No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Windsor Brokers and FXTF ?

In the table below, you can compare the features of Windsor Brokers , FXTF side by side to determine the best fit for your needs.

EURUSD:0.4

EURUSD:0.3

EURUSD:10.21

XAUUSD:28.5

EURUSD: -7.8 ~ 2.2

XAUUSD: -36.29 ~ 21.59

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of windsor-brokers, fxtf lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Windsor Brokers Review Summary in 10 Points | |

| Founded | 1988 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC, FSC (Offshore) , FSA ( Offshore) |

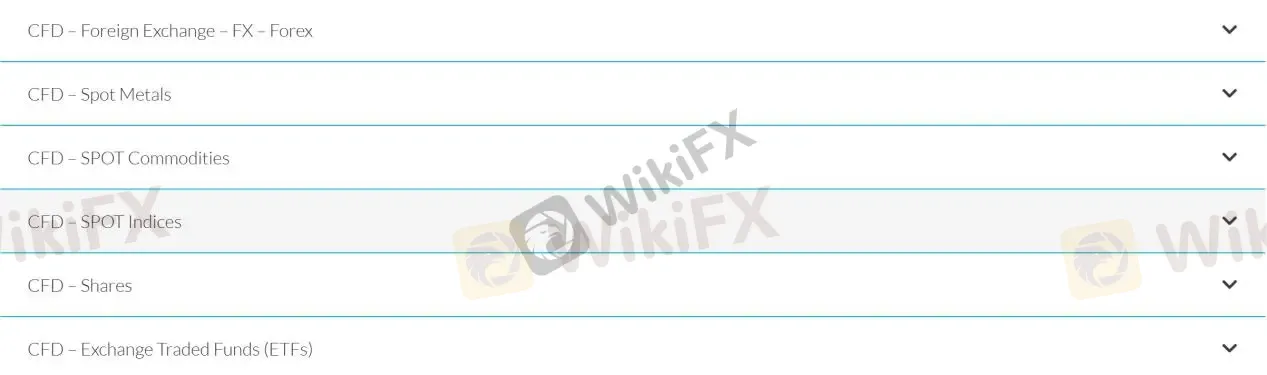

| Market Instruments | CFDs on forex, spot metals, spot commodities, spot indices, shares, ETFs |

| Account Types | Prime account, Zero account |

| Demo Account | Available |

| Leverage | 1:30 |

| EUR/USD Spread | 0.2 pips |

| Trading Platforms | MT4 |

| Minimum deposit | $50 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Windsor Broker Ltd, founded in 1988 and headquartered in Limassol, Cyprus, is an European brokerage firm that has been providing financial services to retail, corporate and institutional investors worldwide for many years, offering a wide range of financial instruments, including Forex, commodities, indices, and shares, as well as a variety of trading platforms and trading tools. Windsor Brokers Ltd is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC, No. 030/04).

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • Regulated by CySEC | • Limited payment methods |

| • Negative balance protection | • Clients from the USA, Japan and Belgium are not accepted |

| • Wide range of trading tools | • Limited info on accounts |

| • MT4 for all devices | |

| • Low spreads and commissions | |

| $30 no deposit bonus | |

| • Wide product portfolios | |

| • Demo accounts available |

Regulation by a reputable authority like Cyprus Securities and Exchange Commission (CySEC) is a positive factor indicating that Windsor Brokers is a legitimate broker. Additionally, the fact that they offer negative balance protection is also a plus for traders.

CFDs on forex, spot metals, spot commodities, spot indices, shares, ETFs are all available at Windsor Brokers. The broker allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade with Windsor Brokers.

Demo Account: Windsor Brokers provides a demo account that allows you to try out the financial markets without the risk of losing money.

Live Account: Windsor Brokers offers two types of real trading accounts: the Prime Account and the Zero Account. The Prime Account, geared towards support-oriented traders, has a lower $50 minimum deposit and spreads starting from 1.0 pips on major pairs. It provides zero commission on forex CFDs, an $8 commission per lot for crypto CFDs, and includes training resources.The Zero Account targets heavy traders with a $1,000 minimum deposit, zero spreads on major currency pairs, and a maximum leverage of 1:1000. It charges an $8 commission per lot for forex, metals, and crypto CFDs, with no commission on other CFDs. Both accounts offer negative balance protection, personal account managers, a 0.01 minimum trade volume, a 50 lot restriction per ticket, hedging allowance, and a 20% stop-out level with a 100% margin call. Notably, the Zero Account does not support Islamic/swap-free accounts.

The maximum leverage offered by Windsor Brokers is only 1:30, which may seem too low to you. Margin requirements for professional clients based on 1:100 leveraged accounts. Other leverages are available to Professional Clients only.

In reality, those leverage of up to 1:500 or even 1:1000 are all from unregulated or offshore regulated brokers, and as we know, offshore regulation is much less strict regulation. For brokers that are formally regulated by the major regulatory bodies, they can only offer leverage of 1:30 or 1:50 at best, which is sufficient for the novice Forex trader. Lower leverage reduces the potential gains on trades, but more importantly, it reduces much of the risk. We recommend that you always keep your account risk at 2% or less.

It is commendable that in the trading instruments interface, Windsor Brokers provides a detailed table showing the spreads, margin requirement, pip value, and stop levels of various instruments in various accounts in detail, which greatly facilitates customers' inquiries and comparisons.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission per Lot |

| Windsor Brokers | 0.2 pips | $0 |

| BlackBull Markets | 0.8 pips | $6 |

| Eightcap | 0.6 pips | $3.50 |

| FOREX TB | 0.7 pips | $0 |

Note: Spreads can vary depending on market conditions and volatility.

Windsor Brokers offers traders the popular MT4 trading platform for PC, Mac, WebTrader, Android, iPhone, Android Tablet and iPad, which is ideal for all traders, whether they are professional traders or beginners. MT4 trading platform features powerful charting capabilities, a large number of indicators and algorithmic trading features, a user-friendly interface, a dynamic security system, and multi-terminal functionality.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Windsor Brokers | MT4, WebTrader |

| BlackBull Markets | MT4, MT5, WebTrader |

| Eightcap | MT4, MT5, WebTrader |

| FOREX TB | MetaTrader 4 |

Windsor Brokers provides a variety of trading tools to its clients to help them make informed trading decisions. These tools include market analysis and commentary, an economic calendar, and information on market holidays. Additionally, the broker offers several Forex calculators, such as Profit, Margin, Pip, Fibonacci, and Pivots calculators, which can be useful in managing risk and determining potential profits. By providing these trading tools, Windsor Brokers aims to empower traders with the necessary knowledge and resources to navigate the financial markets.

In terms of deposits and withdrawals, Windsor Brokers offers these payment methods: Credit/debit cards (Visa/MasterCard), WebMoney, Wire Transfer, Neteller and Skrill.

| Windsor Brokers | Most other | |

| Minimum Deposit | $100 | $100 |

The broker does charges fees for deposits and withdrawals, which vary on the payment method. All deposits are processed on the same day, while most withdrawals can be processed on the same day with the exception of wire transfer withdrawal.

More details concerning deposit/withdrawal fees and processing time can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Credit/debit cards (Visa/MasterCard) | 3% | $/€/£3/transaction | Same day | Same day |

| WebMoney | 0.8% | 0.8% | ||

| Wire Transfer | Vary | Vary $0-30 | Vary | |

| Neteller | 3% | $/€/£3/transaction | Same day | |

| Skrill | 3% | 1% - min $/€/£3£ | ||

| Broker | Deposit Fees | Withdrawal Fees |

| Windsor Brokers | Vary on the method | Vary on the method |

| BlackBull Markets | None | None |

| Eightcap | None | None |

| FOREX TB | None | None |

Note: Fees may vary based on the payment method and currency used. Please refer to the broker's website for the most up-to-date information.

Below are the details about the customer service.

Service Hour: 24/5

Live Chat/Fill in Contact Form

Email: support@windsorbrokers.eu

Phone: +357 25 500 700

Fax: +357 25 500 555

Address: Spyrou Kyprianou 53, Windsor Business Center, 3rd Floor, Mesa Geitonia, 4003 Limassol, Cyprus,

Or you can also follow this broker on some social media platforms, such as Twitter, Facebook, Instagram, YouTube and Linkedin.

Overall, Windsor Brokers' customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/5 multilingual customer support | • No 24/7 customer support |

| • Multi-channel support | |

| • Live chat available | |

| • Quick response time for customer inquiries |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Windsor Brokers' customer service.

Windsor Broker offers a $30 no deposit bonus for new clients, credited after completing a straightforward account opening process - apply, register by meeting requirements, and receive $30 in trading credit upon approval, allowing risk-free platform exploration.

Windsor Brokers offers some educational resources to help traders improve their skills and knowledge. They have a video library that covers topics such as technical analysis, risk management, and trading strategies. They also have a glossary of trading terms and an ebook library that covers a range of topics such as trading psychology, fundamental analysis, and more. These educational resources are available for free to all clients of Windsor Brokers.

On the WikiFX website, you can see that some users have reported unable to withdraw. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Windsor Brokers is a regulated broker that offers access to multiple markets and trading platforms, as well as a range of trading tools and educational resources. The broker's negative balance protection is a positive feature that helps protect traders from incurring losses beyond their deposited funds.

However, some users have reported difficulties with withdrawals, which may raise concerns about the broker's reliability. Overall, Windsor Brokers appears to be a reputable broker that offers a good range of services, but potential traders should carefully consider the reported withdrawal issues before deciding to open an account.

| Q 1: | Is Windsor Brokers regulated? |

| A 1: | Yes. It is regulated by Cyprus Securities and Exchange Commission (CYSEC). |

| Q 2: | At Windsor Brokers, are there any regional restrictions for traders? |

| A 2: | Yes. It does not accept clients from the USA, Japan and Belgium. |

| Q 3: | Does Windsor Brokers offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Windsor Brokers offer the industry-standard MT4 & MT5? |

| A 4: | Yes. It supports MT4. |

| Q 5: | What is the minimum deposit for Windsor Brokers? |

| A 5: | The minimum initial deposit to open an account is $50. |

| Q 6: | Is Windsor Brokers a good broker for beginners? |

| A 6: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Aspect | Information |

| Registered Country | Japan |

| Founded Year | 15-20 years ago |

| Company Name | Goldenway Japan Co., Ltd. |

| Regulation | Regulated in Japan by the Financial Services Agency |

| Minimum Deposit | Not specified |

| Maximum Leverage | Up to 25x for most major currency pairs; 12.5x for specific pairs (TRY/JPY, ZAR/JPY, MXN/JPY) |

| Spreads | Spreads on various currency pairs |

| Trading Platforms | MT4 trading system and GX trading system |

| Tradable Assets | FX (30 currency pairs) and Commodity CFDs |

| Account Types | Not specified |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Phone, email, LINE messaging platform |

| Payment Methods | Bank Transfer |

| Educational Tools | FXTF Future Chart, Technical Analysis Commentary, Margin Calculator, FXTF E-mail Magazine |

FXTF, also known as Goldenway Japan Co., Ltd., is a regulated financial entity based in Japan. With a history of 15-20 years, it operates under the supervision of the Financial Services Agency of Japan. FXTF offers trading services in the forex market, providing margin trading on 30 currency pairs and commodity CFDs. The company has a spread on various currency pairs, allowing traders to execute trades with relatively tight differences between buying and selling prices.

FXTF provides two trading platforms: the MT4 trading system and the GX trading system. The MT4 system offers PC and mobile versions for download. On the other hand, the GX trading system is designed for beginners and features a user-friendly interface.

Customer support is available through phone, email, and the LINE messaging platform. Deposits and withdrawals can be made through bank transfers, and FXTF offers quick deposit services with no additional costs. The company also provides various trading tools such as the Future Chart, Technical Analysis Commentary, Margin Calculator, and an email magazine to enhance the trading experience.

FXTF (ゴールデンウェイ・ジャパン株式会社) offers a range of features and services for traders interested in margin trading. As a regulated entity in Japan, FXTF is overseen by the Financial Services Agency. With low spreads on various currency pairs and leverage options of up to 25x, FXTF aims to attract traders looking for potential profit opportunities. The availability of both the MT4 and GX trading platforms caters to different preferences and trading styles. However, it is important to consider some limitations, such as the lack of detailed information regarding account types and demo accounts, as well as the limited payment methods restricted to bank transfers. Customer support options are also limited, and the absence of live chat or a dedicated FAQ section might be a drawback for some traders. Despite these drawbacks, FXTF's regulatory compliance and range of tradable assets make it a platform worth considering for individuals interested in margin trading.

| Pros | Cons |

| Registered in Japan and regulated by the Financial Services Agency | No specified information about minimum deposit requirements, account types, demo accounts, or Islamic accounts |

| Offers leverage options for trading, up to 25 times for most major currency pairs | Limited information provided about educational tools and resources |

| Accepts bank transfers as a payment method | No information on the company's website regarding expiry date or nature of the “No Sharing” license type |

| Provides two trading platforms: MT4 and GX trading systems | Limited options for payment methods other than bank transfer |

| Offers a range of trading tools | Limited customer support options, no live chat or dedicated FAQ section |

| Provides customer support through phone, email, and LINE messaging platform |

FXTF (ゴールデンウェイ・ジャパン株式会社) is a regulated entity in Japan. It holds a Retail Forex License, which is regulated by the Financial Services Agency of Japan. The license number is 関東財務局長(金商)第258号. FXTF obtained its license on September 30, 2007. The licensed institution is located at 2-11-15 Mita, Minato-ku, Tokyo. Their phone number is 0345776777. The company is certified by the regulatory agency, and the certified documents can be found in Annex1 and Annex2. Unfortunately, no information is provided regarding the website, email address, expiry date, or the nature of the “No Sharing” license type.

FXTF is a financial platform that provides investors with a range of market instruments to engage in margin trading.

FX: FXTF offers margin trading services on 30 currency pairs, known as FX. This instrument allows investors to participate in the foreign exchange market. FX focuses on investing in foreign currencies, providing real-time rates for trading activities. FXTF provides real-time rates for currency pairs such as USD/JPY, EUR/JPY, GBP/JPY, and AUD/JPY.

Commodity CFD: In addition to currency pairs, FXTF provides Commodity CFDs, including XAU/USD (Gold/USD) and XAG/USD (Silver/USD). These instruments allow investors to trade in the price movements of gold and silver against the U.S. dollar. The prices for these commodities are quoted in the respective currency pairs, and the spread indicates the difference between the buying and selling prices.

| Pros | Cons |

| Wide range of currency pairs for FX trading | Limited payment methods |

| Availability of commodity CFDs for trading | Lack of detailed information on account types |

| Ability to profit from both rising and falling prices | Limited customer support options |

| Real-time rates provided for trading activities | No live chat or dedicated FAQ section |

| Access to trade gold and silver against USD | Lack of demo accounts |

STEP 1: Application for opening an account

Click on the “口座開設” (Account Opening) button.

Confirm and agree to the contents of the delivery documents.

Enter your customer information, such as name and date of birth.

After completing the application, check your email for an application reception email.

STEP 2: Submission of confirmation documents

Depending on the identity verification method, there are two patterns:

Take a selfie and a confirmation document from your smartphone.

Speed opening with a smartphone:

After confirming your identity, the account opening examination will be conducted, and upon passing the examination, the account opening will be completed.

Choose one of the three submission methods: “upload,” “email,” or “mail.”

Upload your scanned or photographed identity verification documents and My Number verification documents.

Normal opening:

Alternatively, attach the documents to an email and send them to the specified email address.

If mailing, prepare copies of the verification documents and send them to the designated address.

STEP 3: Account opening review

Your application will undergo an examination.

The results of the screening will be sent to the main email address registered on the day of application.

STEP 4: Account opening completed

Await the examination results.

Once the account opening is approved, the process is completed.

FXTF offers leverage options for trading. For most major currency pairs, traders can apply leverage of up to 25 times their initial investment. However, for specific currency pairs like TRY/JPY, ZAR/JPY, and MXN/JPY, the leverage available is limited to 12.5 times the initial investment.

FXTF provides spreads on various currency pairs. The spreads offered are as follows: 0.1 pips on USDJPY, 0.3 pips on EUR/JPY, 0.2 pips on EURUSD, 0.6 pips on GBPJPY, 1.0 pips on NZDJPY, and 0.7 pips on GBPUSD. These spreads allow traders to execute their trades with relatively tight differences between buying and selling prices.

For quick deposits, customers can choose between two procedures: using their personal page or visiting a bank window or ATM. The company covers the commission fees for this type of deposit, so customers do not bear any additional costs. Deposits are reflected immediately in the trading account, with some exceptions. The minimum deposit amount for this type of deposit starts from 1,000 yen.

FXTF provides 24-hour quick deposit services, allowing customers to deposit funds into their trading accounts at any time. Additionally, they offer a “Same-day Withdrawal Service” for expedited withdrawal requests. If a withdrawal request is made before 9:00 a.m. on weekdays, the funds will be transferred to the customer's account on the same day. However, the availability of same-day withdrawals is subject to certain conditions, such as the withdrawal amount.

FXTF offers an online deposit service called “Quick Deposit” for customers who have an Internet banking contract with their affiliated banks. This service supports deposits from banks such as MIZUHO, PayPay, MUFG, and Rakuten and etc. Deposits made through this service are reflected immediately in the trading account, and the transfer fee is free. The minimum deposit amount for this service starts from 1,000 yen, and deposits can be made in units as small as 1 yen.

The minimum withdrawal amount at FXTF is set at 1,000 yen. However, it is important to note that withdrawals of less than 1,000 yen are only possible at the time of cancellation, and such transactions are processed by the company itself.

| Pros | Cons |

| Quick deposit options | Limited information on withdrawal fees and processing times |

| Same-day withdrawal service available | Minimum withdrawal amount of 1,000 yen |

| Free transfer fees for deposits | Withdrawals less than 1,000 yen only possible at the time of cancellation |

FXTF offers two trading platforms: the MT4 trading system and the GX trading system.

MT4 trading system

The MT4 trading system, also known as Metaquotes version, provides multiple options for traders. The PC installation version allows users to download the platform and access a comprehensive manual for operating it. Additionally, there is a PC browser version available, which also has a separate manual for login and operation. Traders who prefer mobile trading can download the MT4 App for iOS, Android, or iPad devices, with operation manuals provided for each platform.

GX trading system

On the other hand, the GX trading system is a comprehensive platform specifically designed for trading FX and commodity CFDs. It is recommended for beginners due to its easy-to-understand interface and simple operation. The PC web browser version of the GX trading system features a sleek design and incorporates TradingView, a widely recognized charting and analysis tool. Traders can access live trading and refer to the FX and Commodity CFD operation manuals for guidance. The smartphone version of the GX trading system is also available for both iOS and Android devices, for traders who want to trade anytime, anywhere.

| Pros | Cons |

| Accessible through various devices | Lack of detailed information on account types |

| MT4 platform available for PC, mobile | Limited payment methods restricted to bank transfers |

| GX trading system suitable for beginners | Limited customer support options |

| GX platform incorporates TradingView | No live chat or dedicated FAQ section |

FXTF offers a range of trading tools to enhance the trading experience for its users.

1. FXTF Future Chart is a trading tool provided by FXTF that allows users to predict future price movements based on past price data. It includes a trading signal feature that displays buy and sell points on the chart, making it user-friendly even for those without extensive chart analysis knowledge. The Future Chart can be accessed through the member-only page “My Page” or the “GX Web Browser Version” after logging in. It's important to note that the rates displayed on the Future Chart may differ from those on the trading system due to different rate distributors.

2. Technical Analysis Commentary is another trading tool offered by FXTF. It provides an explanation of technical analysis, which involves predicting future price movements by analyzing past market trends. The commentary is presented in an easy-to-understand manner, making it suitable for individuals interested in studying charts and enhancing their technical analysis skills. The tool covers various aspects of technical analysis, including trends and their classifications.

3. Margin Calculator is a tool provided by FXTF that helps traders calculate the margin required for their trades. Margin refers to the collateral required to open and maintain positions in the forex market. The Margin Calculator assists traders in determining the amount of margin needed based on the trade size, leverage, and currency pair being traded. This tool helps traders manage their risk and make informed decisions when executing trades.

4. FXTF E-mail Magazine is an informational service provided by FXTF. It is a newsletter that targets customers who have an account with Mr. Tomorani Saito, the Representative Director of Win-invest Japan Co., Ltd., a well-established FX school. The e-mail magazine provides strategies directly linked to trading and market direction predictions. The newsletter is authored by Masaru Sugita, the Chairman of Win-invest Japan Co., Ltd., and Tomorani Saito, the Representative Director of the FX school. It offers valuable insights and analysis for subscribers interested in staying updated with market trends and trading strategies.

| Pros | Cons |

| FXTF Future Chart helps predict price movements based on past data. | Rates on Future Chart may differ from those on the trading system. |

| Technical Analysis Commentary enhances understanding of technical analysis. | Limited information on the depth and scope of the commentary. |

| Margin Calculator assists in managing risk and making informed decisions. | Possible limitations or complexity in the calculation process. |

| FXTF E-mail Magazine provides valuable insights and analysis. | Limited information on the frequency and reliability of the newsletter. |

FXTF has defined trading hours for both winter and summer seasons. During winter, the trading hours are from Monday 7:05 am to Saturday 6:50 am. However, there is a scheduled maintenance period from Tuesday to Friday, lasting from 6:55 am to 7:05 am, which lasts for 10 minutes. In the summer season, the trading hours start at Monday 7:05 am and end on Saturday 5:50 am. Similarly, there is a maintenance period from Tuesday to Friday, lasting from 5:55 am to 6:05 am, which also lasts for 10 minutes. These trading hours provide a structured timeframe for traders to engage in financial activities with FXTF.

Reception Time: FXTF offers customer support throughout the week, with 24-hour availability during specific hours. During winter time, you can reach them from Monday 8:00 am to Saturday 7:00 am. In summer time, their support hours are Monday 8:00 am to Saturday 6:00 am. However, support is not available on weekends and during year-end and New Year holidays.

Inquiries by Phone: FXTF provides assistance regarding account opening and trading services via phone. You can contact them at 0120-445-435. The phone menu offers different options for specific inquiries. Option 1 is for inquiries about “Forex/Commodity CFD Trading,” option 2 is for inquiries about “account opening” and “deposits and withdrawals,” and option 3 is for “other inquiries.”

Inquiries by Email: For urgent matters, it is recommended to contact FXTF by phone. However, you can also send inquiries via email to support@fxtrade.co.jp. When reaching out via email, it is important to include your name and login ID, especially for customers with DEMO or LIVE accounts.

Inquiries via LINE: FXTF also offers customer support through the messaging platform LINE. However, for urgent matters, contacting them by phone is advised. To add FXTF as a friend on LINE, you can use the LINE ID @GWFX. Please avoid sharing personal information or account details in the chat support.

FXTF is a regulated financial platform based in Japan, offering trading services in the form of margin trading for currency pairs and commodity CFDs. It has been operating for approximately 15-20 years and is regulated by the Financial Services Agency in Japan. FXTF provides spreads on various currency pairs and offers leverage options of up to 25 times the initial investment for most major currency pairs, with a slightly lower leverage of 12.5 times for specific pairs. The platform supports two trading systems: MT4 and GX, catering to different trader preferences. FXTF also provides trading tools such as the FXTF Future Chart, Technical Analysis Commentary, Margin Calculator, and an informative email magazine. Customer support is available via phone, email, and the LINE messaging platform during specified hours. FXTF offers deposit and withdrawal services, with various methods available for customers to manage their funds. Overall, FXTF provides a regulated trading environment with offerings for traders interested in margin trading of currency pairs and commodity CFDs.

Q: What is the leverage offered by FXTF?

A: FXTF offers leverage of up to 25 times for most major currency pairs and 12.5 times for specific pairs like TRY/JPY, ZAR/JPY, and MXN/JPY.

Q: What are the trading platforms provided by FXTF?

A: FXTF offers the MT4 trading system and the GX trading system as trading platforms.

Q: What market instruments can I trade with FXTF?

A: FXTF provides trading services for FX (30 currency pairs) and Commodity CFDs.

Q: How can I open an account with FXTF?

A: To open an account with FXTF, you need to complete an application, submit confirmation documents, undergo an account opening review, and await the approval.

Q: What are the deposit and withdrawal options with FXTF?

A: FXTF offers various deposit options, including quick deposits through personal pages or bank windows/ATMs. Withdrawals can be made with a same-day withdrawal service, subject to certain conditions.

Q: What are the customer support options provided by FXTF?

A: FXTF offers customer support through phone, email, and the LINE messaging platform.

Q: What are the trading tools offered by FXTF?

A: FXTF provides trading tools such as FXTF Future Chart, Technical Analysis Commentary, Margin Calculator, and FXTF E-mail Magazine.

Q: What are the trading hours of FXTF?

A: FXTF has defined trading hours during both winter and summer seasons, with scheduled maintenance periods.

Q: Is FXTF regulated?

A: Yes, FXTF is a regulated entity in Japan, holding a Retail Forex License regulated by the Financial Services Agency.

Q: How long has FXTF been in operation?

A: FXTF has been operating for 15-20 years.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive windsor-brokers and fxtf are, we first considered common fees for standard accounts. On windsor-brokers, the average spread for the EUR/USD currency pair is 0.1 pips, while on fxtf the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

windsor-brokers is regulated by CYSEC,FSC,FSA. fxtf is regulated by FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

windsor-brokers provides trading platform including Standard account,ECN VIP,ECN Standard and trading variety including Foreign exchange, precious metals, CFDs. fxtf provides trading platform including -- and trading variety including --.