No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between WeTrade and CJC Markets ?

In the table below, you can compare the features of WeTrade , CJC Markets side by side to determine the best fit for your needs.

EURUSD:18.95

XAUUSD:31.96

EURUSD: -7.64 ~ 0.36

XAUUSD: -36.1 ~ 13.75

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of wetrade, cjc-markets lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Registered in | United Kingdom |

| Regulated by | LFSA, FSA |

| Year(s) of establishment | 2015 |

| Trading instruments | Forex pairs, metals, energies, indices, stocks, cryptocurrencies… 120+ instruments |

| Minimum Initial Deposit | $100 |

| Maximum Leverage | 1:2000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, WeTrade APP |

| Deposit and withdrawal method | Bank wire transfer, USDT, local deposit, union pay |

| Customer Service | 24/7 Email, live chat, YouTube, Facebook, LINE, WeChat public account,Little Red Book, and BiliBili |

| Fraud Complaints Exposure | No for now |

WeTrade is a UK registered forex broker that is regulated by the Financial Services Authority (FSA) and the Labuan Financial Services Authority (LFSA) in Malaysia. The FSA is one of the most reputable financial regulatory bodies in the world, and its oversight ensures that WeTrade operates according to strict standards of transparency and fairness. The LFSA is also a well-respected regulator and its oversight provides an additional layer of protection for traders. WeTrade's regulatory status is a significant advantage as it offers traders a level of protection and reassurance that their funds are safe and that the broker is operating within the law.

WeTrade is regulated by the Labuan Financial Services Authority (LFSA) in Malaysia under a Straight Through Processing (STP) model, ensuring adherence to local financial regulations. Additionally, it holds offshore regulatory status with the Financial Services Authority (FSA), which includes business registration for broader operational compliance. These regulatory frameworks ensure that WeTrade maintains high standards of transparency and security, providing a reliable trading environment for its clients.

Pros and Cons of WeTrade

Pros:

Cons:

| Pros | Cons |

| Regulated by FSA and LFSA | Limited deposit/withdrawal options |

| Wide range of instruments | Customer support limited to email and social media |

| Multiple account types, including demo | Limited company background information |

| Competitive spreads; high leverage up to 1:2000 | ECN account: $1000 minimum deposit, $7/lot commission |

| Educational resources available |

WeTrade offers its traders a wide range of 120+ instruments to choose from, including forex pairs, metals, energies, indices, stocks, and cryptocurrencies. This provides traders with a great opportunity to diversify their trading portfolio and access a variety of markets and assets. Additionally, the selection of cryptocurrencies offered by WeTrade is somewhat limited compared to some other brokers in the market.

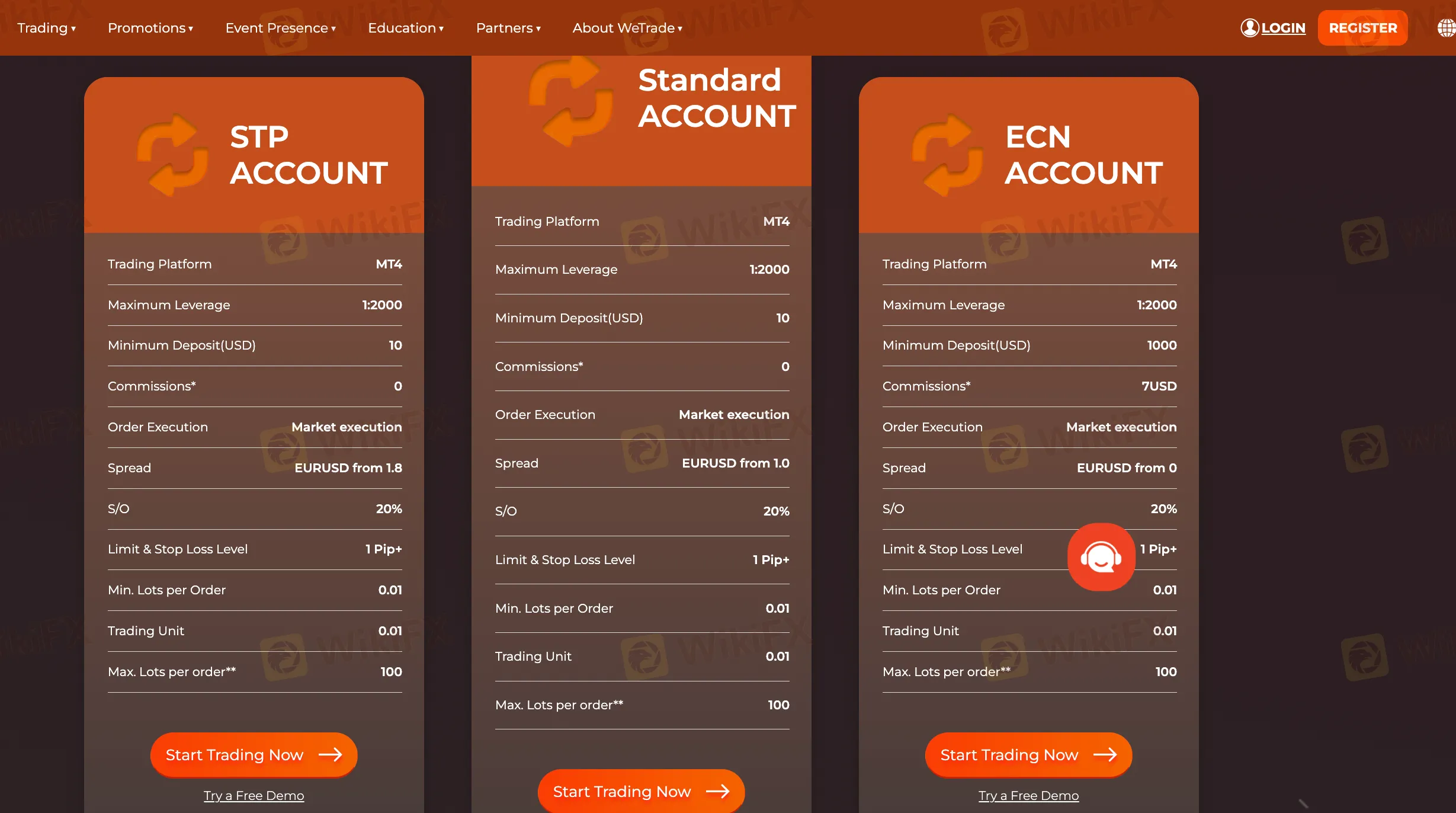

WeTrade offers a variety of account types, including ECN, Standard, and STP, each with different spreads and fees. The ECN account offers zero spreads but charges a $7 commission per lot traded, making it suitable for high-volume traders. The Standard account provides lower EUR/USD spreads starting from 1.0 pips with no commission, making it ideal for advanced traders. The STP account offers EUR/USD spreads starting from 1.8 pips with no commission, making it a good choice for beginner traders. Overall, WeTrades spreads and commission rates are competitive and cater to different trading needs.

WeTrade offers three account types to meet the needs of traders. The ECN account requires a higher minimum deposit of $1,000 but offers spreads as low as 0.0 pips, with a $7 commission per lot traded. Both the Standard and STP accounts have a minimum deposit of $100 and offer commission-free trading. Additionally, traders can use demo accounts to practice their strategies without risking real capital. A high leverage of 1:2000 is available across all account types, although some traders may prefer lower leverage.

WeTrade offers clients the MetaTrader 4 (MT4) platform, a widely used and user-friendly trading platform in the forex industry, also available in a mobile version. MT4 is known for its extensive technical analysis tools, indicators, and support for algorithmic trading via Expert Advisors (EAs).

However, MT4 has some limitations, such as limited customization options, lack of an integrated economic calendar, and no mobile push notifications. Additionally, its backtesting timeframes are restricted, which may hinder traders who need thorough strategy testing.

In addition to MT4, WeTrade also offers its mobile app as an alternative trading platform.

WeTrade offers a maximum leverage of up to 1:2000, which is relatively high compared to other forex brokers. This allows traders to potentially increase their profits with a smaller capital investment and have greater market exposure. However, high leverage also increases the risk of significant losses and margin calls, especially for inexperienced traders who may misuse it or engage in overtrading or emotional trading. Experienced traders with solid risk management strategies may find high leverage useful, but regulated brokers have limits on maximum leverage, which may restrict traders from taking advantage of higher leverage ratios.

WeTrade offers its clients multiple deposit options, including USDT, bank wire, and local deposits. Clients can withdraw funds via union pay and bank wire. WeTrade does not charge any extra fees for deposits or withdrawals. Additionally, there is no minimum account required, making it accessible for traders with different budgets. However, there is limited information provided about the deposit/withdrawal processing time. While WeTrade provides a safe and secure transaction environment, it offers limited withdrawal options compared to other brokers.

WeTrade offers various educational resources to its clients to enhance their trading skills and knowledge of the financial markets. The resources include an economic calendar, market reports, video tutorials, analyst views, indicators, and TV channels. The economic calendar keeps clients informed about important upcoming events that could affect the markets, while the market reports and analyst views provide up-to-date information on market trends. The video tutorials cover a range of topics from the basics of trading to advanced strategies, and clients can access a variety of indicators and TV channels for technical analysis. The educational resources are available in multiple languages to cater to clients from different parts of the world.

WeTrade offers a comprehensive customer care service that is available 24/7 through various communication channels such as email, YouTube, Facebook, and LINE. This provides customers with multiple options to reach out to the support team and get their queries resolved in a timely manner. Additionally, the support team has a reputation for providing quick response times, which ensures that customers' issues are resolved efficiently. However, WeTrade does not offer phone support, which may be inconvenient for some customers who prefer to speak with a representative directly. Moreover, the response time may vary based on the communication channel used, and the nature of the query may also impact the response time.

In conclusion, WeTrade is a UK-based forex broker that is regulated by FSA and LFSA. The broker offers various account types, including ECN, Standard, and STP, with competitive spreads and high leverage up to 1:2000. The broker supports various trading instruments, including forex pairs, metals, energies, indices, stocks, and cryptocurrencies. Overall, WeTrade has some advantages such as competitive trading conditions, a wide range of tradable instruments, and excellent customer support, which make it an attractive option for traders.

However, there are also some drawbacks such as lack of a proprietary trading platform, and no negative balance protection. Therefore, traders should carefully consider their options and weigh the advantages and disadvantages before choosing WeTrade as their preferred forex broker.

| CJC Markets Review Summary in 10 Points | |

| Founded | 2012 |

| Registered Country/Region | New Zealand |

| Regulation | FinCEN, FMA/ASIC (Suspicious clone) |

| Market Instruments | Forex, Metals, Equity Indices, US Shares, Asia Shares, EUR Shares, Cryptocurrency CFDs |

| Demo Account | Not mentioned |

| Leverage | 1:400 |

| EUR/USD Spread | 1.5 pips |

| Trading Platform | MT4 |

| Minimum Deposit | $1,000 |

| Customer Support | 24/5 live chat, phone, email |

Based in Auckland, New Zealand, CJC Markets (Carrick Just Capital Markets Limited) is a regulated online NDD (No Dealing Desk) trading broker that allows clients to trade multiple financial assets with flexible leverage up to 1:400 and floating spreads on the MT4 trading platform via 3 different live account types, as well as 24/5 customer support service.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

| Pros | Cons |

| • Multiple tradable assets and funding options | • Clients from US and China (including Hong Kong) are not accepted |

| • Provides balance protection | • Negative reviews from some clients regarding the platform being a scam |

| • Multiple deposit and withdrawal options | • High minimum initial deposit ($1,000) |

| • MT4 supported | • Unclear commission fees on ECN account |

| • Customer support team available 24/5 |

CJC Markets has several advantages including a wide range of tradable instruments, a variety of deposit and withdrawal options, and 24/5 customer support. However, there are also some significant drawbacks, including high minimum deposit requirements, and mixed reviews from clients. Overall, traders should exercise caution and carefully consider these factors before deciding whether to trade with CJC Markets.

There are many alternative brokers to CJC Markets depending on the specific needs and preferences of the trader. Some popular options include:

FP Markets - An ASIC and CySEC-regulated broker with a wide range of trading instruments, competitive spreads, and multiple trading platforms, suitable for both novice and experienced traders.

FXDD - An offshore broker offering ECN trading accounts with a variety of trading instruments and low spreads, but lacks regulatory oversight and has mixed reviews from clients.

Global Prime - An ASIC-regulated broker with a focus on transparency, offering ECN trading accounts with competitive spreads and a range of trading tools, but has limited trading instruments and high minimum deposit requirements.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

CJC Markets provides investors with 500+ instruments including Forex, Metals, Equity Indices, US Shares, Asia Shares, EUR Shares, Cryptocurrency CFDs. The broker provides access to more than 100 currency pairs, such as the EUR/USD, GBP/USD, and USD/JPY. Clients can also trade precious metals such as gold and silver, as well as a variety of equity indices such as the S&P 500 and the Nasdaq 100. CJC Markets also offers a broad selection of shares from the US, Europe, and Asia. Additionally, the broker provides access to popular cryptocurrency CFDs such as Bitcoin, Ethereum, Ripple, Litecoin, and Tether.

There are three account options available on the CJC Markets platform: Standard, VIP and ECN. The minimum initial deposit for a Standard account is $1,000, way too high for most regular traders to get started. The high minimum initial deposit can be a disadvantage for many traders, especially beginners who want to start with a smaller amount of money.

However, the higher minimum deposit requirement for the Standard account may be suitable for more experienced traders who want access to higher leverage and other advanced trading features. The VIP and ECN accounts require a minimum initial deposit of $25,000 and $50,000 respectively, which may not be feasible for many traders.

In terms of trading leverage, the maximum leverage for the Standard account is up to 1:400, up to 1:300 for the VIP account and up to 1:200 for the ECN account. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads and commissions with CJC Markets are scaled with the accounts offered. Specifically, the spread starts from 1.5 pips on the Standard account, from 1 pip on the VIP account, and raw spreads on the ECN account. As for the commission, there is no commission charged on the Standard and VIP accounts, while unspecified on the ECN account.

While the Standard and VIP accounts do not charge commissions, the spreads are higher, which may not be as cost-effective in the long run. Traders should carefully consider their trading style and needs when choosing an account type with CJC Markets.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| CJC Markets | From 1.5 pips | No |

| FP Markets | From 0.0 pips | AUD $7 round turn |

| FXDD | From 0.2 pips | No |

| Global Prime | From 0.0 pips | AUD $7 round turn |

Note that these rates are subject to change and may vary depending on account type and market conditions. Traders should always confirm the most up-to-date rates directly with the broker.

CJC Markets offers the leading MT4 trading platform for iOS, Android, Windows, and Mac to meet a wide range of user needs. MT4 is currently the most popular forex trading platform on the market, with a user-friendly interface, and powerful charting tools. With a user-friendly interface, powerful charting tools, and a large number of custom indicators, MT4 is available for automated trading and EA trading, helping traders of all levels to develop different trading strategies and help traders to get ahead in the financial markets.

See the trading platform comparison table below:

| Broker | Trading Platform |

| CJC Markets | MetaTrader 4 |

| FP Markets | MetaTrader 4, MetaTrader 5, Iress |

| FXDD | MetaTrader 4 |

| Global Prime | MetaTrader 4 |

From the logos shown at the foot of the home page on CJC Markets official website, we found that this broker seems to accept numerous means of deposit and withdrawal choices, consisting of Visa, MasterCard, Bitcoin, bit wallet, BTPay, Bank Wire, dragon pay, help2ay, PayTrust, Skrill, Neteller, and Tether.

Having multiple payment options provides more convenience and flexibility for traders to deposit and withdraw their funds. It's worth noting that certain payment methods may have fees or restrictions, so it's essential to check with the broker's website or customer service before making any transactions.

| CJC Markets | Most other | |

| Minimum Deposit | $1,000 | $100 |

See the deposit & withdrawal fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee |

| CJC Markets | Not mentioned | Not mentioned |

| FP Markets | None | None |

| FXDD | None | Varies by method |

| Global Prime | None | None |

Note: Withdrawal fees for FXDD vary depending on the payment method used. Please refer to the broker's website for more information.

The CJC Markets customer support team can be contacted 24/5 through telephone, email, social media, or live chat. You can also follow this broker on social networks such as Facebook, Instagram and LinkedIn. FAQ section is also available. Alternatively, traders can visit their physical office in Auckland, New Zealand.

It's worth noting that having a physical office can provide additional peace of mind for traders who value face-to-face communication and transparency with their broker. The availability of multiple channels for customer support is also a plus, as traders can choose the most convenient way to reach out for help. However, the lack of 24/7 customer support may be a disadvantage for traders who need immediate assistance outside of regular business hours.

| Pros | Cons |

| • Available 24/5 through various channels | • No 24/7 customer support |

| • Physical office available for in-person help | • No support for some languages |

| • Active on various social media platforms | |

| • Comprehensive FAQ section on the website |

Please note that these pros and cons are based on the information available and may not be exhaustive.

On our website, you can see that some users have reported scams and unable to withdraw. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Generally, CJC Markets is a regulated broker that provides a range of instruments. However, the high minimum deposit requirement and negative reviews from clients raise concerns about the safety of the platform. On the other hand, the broker offers balance protection up to $500, and there is a range of deposit and withdrawal options available. The customer support team can be contacted 24/5. Overall, traders should approach CJC Markets with caution and consider the potential risks before investing.

| Question 1: | Is CJC Markets regulated? |

| Answer 1: | Yes. It is regulated by FinCEN. |

| Question 2: | At CJC Markets, are there any regional restrictions for traders? |

| Answer 2: | Yes. CJC Markets does not accept customers who are residents of the US and China (including Hong Kong). |

| Question 3: | Does CJC Markets offer the industry-standard MT4 & MT5? |

| Answer 3: | Yes. CJC Markets supports MT4. |

| Question 4: | What is the minimum deposit for CJC Markets? |

| Answer 4: | The minimum initial deposit to open an account is $1,000. |

| Question 5: | Is CJC Markets a good broker for beginners? |

| Answer 5: | No. Although it is a regulated broker, but don't overlook those negative user reviews and the minimum deposit requirement is too high for beginners. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive wetrade and cjc-markets are, we first considered common fees for standard accounts. On wetrade, the average spread for the EUR/USD currency pair is As low as 0 pips, while on cjc-markets the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

wetrade is regulated by LFSA,FSA. cjc-markets is regulated by FMA,ASIC,ASIC,ASIC,ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

wetrade provides trading platform including Islamic Account,ECN ACCOUNT,Standard ACCOUNT,STP ACCOUNT and trading variety including Forex,Metals,Energies,Indices, Stocks,Cryptocurrencies. cjc-markets provides trading platform including ECN,VIP,Standard and trading variety including Forex, CFD’s, Commodities, Stocks.