Score

TradeTime

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://www.tradetime.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed TradeTime also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

tradetime.com

Server Location

United States

Website Domain Name

tradetime.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2000-05-02

Server IP

35.186.245.107

Company Summary

Note: Since this brokers official site (https://www.tradetime.com/) is not accessible at the time of writing this introduction, only a cursory understanding can be obtained from the Internet.

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

| TradeTime Review Summary | |

| Registered Country/Region | United Kingdom |

| Regulation | No regulation |

| Market Instruments | Shares, currencies, commodities, and indices |

| Leverage | 1:400 |

| EUR/USD Spread | 3.3 pips |

| Trading Platforms | MT4 |

| Minimum Deposit | $500 |

| Customer Support | email, telephone, live chat |

What is TradeTime?

TradeTime is an unregulated online financial services provider that excels in offering a comprehensive range of services, particularly in the forex market and various other tradeable assets. With a global presence, the company boasts multiple customer service offices strategically located across the world, ensuring prompt and efficient assistance to its clients. These offices are located in key countries such as Australia, Spain, Sweden, and the UK, enabling TradeTime to effectively cater to the diverse needs of traders from various regions.

Pros & Cons

| Pros | Cons |

| • Flexible leverage ratios | • Inaccessibility for U.S. Traders |

| • MT4 supported | • No valid regulatory information |

| • High minimum deposit requirement | |

| • Unavailable website |

TradeTime Alternative Brokers

There are many alternative brokers to TradeTime depending on the specific needs and preferences of the trader. Some popular options include:

Charles Schwab - A reputable broker that offers a variety of investing alternatives, strong research tools, and an intuitive interface for users of all skill levels.

Fidelity Investments - A trusted broker with a strong reputation, providing a wide range of investment options, retirement planning tools, and exceptional customer service.

TD Ameritrade - Known for its comprehensive research offerings, educational resources, and a user-friendly trading platform, TD Ameritrade is a solid choice for investors seeking a combination of investment guidance and self-directed trading options.

Is TradeTime Safe or Scam?

TradeTime currently has no valid regulation. Regulatory oversight plays a crucial role in ensuring the safety and integrity of a financial services provider. The absence of regulation can raise concerns about the level of protection and oversight provided to traders. The information provided is limited and does not encompass all aspects of TradeTime's operations, such as the company's history, ownership, security measures, or feedback from existing traders. These factors are important considerations when assessing the overall safety and reliability of a trading platform.

Market Instruments

One of the prominent markets offered by TradeTime is the shares market. Traders have access to over 400 global shares, representing a wide range of industries and sectors.

The currencies market is another key market available on TradeTime. Traders can engage in forex trading with more than 60 currency pairs, including popular options such as EUR/GBP and GBP/USD.

TradeTime also recognizes the significance of commodities as an investment avenue. Through the platform's commodities market, traders can participate in the trading of both hard and soft commodities.

Furthermore, TradeTime facilitates trading in the indices market. Traders can choose from a selection of seven major global indices, including renowned benchmarks such as the FTSE100, DAX40, and Dow Jones.

Accounts

TradeTime distinguishes itself by offering customizability in its trading accounts, allowing users to select filters based on their desired deposit amount and asset preferences. By providing this flexibility, traders can align their trading experience with their individual goals and risk tolerance. While starting with the minimum deposit may restrict trading to currencies and commodities, higher deposit amounts unlock access to a wider range of tradeable assets, including shares and indices.

Leverage

For currency trading, TradeTime offers a maximum leverage of 1:300. This means that traders can control a position in the forex market that is up to 300 times the size of their initial investment. The higher leverage in the currency market reflects the typically higher liquidity and volatility of forex pairs, providing traders with increased potential for profit or loss based on smaller market movements.

When it comes to indices, shares, and commodities trading, TradeTime offers leverage at a maximum ratio of 1:75. Upon request, leverage rates can be increased to 1:400.

Spreads & Commissions

For major forex pairs, TradeTime's spreads start at 3.3 pips for EUR/USD and 4.3 pips for EUR/GBP. These spreads represent the difference between the buying and selling prices of the currency pairs. It's worth noting that the spread can vary based on market volatility and liquidity. To access a tighter spread of 2.2 pips for EUR/USD, traders would need to have a minimum investment of $5,000. Similarly, a spread of 1.8 pips for EUR/USD would require an initial investment of $11,000. These reduced spreads for larger investments reflect the potential benefits of higher account balances in terms of trading costs.

For traders seeking even lower spreads, TradeTime offers an ECN (Electronic Communication Network) account. With an ECN account, traders can access a spread of 0.6 pips for EUR/USD, which is significantly tighter compared to other account types. However, it's important to note that an initial investment of $5,000 is required to open an ECN account. Additionally, traders should be aware that ECN accounts typically charge a commission per trade. In the case of TradeTime's ECN account, the commission for trading EUR/USD is $1.80. This commission-based pricing structure ensures transparency and direct market access for traders.

Trading Platform

TradeTime is proud to offer its users the renowned MetaTrader 4 (MT4) platform, known for its advanced features and robust trading capabilities.

One of the key advantages of using the MetaTrader 4 platform is its user-friendly interface, designed to accommodate traders of all levels of expertise. The platform's intuitive layout and navigation make it easy for traders to access various features and execute trades efficiently. Whether users are new to trading or seasoned professionals, the MT4 platform provides a seamless and straightforward trading experience.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| TradeTime | MetaTrader 4 (MT4) |

| Charles Schwab | StreetSmart Edge, Mobile App |

| Fidelity Investments | Active Trader Pro, Fidelity Mobile App |

| TD Ameritrade | thinkorswim, Web Platform, Mobile Apps |

Trading Hours

You can trade 24 hours a day, 5 days a week, however specific global markets will vary by time zone:

· Sydney – 10:00 pm – 7:00 am GMT

· London – 11:00 pm – 8:00 am GMT

· Tokyo – 11:00 pm – 8:00 am GMT

· New York – 12:00 pm – 9:00 pm GMT

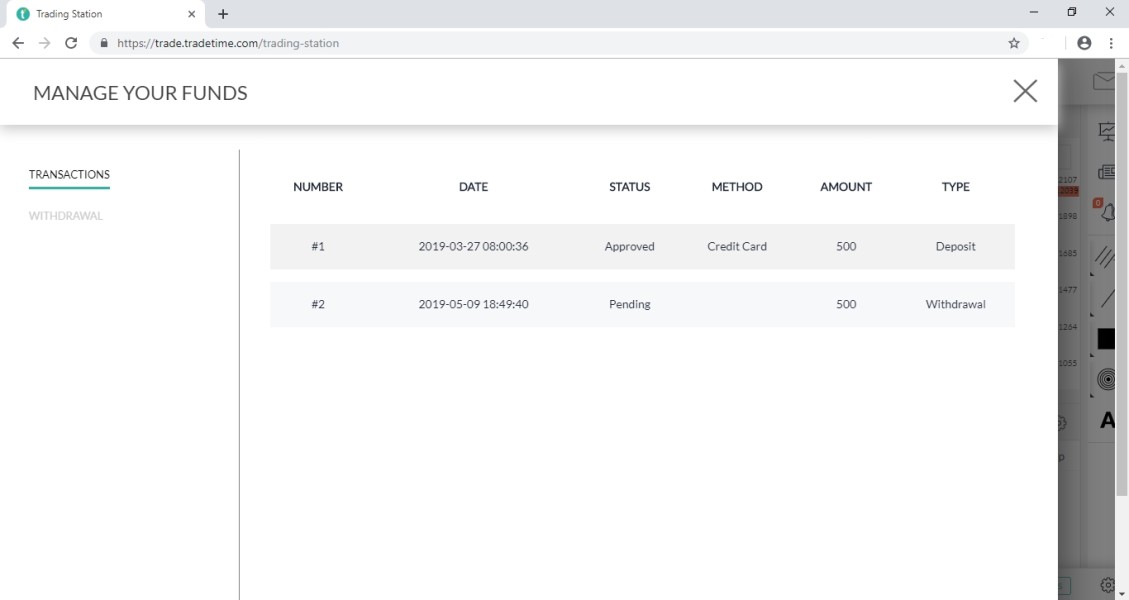

Deposits & Withdrawals

TradeTime offers convenient and flexible funding options, allowing traders to deposit funds into their trading accounts with ease. With a minimum deposit requirement of $500.

Traders can choose from multiple funding methods, including credit/debit cards and bank transfers. By accepting credit and debit cards, TradeTime provides a convenient and efficient way for traders to fund their accounts. Traders can use their Visa, Mastercard, or other major credit/debit cards to make deposits securely. In addition to card payments, TradeTime also supports funding through bank transfers. This traditional method allows traders to transfer funds directly from their bank accounts to their TradeTime trading accounts.

| TradeTime | Most other | |

| Minimum Deposit | $500 | $100 |

Customer Service

Traders can choose from a variety of convenient customer support channels to reach out to TradeTime's dedicated support team.

For traders who prefer written communication, email support is available at support@tradetime.com.

For immediate assistance, traders can utilize the live chat feature conveniently located in the bottom right-hand corner of the TradeTime website.

Traders who prefer to speak directly with a support representative can reach TradeTime via telephone. The provided telephone number, +44 203 150 1127, is dedicated to UK residents. However, TradeTime also offers international numbers specific to residents from Australia, New Zealand, Spain, Sweden, Switzerland, and France.

Accepted Countries

TradeTime proudly welcomes traders from a wide range of countries, including Australia, Thailand, Canada, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar, and many others. This global reach allows traders from diverse regions to access TradeTime's services and engage in online trading activities.

However, it's important to note that TradeTime does not currently accept traders from the United States. This restriction is due to regulatory considerations and compliance requirements specific to the U.S. market. Traders from the United States are advised to seek alternative trading platforms that cater to their specific jurisdictional regulations and requirements.

Conclusion

To meet the demands of varied traders, TradeTime provides a wide variety of trading instruments and flexibility in its trading accounts. It has no legal rules, though. Before using radeTime, traders should do extensive study, look for unbiased evaluations, and weigh the dangers. The choice to trade with the platform should be taken after giving considerable thought to the information that is currently accessible and after thoroughly analyzing the potential benefits and drawbacks of trading with an unregulated broker.

Frequently Asked Questions (FAQs)

Q1: Are there any regulatory bodies overseeing TradeTime?

A1: No.

Q2: What trading instruments does TradeTime offer?

A2: Shares, currencies, commodities, and indices.

Q3: Does TradeTime have any regional restrictions?

A3: Yes, traders cannot use TradeTime from United States.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 3

Content you want to comment

Please enter...

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now