简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Oil Countdown: With 48 Hours To OPEC Meeting, Where Are Prices Headed?

Abstract:It’s the answer every oil trader is seeking, yet will likely get with only a certain degree of accuracy. With about two days left until the all-important ministerial meeting of OPEC+, few things are more crucial than figuring out where oil will be trading before the world alliance of oil producers lays down its policy decisions for December. Dozens of ideas abound on crude prices over the next 48 hours, with as many theories on why they should be so

Its the answer every oil trader is seeking, yet will likely get with only a certain degree of accuracy.

With about two days left until the all-important ministerial meeting of OPEC+, few things are more crucial than figuring out where oil will be trading before the world alliance of oil producers lays down its policy decisions for December.

Dozens of ideas abound on crude prices over the next 48 hours, with as many theories on why they should be so.

What Do The Fundamentals Show?

Just a month ago, there were few vagaries in predicting the course of the US West Texas Intermediate benchmark for crude oil, or that of its peer, London-traded Brent. With OPECs seemingly invincible control of the supply-narrative, prices only pointed one way: up.

Then came the first-ever coordinated crude reserves release by the United States and other major oil consuming countries in an attempt to beat back prices trading near seven-year highs. That was followed by caution from the International Energy Agency that oil could be oversupplied by the first quarter of 2022.

Last weeks panic selling in oil, triggered by worries about the potential hazards of the Omicron variant of COVID-19, provided the perfect storm for those long the market.

While crude prices initially rose 5% on Monday, at the close they only managed to recoup about 3% of Fridays 12% collapse—which marked the worst one-day decline for WTI since April 2020.

As this article was being crafted—at around midnight in New York (0400 GMT) when Asian markets headed for their Tuesday lunch hour—WTI was up another 1% at $70.63 a barrel. But in the broader scheme of things, it was still some $15 or 18% lower than seven-year highs of above $85 per barrel reached in mid-October. (Editor's note: however, at time of publication crude had reversed lower, once again falling below the $70 level.)

Many are betting that OPEC+ will steady the ship again by the time it meets Thursday, firstly by calling off the incremental 400,000 barrels per day it has pledged over the past few months.

“We think the group will lean towards pausing output hikes in light of the Omicron variant and the oil stockpile release by major oil consumers,” Commonwealth Bank commodities analyst Vivek Dhar said in a note.

OPEC+ bigwigs—Saudi Energy Minister Abdulaziz bin Salman and his Russian counterpart Alexander Novak—have said they weren‘t unduly worried about Omicron’s impact on oil despite initially postponing a technical meeting of the alliance to learn a little more about the strain.

Some said Abdulaziz, in his usual combative style, could even threaten to squeeze the market as much as is needed to get it back to $80 a barrel.

“Following the global strategic reserve releases and the announcement of dozens of countries restricting travel to and from South Africa and neighbouring nations, OPEC and its allies can easily justify an output halt or even a slight cut in production,” OANDA analyst Edward Moya said in a note.

Yet, some think the selloff in oil could get worse before things get better.

“Two more weeks of volatility ahead,” Samir Madani of tankertrackers.com predicted in a tweet.

What Do The Technicals Say?

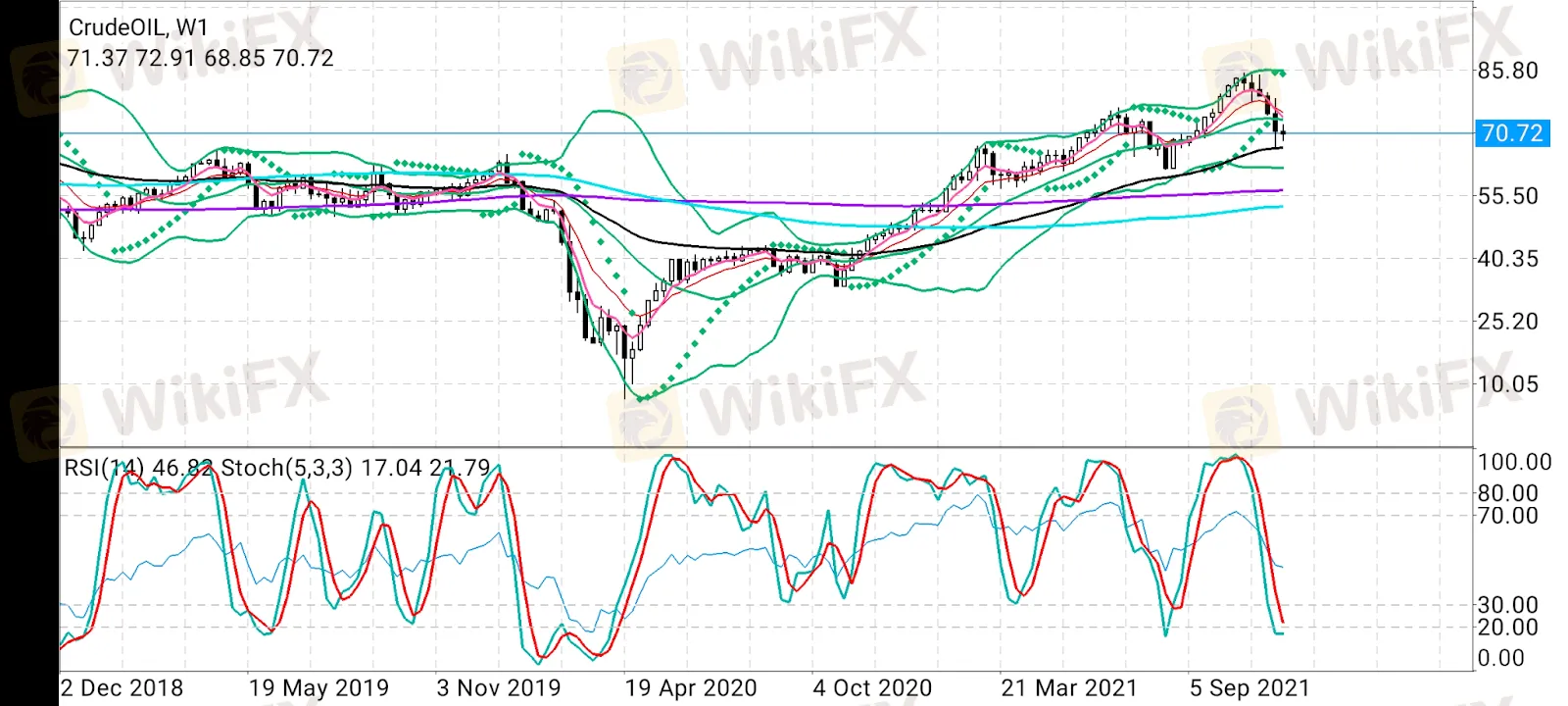

Slobodan Drvenica of Windsor Brokers said WTIs drop to a three-month low of $67.38 on Friday had retraced 76.4% of the $61.81/$85.39 upleg, generating a bearish signal on a weekly close below $70 on the 200-Day Moving Average.

“Recovery is still holding below the base of thickening daily cloud ($73.59) that keeps near-term bias with bears and risk of renewed probe below $70 in play,” Drvenica wrote in a Tuesday post that ran on fxstreet.com.

Only a bounce through to the $74.00/$75.00 zone—breaching the 100-Day Moving Average and former low of Nov. 22—would ease the current bearish pressure and allow for a stronger upward correction, Drvenica added.

Oil Weekly

All technical charts courtesy of skcharting.com

Sunil Kumar Dixit of skcharting.com said WTIs weekly chart shows a break below the middle Bollinger® Band of $74.80 that has pushed the US crude benchmark to find support at the 50-week Exponential Moving Average of $67.25.

Oil Daily

Dixit said WTIs stochastic reading of 16/21 was approaching oversold territory, indicating potential sideways action within a range of the 50-week EMA of $67.25 and the middle Bollinger Band of $74.10.

“Going forward from here, prices holding above $67 can cause sideways action, with some recovery to retest $71.20, $72. 50 and $74.50,” said Dixit, a regular contributor of commodity technicals to Investing.com.

Jeffrey Halley, another analyst for OANDA, had a neutral view on oil pre-OPEC, although he agreed with Dixit that any test of the highs could be capped at $77 for Brent and $74 for WTI.

“Rather than second-guessing OPEC+, I am content to watch from the side-lines from here, as oil markets will be more vulnerable than most Omicron headlines and violent swings in sentiment,” Halley wrote in a commentary published Tuesday.

“Heightened volatile means that long or short, your P and L can still be nought.”

That said, the respective 200-DMAs at $72.70 and $70.00 a barrel for Brent and WTI “should provide some support, if for no reason that a fall to those points will send the relative strength indexes (RSIs) into oversold territory,” he wrote.

“Above, some resistance should be found at $77.00, and $74.00 a barrel respectively,” he added.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

GemForex | Crude Oil (WTI)

Crude Oil (WTI) - Rebound in the offing?

Oil inches higher as OPEC meetings continue

A stronger than expected payroll report last Friday pushed equity markets to another all-time high. The U.S. economy added 850,000 new jobs during June when the consensus expected 700,000. Whilst the headline number looks good, there’s plenty to be worried about under the hood, as the new jobs are mostly in those sectors of the economy that have reopened. For instance, the leisure and hospitality sectors added 343,000 new jobs, education around 269,000, and the retail sector 67,000. These add up to around 80% of the total; this is great at first glance but not in the long run since these sectors do not drive the productivity or wage growth required for sustainable expansion. In particular, the U.S. economy is 70% consumer driven, which emphasizes the importance of a healthy and wealthy labor market. With the country still 7 million jobs short of pre-pandemic levels and most of the recovery happening in low-paying and low-productivity sectors, there is still a long way to go before the

Oil and euro slip, markets on edge over COVID-19 curbs in Europe

Asian stocks made a soft start to the week on Monday while oil and the euro were under pressure, as the return of COVID-19 restrictions in Europe and talk about hastened tapering from the U.S. Federal Reserve put investors on guard.

Oil Trades Near $80 as Global Power Crisis Set to Boost Demand

Oil steadied near the psychological $80-a-barrel mark as a global power crunch rattled the market while OPEC+ output has been slow to ramp up.

WikiFX Broker

Latest News

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

eToro Expands Nationwide Access with New York Launch

Webull Partners with Coinbase to Offer Crypto Futures

Why Is UK Inflation Rising Again Despite Recent Lows?

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Find Regulated Brokers from A to Z on WikiFX

Currency Calculator