No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between BCR and BlackBull ?

In the table below, you can compare the features of BCR , BlackBull side by side to determine the best fit for your needs.

--

XAUUSD:27.33

EURUSD: -6.82 ~ 2.29

XAUUSD: -37.66 ~ 18.83

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of bcr, blackbull-markets lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| BCR | Basic Information |

| Founded | 2008 |

| Registered Country | British Virgin Islands |

| Regulation | ASIC, FSC (Offshore) |

| Tradable Assets | Forex, CFDs on metals, commodities, indices |

| Account Types | Standard, Advantage, Alpha, and Affiliate |

| Demo Account | ✔ |

| Islamic Account | Not specified |

| Maximum Leverage | 400:1 |

| Spreads | From 3.0 pips |

| Trading Platforms | MT4, MT5, WebTrader, MAM |

| Minimum Deposit | $300 |

| Payment Methods | Bank transfer, MasterCard, Direct Debit, Visa, UnionPay, Fasapay, helpay2, NPAY, Skrill, Neteller, POLi, USDT |

| Customer Support | 24/5 online chat, contact form, phone: +44 3300010590, email: info@thebcr.com, social media |

BCR is a forex broker that was established in 2008 under the company name BACERA CO PTY LTD. The broker is regulated by ASIC (Australian Securities and Investments Commission) and offshore regulated by FSC (Financial Services Commission).

| Pros | Cons |

| • Regulated by ASIC | • Offshore Regulation |

| • Demo Account | • Limited Account Types |

| • Commission-free | • Wide Spreads |

| • Advanced MT4 Trading Platform | • No 24/7 Support |

| • Various Market Research Tools |

• Regulation: BCR is regulated by ASIC (Australian Securities and Investments Commission), which provides a level of security and trustworthiness for traders.

• Demo Account: BCR provides a demo account, allowing traders to practice and test their trading strategies in a risk-free environment.

• Commission-free: BCR offers commission-free trading for all account types.

• Advanced Trading Platforms: BCR provides access to advanced MT4 trading platform, offering comprehensive charting tools, indicators, and automated trading capabilities.

• Market Research Tools: BCR offers various market research tools, including economic calendars and market live.

• Offshore Regulation: BCR claims to be regulated by FSC, but it is offshore.

• Limited Account Types: BCR only offers two account types, which could restrict options for traders with specific needs or preferences.

• Wide Spreads: BCR offers spreads from 3.0 pips, while the industry average spread is just 1.5 pips.

• No 24/7 Support: The availability of customer support might be limited outside of regular business hours, which could be inconvenient for traders in different time zones or those requiring immediate assistance.

BCR operates within a well-regulated framework, authorized and regulated by respected financial authorities, including the Australian Securities and Investments Commission (ASIC, No. 328794) and offshore regulated by the Financial Services Commission (FSC, No. SIBA/L/19/1122) in the Virgin Islands.

This regulatory oversight ensures that BCR complies with stringent financial regulations, industry standards, and best practices. The ASIC and FSC play a crucial role in monitoring and supervising Doo Prime's operations, ensuring that the broker maintains transparency, ethical practices.

Additionally, BCR's practice of keeping segregated client funds means that client money is kept separate from the company's own funds. This can offer an additional layer of security for traders, since in the event of a company bankruptcy, these funds would not be treated as recoverable assets by general creditors of the company. This practice is common among regulated brokers as it provides more protection for traders' investments.

Forex, CFDs on metals, commodities, indices... BCR allows clients to access 300+ trading markets. Therefore, both beginners and experienced traders can find what they want to trade on BCR.

| Tradable Assets | Supported |

| Forex | ✅ |

| Commodities | ✅ |

| Metals | ✅ |

| Indices | ✅ |

| Cryptocurrencies | ❌ |

| Futures | ❌ |

| Options | ❌ |

This includes prominent global forex currency pairs, allowing for trading in the foreign exchange market.

They also offer CFDs on metals, which may include precious metals like gold and silver, as well as industrial metals.

In addition, traders can access CFDs on commodities, from energy sources like oil and gas to agricultural products.

This is extended to indices, tracking performance of groups of shares in a particular market or sector.

However, cryptocurrencies are currently unavailable.

Apart from demo accopunts, BCR offers four live account types: Standard, Advantage, Alpha, and Affiliate. All account types provide leverage up to 400:1, a 50% stop-out level, micro-lot trading (0.01), and access to single stock CFDs, except for the Alpha account. The minimum deposit requirements range from $300 for the Standard and Advantage accounts to $3,000 for the Affiliate account. Spreads start from 1.2 pips for the Advantage account, with the Alpha account offering zero spreads. Additionally, the Advantage account charges a $3 commission per lot per side. The lot size per transaction is capped at 20 for all account types.

Here are four specific steps to open an account with BCR:

Step 1: Visit the BCR official website: Go to the BCR website using a web browser on your computer or mobile device. Navigate to the account opening section: Look for the “Join Now” button on the website on the homepage.

Step 2: Fill out the account application form: Click on the account opening button/link, and you will be directed to an online form. Provide the requested information, including your full name, contact details (such as phone number and email address), and password.

Step 3: Submit identification documents: As part of the account verification process, BCR may require you to provide identification documents. These documents may include a copy of your passport or national ID card, proof of address (such as a utility bill or bank statement), and any other documents requested by the broker.

Step 4: Review and agree to the terms and conditions: Before finalizing your account creation, carefully read through the terms and conditions provided by BCR. Make sure you understand and agree to all the terms before proceeding. If you have any questions or concerns, you can contact their customer support for clarification.

BCR provides traders with maximum levearge up to 400:1.

Leverage, in simple terms, is a tool that enables traders to control a larger position in the market with a smaller amount of capital. It can be a valuable tool for experienced traders who understand its risks and benefits. By using leverage, traders can potentially generate higher returns on their investments.

However, leverage is a double-edged sword. While it can enhance profits, it can also magnify losses. Traders should exercise caution and implement effective risk management strategies when utilizing leverage. It is crucial to have a thorough understanding of the market and the associated risks before engaging in leveraged trading.

Specifically, the commissions and spreads need to pay will differ for the various trading accounts traders have.

The Standard account offers a zero-commission trading environment, allowing traders to execute trades without incurring any additional charges. Spreads for the Standard account start from 8.0 pips.

For those seeking even tighter spreads, the Advantage account is available. With spreads starting from 3.0 pips and no commissions, this account offers enhanced trading conditions for traders looking to optimize their trading strategies and minimize their trading costs.

Spreads and commissions vary on the trading symbol, more details can be found in the screenshot below.

BCR provides traders with popular MT4 (MetaTrader4) and MT5 (MetaTrader5) platforms as well as a user-friendly Webtrader and MAM platform. Some other popular and user-friendly trading platforms like cTrader and TradingView are not supported.

| Platforms | Supported |

| MetaTrader 4 (MT4) | ✅ |

| MetaTrader 5 (MT5) | ✅ |

| WebTrader | ✅ |

| MAM | ✅ |

| cTrader | ❌ |

| TradingView | ❌ |

BCR provides its customers with over 10 payment options. The options available for depositing and withdrawing funds include Bank transfer, MasterCard, Direct Debit, Visa, UnionPay, Fasapay, helpay2, NPAY, Skrill, Neteller, POLi, and USDT.

In terms of withdrawal request processing, BCR operates a specific schedule. The cut-off time for processing on the same day is 10:00 AM. Requests submitted before this time will be processed on the same day, whereas requests submitted afterwards will not be processed until the following business day.

Additionally, BCR does not charge any fees for deposits or withdrawals. However, transactions between international banks might incur fees such as intermediary fees.

BCR also provides some trading tools and educational resources to help traders to gain a superb trading environment.

Their economic calendar is a must-have tool for traders, allowing them to stay informed about important economic events that have the potential to impact the markets. Identifying these events can help with planning trading strategies.

Their glossary is an excellent educational resource, especially for beginner traders. It provides definitions for numerous terms used in trading, helping traders become familiar with industry jargon.

Additionally, BCR offers a 'Market Live' feature, which provides real-time updates about market conditions and trends.

These tools, combined with their educational resources, assist traders in making informed decisions and understanding the complexity of the markets, which ultimately contributes towards a more efficient trading experience.

Language(s): English, Chinese, Vietnamese, Japanese, etc.

Service Time: 24/5

Live chat, contact form

Email: info@thebcr.com

Phone: +44 3300010590

Social Media: Facebook, Twitter, Instagram, LinkedIn

Address: BCR Co Pty Ltd, Trident Chambers, Wickhams Cay 1, Road Town, Tortola, British Virgin Islands.

Is BCR Legit?

Yes. BCR operates legally and it is regulated by ASIC and offshore regulated by FSC.

What assets can I trade with BCR?

Forex and CFDs on metals, commodities, and indices.

Does BCR offer demo accounts?

Yes.

Does BCR offer industry leading MT4 & MT5?

Yes. It supports both MT4 and MT5.

Is BCR a good broker for beginners ?

Yes, given its stringent Australian regulation and its provision of demo accounts for novices to engage in risk-free trading, BCR could be an excellent option for beginners.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

| BlackBull Review Summary in 10 Points | |

| Founded | 2014 |

| Registered Country/Region | Auckland, New Zealand |

| Regulation | FMA |

| Market Instruments | forex, energy, indices, cryptocurrencies, equities and metals |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/USD Spread | From 0.0 pips |

| Trading Platforms | TradingView, MT4, MT5, BlackBull Trader and BlackBull Shares |

| Minimum deposit | $0 |

| Customer Support | 24/7 live chat, phone, email |

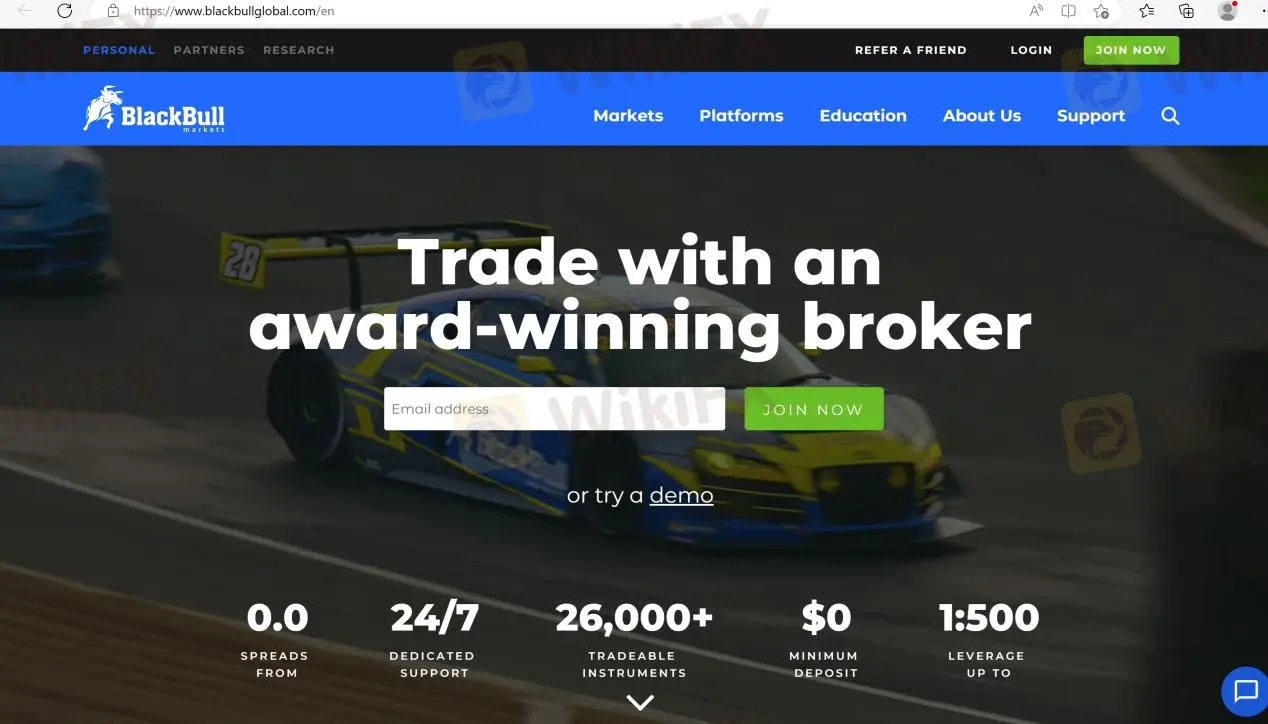

BlackBull is an STP (Straight Through Processing) forex broker that provides online trading services to retail and institutional clients. The company was founded in 2014 and is headquartered in Auckland, New Zealand. BlackBull is regulated by the Financial Markets Authority (FMA) of New Zealand and offers over 26,000 tradable instruments including forex, energy, indices, cryptocurrencies, equities, and metals. The broker provides clients with multiple trading platforms such as MetaTrader 4/5 and various trading tools. The company also provides educational resources to assist traders in their trading journey.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

BlackBull appears to be a reliable and well-regulated broker that offers a wide range of trading instruments, platforms, and educational resources. The broker's emphasis on security and transparency, such as offering segregated accounts and holding funds in Tier 1 New Zealand banks, is also a positive aspect.

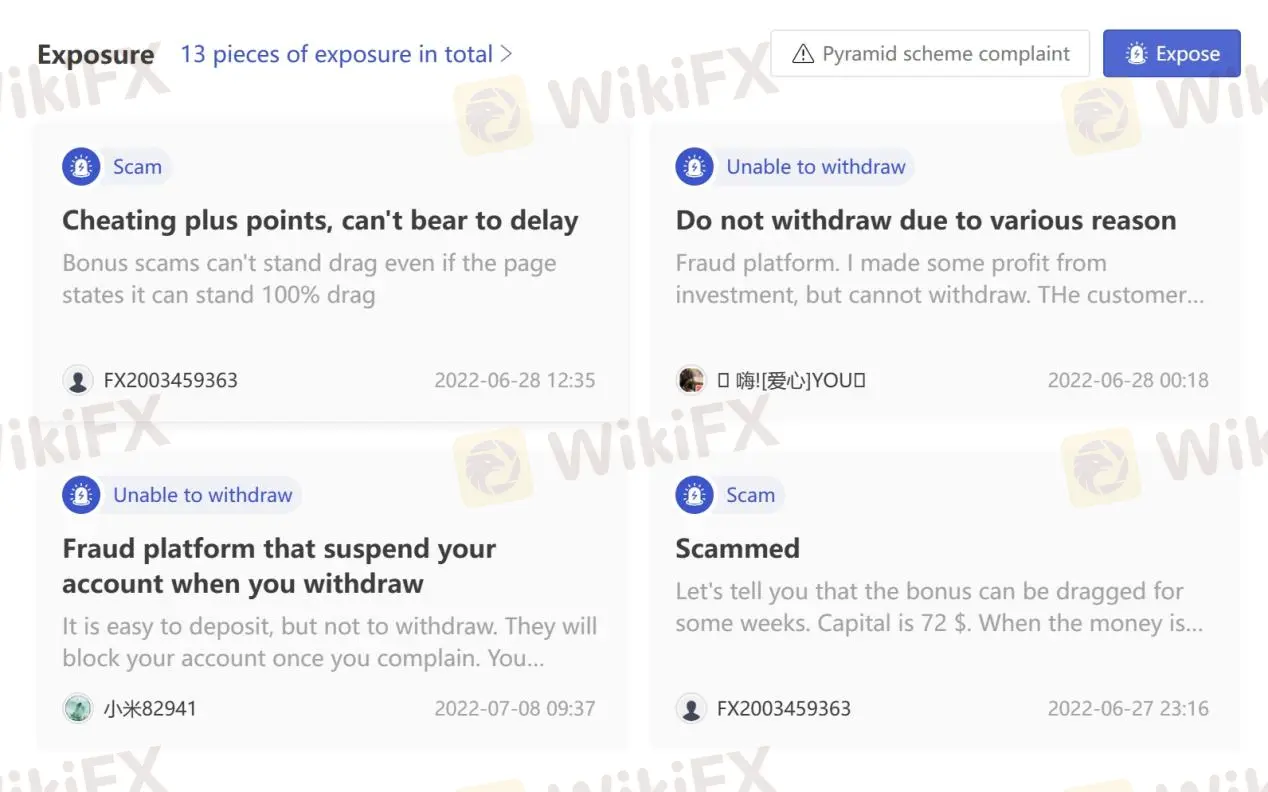

However, there have been some negative reviews regarding difficulties in withdrawing funds and claims of the broker being a scam, which is a cause for concern.

| Pros | Cons |

| • Regulated by FMA | • Negative reviews from clients regarding withdrawal issues |

| • Wide range of tradable instruments | • Limited range of payment options |

| • Demo accounts available | |

| • Multiple trading platforms and tools | |

| • No minimum deposit requirement | |

| • Rich educational resources |

It's important to note that this is just a general overview of the pros and cons, and individual experiences may vary.

There are many alternative brokers to BlackBull depending on the specific needs and preferences of the trader. Some popular options include:

UFX - provides a user-friendly trading platform and a wide range of educational materials, but there are some concerns about its regulation and customer service.

Valutrades - offers competitive spreads and multiple account types, but its product offerings are limited and its customer service could be improved.

Z.com Trade - offers low spreads and no deposit or withdrawal fees, but its product offerings are limited and it is only regulated in one jurisdiction.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

It's difficult to make a definitive determination on whether BlackBull is safe or a scam as there is no clear consensus on the matter. While the broker is regulated by the Financial Markets Authority and claims to hold client funds in safe, Tier 1 New Zealand-based banks with segregated accounts, the negative reviews from some clients who report issues with withdrawing their funds raise concerns. It's important for individuals to conduct their own research, carefully evaluate the broker's features and services, and exercise caution when investing their money.

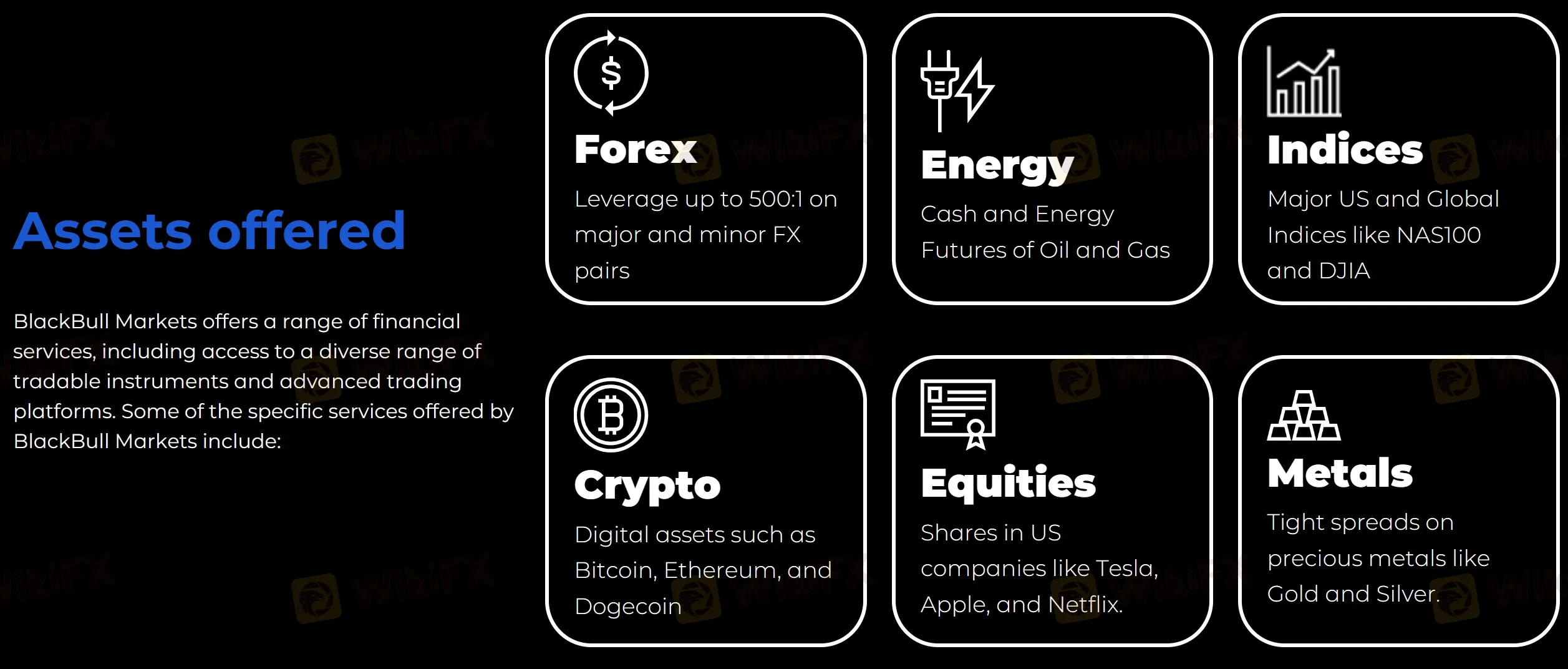

BlackBull offers a diverse range of 26,000+ financial instruments across various asset classes, including forex, energy, indices, cryptocurrencies, equities, and metals. Traders have access to a wide range of currency pairs, including majors, minors, and exotics, and can also trade popular cryptocurrencies like Bitcoin, Ethereum, and Dogecoin. Additionally, the broker provides access to a variety of equity CFDs, including those from major markets like the US, Europe, and Asia. Traders can also trade popular indices like major US and the NASDAQ, as well as energy products like crude oil and natural gas. Lastly, BlackBull provides access to precious metals like gold and silver, which are often used as safe-haven assets during times of market volatility. Therefore, both beginners and experienced traders can find what they want to trade on BlackBull.

Demo Account: BlackBull provides a demo account that allows you to try out the financial markets without the risk of losing money.

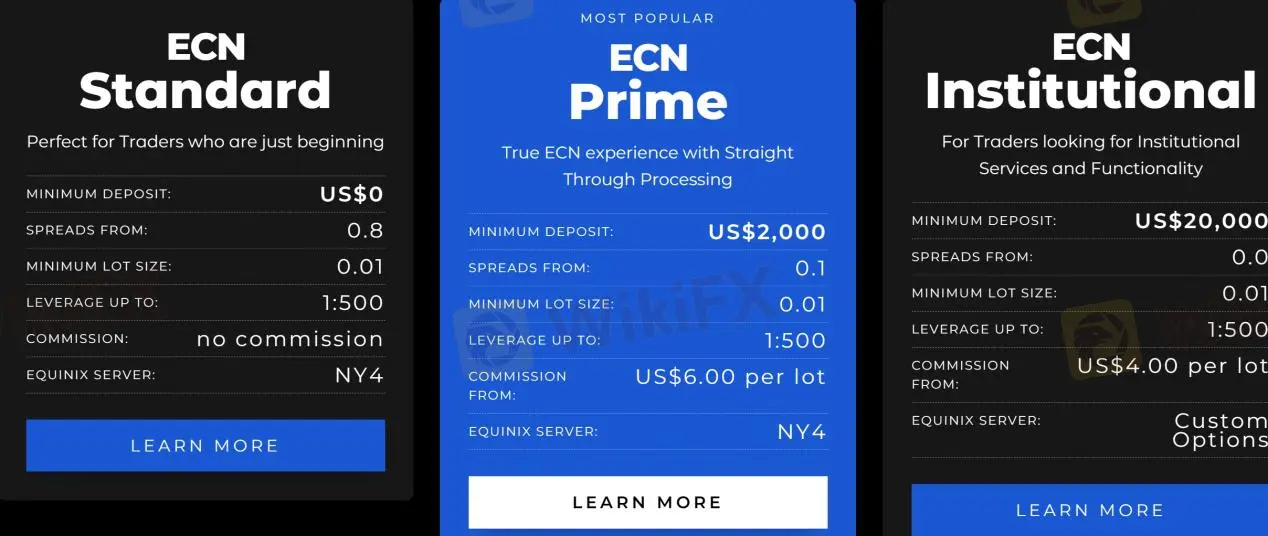

Live Account: BlackBull offers a total of 3 account types: ECN Standard, ECN Prime and ECN Institutional. The minimum deposit to open an account is $0, $2,000 and $20,000 respectively. If you are still a beginner and don't want to invest too much money in Forex trading, the ECN Standard account will be the most suitable option for you.

BlackBull offers a maximum leverage of up to 1:500, which is a generous offer and ideal for professional traders and scalpers. However, since leverage can magnify your profits, it can also result in a loss of capital, especially for inexperienced traders. Therefore, traders must choose the right amount according to their risk tolerance.

BlackBull spreads and commissions depend on the account type. We can see that the spread starts from 0.8 pips on the ECN Standard account, from 0.1 pips on the ECN Prime account, while only the ECN Institutional account can enjoy raw spreads from 0.0 pips.

There is no commission for the ECN Standard account, a commission of 6 USD per lot for the ECN Prime account and 4 USD per lot for the ECN Institutional account.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| BlackBull | 0.8 pips | No commission (Standard) |

| UFX | 2.0 pips | No commission |

| Valutrades | 0.5 pips | $7 per lot round turn (ECN Pro) |

| Z.com Trade | 0.5 pips | No commission (Standard) |

Note: Spreads can vary depending on market conditions and volatility.

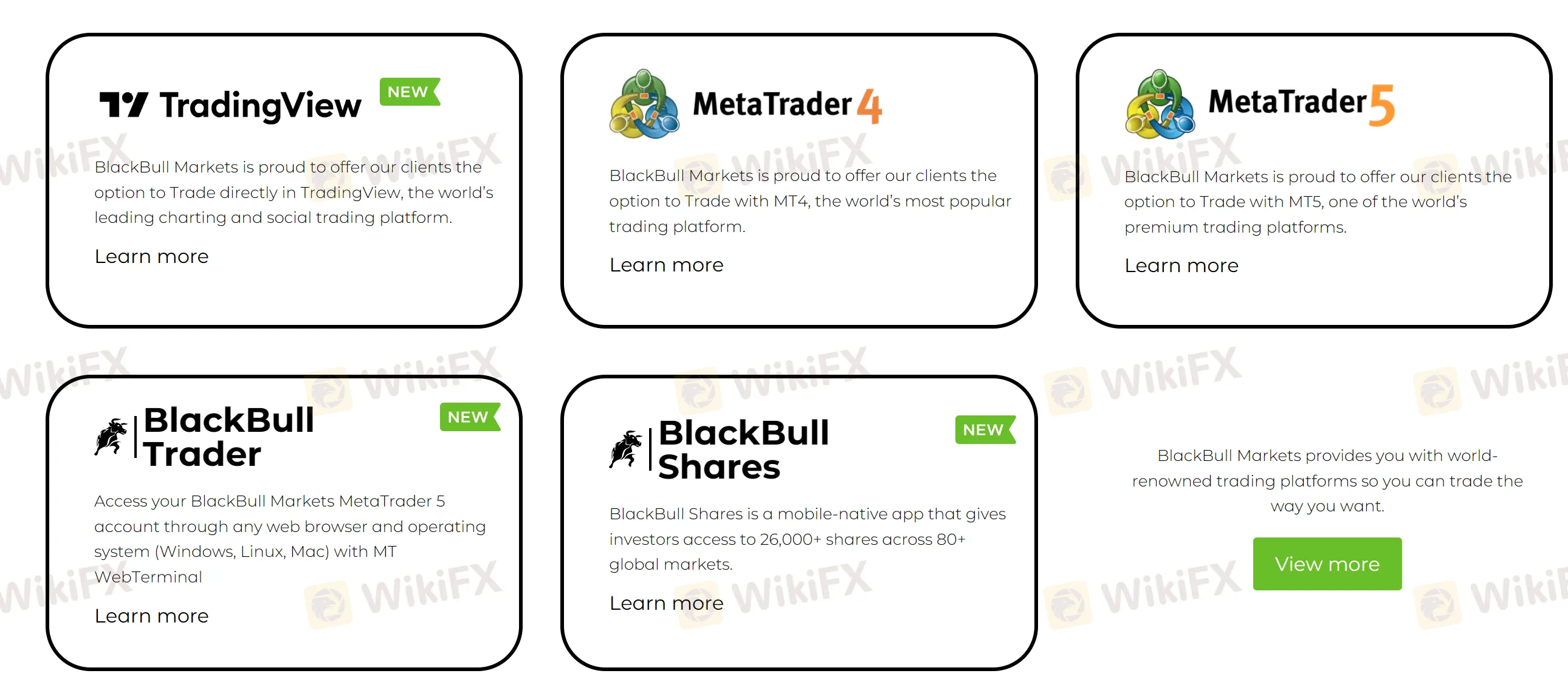

As for the trading platform, BlackBull provides its clients with many options. There are public platforms including TradingView, MetaTrader 4 (MT4), MetaTrader 5 (MT5), BlackBull Trader, and BlackBull Shares.

TradingView is a popular charting and social trading platform that allows traders to connect with other traders, access a wide range of charting tools, and share trading ideas. MT4 and MT5 are well-known platforms in the forex industry, offering advanced charting capabilities, customizable indicators, and algorithmic trading options. BlackBull Trader is a proprietary platform developed by BlackBull that offers advanced charting and trading tools, while BlackBull Shares is a social trading platform that allows clients to automatically copy the trades of experienced traders.

Overall, BlackBull's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| BlackBull | TradingView, MT4, MT5, BlackBull Trader, BlackBull Shares |

| UFX | ParagonEx, MT4, UFX Trader |

| Valutrades | MT4, MT5, FIX API Trading, ValuMax |

| Z.com Trade | MT4, MT5, Z.com Trader, Z.com Web Trader |

BlackBull offers Virtual Private Server (VPS) trading to its clients, which is a useful tool for traders who use automated trading strategies or expert advisors. The broker also provides access to other trading tools such as FIX API Trading, which allows traders to connect their own custom software to the BlackBull liquidity pool, as well as Autochartist, which provides market analysis and trading signals. ZuluTrade and MyFxbook are also available for those who want to follow and copy trades of other successful traders. Overall, BlackBull offers a range of trading tools to assist traders in their trading activities.

BlackBull offers its clients multiple options for depositing and withdrawing funds, including bank wire, POLi, and credit/debit card (Visa/MasterCard). The base currencies are USD and NZD.

No minimum deposit requirement. No fees for deposits and withdrawals. Most deposits are processed instantly, while withdrawals are typically processed within 24 hours.

| BlackBull | Most other | |

| Minimum Deposit | $0 | $100 |

See the deposit & withdrawal fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee |

| BlackBull | None | None |

| UFX | None | $50-$100 |

| Valutrades | None | None |

| Z.com Trade | None | None |

Note: The above information is subject to change and may vary based on the payment method used. It's always recommended to check with the broker for the most up-to-date and accurate fee information.

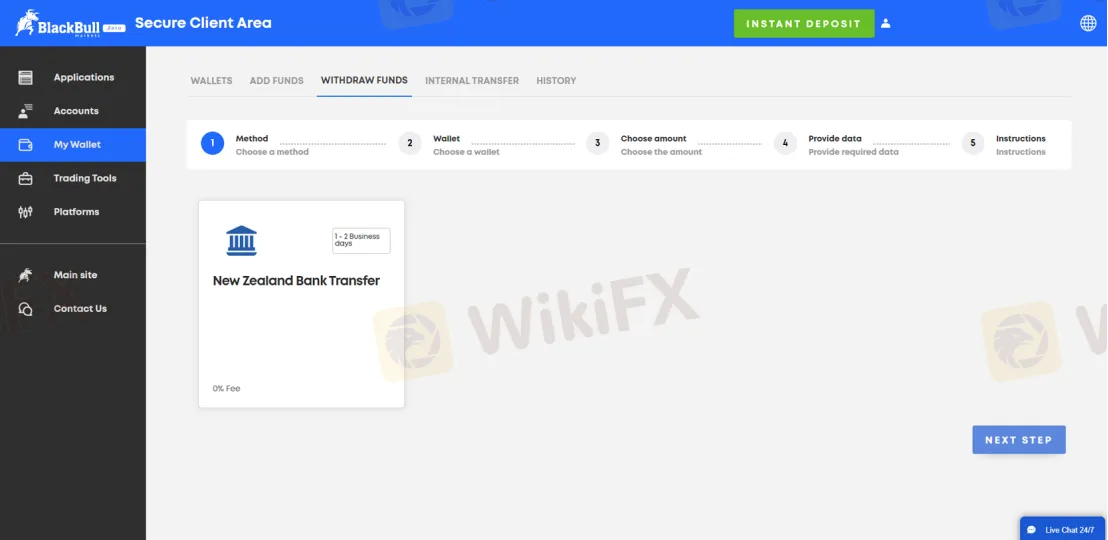

To withdraw funds from your account, visit the “My Wallet” tab found on the left-hand side of the portal.

Find the ‘WITHDRAW FUNDS’ tab along the top of this portal page. Within this tab, you will be presented with a 4-step process to request a withdrawal.

Step 1: Select the method by which you want to make a withdrawal. Only methods that you are approved to use will show up as an option to select.

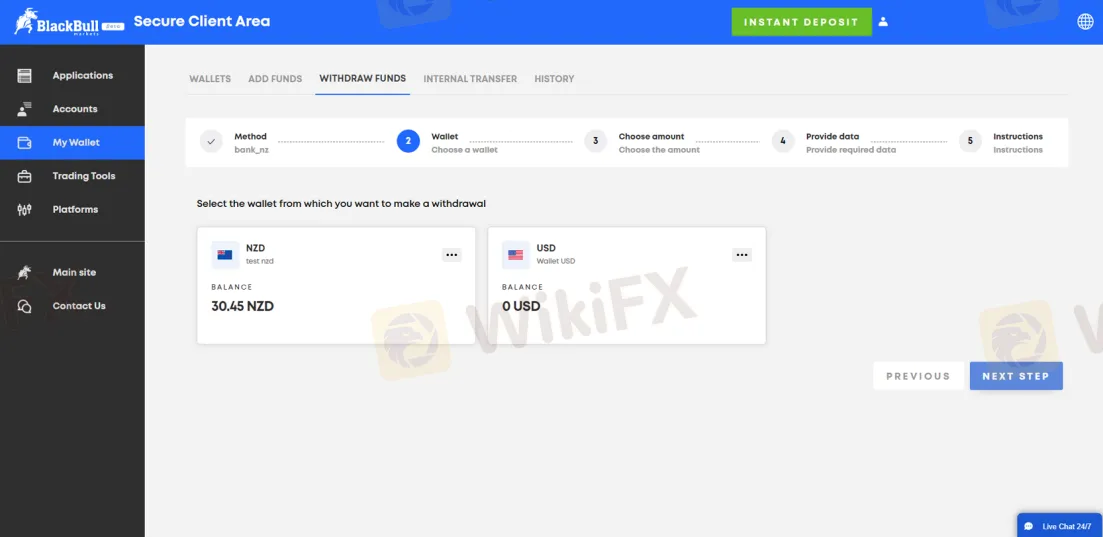

Step 2: Select the wallet from which you want to make a withdrawal. Please note: Each withdrawal request is restricted to one wallet.

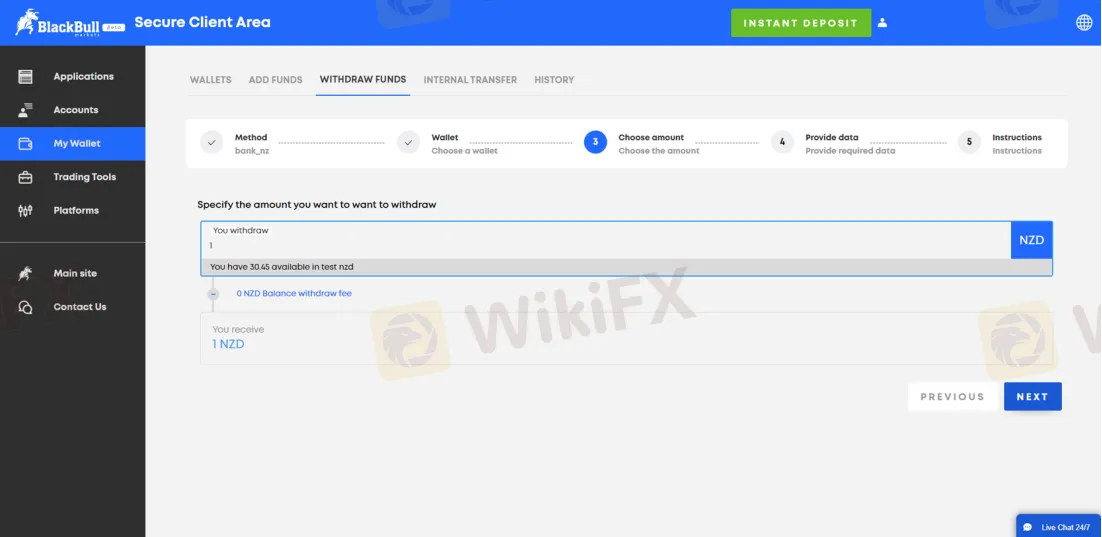

Step 3: Specify the amount you want to withdraw.

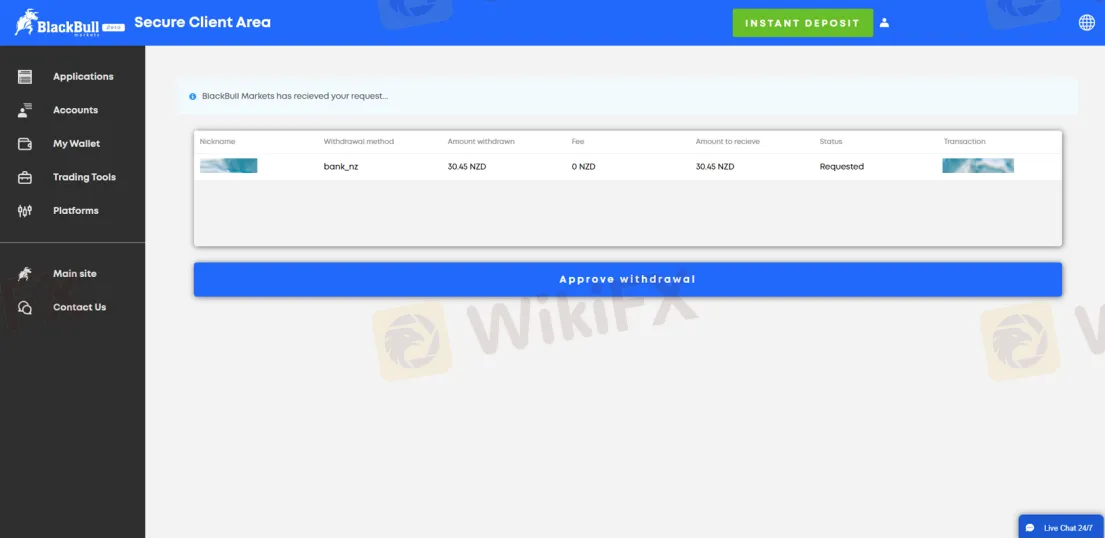

Step 4: Finally, confirm your request within the Secure Client Area, and the status of your request will change to pending.

Below are the details about the customer service.

Languages: English, Spanish, French, Chinese, German, Portuguese, Italian, Thai language, Korean, Arabic, Vietnamese, etc.

Service Hour: 24/7

Live chat

Email: support@blackbull.com

Phone: +64 9 558 5142

Address: BlackBull Markets, Level 20, 188 Quay Street, Auckland, 1010

Social media: Facebook, Instagram, LinkedIn, YouTube, Twitter, WhatsApp and Telegram

Overall, BlackBull's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • 24/7 live chat support | • No option for call back requests |

| • Multilingual support | |

| • Social media presence for easy communication | |

| • Quick response time to customer inquiries |

Note: The information is based on online research and may be subject to change.

A series of educational resources is available at BlackBull, such as webinars, market analysis, and trading videos that cover various topics related to trading.

The educational materials are categorized based on the clients level of experience, with Forex Beginner, Forex Intermediate, and Forex Advanced categories. The educational articles cover a wide range of topics, from the basics of trading to advanced strategies and technical analysis. These resources are designed to help traders develop a better understanding of the markets and improve their trading skills, which can ultimately lead to more successful trades.

On our website, you can see that some users have reported unable to withdraw and scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Based on the information provided, BlackBull appears to be a well-regulated broker that offers a wide range of tradable instruments across multiple asset classes, as well as a variety of trading platforms and tools. The broker's educational resources and customer service are also noteworthy.

However, there are some negative reviews from clients regarding difficulty with withdrawals and accusations of being a scam platform, so traders should proceed with caution and do their own research before investing with BlackBull.

| Q 1: | Is BlackBull regulated? |

| A 1: | Yes. It is regulated by Financial Markets Authority(FMA) in New Zealand. |

| Q 2: | Does BlackBull offer demo accounts? |

| A 2: | Yes. |

| Q 3: | How much leverage does this broker offer? |

| A 3: | The maximum leverage of BlackBull is 1:500. Please note that this leverage may only be available for some accounts and products. Please consult our articles or the dealer's website for specific information. |

| Q 4: | Does this broker offer copy trading or social trading? |

| A 4: | Yes. BlackBull offers both of them. |

| Q 5: | Does BlackBull offer the industry-standard MT4 & MT5? |

| A 5: | Yes. It supports TradingView, MT4, MT5, BlackBull Trader and BlackBull Shares. |

| Q 6: | What is the minimum deposit for BlackBull? |

| A 6: | There is no minimum initial deposit requirement. |

| Q 7: | Is BlackBull a good broker for beginners? |

| A 7: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive bcr and blackbull-markets are, we first considered common fees for standard accounts. On bcr, the average spread for the EUR/USD currency pair is 1.7+ pips, while on blackbull-markets the spread is EURUSD average is 0.2; Gold average is 0.2.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

bcr is regulated by ASIC,FSC. blackbull-markets is regulated by FMA,FSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

bcr provides trading platform including Affiliate,Alpha,Advantage,Standard and trading variety including --. blackbull-markets provides trading platform including ECN STANDARD,ECN PRIME,ECN INSTITUTIONAL and trading variety including --.