No data

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Do you want to know which is the better broker between BCR and ActivTrades ?

In the table below, you can compare the features of BCR , ActivTrades side by side to determine the best fit for your needs.

--

XAUUSD:27.33

EURUSD: -6.82 ~ 2.29

XAUUSD: -37.66 ~ 18.83

--

--

You can determine the reliability and credibility of a broker by checking four factors:

1.Forex broker introduction。

2.Are the transaction costs and expenses of bcr, activtrades lower?

3.Which broker is safer?

4.Which broker provides better trading platform?

Based on these four factors, we can compare which is reliable. We have broken down the reasons as follows:

| BCR | Basic Information |

| Founded | 2008 |

| Registered Country | British Virgin Islands |

| Regulation | ASIC, FSC (Offshore) |

| Tradable Assets | Forex, CFDs on metals, commodities, indices |

| Account Types | Standard, Advantage, Alpha, and Affiliate |

| Demo Account | ✔ |

| Islamic Account | Not specified |

| Maximum Leverage | 400:1 |

| Spreads | From 3.0 pips |

| Trading Platforms | MT4, MT5, WebTrader, MAM |

| Minimum Deposit | $300 |

| Payment Methods | Bank transfer, MasterCard, Direct Debit, Visa, UnionPay, Fasapay, helpay2, NPAY, Skrill, Neteller, POLi, USDT |

| Customer Support | 24/5 online chat, contact form, phone: +44 3300010590, email: info@thebcr.com, social media |

BCR is a forex broker that was established in 2008 under the company name BACERA CO PTY LTD. The broker is regulated by ASIC (Australian Securities and Investments Commission) and offshore regulated by FSC (Financial Services Commission).

| Pros | Cons |

| • Regulated by ASIC | • Offshore Regulation |

| • Demo Account | • Limited Account Types |

| • Commission-free | • Wide Spreads |

| • Advanced MT4 Trading Platform | • No 24/7 Support |

| • Various Market Research Tools |

• Regulation: BCR is regulated by ASIC (Australian Securities and Investments Commission), which provides a level of security and trustworthiness for traders.

• Demo Account: BCR provides a demo account, allowing traders to practice and test their trading strategies in a risk-free environment.

• Commission-free: BCR offers commission-free trading for all account types.

• Advanced Trading Platforms: BCR provides access to advanced MT4 trading platform, offering comprehensive charting tools, indicators, and automated trading capabilities.

• Market Research Tools: BCR offers various market research tools, including economic calendars and market live.

• Offshore Regulation: BCR claims to be regulated by FSC, but it is offshore.

• Limited Account Types: BCR only offers two account types, which could restrict options for traders with specific needs or preferences.

• Wide Spreads: BCR offers spreads from 3.0 pips, while the industry average spread is just 1.5 pips.

• No 24/7 Support: The availability of customer support might be limited outside of regular business hours, which could be inconvenient for traders in different time zones or those requiring immediate assistance.

BCR operates within a well-regulated framework, authorized and regulated by respected financial authorities, including the Australian Securities and Investments Commission (ASIC, No. 328794) and offshore regulated by the Financial Services Commission (FSC, No. SIBA/L/19/1122) in the Virgin Islands.

This regulatory oversight ensures that BCR complies with stringent financial regulations, industry standards, and best practices. The ASIC and FSC play a crucial role in monitoring and supervising Doo Prime's operations, ensuring that the broker maintains transparency, ethical practices.

Additionally, BCR's practice of keeping segregated client funds means that client money is kept separate from the company's own funds. This can offer an additional layer of security for traders, since in the event of a company bankruptcy, these funds would not be treated as recoverable assets by general creditors of the company. This practice is common among regulated brokers as it provides more protection for traders' investments.

Forex, CFDs on metals, commodities, indices... BCR allows clients to access 300+ trading markets. Therefore, both beginners and experienced traders can find what they want to trade on BCR.

| Tradable Assets | Supported |

| Forex | ✅ |

| Commodities | ✅ |

| Metals | ✅ |

| Indices | ✅ |

| Cryptocurrencies | ❌ |

| Futures | ❌ |

| Options | ❌ |

This includes prominent global forex currency pairs, allowing for trading in the foreign exchange market.

They also offer CFDs on metals, which may include precious metals like gold and silver, as well as industrial metals.

In addition, traders can access CFDs on commodities, from energy sources like oil and gas to agricultural products.

This is extended to indices, tracking performance of groups of shares in a particular market or sector.

However, cryptocurrencies are currently unavailable.

Apart from demo accopunts, BCR offers four live account types: Standard, Advantage, Alpha, and Affiliate. All account types provide leverage up to 400:1, a 50% stop-out level, micro-lot trading (0.01), and access to single stock CFDs, except for the Alpha account. The minimum deposit requirements range from $300 for the Standard and Advantage accounts to $3,000 for the Affiliate account. Spreads start from 1.2 pips for the Advantage account, with the Alpha account offering zero spreads. Additionally, the Advantage account charges a $3 commission per lot per side. The lot size per transaction is capped at 20 for all account types.

Here are four specific steps to open an account with BCR:

Step 1: Visit the BCR official website: Go to the BCR website using a web browser on your computer or mobile device. Navigate to the account opening section: Look for the “Join Now” button on the website on the homepage.

Step 2: Fill out the account application form: Click on the account opening button/link, and you will be directed to an online form. Provide the requested information, including your full name, contact details (such as phone number and email address), and password.

Step 3: Submit identification documents: As part of the account verification process, BCR may require you to provide identification documents. These documents may include a copy of your passport or national ID card, proof of address (such as a utility bill or bank statement), and any other documents requested by the broker.

Step 4: Review and agree to the terms and conditions: Before finalizing your account creation, carefully read through the terms and conditions provided by BCR. Make sure you understand and agree to all the terms before proceeding. If you have any questions or concerns, you can contact their customer support for clarification.

BCR provides traders with maximum levearge up to 400:1.

Leverage, in simple terms, is a tool that enables traders to control a larger position in the market with a smaller amount of capital. It can be a valuable tool for experienced traders who understand its risks and benefits. By using leverage, traders can potentially generate higher returns on their investments.

However, leverage is a double-edged sword. While it can enhance profits, it can also magnify losses. Traders should exercise caution and implement effective risk management strategies when utilizing leverage. It is crucial to have a thorough understanding of the market and the associated risks before engaging in leveraged trading.

Specifically, the commissions and spreads need to pay will differ for the various trading accounts traders have.

The Standard account offers a zero-commission trading environment, allowing traders to execute trades without incurring any additional charges. Spreads for the Standard account start from 8.0 pips.

For those seeking even tighter spreads, the Advantage account is available. With spreads starting from 3.0 pips and no commissions, this account offers enhanced trading conditions for traders looking to optimize their trading strategies and minimize their trading costs.

Spreads and commissions vary on the trading symbol, more details can be found in the screenshot below.

BCR provides traders with popular MT4 (MetaTrader4) and MT5 (MetaTrader5) platforms as well as a user-friendly Webtrader and MAM platform. Some other popular and user-friendly trading platforms like cTrader and TradingView are not supported.

| Platforms | Supported |

| MetaTrader 4 (MT4) | ✅ |

| MetaTrader 5 (MT5) | ✅ |

| WebTrader | ✅ |

| MAM | ✅ |

| cTrader | ❌ |

| TradingView | ❌ |

BCR provides its customers with over 10 payment options. The options available for depositing and withdrawing funds include Bank transfer, MasterCard, Direct Debit, Visa, UnionPay, Fasapay, helpay2, NPAY, Skrill, Neteller, POLi, and USDT.

In terms of withdrawal request processing, BCR operates a specific schedule. The cut-off time for processing on the same day is 10:00 AM. Requests submitted before this time will be processed on the same day, whereas requests submitted afterwards will not be processed until the following business day.

Additionally, BCR does not charge any fees for deposits or withdrawals. However, transactions between international banks might incur fees such as intermediary fees.

BCR also provides some trading tools and educational resources to help traders to gain a superb trading environment.

Their economic calendar is a must-have tool for traders, allowing them to stay informed about important economic events that have the potential to impact the markets. Identifying these events can help with planning trading strategies.

Their glossary is an excellent educational resource, especially for beginner traders. It provides definitions for numerous terms used in trading, helping traders become familiar with industry jargon.

Additionally, BCR offers a 'Market Live' feature, which provides real-time updates about market conditions and trends.

These tools, combined with their educational resources, assist traders in making informed decisions and understanding the complexity of the markets, which ultimately contributes towards a more efficient trading experience.

Language(s): English, Chinese, Vietnamese, Japanese, etc.

Service Time: 24/5

Live chat, contact form

Email: info@thebcr.com

Phone: +44 3300010590

Social Media: Facebook, Twitter, Instagram, LinkedIn

Address: BCR Co Pty Ltd, Trident Chambers, Wickhams Cay 1, Road Town, Tortola, British Virgin Islands.

Is BCR Legit?

Yes. BCR operates legally and it is regulated by ASIC and offshore regulated by FSC.

What assets can I trade with BCR?

Forex and CFDs on metals, commodities, and indices.

Does BCR offer demo accounts?

Yes.

Does BCR offer industry leading MT4 & MT5?

Yes. It supports both MT4 and MT5.

Is BCR a good broker for beginners ?

Yes, given its stringent Australian regulation and its provision of demo accounts for novices to engage in risk-free trading, BCR could be an excellent option for beginners.

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

| ActivTrades Review Summary in 10 Points | |

| Founded | 2001 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA, SCB (Offshore) |

| Market Instruments | Currencies, Commodities, Indices, Shares, Bonds and ETFs |

| Demo Account | ✅($10,000 virtual fund) |

| Leverage | 1:30 for retail, 1:400 for pro |

| EUR/USD Spread | From 0.5 pips |

| Trading Platforms | ActivTrader, MT4, MT5 |

| Minimum deposit | $500 |

| Customer Support | 24/5 multilingual live chat, phone, email |

Founded in 2001, ActivTrades is a brokerage firm, headquartered in London, with offices in Milan, Nassau, and Sofia. It initially focused on the forex business and then gradually expanded its product ranges, providing trading conditions and service support for clients in more than 140 countries. The company is regulated byFCA (UK) and SCB (Offshore, Bahamas) and offers a range of trading instruments, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. ActivTrades also provides its clients with a variety of trading platforms, including the popular MetaTrader 4 and 5 platforms, as well as its proprietary platform, ActivTrader.

ActivTrades offers a good range of trading instruments, is regulated by a reputable financial authority, and offers various account types with negative balance protection and segregated accounts.

However, some clients have reported issues with trading platform stability.

| Pros | Cons |

| • Regulated by FCA | • SCB license is offshore |

| • Segregated accounts and Negative Balance Protection | • High minimum deposit requirement |

| • Wide range of trading products | • Fees charged for Credit/Debit card deposits |

| • Demo and Islamic accounts offered | |

| • Variety of trading platforms including MetaTrader4/5 and ActivTrader | |

| • Free educational resources and market analysis | |

| • Multiple funding options | |

| • 24/5 multilingual customer support |

ActivTrades is regulated by both the Financial Conduct Authority (FCA) in the United Kingdom and the Securities Commission of the Bahamas (SCB).

The FCA regulation ensures strict adherence to financial standards and integrity within the UK as a Market Maker. Additionally, SCB regulation allows ActivTrades to hold a Retail Forex License in the Bahamas, providing broader international service under reliable oversight.

At ActivTrades, you can trade over 1,000 different CFD instruments across 6 asset classes, including Currencies, Commodities, Indices, Shares, Bonds and ETFs. This provides clients with a diversified portfolio and the opportunity to trade a range of different assets.

Traders can open either an Individual Account (which allows them to trade small and micro lots) or a Professional Account (minimum financial portfolio size of $500,000, Dedicated Account Manager) with ActivTrades. Beginner traders can test out the trading interface and get a feel for how the broker works with a free demo account. People who adhere to Sharia law can choose from two more account options: an Islamic (Swap-Free) Account.

Leverage is capped at 1:30 in line with the EMSA regulations, the maximum leverage is 1:30 for currency pairs, 1:20 for indices and shares, 1:10 for commodities and 1:5 for cryptocurrencies. While only the Pro account holders can enjoy the maximum leverage of 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

ActivTrades' currency spreads begin at 0.5 pips, and its spreads on indices and financial CFDs are also 0.5 pips, both of which are competitively cheap.

It's also important to note that this is not a situation that can be fixed overnight (the underlying Futures price already accounts for the adjustment). Commissions for trading shares as CFDs begin at €1 per side, whereas spread betting on shares incurs no fees beyond 0.10% of the transaction value.

Trading Platforms

ActivTrades also stands out due to its platform selection, which features not only the company's proprietary platform - ActivTrader but also the popular MT4 and MT5 platforms, as well as a set of unique Add-Ons.

• Web Trading

The ActiveTrades trading platform is web-based, allowing trades to be made directly in the browser; it also has a dedicated app for the iPhone and iPad. The platform has an easy-to-use design but advanced functionality, such as access to more than 90 technical analysis indicators, for seasoned traders of all trading types.

• ActivTrader

The upgraded ActivTrader platform incorporates cutting-edge tools and features to provide a revolutionary trading environment. You can gain exposure to the Forex, Commodities, Financial & Indices, Shares, and Exchange-Traded Funds markets and trade over a thousand CFDs.

• MetaTrader4

ActivTrades' desktop trading platform MT4 is available to those who prefer a more traditional trading experience. In addition, the technology has been upgraded in accordance with the firm's security standards, and the use of sophisticated charts has made it possible to automate the tactics using EAs.

• MetaTrader5

New and improved features take online trading to a whole new level in MetaTrader5. More than 450 CFDs on equities with diverse characteristics and the option to auto-trade are available on the platform, and trading statements are seamlessly integrated.

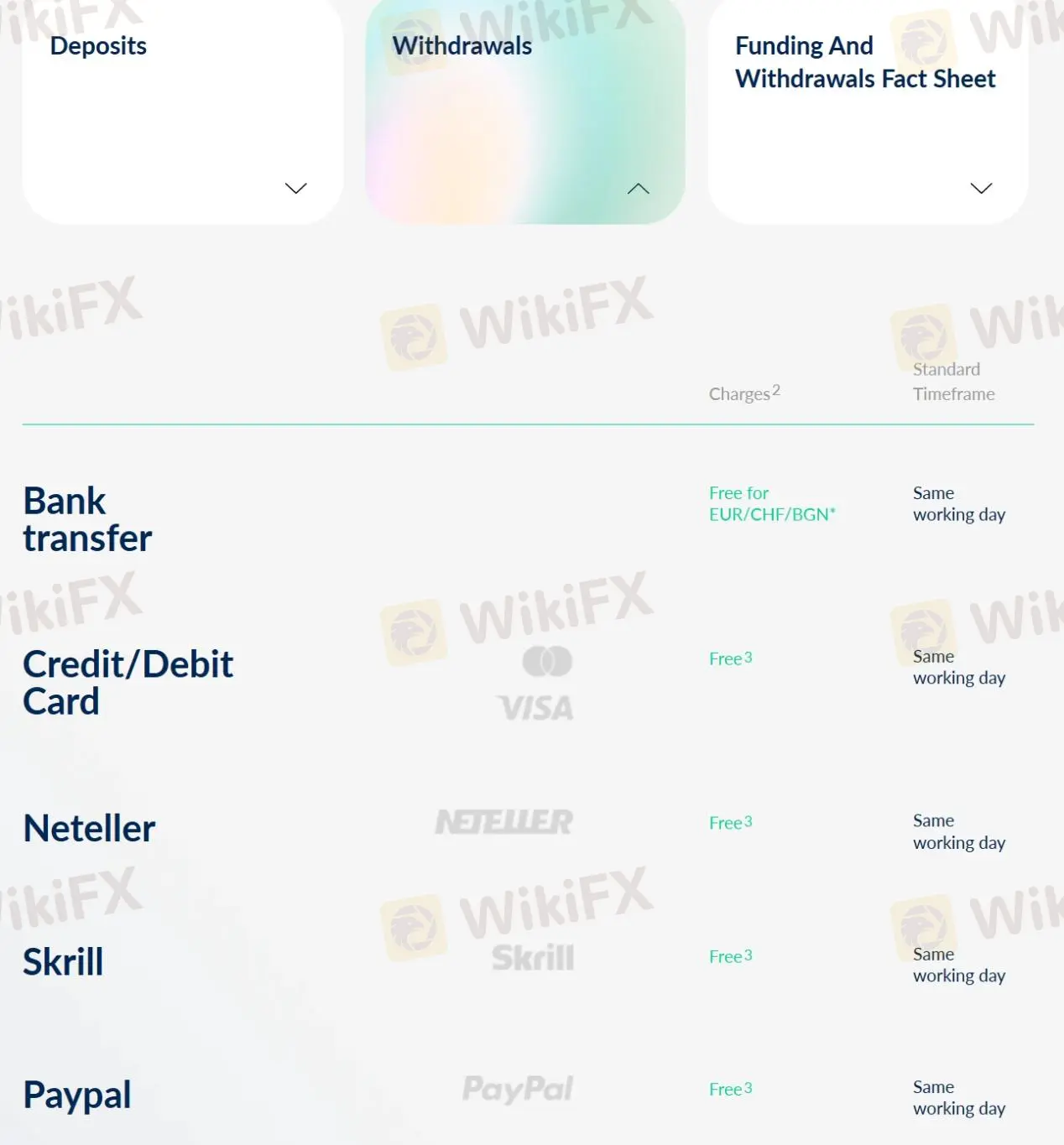

ActivTrades accepts deposits via Bank Transfers, Credit/Debit cards, Neteller, Skrill, Sofort, and PayPal, while only Sofort is excluded from withdrawal methods.

Base Currencies:

EUR, USD, GBP or CHF

The minimum deposit is as high as $500.

| ActivTrades | Most other | |

| Minimum Deposit | $500 | $100 |

Deposits via credit/debit card UK&EEA are charged 0.5% fees, while credit/debit card non-EEA are charged 1.5% fees. Other deposits and all withdrawals are free of charge.

Most deposits are said to take 30 minutes (except for Bank Transfer deposits are processed on the same working day), while all withdrawals can be processed on the same working day.

More details can be found in the table below:

| Payment Options | Fee | Processing Time | ||

| Deposit | Withdraw | Deposit | Withdraw | |

| Bank Transfer | Free | Free for EUR/CHF/BGN | Same working day | Same working day |

| Credit/Debit card | 0.5% (UK & EEA), 1.5% (non EEA) | Free | 30 minutes | |

| Neteller | Free | |||

| Skrill | ||||

| PayPal | ||||

| Sofort | / | / | ||

ActivTrades offers 24/5 multilingual customer service via live chat, telephone: +44 (0) 207 6500 567, +44 (0) 207 6500 500, email: englishdesk@activtrades.com, institutional_en@activtrades.com, request a callback, or messaging online. Help Center is also available. You can also follow this broker on social networks such as Twitter, Facebook, Instagram and YouTube. Company address: The Loom 2.5, 14 Gower's Walk, London, E1 8PY.

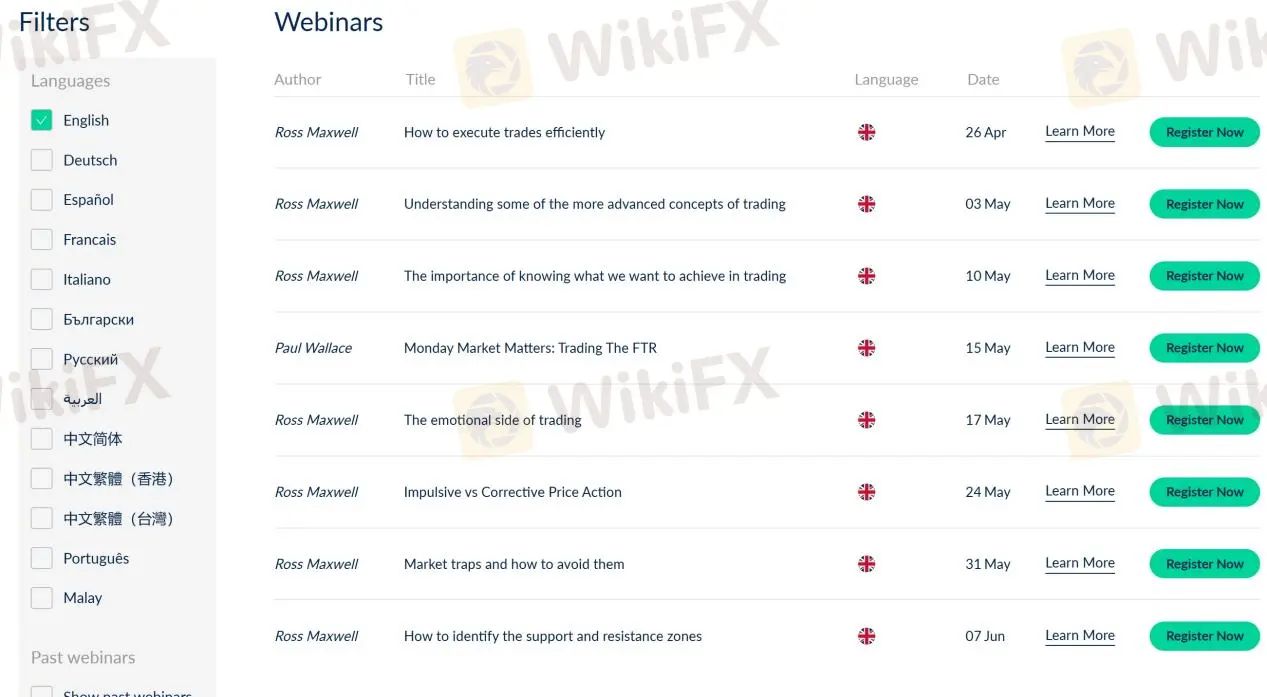

ActivTrades provides comprehensive educational resources organized by subject, including webinars, seminars, manuals, news & analysis. In addition, you get access to a demo account, robust analytical and technical analysis tools within the platforms and exclusive add-ons that will help you study and trade more effectively.

As a whole, ActivTrades is a regulated broker that provides a wide range of trading instruments and platforms. The company offers several account types and has competitive trading fees with low spreads. The broker also provides negative balance protection and segregated client accounts.

However, ActivTrades has some negative reviews from clients regarding trading platform. Additionally, the broker charges deposit fees for some payment methods. Overall, ActivTrades may be a good option for experienced traders who prioritize low trading fees and a variety of trading instruments.

| Q 1: | Is ActivTrades regulated? |

| A 1: | Yes. It is regulated by FCA and offshore regulated by SCB. |

| Q 2: | Does ActivTrades offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does ActivTrades offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Both MT4 and MT5 are available, and it also offers ActivTrader. |

| Q 4: | What is the minimum deposit for ActivTrades? |

| A 4: | The minimum initial deposit with ActivTrades is $500. |

| Q 5: | Is ActivTrades a good broker for beginners? |

| A 5: | Yes. ActivTrades is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

To compare transaction costs across different brokers, our experts analyze the transaction-specific fees (such as spreads) and non-trading fees (such as inactivity fees and payment costs).

To get a comprehensive understanding of how cheap or expensive bcr and activtrades are, we first considered common fees for standard accounts. On bcr, the average spread for the EUR/USD currency pair is 1.7+ pips, while on activtrades the spread is --.

To determine the safety of our top brokers, our experts will consider many factors. This includes which licenses the broker holds and the credibility of these licenses. We also consider the history of brokers, because long-term brokers are usually more reliable and trustworthy than new brokers.

bcr is regulated by ASIC,FSC. activtrades is regulated by FCA,SCB,DFSA.

When our experts review brokers, they will open their own accounts and trade through the broker's trading platform. This enables them to comprehensively evaluate the quality, ease of use, and function of the platform.

bcr provides trading platform including Affiliate,Alpha,Advantage,Standard and trading variety including --. activtrades provides trading platform including -- and trading variety including --.