk-controlled. Everything is a tricl. You must come in and take a look on this.

Exposure

2022-08-31

FX1877989382

Hong Kong

Make u unable to withdraw with varied reasons. Keep u depositing money, But the web is not accessible now

Exposure

2021-03-31

FX1877989382

Hong Kong

The web is disabled. And I can’t get the money of over 60,000

Exposure

2021-03-23

FX1300872812

Nigeria

Amazing service! Trustworthy broker, fast execution and real-time data! Haitong has good and comfortable customer service, honesty in punctuality, I feel lucky to deal with them! Good luck!

Positive

2023-03-03