No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between MultibankFX and FirewoodFX ?

In the table below, you can compare the features of MultibankFX , FirewoodFX side by side to determine the best fit for your needs.

--

--

EURUSD:0.3

EURUSD:0.4

EURUSD:14.52

XAUUSD:34.85

EURUSD: -8.59 ~ 2.38

XAUUSD: -26.34 ~ 11.57

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of multibankfx, firewoodfx lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

Note: For some unknown reason, we cannot open MultibankFXs official site (https://www.multibankfx.com) while writing this introduction, therefore, we could only gather relevant information from the Internet to present a rough picture of this broker. Traders should be careful about this issue.

General Information & Regulation

MultibankFX, a trading name of MEX Group Worldwide Limited, is allegedly a forex and CFD broker registered in the United Kingdom that claims to provide its clients with over 1,000+ tradable financial instruments with leverage capped at 1:500 and variable spreads from 0.0 pips on the leading MetaTrader4 and MetaTrader5 trading platforms, as well as a choice of three different live account types.

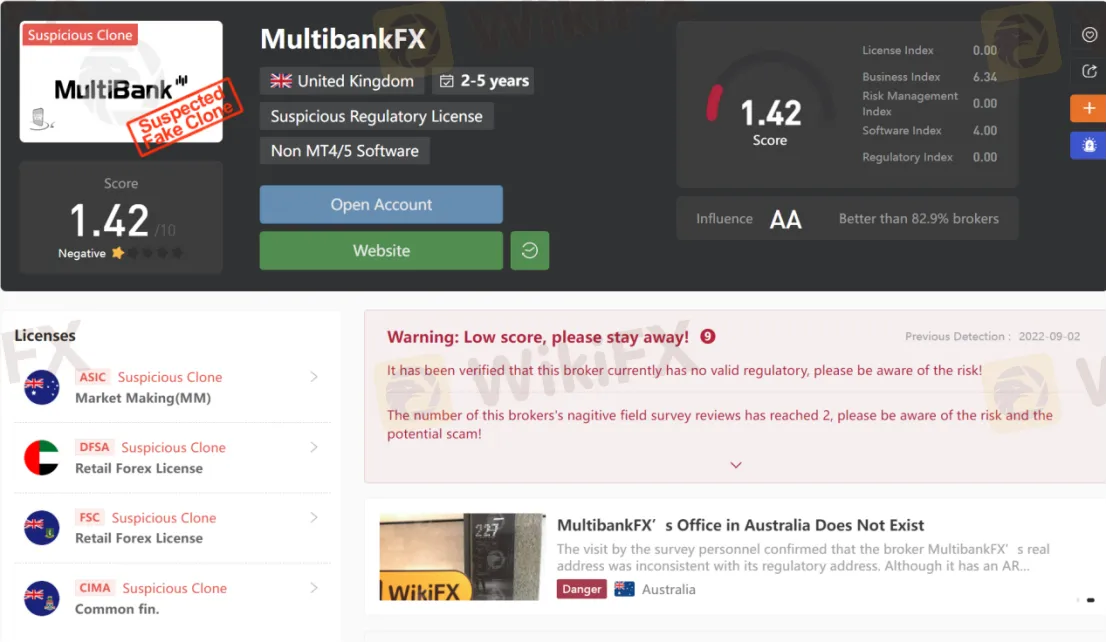

As for regulation, it has been verified that MultibankFX has four different licenses, but they are all suspicious clone, that is why its regulatory status on WikiFX is listed as “Suspected Fake Clone” and it receives a relatively low score of 1.42/10. Please be aware of the risk.

Field Survey

The investigators went to London, UK, to visit the foreign exchange dealer MultibankFX as planned. However, they did not find the dealers office at the publicly displayed address. The dealer may just borrow the address to register the company without a real business place. Investors are advised to choose the dealer carefully.

Market Instruments

MultibankFX advertises that it offers access to more than 1,000 trading instruments in financial markets, including forex pairs and CFDs on indices, commodities, precious metals and shares.

Account Types

MultibankFX claims to offer three types of trading accounts, namely Maximus, MultiBank Pro and ECN Pro. The minimum initial deposit amount is $50 for the Maximus account, while the other two account types have much higher minimum initial capital requirements of $1,000 and $5,000 respectively.

Leverage

The leverage offered by MultibankFX is capped at 1:500, which is much higher than that provided by most brokers. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads

MultibankFX claims that different account types can enjoy quite different spreads. Specifically, the spread on the Maximus account starts from 1.4 pips, the MultiBank Pro account has spread from 0.8 pips, while only the ECN Pro account holders can enjoy raw spreads from 0.0 pips. These spreads are all below the industry average of 1.5 pips.

Trading Platform Available

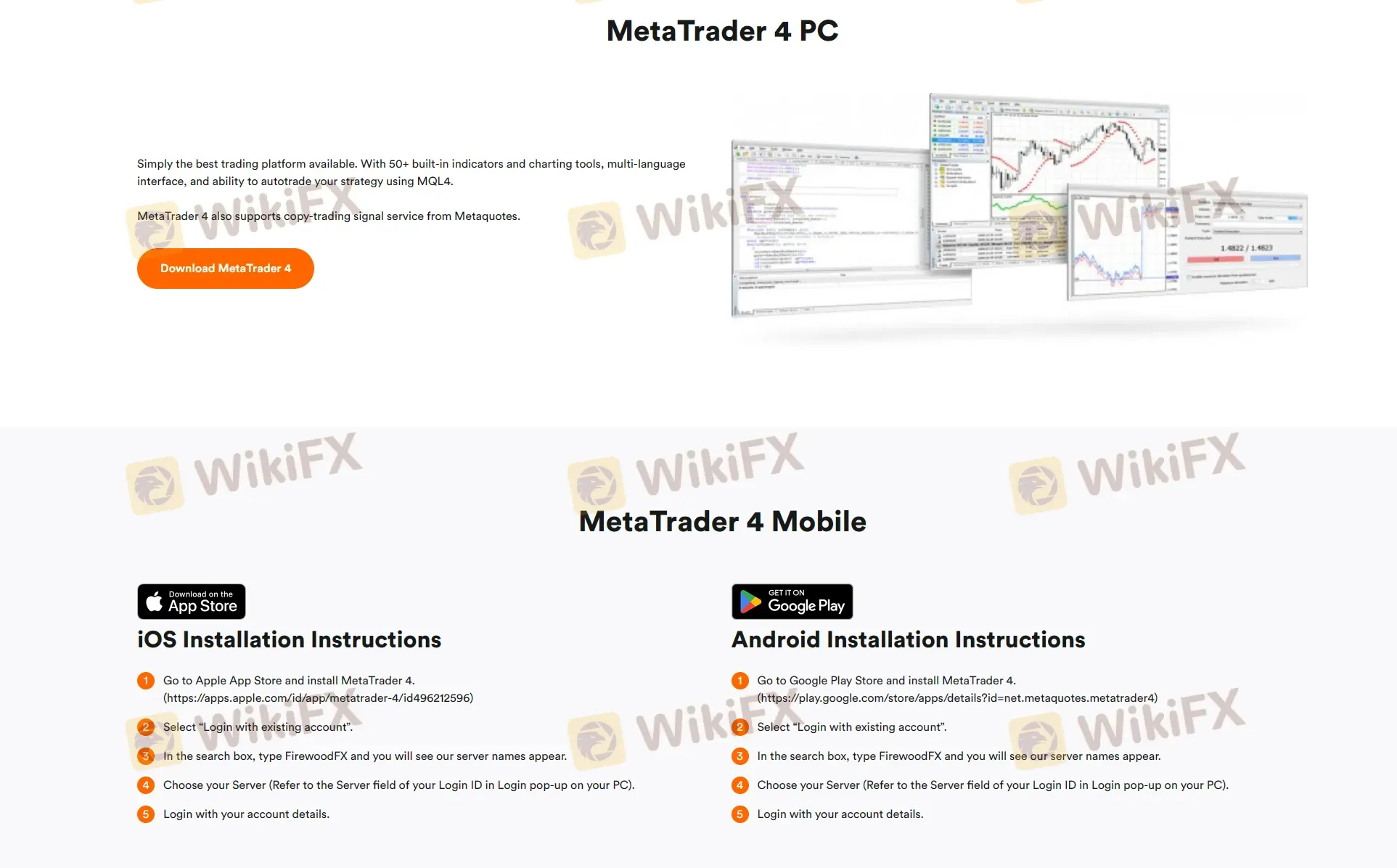

Platforms available for trading at MultibankFX are said to be the industry-standard MetaTrader4 and MetaTrader5. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

MultibankFX says to accept payments with credit cards like Visa and MasterCard, bank wire, Neteller and Skrill. The minimum initial deposit requirement is said to be only $50.

Bonuses & Fees

MultibankFX claims to offer all kinds of bonuses, covering the 100% bonus, the 20% bonus, Imperial bonus and Refer a Friend bonus. Just take the 20% bonus as an example: the minimum deposit required for it is $1,000. Clients who wish to withdraw $200 of their bonus must trade 80 lots for every $200 they wish to withdraw. Additionally, clients must complete the trading requirements within 90 days of receiving the bonus. Clients who fail to meet the deadline will only receive a percentage of the bonus.

In any case, you should be very cautious if you receive a bonus. First of all, bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task. Remember that brokers who are regulated and legitimate do not offer bonuses to their clients.

Also, the broker also charges an inactivity fee. If a trading account stays inactive for 3 months, a monthly fee of $60 will be charged. However, other licensed brokers give a grace period of 6 months or even 1 year.

Customer Support

MultibankFX‘s customer support can be reached by telephone: +44 203 953 8381 (English), +62 02129264151 (Indonesian), +351 304 500 657 (Portuguese), +400 120 8619 (Chinese), +49 69 257377474 (German), +1 833 291 1788 (French), +7 499 609 46 73 (Russian), +34 931 220 671 (Spanish), +84 28 44581652 (Vietnamese), email: cs@multibankfx.com, cncs@multibankfx.com, cs.mys@multibankfx.com. You can also follow this broker on social media platforms such as Twitter, Facebook, Instagram, YouTube and LinkedIn. However, this broker doesn’t disclose other more direct contact information like the company address that most brokers offer.

Risk Warning

Online trading involves a significant level of risk and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| Firewood FX Review Summary | |

| Founded | 2014 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | Forex, Gold, Cryptos, Oil, etc. |

| Demo Account | ✅ |

| Leverage | Up to 1:3000 |

| Spread | From 2 pips (Standard account) |

| Trading Platform | MT4 |

| Min Deposit | $10 |

| Customer Support | Live chat, contact form |

| Tel: +442036083558 | |

| Email: support@firewoodfx.com | |

| Address: Suite 305, Griffith Corporate Centre, Beachmont. St. Vincent and the Grenadines | |

| Regional Restrictions | The United States, North Korea, Iraq, Iran, Saint Lucia and Saint Vincent and the Grenadines |

Based in Saint Vincent and the Grenadines, FirewoodFX is an unregulated forex broker that was established in 2014. FirewoodFX provides various financial products to trade via the MT4 platform, including Forex, Gold, Cryptos, Oil and more. Demo accounts are available and the minimum deposit requirement to open a live account is only $10.

| Pros | Cons |

| Various trading options | Unregulated |

| Demo accounts | Regional restrictions |

| Cent account offered | |

| Multiple account types | |

| Commission-freefor most accounts | |

| Low minimum deposit | |

| Multiple payment options | |

| Live chat support |

No, FirewoodFX is not regulated by any reputable financial body. Please be aware of the risk!

| Tradable Instruments | Supported |

| Forex | ✔ |

| Gold | ✔ |

| Cryptos | ✔ |

| Oil | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

FirewoodFX offers five accounts to choose from, including Cent, Micro,Standard, Premium and ECN accounts. Besides, it also sets up demo accounts for traders to practice trading with virtual credit. Islamic swap free accounts are available.

| Account Type | Min Deposit | Max Trade Size | Min Trade Size |

| Cent | $10 | 100 cent lot (100,000) | 0.01 cent lot (1,000) |

| Micro | 200 micro lot (200,000) | 0.01 micro lot (100) | |

| Standard | 30 lot (3,000,000) | 0.01 lot (1,000) | |

| Premium | 50 lot (3,000,000) | ||

| ECN | $200 |

FirewoodFX provides leverage up to 1:3000 for Cent account and up to 1:1000 for other accounts. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

| Account Type | Max Leverage |

| Cent | 1:3000 |

| Micro | 1:1000 |

| Standard | |

| Premium | |

| ECN |

FirewoodFX offers different spreads for different accounts. The broker charged $7/lot for ECN account and commission-free on other accounts.

| Account Type | Spread | Commission |

| Cent | Floating from 1 pip | ❌ |

| Micro | Fixing from 3 pips | ❌ |

| Standard | Fixing from 2 pips | ❌ |

| Premium | Floating from 0.3 pip | ❌ |

| ECN | Floating from 0 pips | $7/lot |

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web, PC, Mac, mobile and tablet | Beginners |

| MT5 | ❌ | / | Experienced traders |

| Payment Options | Accepted Currencies | Min Deposit | Fees | Processing Time |

| Bank Transfer | USD | $100 | Bank fees may apply | 24 hours |

| QRIS | IDR | IDR 100,000 | ❌ | Few minutes |

| Internet Banking (Indonesian Local Bank) | $10 | |||

| Virtual Account (E-Wallet) | ||||

| USD Tether TRC20/BEP20 | USTD | $1 | ||

| USD Coin BEP20 | ||||

| IDRX BEP20 | IDRX | |||

| Credit Card | USD | $50 | $0.5+ 5% | Instant deposit |

| Perfect Money | $1 | ❌ | ||

| Fasapay | USD, IDR | |||

| Thai QR Payment | THB | $10 | Few minutes |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive multibankfx and firewoodfx are, we first considered common fees for standard accounts. On multibankfx, the average spread for the EUR/USD currency pair is -- pips, while on firewoodfx the spread is From 0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

multibankfx is regulated by ASIC,DFSA,FCA,FSC,CIMA. firewoodfx is regulated by --.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

multibankfx provides trading platform including -- and trading variety including --. firewoodfx provides trading platform including ECN,Micro,Standard,Premium,Cent and trading variety including --.