No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between TMGM and S.A.M. Trade ?

In the table below, you can compare the features of TMGM , S.A.M. Trade side by side to determine the best fit for your needs.

EURUSD:10.65

XAUUSD:19.46

EURUSD: -6.35 ~ 2.66

XAUUSD: -36.22 ~ 21.38

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of tmgm, sam-trade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

TMGM appears to a respected forex broker, presenting access to more than 12,000 spanning forex, CFDs, and cryptocurrencies. Traders can enjoy competitive spreads across various instruments, exemplified by the EUR/USD currency pair with an average spread of around 0.1 pips. Besides, TMGM extends a diverse set of trading platforms, notably including MetaTrader 4 and MetaTrader 5. Morever, TMGM enriches the trading journey with rich educational resources and trading tools. Lastly, 24/7 multilingual customer support stands ready. However, the question remains: Does TMGM truly live up to its claims? Let's explore more.

| TMGM Review Summary in 10 Points | |

| Founded | 2013 |

| Headquarters | Sydney, Australia |

| Regulation | ASIC, VFSC (Offshore) |

| Market Instruments | forex, indices, shares, futures, precious metals, energies and cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/USD Spread | 1.0 pips |

| Trading Platforms | MT4, MT5 |

| Minimum deposit | $100 |

| Customer Support | Live chat, phone, email |

Founded in 2013 and headquartered in Sydney, Australia, TMGM is an online ECN/STP broker. Notably, in 2016, TMGM introduced its MetaTrader 5 platform. Subsequently, the company achieved FCA membership in the UK during 2017. The year 2019 witnessed the launch of TMGM's mobile trading app, further enhancing accessibility. By 2021, TMGM's reach expanded to encompass over 200 countries worldwide.

Offering a diverse array of more than 12,000 trading instruments spanning forex, commodities, cryptocurrencies, and stocks, TMGM caters to traders through popular platforms including MT4 and MT5.

| Pros | Cons |

| • ASIC regulation | • No US clients accepted |

| • Competitive spreads and low commissions | • Inactivity fees applied |

| • Over 12000 trading instruments | |

| • MT4 and MT5 platforms offered | |

| • 24/7 multilingual cutsomer support | |

| • Multiple account types with flexible options | |

| • Rich educational resources | |

| • High leverage up to 1:500 |

TMGM, a regulated broker, holds authorization from the tier-one regulator ASIC and is also licensed by the New Zealand Financial Markets Authority (FMA). Additionally, TMGM's international operations are overseen by the VFSC in Vanuatu offshore. Now, let's quickly delve into TMGM's regulations and licenses, which will shed light on how the broker ensures compliance with industry standards and protects clients.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| ASIC | TRADEMAX AUSTRALIA LIMITED | Market Making(MM) | 436416 |

| VFSC | Trademax Global Limited | Retail Forex License | 40356 |

Under the oversight of ASIC, a prominent tier-1 regulatory authority, TMGM's Australian branch known as TRADEMAX AUSTRALIA LIMITED operates with regulatory number 436416. This entity is licensed for Market Making (MM). As per the stringent rules set by ASIC, which is globally recognized, brokers must ensure the safety of clients' funds.

Since TMGM claims to obtain the ASIC license, an investigation team from WikiFX visited the company's registered address in Australia. This visit, conducted in person, revealed that the company is operating smoothly and on a large scale. This direct observation by the investigator enhances our confidence in TMGM's legitimacy and highlights its strong and credible operations under ASIC's regulation.

TMGM's international branch, Trademax Global Limited, operates under the regulation and authorization of VFSC offshore, holding a license for retail forex activities.

TMGM goes above and beyond by offering an impressive collection of 12,000+ trading instruments, setting it apart as a broker with an exceptional range of options, covering 60 currency pairs, indices, and stocks sourced from major global exchanges. Moreover, TMGM extends its offerings to include futures, as well as sought-after precious metals like gold and silver. Adding to the mix are energies such as oil and natural gas, not to mention a selection of 10 cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

| Trading Assets | Available |

| Forex | |

| Shares | |

| Energies | |

| Indices | |

| Precious Metals | |

| Cryptocurrencies | |

| Futures | |

| Indices CFD Dividend | |

| Shares CFD Dividend | |

| ETFS | |

| Stocks | |

| Options |

TMGM tailors its account types to match the chosen trading platform. If you're using the MetaTrader 4 platform, they provide EDGE and CLASSIC accounts. Plus, for those who prefer Swap Free accounts or want to practice with demo accounts, TMGM offers those options as well.

Both accounts require a minimum deposit of $100, quite reasonable for most regular traders to get started.

| Classic | Edge | |

| Min Deposit | $100 | $100 |

| Min Lot Size | 0.01 Lot | 0.01 Lot |

| Max Leverage | 1:500 | 1:500 |

| Funding | Free | Free |

| Execution Type | ECN | ECN |

| EA Available | ||

| Islamic Account | ||

| Hedging Allowed |

The minimum deposit requirement is $5,000 for STANDARD Account, $10,000 for PREMIUM Account, and $50,000 for GOLD Account. When it comes to fees, the Standard account entails a platform fee of $35 USD or $45 AUD per month. The Premium and Gold account holders, on the other hand, enjoy fee-free access to the platform. Additionally, all account types are subject to a data fee for each exchange they use.

| Standard | Premium | Gold | |

| Minimum Deposit | $5,000 | $10,000 | $50,000 |

| Platform Fee | $35 or A$45/per month | No Fee | No Fee |

| Data Fee | For Every Exchange | ||

| Min. Commission | $10 | Not mentioned | |

| Commission Rate (cps) | 2.25 | 7 | 1.8 |

| Minimum(Trade Size) | 333Shares | Not mentioned | |

| Financing | Libor+3.5%/-3.5% | Libor +3%/-3% | Libor +2.5%/-2.5% |

TMGM also provides a Swap Free account for those who are unable to pay or receive interest owing to their religious convictions. To open a Swap-Free account, you'll need to have an Edge account, which requires a minimum of $100 and a minimum lot size of 0.01.

Demo trading accounts are available through TMGM for anyone interested in testing the waters before opening a real account. These accounts allow you to test out the broker's services before committing any real money. In addition, it provides a means of learning as much as possible about TMGM before you commit to an investment account.

The MetaTrader4 trading platform (which we'll come to in a moment) is available to demo accounts for an entire year. However, in the event of inactivity for six months, your access will be terminated. A $5,000, $10,000, or $50,000 virtual currency balance is available to you.

TMGM offers quite a high trading leverage up to 1:500 on all account types. Forex products trading can use leverage of up to 1:500, indices and energy with leverage of 1:100, and precious metals featuring 400x leverage.

Here's a table comparing leverage provided by major industry players. Notably, TMGM offers relatively higher leverage, though it appears somewhat more cautious compared to the other three competitors. However, users should remember that high leverage is a two-edged tool with potential risks.

| Broker | TMGM | Exness | FXTM | IC Markets |

| Max. Leverage | 1:500 | 1:Unlimited | 1:2000 | 1:500 |

TMGM offers competitive spreads and commissions on their trading instruments. The exact spreads and commissions vary depending on the account type and trading platform used. The spreads on CLASSIC accounts start at 1.0 pips, with no commission charged, while the spreads on EDGE accounts start at 0.0 pips, and a commission of $7 (round turn) is charged per lot.

Generally, TMGM offers tight spreads on major forex pairs such as EUR/USD, with spreads as low as 0.0 pips. Commissions may be charged on some trading instruments, such as shares and futures. However, these commissions are generally competitive compared to other brokers in the industry.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| TMGM | 0.0 pips | $7 per round turn |

| Pepperstone | 0.09 pips | $3.5 per lot |

| eToro | 1.0 pips | $0 |

| IG | 0.6 pips | $0 |

| Plus500 | 0.8 pips | $0 |

| XM | 0.9 pips | $0 |

TMGM offers popular trading platforms for their clients: MetaTrader4 (MT4) and MetaTrader5 (MT5).

| Available Devices | PC, Mac, Mobile (iOS and Android) |

| Language | English |

| Scalping | |

| Hedging | |

| Automated Trading | |

| One-click Execution | |

| Web-based Trading | |

| Mobile Trading | |

| MT5 | |

| cTrader | |

| Proprietary Platform |

MT4 is a popular and widely used platform that provides advanced charting tools, technical analysis indicators, and customizable trading robots. It also supports a variety of order types and execution modes, allowing for flexible and efficient trading.

TMGM provides its traders with various trading tools to enhance their trading experience. These tools include:

| Educational Contents | Available |

| HUBx | |

| Trading Calendar | |

| Market Sentiment Tool | |

| ForexVPS | |

| Trading Central | |

| Traders Terminology | |

| Max-Calculator |

| TMGM | Most other | |

| Minimum Deposit | $100 | $100 |

The minimum deposit and withdrawal amount is both $100. Depositing doesn't cost anything, but the time it takes and the currency options depend on your chosen payment method. Be aware, though, that some deposit methods like Union Pay, FasaPay, Visa, and MasterCard can't be used for withdrawals.

| Payment Options | Currencies | Min.Deposit | Min.Withdrawal | Fees | Processing Time ( Deposit) | Processing Time ( Withdrawal) |

| NZD, USD, AUD, EUR, CAD | $100 | $100 | $0 | 1-3 Working Day | 1 Working Day |

| USD | Instant | ||||

| NZD | Not mentioned | 1 Working Day | Not mentioned | ||

| USD | $100 | Instant | 1 Working Day | ||

| USD, EUR, GBP, AUD, NZD, CAD | 1 Working Day | ||||

| ||||||

| CNY | Not mentioned | Instant | Not mentioned | ||

| $100 | 1 Working Day | ||||

| USD | Not mentioned | Not mentioned | |||

| USD, EUR, GBP, AUD, NZD, CAD | 3 Working Days | ||||

| MYR, THB, IDR, VND | $100 | Instant | |||

| USD, EUR, GBP, AUD, NZD, CAD | Not mentioned | ||||

|

TMGM charges various fees, including spreads and commissions that we have mentioned before, as well as overnight financing fees. The specific fees vary depending on the type of account and trading platform used. TMGM does not charge any deposit or withdrawal fees, but clients may incur fees from their payment providers.

Additionally, TMGM charges an inactivity fee of $10 per month if there is no activity in the trading account for a period of six months or more. This fee will be deducted from the available balance of the account. However, if the available balance is less than $10, no inactivity fee will be charged. It is important to note that the inactivity fee is a common practice in the industry and is designed to encourage active trading and to offset the costs of maintaining inactive accounts.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| TMGM | Free | Free | $10/month after 6 months of inactivity |

| Pepperstone | Free for Australian Bank Transfer, $20 for International Transfer | $0 after 12 months of inactivity | |

| eToro | $5 | $10/month after 12 months of inactivity | |

| IG | $1 for AUD, CAD, and USD, £1 for GBP, €1 for EUR | $18/month after 24 months of inactivity | |

| Plus500 | $1.5-$10 depending on withdrawal method | $10/month after 3 months of inactivity | |

| XM | Free | $5/month after 90 days of inactivity |

TMGM offers customer support through multiple channels including live chat, phone, email, and social media (YouTube, Twitter, Facebook, Instagram and LinkedIn).

| Contact Channels | Details |

| +612 8036 8388 |

| support@tmgm.com |

| 24/7 |

| Sydney office, Melbourne Office, Adelaide Office, Canberra Office, Auckland Office |

| https://www.facebook.com/TMGMgroup |

| https://twitter.com/TMGMgroup |

| https://www.youtube.com/tmgmgroup |

| https://www.instagram.com/tmgmgroup/ |

| https://www.linkedin.com/company/tmgmgroup |

| https://api.whatsapp.com/send/?phone=61452597488&text&app_absent=0 |

You'll find an extensive and user-friendly FAQ section right on their website, covering a wide range of topics, from account setup to trading strategies, making it an invaluable tool for traders of all levels.

| Pros | Cons |

| • Multiple languages supported | • No dedicated account manager or personal service |

| • Quick response times to inquiries | • Limited availability on weekends and holidays |

| • Personalized service with tailored solutions |

Is TMGM regulated?

Yes. It is regulated by ASIC, and VFSC (offshore).

At TMGM, are there any regional restrictions for traders?

Yes. Products and Services offered on their website are not intended for residents of the United States.

Does TMGM offer demo accounts?

Answer 3: Yes.

Does TMGM offer the industry-standard MT4 & MT5?

Yes. It supports MT4 and MT5.

What is the minimum deposit for TMGM?

The minimum initial deposit at TMGM to open an account is $100.

| S.A.M. Trade | Basic Information |

| Company Name | S.A.M. Trade |

| Founded | 2015 |

| Headquarters | Australia |

| Regulations | Unlicensed broker |

| Tradable Assets | Forex, Indices, Commodities, Futures, Cryptocurrencies |

| Account Types | Standard Account, VIP Account, ECN Account, Islamic Account |

| Minimum Deposit | $10 |

| Maximum Leverage | 1:1000 |

| Spreads | Varies depending on account type and instrument |

| Commission | No commission for most account types; $5 commission per round lot turn for ECN Account |

| Deposit Methods | Tether (USDT), Bank Wire Transfer, Visa/Mastercard Credit & Debit Cards |

| Trading Platforms | MetaTrader 4 (MT4), CopySam™ |

| Customer Support | Contact form, Email |

| Education Resources | Educational guides, Membership program |

| Bonus Offerings | Not specified |

S.A.M. Trade is an unlicensed broker based in Australia that offers a range of tradable assets including Forex, Indices, Commodities, Futures, and Cryptocurrencies. They provide different account types such as Standard, VIP, ECN, and Islamic accounts, with minimum deposits starting at $10. The broker offers leverage of up to 1:1000 and varying spreads depending on the account type and instrument. Traders have access to the MetaTrader 4 (MT4) platform and a copy trading platform called CopySam™. S.A.M. Trade also provides educational resources, membership programs, and accessible customer support channels.

However, it's important to note that S.A.M. Trade operates as an unlicensed broker. This raises concerns about regulatory oversight and accountability, as well as potential issues with fund safety and unfair trading practices. Traders should exercise caution when considering trading with an unlicensed broker, as there may be limited avenues for dispute resolution and challenges in recovering funds in case of disputes or financial issues.

While S.A.M. Trade offers a wide range of tradable assets, account types with varying leverage options, and access to popular trading platforms, the lack of regulatory oversight and accountability is a significant drawback. Traders should carefully evaluate the risks and consider regulated alternatives before engaging with S.A.M. Trade or any unlicensed broker.

S.A.M. Trade is an unlicensed broker, and it is risky trading with it. Caution is advised when considering trading with S.A.M. Trade, as this broker operates without a license. Trading with an unlicensed broker carries inherent risks and raises concerns regarding the safety and security of funds. Regulatory authorities play a crucial role in overseeing and regulating the operations of brokers, ensuring compliance with industry standards and protecting the interests of traders.

Choosing to trade with an unlicensed broker such as S.A.M. Trade means there is a lack of regulatory oversight and accountability. This absence of oversight can result in potential issues such as inadequate client fund protection, unfair trading practices, and limited avenues for dispute resolution. In the event of any disputes or financial issues, traders may face challenges in seeking recourse or recovering their funds.

S.A.M. Trade offers a wide range of tradable assets and provides different account types with varying leverage options and spreads. Traders have access to the popular MetaTrader 4 (MT4) platform and a copy trading platform called CopySam™. The broker also provides educational resources and a membership program. Additionally, they offer accessible customer support channels. However, it's important to note that S.A.M. Trade is an unlicensed broker, which raises concerns about regulatory oversight and accountability. There may be potential issues with fund safety and unfair trading practices. Furthermore, the limited avenues for dispute resolution can be a disadvantage for traders.

| Pros | Cons |

| Wide range of tradable assets | Unlicensed broker |

| Different account types with varying leverage options and spreads | Lack of regulatory oversight and accountability |

| Availability of MetaTrader 4 (MT4) and CopySam™ platform | Potential issues with fund safety and unfair trading practices |

| Educational resources and membership program | Limited avenues for dispute resolution |

| Accessible customer support channels |

S.A.M. Trade offers a variety of trading instruments to its clients, including Forex, Indices, Commodities, Futures, and Cryptocurrencies. Here's a breakdown of each category:

1. Forex:

S.A.M. Trade provides trading services for over 30+ currency pairs. Each currency pair is offered with a standard contract size of 100,000 units of the first-named currency. The company operates 24/5 trading, allowing traders to participate in the forex market throughout the week. It's important to note that there may be fluctuations in spreads during opening, closing, and between market sessions. These fluctuations can be attributed to routine settlements conducted by major financial institutions, which can affect prices. S.A.M. Trade offers a range of major and minor currency pairs, each with its own value per pip, contract size, minimum lot size, and typical spread.

2. Indices:

S.A.M. Trade provides investors with the opportunity to trade on derivatives of various indices. Trading indices offers a way to diversify risk compared to single stock trading. The company offers a selection of popular indices such as ASX 200, FTSE CHINA A50, Germany DAX 30, Euro Stoxx 50, Hang Seng, KOSPI 200, and more. Each index contract has its own value per tick, quote digits, contract size per lot, minimum lot size, and average spread.

3. Commodities:

S.A.M. Trade allows investors to expand their investment portfolios by trading derivatives on spot metals and energies. The company offers contracts for gold, silver, WTI crude oil, Brent crude oil, and natural gas. Each commodity contract has a specific value per contract, quote digits, contract size per lot, minimum lot size, and average spread.

4. Futures:

Trading futures enables investors to diversify their portfolios and explore various trading opportunities. S.A.M. Trade offers futures contracts for the volatility index, Hang Seng China Enterprises, India Nifty 50, KOSPI 200, Russell 2000 Mini, Dollar Index, 10-year US Bond, DAX 30, Mini-sized DJIA, and US Oil. Each futures contract has its own value per tick, quote digits, contract size per lot, minimum lot size, and average spread.

5. Cryptocurrencies:

S.A.M. Trade allows clients to trade CFDs on popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and more. The company offers a range of cryptocurrency pairs, each with its own value per contract, quote digits, contract size per lot, and minimum lot size. It's important to note that leverage on cryptocurrency CFDs is capped at 1:5, and trading hours are available 24/7.

By offering these diverse trading instruments, S.A.M. Trade aims to provide its clients with a wide range of options to suit their investment preferences and strategies.

Here is a comparison table of trading instruments offered by different brokers:

| Trading Instruments | S.A.M Trade | IG Group | Just2Trade | Forex.com |

| CFDs | Yes | No | No | Yes |

| Forex | Yes | Yes | No | Yes |

| Indices | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Cryptocurrencies | Yes | Yes | No | Yes |

| ETFs | No | Yes | Yes | No |

| Shares | No | Yes | No | No |

| Options | No | Yes | Yes | Yes |

S.A.M. Trade offers a range of account types tailored to meet the specific needs and expertise levels of traders. The account types differ based on factors such as minimum funding requirements, spreads, leverage options, commissions, and additional features.

For the Australia region, S.A.M. Trade provides the following account types:

1. Standard Account: This account offers standard spreads, leverage of up to 1:30, no commission charges, floating spreads, negative balance protection, and 24/5 technical and account support. The minimum funding requirement for this account is USD 10.

2. VIP Account: The VIP account features tight spreads, priority customer support, leverage of up to 1:30, no commissions, floating spreads, negative balance protection, and 24/5 technical and account support. The minimum funding requirement for this account is also USD 10.

3. ECN Account: The ECN account offers the best available spreads, priority customer support, leverage of up to 1:30, USD 5 commission charges, floating spreads, negative balance protection, and 24/5 technical and account support. The minimum funding requirement for this account is USD 100.

For the St Vincent and the Grenadines region, S.A.M. Trade provides the following account types:

1. Standard Account: This account type offers standard spreads, leverage of up to 1:1000, no commission charges, floating spreads, negative balance protection, 24/5 technical and account support, and daily trade call. The minimum funding requirement for this account is USD 10.

2. VIP Account: The VIP account features tight spreads, priority customer support, leverage of up to 1:1000, no commissions, floating spreads, negative balance protection, 24/5 technical and account support, and daily trade call. The minimum funding requirement for this account is also USD 10.

3. ECN Account: The ECN account provides the best available spreads, priority customer support, leverage of up to 1:200, USD 5 commission charges, floating spreads, negative balance protection, 24/5 technical and account support, and daily trade call. The minimum funding requirement for this account is USD 100.

4. Islamic Account: S.A.M. Trade also offers an Islamic account with standard spreads, swap-free trading, leverage of up to 1:500, no commission charges, floating spreads, negative balance protection, 24/5 technical and account support, and daily trade call. The minimum funding requirement for this account is USD 10.

Traders should note that the maximum leverage differs between the two regions, with the Australia region offering a maximum leverage of 1:30, while the St Vincent and the Grenadines region offers higher maximum leverage options, ranging from 1:1000 to 1:200 depending on the account type. It is crucial for traders to consider their risk tolerance and trading strategies when selecting the appropriate account type.

To open an account on S.A.M. Trade, follow these steps:

Visit the S.A.M. Trade website: Go to the official website of S.A.M. Trade and locate the “Open Live Account” button on the homepage. Click on it to initiate the account opening process.

2. Choose your account type: On the registration page, you will be presented with different account types to choose from, including Individual, Joint and Corporate.

3. Complete the registration process: Fill in the required information, including your personal details, contact information, and any additional information requested. Ensure that all the provided information is accurate and up to date.

4. Receive your account login details: After submitting the registration form, you will receive an automated email containing your personal account login information. Keep this information secure as it will be used to access your trading account.

5. Log in to your account: Using the provided login details, access your S.A.M. Trade account by logging in through the website's login portal. Make sure to use the correct username and password to gain access successfully.

6. Deposit funds: Once logged in, proceed to deposit funds into your trading account. S.A.M. Trade typically provides multiple payment methods, including Bank Transfers, Visa / Master and Tether (USDT). Choose the most convenient option for you and follow the instructions to deposit the desired amount.

7. Download the trading platform: To start trading, you will need to download the trading platform provided by S.A.M. Trade. Follow the instructions on the website to download and install the trading platform.

Once the trading platform is installed, you can log in using your account credentials and begin trading in the financial markets offered by S.A.M. Trade. It is recommended to familiarize yourself with the platform's features and tools before placing any trades.

S.A.M. Trade provides different leverage options based on the account types and the regions in which they operate. In the Australia region, the maximum leverage offered is 1:30 for all the account types available, including the Standard, VIP, and ECN accounts. This means that traders can access a leverage ratio of up to 1:30 for their trades.

On the other hand, in the St Vincent and the Grenadines region, S.A.M. Trade offers higher maximum leverage options. The Standard and VIP accounts in this region allow traders to utilize leverage of up to 1:1000, providing greater potential for amplifying trading positions. The ECN account, however, offers a maximum leverage of 1:200.

It's important for traders to understand that leverage magnifies both potential profits and losses. Higher leverage can increase potential gains but also increases the risk of significant losses. Therefore, it is crucial for traders to carefully assess their risk tolerance, trading strategies, and market conditions when deciding on the appropriate leverage level.

Here is a comparison table of maximum leverage offered by different brokers:

| S.A.M Trade | IG Group | Just2Trade | Forex.com | |

| Maximum Leverage | 1:1000 | 1:30 | 1:20 | 1:200 |

S.A.M. Trade offers a variety of account types with different spreads and commissions to suit the needs of different traders. For most account types, including the standard ones, there are no commissions charged for investing. This means that traders can execute trades without incurring additional fees beyond the spreads.

While S.A.M. Trade does not provide specific spreads for each account or instrument, they do offer average prices for certain popular trading pairs and assets. For example, the EUR/USD currency pair typically has a spread ranging from 1.7 to 2 pips, indicating the difference between the buying and selling prices. The GBP/USD pair, on the other hand, has an average spread of 2.4 to 2.6 pips. Commodity trades like Crude Oil and Natural Gas have an average spread of 5.0 cents.

For traders looking for the tightest spreads, S.A.M. Trade offers an ECN account type. With this account, traders can access the market through an STP/ECN model, which provides direct access to liquidity providers. However, there is a $5 commission per round lot turn for trades executed through the ECN account. This commission covers the cost of accessing the competitive spreads and liquidity offered by the ECN model.

In summary, S.A.M. Trade offers commission-free investing for most account types, allowing traders to trade without additional fees beyond the spreads. While specific spreads are not provided for all instruments, average prices are available for popular trading pairs and commodities. Traders seeking the tightest spreads can opt for the ECN account, but should be aware of the $5 commission per round lot turn.

S.A.M. Trade imposes swap charges for positions held overnight. They offer a profit-sharing plan called CopySam™, where users may share a portion of the profits generated from copied trades. Opening a live trading account with S.A.M. Trade is free, and there are no account management fees.

S.A.M. Trade offers different trading platforms for traders in Australia and St Vincent and the Grenadines.

In Australia, S.A.M. Trade provides the popular MetaTrader 4 (MT4) trading platform. MT4 is widely recognized as a leading trading platform in the world. Traders can download MT4 for free and enjoy its user-friendly interface, extensive tools, and indicators. It supports various financial instruments such as forex, commodities, indices, and cryptocurrencies, providing a seamless trading experience.

For traders in St Vincent and the Grenadines, S.A.M. Trade introduces CopySam™, an innovative trade copying technology. CopySam™ allows traders to follow and trade like expert traders by automatically copying their trades with precision. It offers beginners the opportunity to replicate winning traders' trades and experienced traders the convenience of minimal time involvement while diversifying their portfolios. CopySam™ has received the Collective Investment Platform Certification, ensuring transparency and fair trading practices.

By offering both MT4 and CopySam™, S.A.M Trade caters to the needs of different types of traders. MT4 provides a robust and versatile trading platform for those who prefer to analyze the markets and execute their own trades, while CopySam™ offers a convenient way to follow and copy the trades of successful traders, making it suitable for traders who prefer a more hands-off approach to trading.

S.A.M. Trade offers customer service support through different channels, including a contact form on their website and dedicated email addresses for media/partnership inquiries and general support. Traders can fill out the contact form with their details to receive a prompt response. Media and partnership inquiries can be sent to marketing@samtradefx.com, while general support inquiries can be directed to support@samtradefx.com. Additionally, customers can follow S.A.M. Trade on Facebook and YouTube for updates. While phone support may not be mentioned, the broker is committed to providing accessible customer service through these available channels.

S.A.M. Trade recognizes the importance of education and provides a range of resources to help clients gain knowledge and skills in forex and commodity trading. They offer educational guides and articles that cover various topics such as forex trading basics, CFDs and commodities, leverage and margin, and important concepts like Overnight Funding and Margin Call Policy. These resources aim to equip traders with the necessary understanding to navigate the trading world effectively.

In addition to educational materials, S.A.M. Trade offers an exclusive membership program that provides valuable guidance and market analysis. Led by expert trainers, registered clients gain access to the latest market news, fundamental research, and a results-driven approach to trading. The membership program includes eight sessions held every Friday evening for eight weeks, as well as a Bootcamp consisting of 10 sessions spread over three weekends. While there is a one-time membership fee of $10,000 associated with this program, clients can benefit from the expertise and insights shared during these sessions to enhance their trading strategies.

S.A.M. Trade offers trading tools to enhance the trading experience and ensure the security of funds. One of these tools is SamTracks™, a Portfolio Monitoring System that helps traders track their account and trading performance. It provides an overview of the account, allows performance tracking, monitors asset allocation, and displays traded volume.

S.A.M. Trade also prioritizes fund security through their Six Pillars of Secured Fund Coverage, known as SamAide™. These pillars include measures such as segregating clients' funds, professional indemnity insurance, third-party insurance protection, membership in the Financial Commission, and Negative Balance Protection. They also provide real-time deposit and withdrawal notifications to keep clients informed about their account activity.

S.A.M. Trade provides promotional offers to its clients, including the SamRewards™ program. This program rewards retail investors based on their trading volumes. By meeting certain criteria such as making a first deposit of $500, trading 1 standard FX lot, or referring new clients, investors can earn 'points'. These points can then be exchanged for luxury prizes, including electronics.

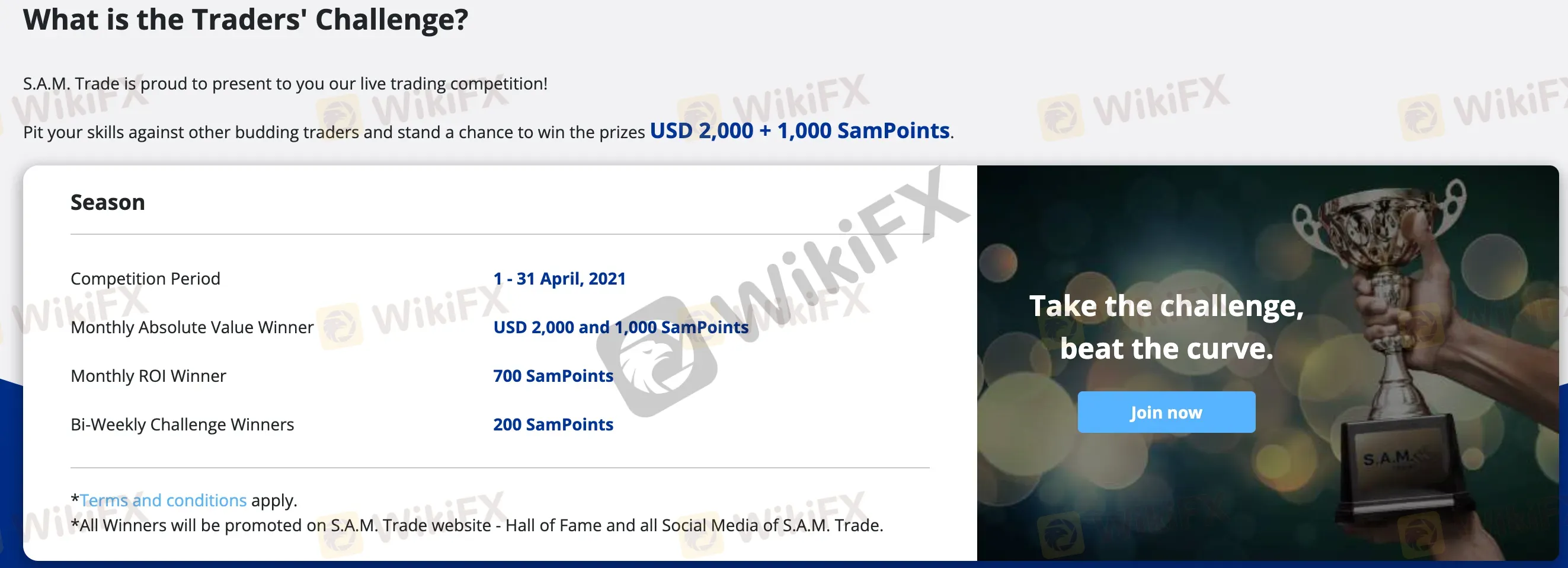

In addition, S.A.M. Trade occasionally organizes a 'Traders' Challenge'. This challenge allows clients to compete based on their performance during a specific month. Participants have the opportunity to win up to $2000 and earn 1,000 SamPoints, providing an added incentive for traders to excel in their trading activities.

At S.A.M. Trade, there are several deposit methods available for clients. These include Tether (USDT), which typically takes up to one working day to process, Bank Wire Transfer, which takes one to four working days, and Visa & Mastercard Credit & Debit Cards, which are processed within one hour during weekdays. While most S.A.M. Trade live accounts have a minimum deposit of $10, the accepted payment methods require a minimum deposit of $20 or its equivalent currency (or USDT 50). The broker itself does not charge any fees for deposits, but investors may be responsible for any third-party charges.

When it comes to withdrawals, S.A.M. Trade accepts withdrawals through the same deposit methods. A minimum withdrawal amount of $20 or USDT 50 applies. Withdrawal processing times typically range from one to four working days for bank transfers and credit/debit cards. However, all withdrawals are processed by the broker within 72 hours. Tether payments, on the other hand, can be processed in one working day. Just like with deposits, S.A.M. Trade does not charge any withdrawal fees, but investors may need to bear any applicable third-party charges.

In conclusion, S.A.M. Trade is an unlicensed broker based in Australia that offers a variety of tradable assets and account types with attractive features such as low minimum deposits, high leverage, and access to popular trading platforms. However, the lack of regulatory oversight and accountability is a significant disadvantage. Trading with an unlicensed broker raises concerns about fund safety, unfair trading practices, and limited avenues for dispute resolution. Traders should carefully evaluate the risks involved and consider regulated alternatives before engaging with S.A.M. Trade or any unlicensed broker.

Q: Is S.A.M. Trade a regulated broker?

A: No, S.A.M. Trade currently operates without valid regulation.

Q: What trading instruments are available on S.A.M. Trade?

A: S.A.M. Trade offers Forex, Indices, Commodities, Futures, and Cryptocurrencies as trading instruments. Each category has a variety of assets available for trading.

Q: What leverage options does S.A.M. Trade offer?

A: S.A.M. Trade offers leverage options of up to 1:1000 for Standard and VIP accounts, up to 1:200 for ECN accounts, and up to 1:500 for Islamic accounts.

Q: What trading platforms are available at S.A.M. Trade?

A: S.A.M. Trade offers MetaTrader 4 (MT4) and their proprietary copy trading platform, CopySam™.

Q: What are the deposit and withdrawal methods offered by S.A.M. Trade?

A: S.A.M. Trade accepts deposits through Tether (USDT), Bank Wire Transfer, and Visa/Mastercard Credit & Debit Cards. Withdrawals can be made using the same methods.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive tmgm and sam-trade are, we first considered common fees for standard accounts. On tmgm, the average spread for the EUR/USD currency pair is From 0 pips, while on sam-trade the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

tmgm is regulated by ASIC,VFSC. sam-trade is regulated by ASIC,FCA,ASIC,VFSC,FCA,ASIC.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

tmgm provides trading platform including Edge ,Classic and trading variety including FX: 56 Bullion: 3 Oil: 2 CFD: 20 Crypto: 12 Shares: 48. sam-trade provides trading platform including ECN,Islamic,Standard,VIP and trading variety including --.