No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between Eightcap and WeTrade ?

In the table below, you can compare the features of Eightcap , WeTrade side by side to determine the best fit for your needs.

EURUSD:0.9

EURUSD:-0.8

EURUSD:15.62

XAUUSD:14.51

EURUSD: -6.88 ~ 2.5

XAUUSD: -31.25 ~ 23.37

EURUSD:18.95

XAUUSD:31.96

EURUSD: -7.64 ~ 0.36

XAUUSD: -36.1 ~ 13.75

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of eightcap, wetrade lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| Eightcap Review Summary | |

| Founded in | 2009 |

| Registered Country | Australia |

| Regulation | ASIC, FCA, CySEC, SCB (Offshore) |

| Trading Assets | 800+ CFDs on forex, commodity, crypto, index, share |

| Demo Account | ✅(30 days) |

| Leverage | Up to 1:500 |

| EUR/USD Spread | From 0 pips |

| Minimum Deposit | $100 |

| Trading Platform | MetaTrader 4, MetaTrader 5, Tradingview |

| Payment Method | MasterCard, Visa, PayPal, Wire Transfer, BPAY, Skrill, Neteller, etc. (vary on the region) |

| Customer Support | Live chat, phone, email, FAQs |

Eightcap is a popular online forex and CFDs broker that offers access to trade various financial markets. The broker was founded in 2009 in Melbourne, Australia, and has since expanded its presence to other regions such as Europe, Asia, and the Middle East. Eightcap prides itself on providing a user-friendly trading experience, robust trading platforms, and competitive trading conditions for its clients.

The broker offers a wide range of financial instruments to trade, including 800+CFDs on forex, commodity, crypto, index, and share. Clients can access these markets through the popular trading platforms, MetaTrader 4, MetaTrader 5, and TradingView. The broker also offers three types of account types to suit the individual needs of its clients, including Standard, Raw and TradingView, with the minimum deposit requirement of $100.

Eightcap is a global forex and CFD broker offering many features and benefits that make it an attractive choice for traders of all levels. One of the primary advantages of Eightcap is its range of trading instruments, including CFDs on forex, commodity, crypto, index, and share. This diversity allows traders to take advantage of a wide range of market opportunities and build diversified portfolios.

In addition to its broad range of trading instruments, Eightcap also offers competitive trading conditions, such as tight spreads and low commissions, which can help traders maximize their profits. The broker also provides access to multiple trading platforms, including MetaTrader 4 and 5, as well as TradingView.

While there are many benefits to trading with Eightcap, there are also some drawbacks to consider. One of these is the limited selection of educational resources, which may be a disadvantage for novice traders. Additionally, the broker does not currently offer social trading options and 24/7 customer support.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Yes, Eightcap is considered a legitimate broker, regulated by reputable financial authorities including ASIC (Australia), FCA (UK), CySEC (Cyprus), and SCB (Bahamas). These regulatory bodies impose strict rules and regulations on the broker to ensure they operate in a fair and transparent manner, thereby providing traders with a safe and secure trading environment.

EIGHTCAP PTY LTD, its Australian entity, is authorized and regulated by the Australia Securities & Investment Commission (ASIC) under the regulatory license number 391441.

Eightcap EU Ltd, is regulated by the Cyprus Securities and Exchange Commission (CYSEC) under license no. 246/14.

Eightcap Group Ltd, its UK entity, is authorized and regulated by the Financial Conduct Authority (FCA) under the regulatory license number of 921296.

Eightcap Global Limited, the international entity, is authorized and offshore regulated by the Security Commission of the Bamas (SCB) under the regulatory license number of SIA-F220.

800+ CFDs on forex, commodity, crypto, index, share... EightCap allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade on EightCap.

Live Accounts: EightCap offers three types of accounts at EightCap: Raw, Standard and TradingView accounts. All require a moderate minimum deposit of 100 USD, which is quite friendly for beginners. Their most relevant differences consist in the spreads, the raw account has a lower spread. Standard and TradingView accounts offers a commission-free trading environment, yet compensated by wider spreads, while Raw accounts offers raw spreads, accompanied by additional commissions.

The Raw Account is designed for traders seeking tight spreads and transparent pricing. With a minimum deposit of $100, traders can access over 800 instruments with spreads starting from 0.0 pips. However, a commission is charged on each side of the trade, ranging from $3.5 for major currencies like AUD, USD, NZD, SGD, and CAD, to $2.25 for GBP and $2.75 for EUR per standard lot traded. This account type allows scalping and supports a wide range of base currencies, including AUD, USD, EUR, GBP, NZD, CAD, and SGD. The minimum trade size is 0.01 lots, with a maximum of 100 lots.

The Standard Account is designed for traders seeking a more straightforward pricing structure. With a minimum deposit of $100, traders can access over 800 instruments with spreads starting from 1.0 pips. No commissions are charged, making it a cost-effective option for traders who prefer to pay through the spread. Like the Raw Account, the Standard Account allows scalping, supports multiple base currencies, and offers the same minimum and maximum trade sizes, margin call levels, and stop-out levels.

The TradingView Account is a unique offering that integrates with the popular TradingView platform. With a minimum deposit of $100, traders can access over 800 instruments with spreads starting from 1.0 pip and no commissions charged. This account type is suitable for traders who prefer to use the TradingView platform for analysis and trading. Similar to the other account types, the TradingView Account allows scalping, supports a wide range of base currencies, and offers the same minimum and maximum trade sizes, margin call levels, and stop-out levels.

Aside from two types of live trading accounts, Eightcap offers a 30-day demo account for traders who want to practice and test their trading strategies without risking real money. The demo account is free and is designed to simulate real market conditions, allowing traders to get a feel for the platform and instruments before they start trading with a live account. The demo account is funded with virtual money and offers access to the same features as the live account, including a range of instruments and trading platforms.

The maximum leverage is determined by the regulator; the maximum ASIC leverage is only 1:30, but the Bahamas SCB allows a leverage of 1:500. However, other trading conditions may vary accordingly and you can decide for yourself.

High leverage is ideal for active traders and scalpers, as it presents greater trading flexibility in general, which directly impacts profitability, but new users are advised to operate with caution with such large leverage.

Eightcap offers competitive spreads and commissions on their trading instruments. The spreads on forex pairs start from as low as 0.0 pips on the Raw account and 1.0 pips on the Standard account. The commissions charged on forex trades start from $3.50 per lot round trip on the Raw account and there are no commissions on the Standard account.

For indices, the spreads start from 0.5 pips on the Raw account and 1.0 pips on the Standard account.There are no commissions charged on indices trading. The spreads on commodities trading start from 0.03 pips on the Raw account and 0.5 pips on the Standard account, and there are no commissions charged on commodities trading. The spreads and commissions may vary depending on market conditions and the type of account held by the trader.

Eightcap charges non-trading fees, which are fees not directly related to trading, such as deposit and withdrawal fees, inactivity fees, and currency conversion fees.

For deposits, Eightcap does not charge any fees, but there may be fees charged by the payment provider or bank. Withdrawals made via bank transfers are free, but there is a fee of $10 for withdrawals via credit/debit cards.

Additionally, Eightcap charges an inactivity fee of $50 per quarter if there are no trades or account activity for a period of 90 days or more. It's important to note that this fee is only charged if there are sufficient funds in the account, and it does not apply to demo accounts.

Eightcap also charges a currency conversion fee of 0.5% for clients who deposit or withdraw in a currency other than their account base currency. This fee can be higher for certain currencies, so it's important to check with Eightcap for the exact fee amount.

Eightcap offers multiple trading platforms, including the popular MetaTrader 4, MetaTrader 5, and Tradingview. These platforms are known for their user-friendly interface and advanced charting tools. Additionally, Eightcap also provides a web-based trading platform that can be accessed from any device with an internet connection. This platform is ideal for traders who prefer a simpler interface or who don't want to download and install software on their device.

With the MetaTrader platforms, Eightcap offers a range of customizable features, including the ability to use custom indicators and expert advisors. These platforms also provide access to real-time market data and allow traders to execute trades quickly and efficiently. Traders can also use the platforms to set up automated trading strategies, which can be particularly useful for those who want to trade around the clock.

EightCap's TradingView leverages 15+ customizable chart types, including Kagi, Renko, and Point & Figure. Organize up to 8 synchronized charts per tab and utilize 90+ smart drawing tools for comprehensive analysis.

Furthermore, Eightcap's web-based trading platform is designed to offer a streamlined trading experience. It includes essential features such as real-time market news, customizable charts, and advanced order types. The platform also offers access to a range of educational resources, including trading videos, webinars, and tutorials, which can be helpful for new traders looking to improve their skills.

Eightcap offers a variety of deposit and withdrawal methods, such as MasterCard, Visa, PayPal, Wire Transfer, BPAY, Skrill, Neteller, etc. (vary on the region). You can find more detailed info in the table below:

| Payment Option | Accepted Currencies | Deposit Fee | Withdrawal Fee | Deposit Processing Time | Withdrawal Processing Time |

| MasterCard | AUD, USD, GBP, EUR, NZD, CAD, SGD | ❌ | ❌ | Instant | 2-5 business days |

| Visa | |||||

| PayPal | AUD, USD, GBP, EUR, NZD, SGD | 1-5 business days | |||

| Wire Transfer | AUD, USD, GBP, EUR, NZD, CAD, SGD | Variable | 1-5 business days | ||

| B-PAY | AUD | ❌ | 1-2 business days | 1-3 business days | |

| UnionPay | RMB | Instant | 1 business day | ||

| Skrill | USD, EUR (only for EEA clients), CAD | Variable | |||

| Neteller | |||||

| Cryptos | USDT (TRC20), USDT (ERC20), BTC (only for USD accounts) | ❌ | / | Instant | |

| Interac | CAD | ❌ | 1-3 business days | ||

| fasapay | USD | 1 business day | |||

| pix | BRL | / | / | / | 1-5 business days |

| dragonpay | MYR, PHP | Variable | ❌ | Instant | 1 business day |

| ... | THB, VND, MYR, IDR, PHP |

Eightcap offers live chat, phone, and email. Their live chat feature is available 24/5, which means clients can get instant assistance whenever they need it. Phone support is available during business hours, and email support promises a response within 24 hours.

In addition, Eightcap has an extensive FAQ section on its website that covers various topics, such as account opening, trading platforms, funding and withdrawals, and trading conditions.

In conclusion, Eightcap seems like a solid choice for traders looking for a reliable broker with a wide range of instruments, competitive pricing, and user-friendly platforms. Their customer support is also top-notch, with various ways to get in touch and a comprehensive FAQ section. While their educational resources may not be as extensive as some other brokers, they still provide useful tools and market analysis to help traders stay informed. The only potential downside is the lack of proprietary trading platforms, but with MT4, MT5, and TradingView available, there's still plenty of options to choose from.

Is Eightcap regulated?

Yes, Eightcap is regulated by ASIC, FCA, CySEC, and SCB (Offshore).

What trading platforms does Eightcap offer?

Eightcap offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView.

What are the minimum deposit requirements for Eightcap?

The minimum deposit requirement for Eightcap's Standard account is $100.

What is the maximum leverage available at Eightcap?

Up to 1:500.

Can I open a demo account with Eightcap?

Yes, Eightcap offers a 30-day demo account that allows traders to practice their trading strategies without risking real money.

What financial instruments can I trade at Eightcap?

You can trade CFDs on forex, commodity, crypto, index, and share on Eightcap.

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities.

| Registered in | United Kingdom |

| Regulated by | LFSA, FSA |

| Year(s) of establishment | 2015 |

| Trading instruments | Forex pairs, metals, energies, indices, stocks, cryptocurrencies… 120+ instruments |

| Minimum Initial Deposit | $100 |

| Maximum Leverage | 1:2000 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, WeTrade APP |

| Deposit and withdrawal method | Bank wire transfer, USDT, local deposit, union pay |

| Customer Service | 24/7 Email, live chat, YouTube, Facebook, LINE, WeChat public account,Little Red Book, and BiliBili |

| Fraud Complaints Exposure | No for now |

WeTrade is a UK registered forex broker that is regulated by the Financial Services Authority (FSA) and the Labuan Financial Services Authority (LFSA) in Malaysia. The FSA is one of the most reputable financial regulatory bodies in the world, and its oversight ensures that WeTrade operates according to strict standards of transparency and fairness. The LFSA is also a well-respected regulator and its oversight provides an additional layer of protection for traders. WeTrade's regulatory status is a significant advantage as it offers traders a level of protection and reassurance that their funds are safe and that the broker is operating within the law.

WeTrade is regulated by the Labuan Financial Services Authority (LFSA) in Malaysia under a Straight Through Processing (STP) model, ensuring adherence to local financial regulations. Additionally, it holds offshore regulatory status with the Financial Services Authority (FSA), which includes business registration for broader operational compliance. These regulatory frameworks ensure that WeTrade maintains high standards of transparency and security, providing a reliable trading environment for its clients.

Pros and Cons of WeTrade

Pros:

Cons:

| Pros | Cons |

| Regulated by FSA and LFSA | Limited deposit/withdrawal options |

| Wide range of instruments | Customer support limited to email and social media |

| Multiple account types, including demo | Limited company background information |

| Competitive spreads; high leverage up to 1:2000 | ECN account: $1000 minimum deposit, $7/lot commission |

| Educational resources available |

WeTrade offers its traders a wide range of 120+ instruments to choose from, including forex pairs, metals, energies, indices, stocks, and cryptocurrencies. This provides traders with a great opportunity to diversify their trading portfolio and access a variety of markets and assets. Additionally, the selection of cryptocurrencies offered by WeTrade is somewhat limited compared to some other brokers in the market.

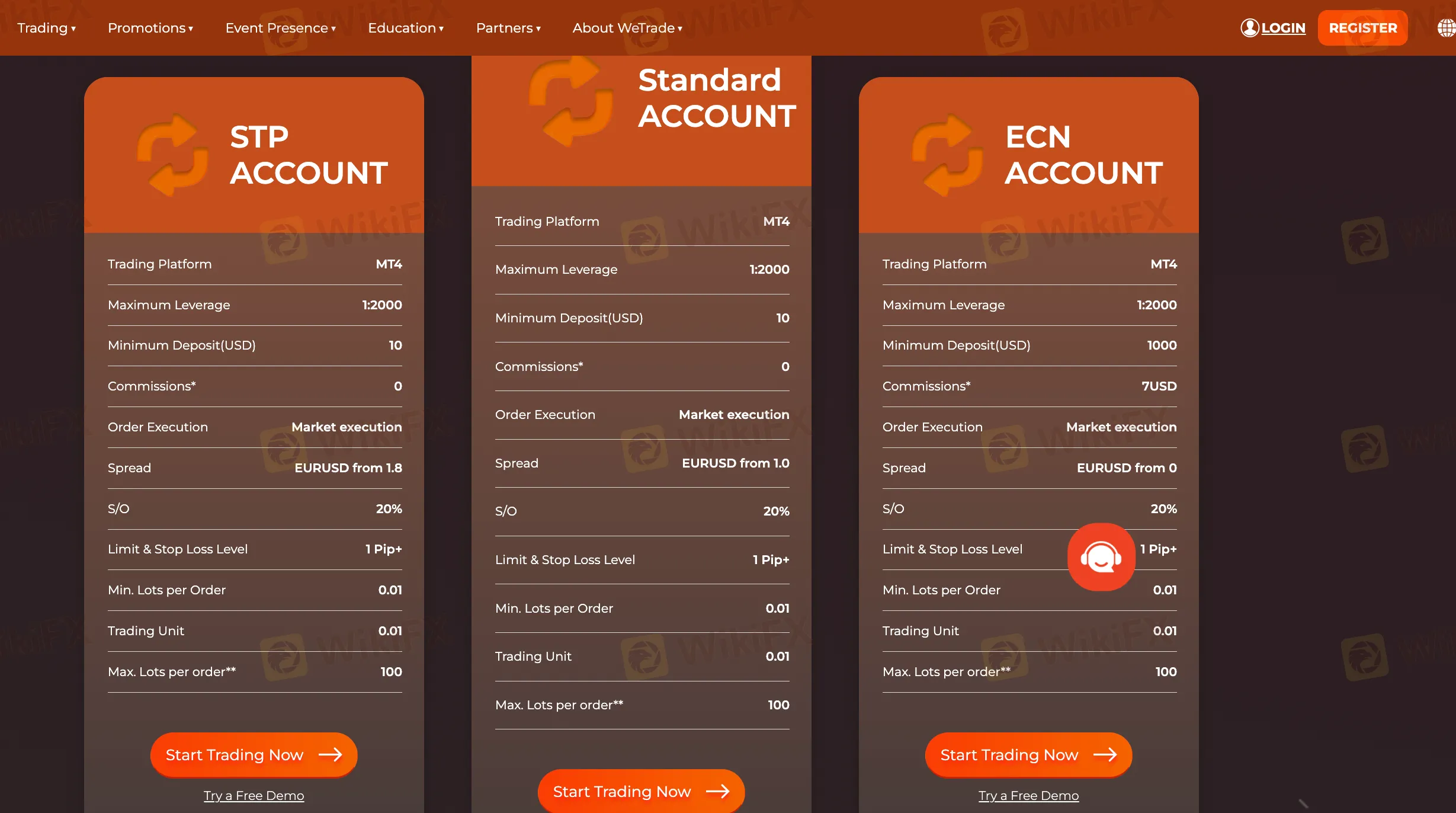

WeTrade offers a variety of account types, including ECN, Standard, and STP, each with different spreads and fees. The ECN account offers zero spreads but charges a $7 commission per lot traded, making it suitable for high-volume traders. The Standard account provides lower EUR/USD spreads starting from 1.0 pips with no commission, making it ideal for advanced traders. The STP account offers EUR/USD spreads starting from 1.8 pips with no commission, making it a good choice for beginner traders. Overall, WeTrades spreads and commission rates are competitive and cater to different trading needs.

WeTrade offers three account types to meet the needs of traders. The ECN account requires a higher minimum deposit of $1,000 but offers spreads as low as 0.0 pips, with a $7 commission per lot traded. Both the Standard and STP accounts have a minimum deposit of $100 and offer commission-free trading. Additionally, traders can use demo accounts to practice their strategies without risking real capital. A high leverage of 1:2000 is available across all account types, although some traders may prefer lower leverage.

WeTrade offers clients the MetaTrader 4 (MT4) platform, a widely used and user-friendly trading platform in the forex industry, also available in a mobile version. MT4 is known for its extensive technical analysis tools, indicators, and support for algorithmic trading via Expert Advisors (EAs).

However, MT4 has some limitations, such as limited customization options, lack of an integrated economic calendar, and no mobile push notifications. Additionally, its backtesting timeframes are restricted, which may hinder traders who need thorough strategy testing.

In addition to MT4, WeTrade also offers its mobile app as an alternative trading platform.

WeTrade offers a maximum leverage of up to 1:2000, which is relatively high compared to other forex brokers. This allows traders to potentially increase their profits with a smaller capital investment and have greater market exposure. However, high leverage also increases the risk of significant losses and margin calls, especially for inexperienced traders who may misuse it or engage in overtrading or emotional trading. Experienced traders with solid risk management strategies may find high leverage useful, but regulated brokers have limits on maximum leverage, which may restrict traders from taking advantage of higher leverage ratios.

WeTrade offers its clients multiple deposit options, including USDT, bank wire, and local deposits. Clients can withdraw funds via union pay and bank wire. WeTrade does not charge any extra fees for deposits or withdrawals. Additionally, there is no minimum account required, making it accessible for traders with different budgets. However, there is limited information provided about the deposit/withdrawal processing time. While WeTrade provides a safe and secure transaction environment, it offers limited withdrawal options compared to other brokers.

WeTrade offers various educational resources to its clients to enhance their trading skills and knowledge of the financial markets. The resources include an economic calendar, market reports, video tutorials, analyst views, indicators, and TV channels. The economic calendar keeps clients informed about important upcoming events that could affect the markets, while the market reports and analyst views provide up-to-date information on market trends. The video tutorials cover a range of topics from the basics of trading to advanced strategies, and clients can access a variety of indicators and TV channels for technical analysis. The educational resources are available in multiple languages to cater to clients from different parts of the world.

WeTrade offers a comprehensive customer care service that is available 24/7 through various communication channels such as email, YouTube, Facebook, and LINE. This provides customers with multiple options to reach out to the support team and get their queries resolved in a timely manner. Additionally, the support team has a reputation for providing quick response times, which ensures that customers' issues are resolved efficiently. However, WeTrade does not offer phone support, which may be inconvenient for some customers who prefer to speak with a representative directly. Moreover, the response time may vary based on the communication channel used, and the nature of the query may also impact the response time.

In conclusion, WeTrade is a UK-based forex broker that is regulated by FSA and LFSA. The broker offers various account types, including ECN, Standard, and STP, with competitive spreads and high leverage up to 1:2000. The broker supports various trading instruments, including forex pairs, metals, energies, indices, stocks, and cryptocurrencies. Overall, WeTrade has some advantages such as competitive trading conditions, a wide range of tradable instruments, and excellent customer support, which make it an attractive option for traders.

However, there are also some drawbacks such as lack of a proprietary trading platform, and no negative balance protection. Therefore, traders should carefully consider their options and weigh the advantages and disadvantages before choosing WeTrade as their preferred forex broker.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive eightcap and wetrade are, we first considered common fees for standard accounts. On eightcap, the average spread for the EUR/USD currency pair is From 0.0 pips, while on wetrade the spread is As low as 0.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

eightcap is regulated by ASIC,FCA,CYSEC,SCB. wetrade is regulated by LFSA,FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

eightcap provides trading platform including Raw,Standard and trading variety including --. wetrade provides trading platform including Islamic Account,ECN ACCOUNT,Standard ACCOUNT,STP ACCOUNT and trading variety including Forex,Metals,Energies,Indices, Stocks,Cryptocurrencies.