Score

Unions Market

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://unionsmarket.group/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Users who viewed Unions Market also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

unionsmarket.group

Server Location

United States

Website Domain Name

unionsmarket.group

Server IP

172.67.167.207

Company Summary

Note: Unions Market' official website: https://unionsmarket.group/ is currently inaccessible normally.

| Unions Market Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | Forex currency pairs, stocks |

| Demo Account | ❌ |

| Leverage | Up to 1:500 |

| Spread | From 0.1 pips |

| Trading Platform | Web-based |

| Min Deposit | €250 |

| Customer Support | Tel: +37282243643 |

| Email: technical_support@unionsmarket.group, compliance@unionsmarket.group | |

| Address: First floor, First St Vincent Bank Ltd Building, James Street Kingstown, St.Vincent and the Grenadines | |

Unions Market, a trading name of Bodacious Consulting LLC, is allegedly a forex broker registered in Saint Vincent and the Grenadines that claims to provide flexible leverage up to 1:500 and variable spreads from 0.1 pips on the web-based trading platform, as well as a choice of three different live account types. However, it has no valid regulations currently.

Pros and Cons

| Pros | Cons |

| Multiple account types | Inaccessible website |

| Flexible leverage ratios | Unregulated broker |

| Limited trading assets | |

| No demo accounts | |

| No MT4 or MT5 | |

| High minimum deposit | |

| Limited payment options | |

| Withdrawal fee charged |

Is Unions Market Legit?

Unions Market claims to be owned and operated by Bodacious Consulting LLC, an offshore company based in St. Vincent and the Grenadines. However, this is the extent of our information about its owners, as there is no corporate background available, and the website appears entirely anonymous, aside from an offshore post box address. Additionally, the platform is unregulated, and its official website is currently inaccessible.

What Can I Trade on Unions Market?

| Tradable Instruments | Supported |

| Forex currency pairs | ✔ |

| Stocks | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

Unions Market claims to offer three types of trading accounts, namely Standard, Premium and Professional.

| Account Type | Min Deposit |

| Standard | €250 |

| Premium | €2,500 |

| Professional | €25,000 |

Leverage

Traders holding different account types can enjoy different maximum leverage ratios.

| Account Type | Max Leverage |

| Standard | 1:100 |

| Premium | 1:200 |

| Professional | 1:500 |

However, higher leverage means potentially greater profits, but it also comes with increased risks. Be cautious when using high leverage to protect against substantial losses.

Spread

Unions Market claims that different account types can enjoy quite different spreads.

| Account Type | Spread |

| Standard | From 0.1 pips |

| Premium | From 1.2 pips |

| Professional | From 1.3 pips |

Trading Platform

Unions Market offers a web-based trading platform. However, such web-based trading platforms are basic and cost-effective—scammers prefer to avoid spending more on sophisticated, functional platforms like MetaTrader 4 or MetaTrader 5.

| Trading Platform | Supported | Available Devices | Suitable for |

| Web-based | ✔ | Web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

Unions Market says to work with numerous means of deposit and withdrawal choices, consisting of credit/debit cards like VISA and MasterCard or bank transfers. On the platform, however, there was no mention of bank transfer and clients could choose between credit cards, Bitcoin and various other cryptocurrencies. We soon found out that even that is not true since the only cryptocurrency that was actually available for deposit was Bitcoin.

The minimum initial deposit requirement is said to be €250, while there is no mention of what the minimum withdrawal amount is.

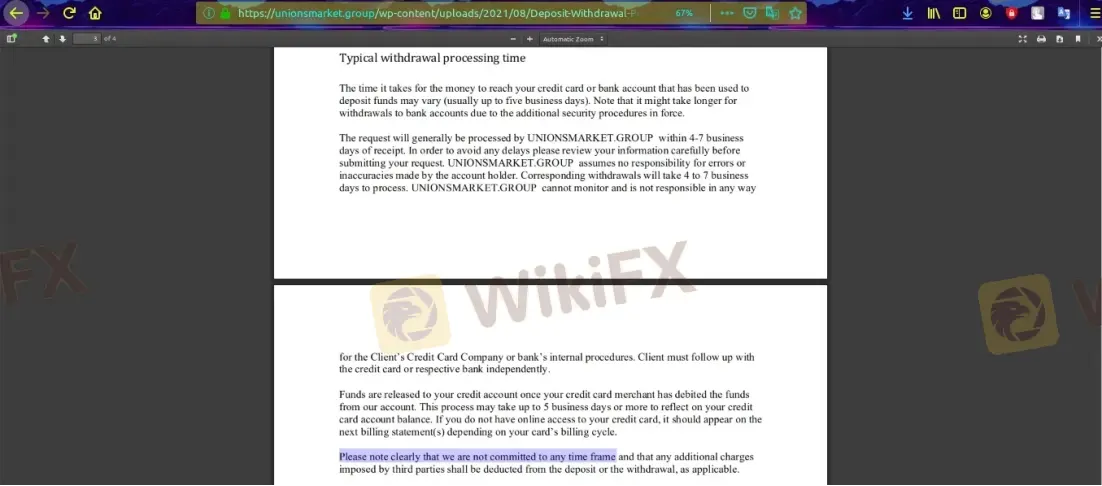

The broker also charges some withdrawal processing and handling fees, however, it states that it is simply not committed to any time frame.

The typical withdrawal processing time is said to be 5 business days.

Bonus

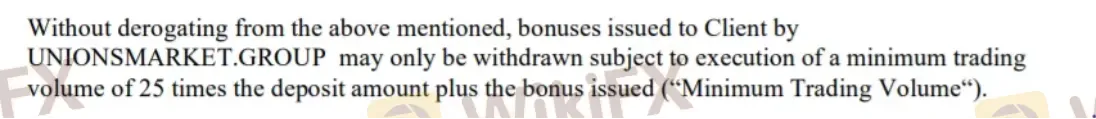

Unions Market claims to offer some bonuses. However, the bonus can only be withdrawn when an execution of a minimum trading volume of 25 times the deposit amount plus the bonus issued.

In any case, you should be very cautious if you receive a bonus. First of all, bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task. Remember that brokers who are regulated and legitimate do not offer bonuses to their clients.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now