简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

TeleTrade-Overview Guide of This Broker

Zusammenfassung:

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| TeleTrade Review Summary in 10 Points | |

| Founded | 1994 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC |

| Market Instruments | Forex, CFDs on metals, indices, energy, shares, cryptocurrencies and commodities |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/ USD Spreads | 0.2 pips |

| Trading Platforms | MT4, MT5 |

| Minimum Deposit | $100 |

| Customer Support | Phone, email, social media |

What is TeleTrade?

Teletrade (EU) is an award-winning EU-authorized and regulated retail broker, part of the Teletrade Group, which was founded in 1994. The company operates in the European market under the EU Markets in Financial Instruments Directive (MiFID) and is licensed by the Cyprus Securities. TeleTrade is regulated by Cyprus Securities and Exchange Commission (CySEC).

When it comes to account types, TeleTrade offers a range of options to suit the needs of different traders. Additionally, it offers a demo account option for traders who want to test their trading strategies before opening a live account. TeleTrade customers have access to a wide range of financial markets. The company also provides a range of tools, and analysis to help traders make informed decisions.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

TeleTrade Alternative Brokers

There are many alternative brokers to TeleTrade depending on the specific needs and preferences of the trader. Some popular options include:

OctaFX - A leading online trading broker with a user-friendly platform and low trading costs, making it ideal for beginner traders.

Tickmill- A reliable and reputable trading broker with competitive spreads and a wide range of trading instruments, making it a good choice for experienced traders.

Axi – A well-regulated and respected trading broker with a range of advanced trading tools, making it an excellent choice for professional traders seeking advanced trading capabilities.

Is TeleTrade Safe or Scam?

TeleTrade is regulated by Cyprus Securities and Exchange Commission (CYSEC, No. 158/11). Based on the information available, TeleTrade appears to be a reliable and trustworthy broker. It is regulated by reputable authority, has been in operation for several years, and has received positive reviews from many customers.

However, as with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

Market Instruments

TeleTrade offers a variety of trading instruments across different asset classes, including Forex, metals, indices, energy, shares, cryptocurrencies, commodities

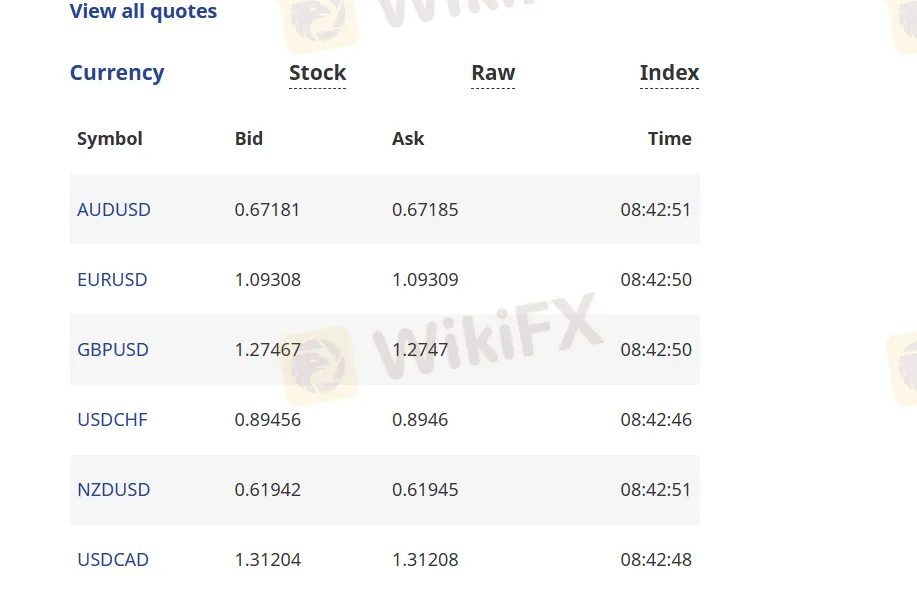

Forex

TeleTrade provides access to various major currency pairs like EUR/USD, GBP/USD, USD/JPY, and more. These currency pairs enable traders to speculate on the future price movements of currencies and potentially earn profits from their trades.

Metals

Gold and silver are two of the most popular metals to trade, and TeleTrade provides access to both. Gold and silver are often used as safe-haven assets, which means that their value tends to increase during times of economic uncertainty. Traders can use this to their advantage by buying these metals when the market is volatile and selling them when the market stabilizes.

Indices

An index is a group of stocks that represent a particular market or sector. TeleTrade provides access to a variety of popular indices like the S&P 500, Dow Jones Industrial Average, and more. These indices allow investors to trade a basket of stocks, providing them with greater diversification and potentially lower risk.

Energy

The energy market has the potential to be highly volatile, making it an attractive trading instrument for risk-tolerant investors. Additionally, TeleTrade offers shares trading on major stock markets such as the New York Stock Exchange and Nasdaq.

Cryptocurrencies

Cryptocurrencies like Bitcoin, Ethereum, and Litecoin have gained popularity in recent years and provide traders with yet another way to invest their money. Cryptocurrencies are relatively new and highly volatile, making them a higher risk investment option.

Overall, TeleTrade offers a diverse range of trading instruments across different asset classes, giving traders a variety of options to choose from when building their portfolios.

Accounts

TeleTrade offers four live account types including Sharp ECN account, NLT account, NDD account and Standard account with the minimum deposit requirement of $100 each.

Sharp ECN Account

The Sharp ECN account provides investors with access to trading on the widest range of financial instruments on platforms. It is suitable for experienced traders.

NLT Account

The NTL account provides investors with access to trading CFDs on leading stocks and ETFs from exchanges around the world with no leverage. Some of the most tradable shares in the world, including Apple Computer Inc. and Netflix Inc., and ETFs like the SPDR S&P 500 ETF, can become part of your CFD investment portfolio with this account.

NDD Account

The NDD account provides investors with access to trading on the widest range of financial instruments on the MT4 platform.

Standard Account

The Standard account provides investors with access to standard lots on the widest range of Forex and CFD instruments available on the MT4 platform. The Standard Account is the most suitable account type for most traders.

Leverage

Maximum leverage of 1:500 is available for professional clients. Otherwise, leverage limits for retail client range between 1:2 and 1:30 depending on the asset traded. Margin requirements are provided on the website.

Leverage is a powerful tool that allows traders to amplify their positions and potentially earn greater profits from their trades. TeleTrade offers a maximum leverage of 1:500, which means that traders can control positions that areup to 500 times their initial investment.

The advantage of using leverage is that it allows traders to increase their exposure to the market without requiring significant capital. For example, if a trader wants to buy 100,000 units of a currency pair and the price is currently $1 per unit, they would need $100,000 to make the purchase. However, with the maximum leverage of 1:500 offered by TeleTrade, the trader could enter the same position with only $200. This provides greater flexibility in trading and allows traders with smaller account balances to participate in the market.

However, it's important to note that leverage can also magnify losses. Traders need to be extremely careful when using leverage and it's vital to have a solid risk management strategy in place.

Spreads & Commissions

TeleTradeoffers the spread from 0.2 pips for all accounts. Besides, commission vary according to the different accounts.

Sharp ECN accounts, NDD accounts and Standard accounts charge commissions while having no additional markups on spreads and rely on Market Execution. NLT account charge no commission.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| TeleTrade | 0.2 pips | Variable |

| OctaFX | 0.3 pips | None |

| Tickmill | 0.1 pips | $2 per lot |

| Axi | 0.4 pips | None |

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

Trading Platforms

Teletrade offers traders the world's leading and popular MT4 and MT5 platforms available for mobile (iOS and Android), web and desktop versions.

The MetaTrader 4 (MT4) platform is widely considered the gold standard for online trading platforms. It offers a user-friendly interface, advanced charting tools, and a wide range of technical analysis indicators.

The MetaTrader 5 (MT5) platform is the successor to the MT4 platform and offers even more advanced trading features. This platform offers an improved interface, superior charting tools, and a larger selection of technical analysis indicators. MT5 also provides traders with access to more timeframes, enabling them to analyze market movements in more detail.

Overall, TeleTrade's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platform |

| TeleTrade | MT4,MT5 |

| OctaFX | MT4, MT5, cTrader |

| Tickmill | MT4,MT5 |

| Axi | MT4 |

Trading Tools

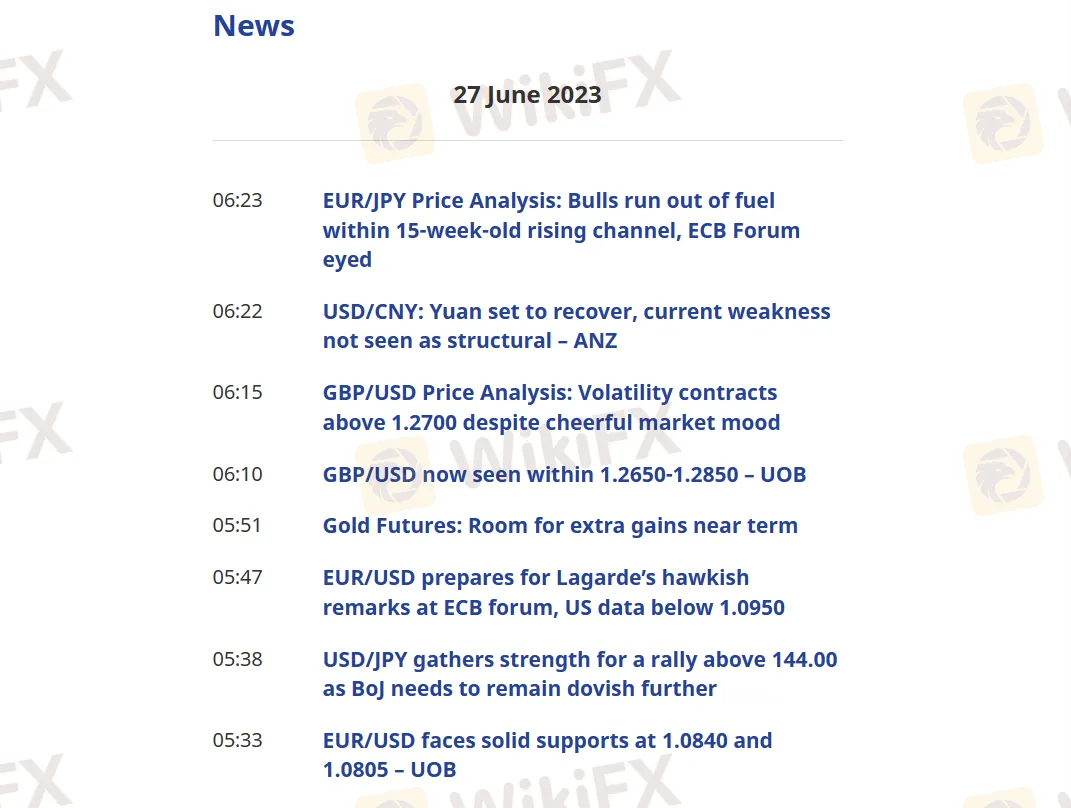

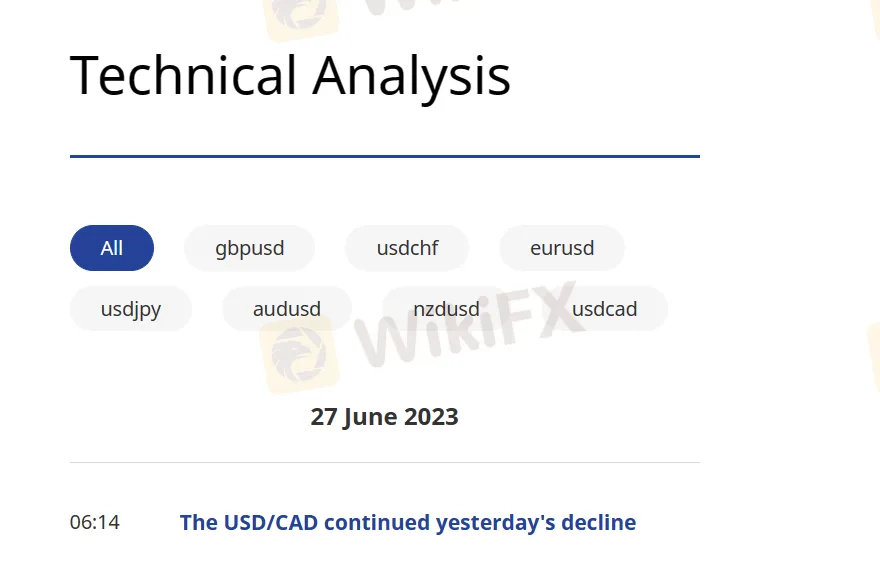

TeleTrade offers market news, quotes, opinions, technical analysis, interactive chart, interest rates, economic holiday and calendar.

- Market news: Access to the latest market developments and trends to help traders stay informed of any important news that may impact trading activity.

- Quotes: Real-time quotes on a variety of currency pairs and other financial instruments, providing traders with valuable market insights.

- Opinions: Expert market opinions and analysis to help traders stay ahead of the curve and make informed trading decisions.

- Technical analysis: A variety of technical analysis tools to help traders identify key market trends and potential trading opportunities.

- Interactive chart: A chart that allows traders to analyze the market movements and patterns in real-time.

- Interest rates: Access to current interest rates, which can impact the value of currencies and stocks, and may affect trading decisions.

- Economic calendar and holiday schedule: Up-to-date information on upcoming market events and holidays that can help traders make informed trading decisions and stay ahead of the competition.

In summary, TeleTrade provides a range of tools and resources to help traders navigate the forex market effectively.

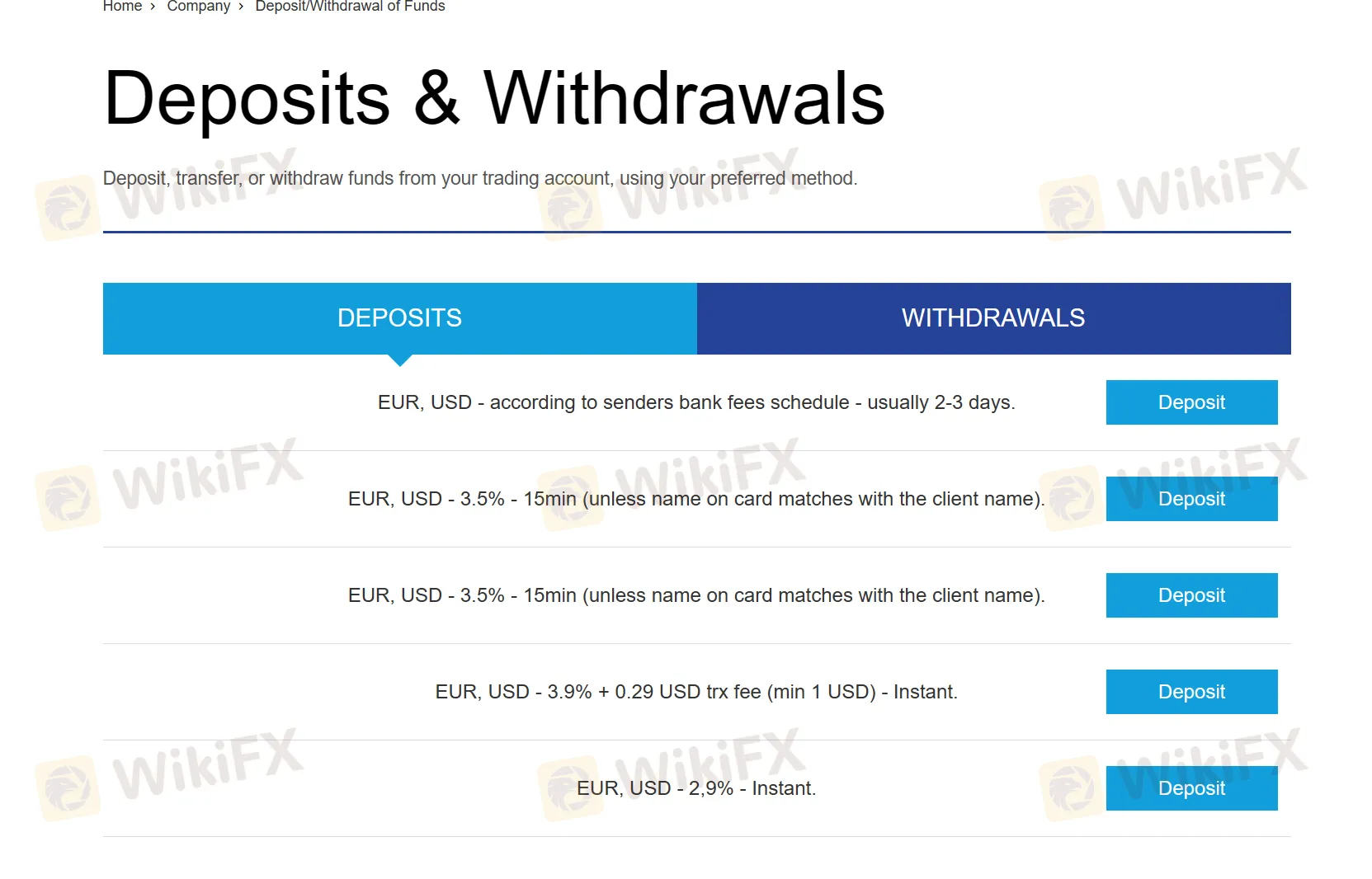

Deposits & Withdrawals

The company welcomes several convenient and withdrawal methods, mainly wire transfer (for EUR, USD), VISA/MASTERCARD credit or debit card (for EUR, USD, 3.5% commission for deposit and 2.35% + 1 EUR/$1.30 commission for withdrawal), NETELLER (for EUR, USD, 3.9% commission for deposit + 0.29 USD and 1 EUR/$1.30 commission for withdrawal), and NETELLER (for EUR, USD, 3.9% commission for deposit and 1.29 USD commission for withdrawal). + $0.29 commission, withdrawal charges 2% fee), Skrill (supports EUR, USD, deposit charges 2.9% commission, withdrawal charges 1% commission), fasapay (supports USD, deposit charges 0.5% fee, up to $5, withdrawal charges 0.5% fee).

TeleTrade's minimum deposit vs other brokers

| TeleTrade | Most other | |

| Minimum Deposit | $100 | $100 |

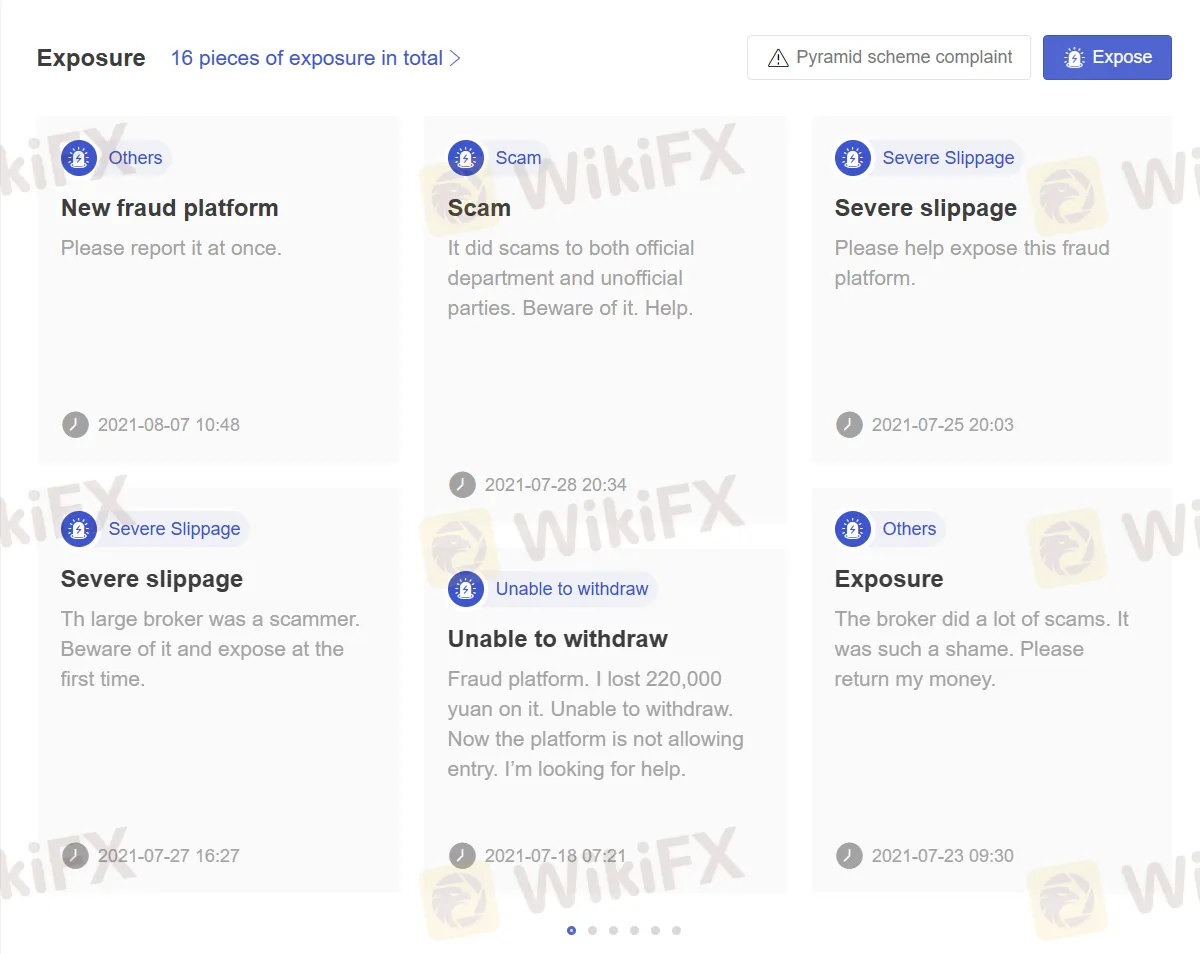

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw, scams and severe slippage. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

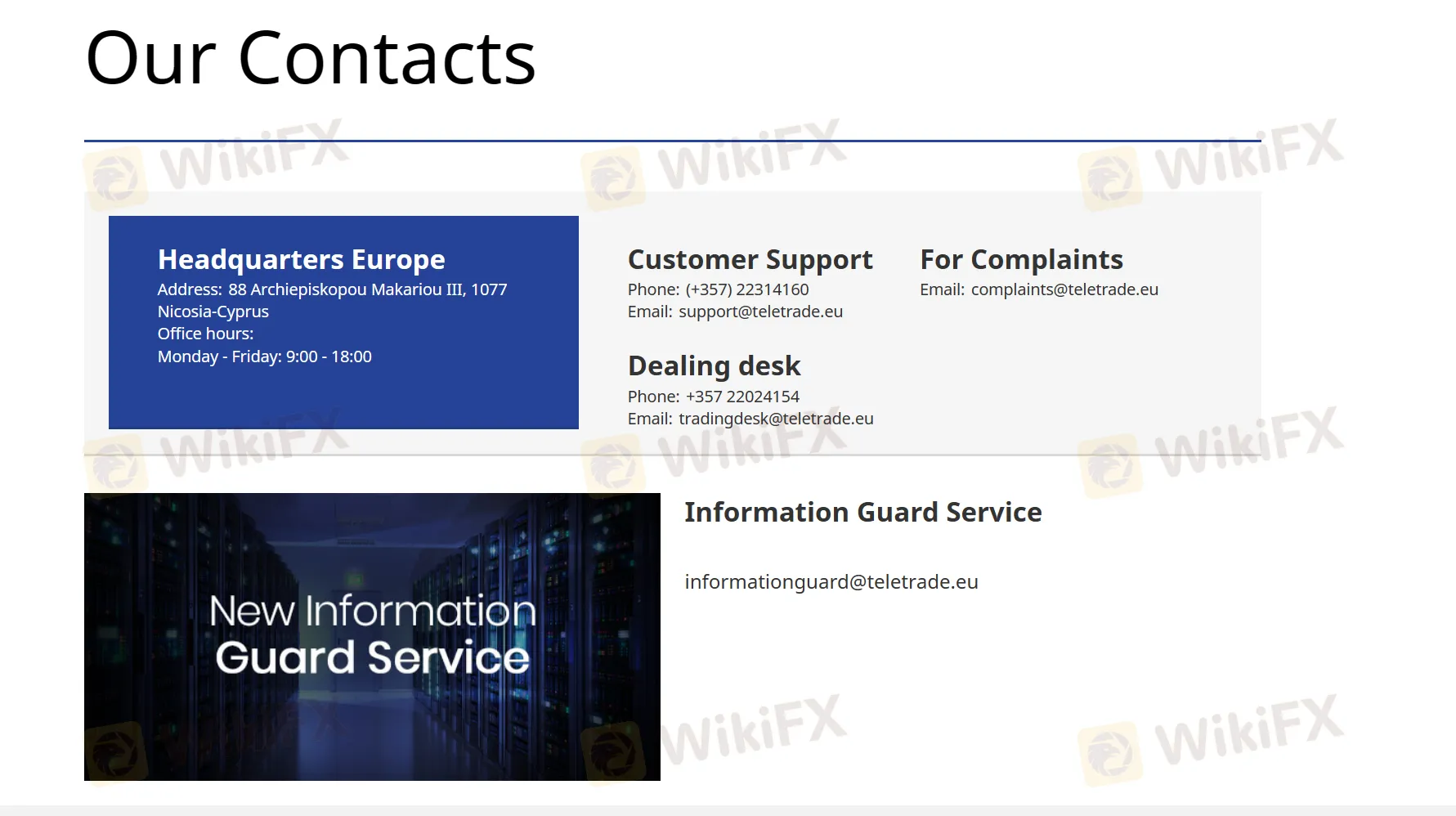

Live chat service is considered as the best way to reach customer support ; the chat logo at the top of the website will take you through to the online assistant service, which is fast and helpful. Alternatively, you can contact the broker via their email or telephone number. There are also additional EU support offices located in Portugal, Hungary, Italy, and Poland.

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: (+357) 22314160

Email: support@teletrade.eu

Address: 88 Archiepiskopou Makariou III, 1077 Nicosia-Cyprus (office hour: Monday - Friday: 9:00 - 18:00)

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram, YouTube and Linkedin.

Twitter: https://twitter.com/TTMarketNews_eu

Facebook: https://www.facebook.com/TeleTradeEU

Instagram: https://www.instagram.com/teletradeeu/

YouTube: https://www.youtube.com/user/TeleTRADEEU

Linkedin: https://www.linkedin.com/company/3356110

Overall,TeleTrades customer service is considered reliable and responsive, with various options available for traders to seek assistance.

Pros and cons of customer service of TeleTrade:

| Pros | Cons |

|

|

|

|

|

Conclusion

Overall, TeleTrade is a well-regulated financial services company that offers a broad range of trading products, educational resources, and customer support options. The company provides a variety of account types to suit different trader needs and operates under the regulatory oversight of major financial institutions in multiple jurisdictions, providing an additional level of safety and security for traders.

TeleTrade's trading tools are resourceful, making it a good option for traders looking to improve their skills and knowledge. The company's customer support is also generally regarded as reliable and responsive, with multiple channels available for traders to seek assistance.

In conclusion, TeleTrade is a reputable financial services company that is well-regulated and provides a strong range of trading products, education, and customer support options.

Frequently Asked Questions (FAQs)

| Q 1: | Is TeleTrade regulated? |

| A 1: | Yes. It is regulated by CYSEC. |

| Q 2: | Can I open a demo account with TeleTrade? |

| A 2: | Yes. |

| Q 3: | Does TeleTrade offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MT4 and MT5. |

| Q 4: | What is the minimum deposit for TeleTrade? |

| A 4: | The minimum initial deposit to open an account is $100. |

| Q 5: | Is TeleTrade a good broker for beginners? |

| A 5: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 and MT5 platforms. Also, it offers demo accounts that allow traders to practice trading without risking any real money. |

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Bitcoin: Ruhe vor den Wahlen – steht ein Kursfeuerwerk bevor?

Weil sie lieber sparen, statt anzulegen: Deutsche verlieren 700 Milliarden, weil sie ihr Geld auf dem Girokonto lassen

Adidas im Aufschwung: Wie der Vintage-Hype und Retro-Modelle das deutsche Unternehmen beflügeln

Bitcoin-ETFs schlagen Gold-ETFs um 65% seit Auflegung

Warum der Michigan-Pensionsfonds jetzt auf Ethereum setzt

Litecoin nach Bruch der aufsteigenden Trendlinie auf zweistelligen Rückgang eingestellt

Ethereum: Die unterschätzte Wachstumsstory im Schatten von Bitcoin

Zalando steigert erneut Gewinn: Das steckt hinter dem Erfolg des Online-Händlers

Institutionelles Interesse an XRP wächst: Ripple-CEO sieht klare Botschaft des Marktes

Bitcoin: Rückschlag und blitzschnelle Erholung - DOGE und SHIB geben Gas

Wechselkursberechnung