Score

PURECAPITALS

United States|2-5 years|

United States|2-5 years| https://purecapitals.com/

Website

Rating Index

Contact

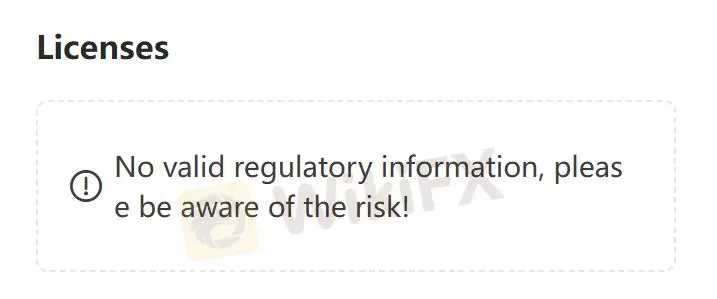

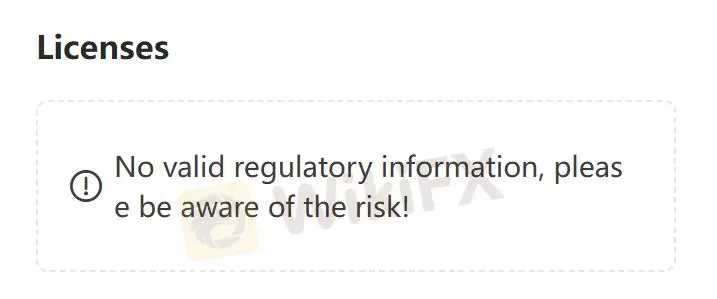

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesUsers who viewed PURECAPITALS also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

purecapitals.com

Server Location

United States

Website Domain Name

purecapitals.com

Server IP

70.39.232.220

Company Summary

Note: PURECAPITALS's official website: https://purecapitals.com/ is currently inaccessible normally.

PURECAPITALS Information

PURECAPITALS is an unregulated brokerage company registered in the United States. The company provides 4 major investment plans with a minimum fee of $100 including welcome-pack, starter, open-minds, and extra. While the broker's official website has been closed, so traders cannot obtain more security information.

Note: PURECAPITALS's official website: https://purecapitals.com/ is currently inaccessible normally.

PURECAPITALS Information

PURECAPITALS is an unregulated brokerage company registered in the United States. The company provides 4 major investment plans with a minimum fee of $100 including welcome-pack, starter, open-minds, and extra. While the broker's official website has been closed, so traders cannot obtain more security information.

Is PURECAPITALS Legit?

PURECAPITALS is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with PURECAPITALS.

Downsides of PURECAPITALS

- Unavailable Website

Because of the inaccessible PURECAPITALS's official website, traders raise concerns about its reliability and accessibility.

- Lack of Transparency

Since PURECAPITALS does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

PURECAPITALS is not regulated, which increases the possibility of fraud.

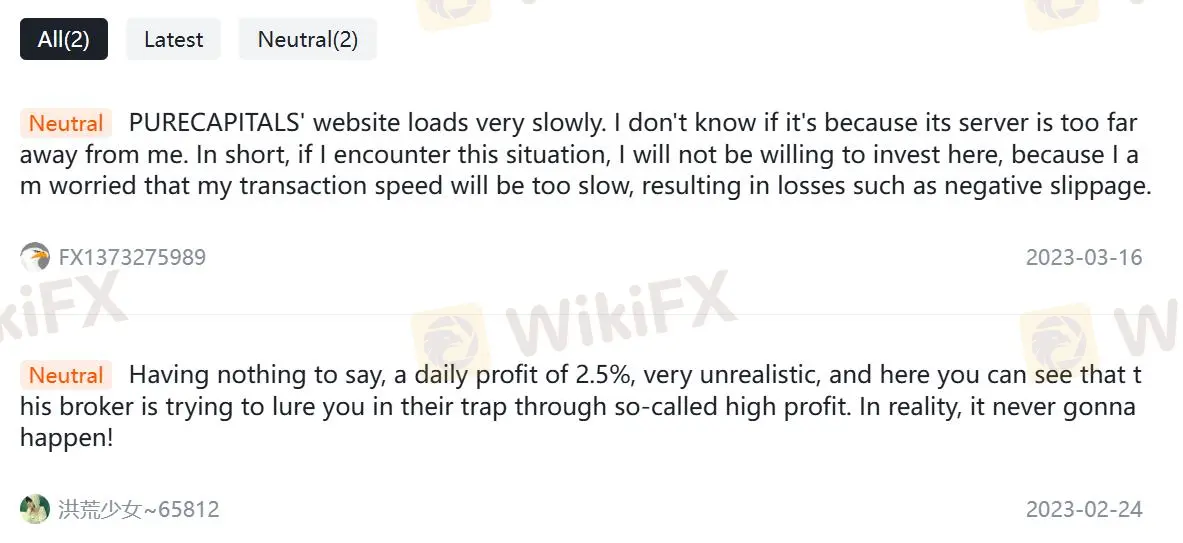

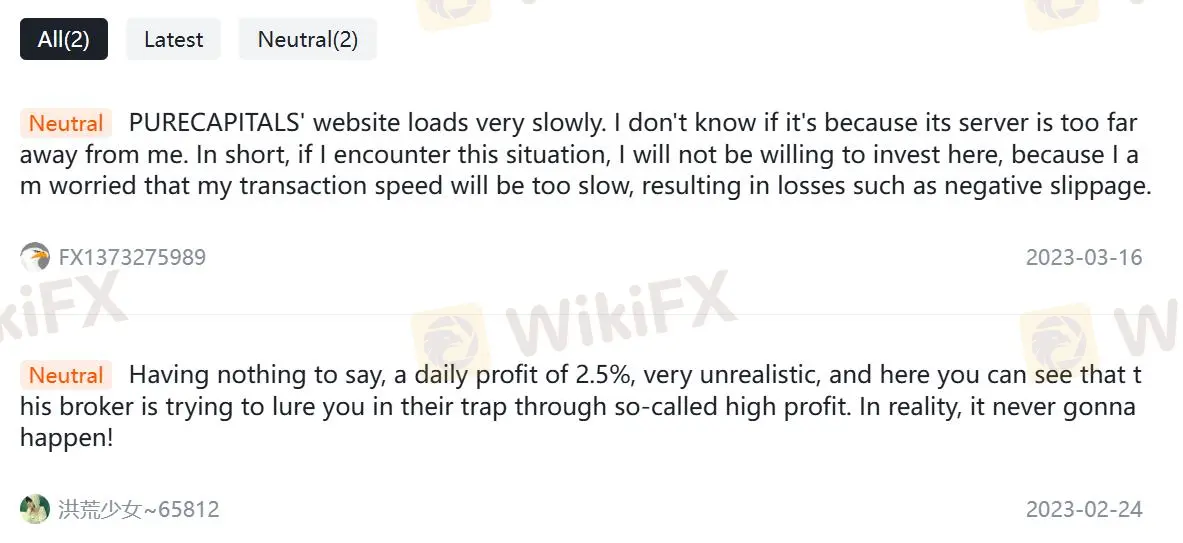

Negative PURECAPITALS Reviews on WikiFX

On WikiFX, traders must review the information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

Currently, there are two pieces of PURECAPITALS neutral, expressing concerns about the brokers. You may visit: https://www.wikifx.com/en/comments/detail/Co202303167961297188.html https://www.wikifx.com/en/comments/detail/Co202302244711597395.html.

Conclusion

PURECAPITALS Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status indicates that this brokers trading risks are high. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

Is PURECAPITALS Legit?

PURECAPITALS is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with PURECAPITALS.

Downsides of PURECAPITALS

- Unavailable Website

Because of the inaccessible PURECAPITALS's official website, traders raise concerns about its reliability and accessibility.

- Lack of Transparency

Since PURECAPITALS does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

PURECAPITALS is not regulated, which increases the possibility of fraud.

Negative PURECAPITALS Reviews on WikiFX

On WikiFX, traders must review the information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

Currently, there are two pieces of PURECAPITALS neutral, expressing concerns about the brokers. You may visit: https://www.wikifx.com/en/comments/detail/Co202303167961297188.html https://www.wikifx.com/en/comments/detail/Co202302244711597395.html.

Conclusion

PURECAPITALS Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status indicates that this brokers trading risks are high. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now