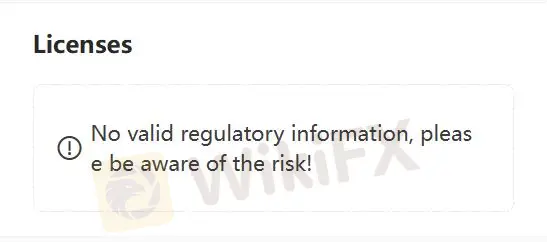

监管信息

监管信息

暂未查证到有效监管信息,请注意风险!

- 经查证,该交易商当前暂无有效监管,请注意风险!

基础信息

英国

英国账户信息

浏览 Etora Grand 的用户还浏览了..

VT Markets

- 5-10年 |

- 澳大利亚监管 |

- 全牌照(MM) |

- 主标MT4

MultiBank Group

- 10-15年 |

- 澳大利亚监管 |

- 全牌照(MM) |

- 主标MT4

官网鉴定

etoragrand.com

服务器所在地

美国

官网域名

etoragrand.com

服务器IP

172.67.137.206

公司简介

| Etora Grand Review Summary | |

| Registered Country/Region | United Kingdom |

| Regulation | No Regulation |

| Market Instruments | Forex, Indices, Commodities, Shares and CFDs |

| Demo Account | Available |

| Leverage | 1:100 - 1:400 |

| Spread | From 1 pip (Basic Account) |

| Trading Platforms | MetaTrader 4, Webtrader, and Mobile Trading App |

| Minimum Deposit | EUR 250 |

| Customer Support | Email: support@etoragrand.com |

What is Etora Grand?

Etora Grand, a brokerage registered in the United Kingdom, offers a versatile trading experience across various financial markets, including forex, equities, indices, and commodities. With a focus on client satisfaction and safety, Etora Grand advertises free educational opportunities, tight spreads, and reliable trading platforms.

However, a key concern with Etora Grand is the lack of regulation.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Pros:

Versatile Trading Experience: Etora Grand offers a wide range of financial instruments, including forex, equities, indices, and commodities, providing traders with diverse investment opportunities.

Educational Opportunities: The brokerage offers free educational resources, enabling traders to enhance their trading knowledge and skills.

Account Security: Etora Grand keeps client funds separate from company assets in reputable UK banks, ensuring the safety of client funds.

Multiple Trading Platforms: Etora Grand supports MetaTrader 4, Webtrader, and a Mobile Trading App, offering flexibility and convenience for traders.

Cons:

Lack of Regulation: Etora Grand is not regulated, which impacts trader trust and confidence in the security of their funds.

Limited Information: There is limited information available about Etora Grand's trading conditions, fees, and other important details.

Is Etora Grand Safe or Scam?

While Etora Grand offers some features that can be seen as positive indicators, including a demo account and multiple trading platforms, it cannot be definitively labeled safe due to the red flag of lacking regulation. The lack of regulation means that Etora Grand operates without the oversight of a regulatory authority, which exposes traders to risks such as fund mismanagement or fraudulent activities.

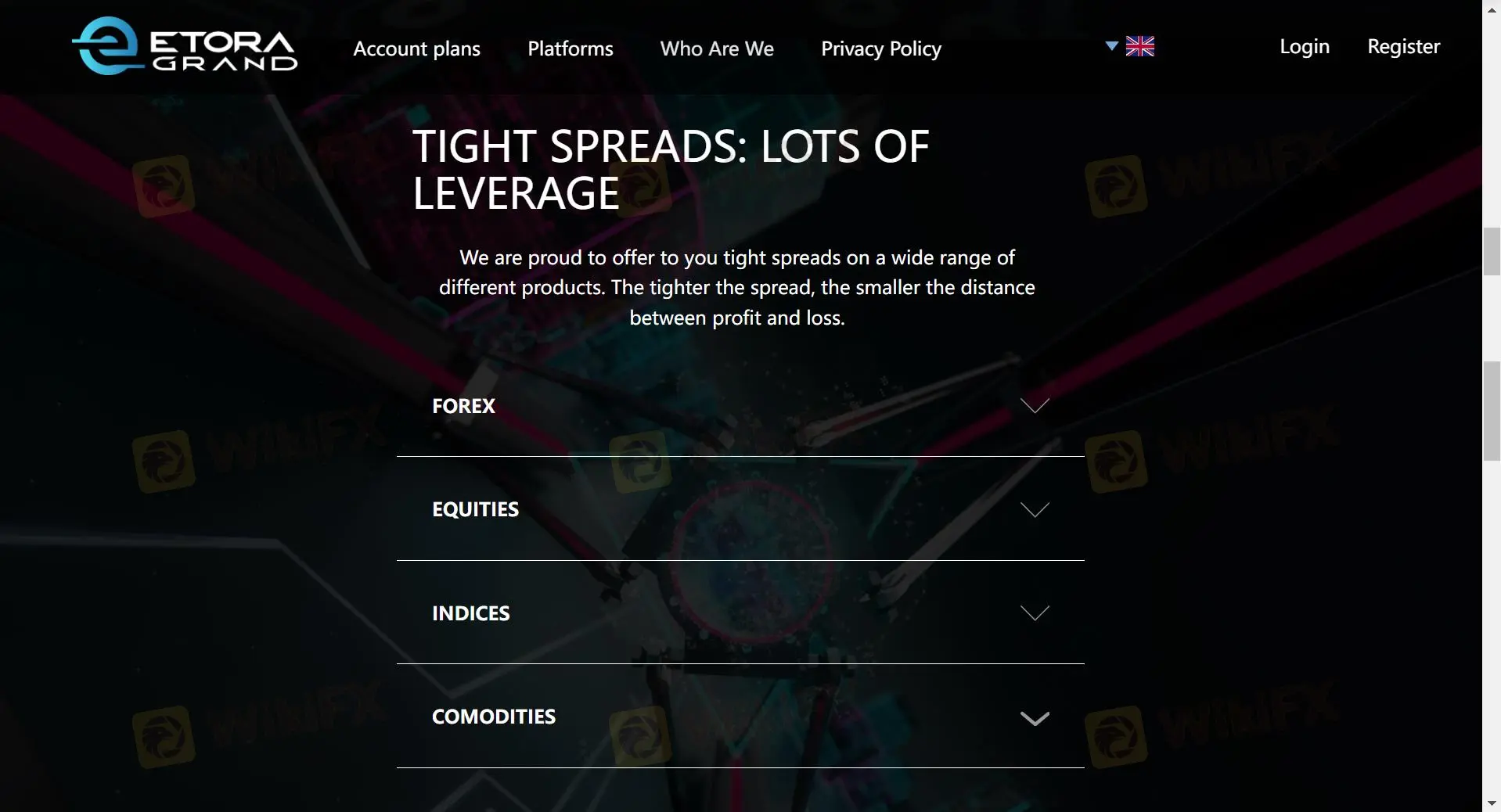

Market Instruments

Etora Grand offers a variety of market instruments for traders to choose from, providing access to different asset classes and trading opportunities.

Forex: Traders can trade a wide range of currency pairs, including major, minor, and exotic pairs. This allows traders to take advantage of fluctuations in exchange rates between different currencies.

Indices: Etora Grand offers trading on major stock indices from around the world. Trading indices allows traders to speculate on the performance of a group of stocks from a particular region or industry.

Commodities: Traders can trade commodities such as gold, silver, oil, and natural gas. Trading commodities can be a way to diversify a trading portfolio and hedge against inflation or geopolitical risks.

Shares: Etora Grand provides access to trading shares of major companies listed on stock exchanges around the world. Trading shares allows traders to invest in individual companies and potentially benefit from their performance.

CFDs: Contract for Difference (CFD) trading allows traders to speculate on the price movements of various financial instruments without actually owning the underlying asset. This enables traders to profit from both rising and falling markets.

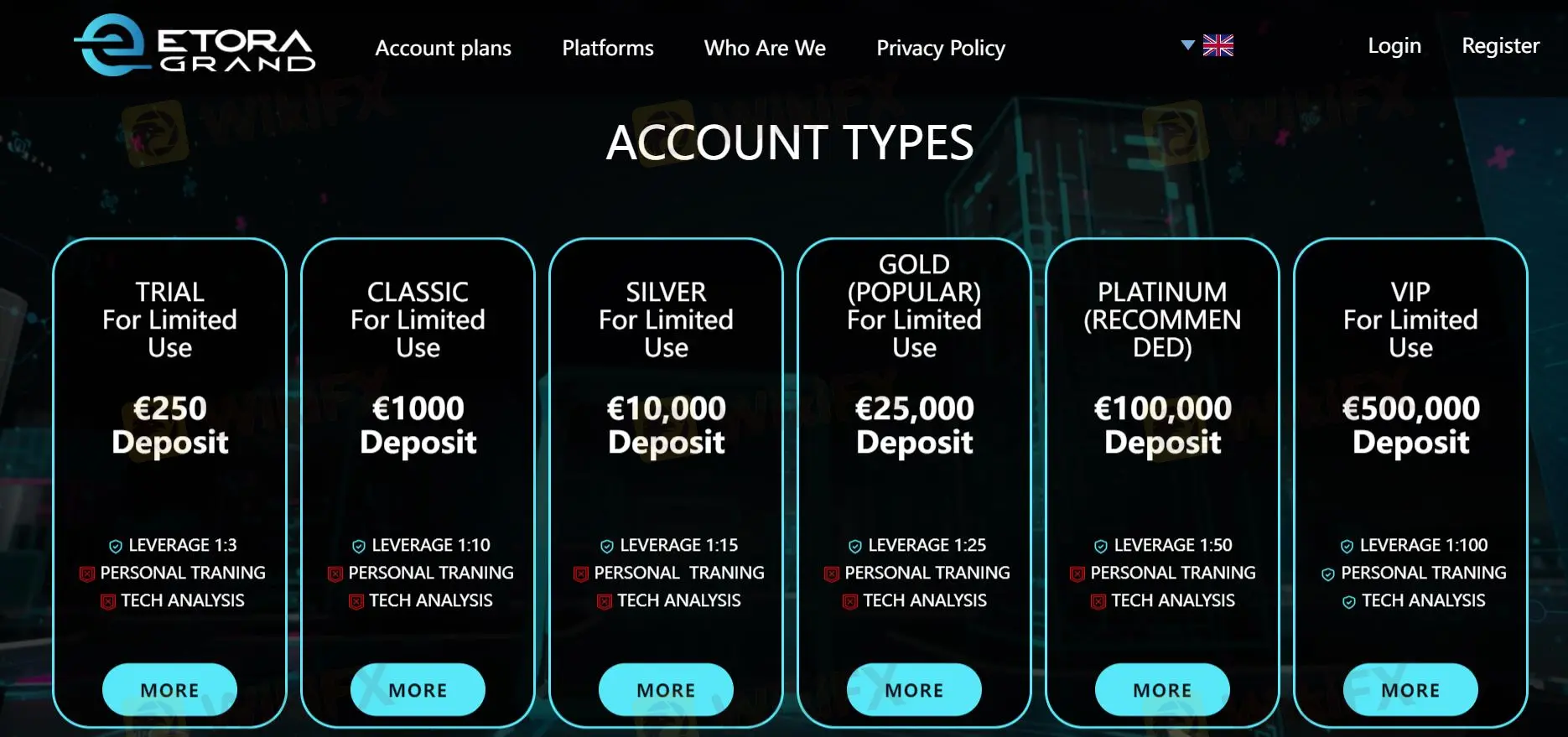

Account Types

Etora Grand offers six different account types to cater to the varying needs and preferences of traders.

Basic (Trial) Account: The Basic Account is designed for new traders and those who prefer to trade with smaller volumes. The minimum deposit requirement is EUR 250.

Classic Account: Similar to the Basic Account, the Classic Account is suitable for new traders and those trading with smaller volumes. The account requires a slightly higher minimum opening deposit of EUR 1000.

Silver Account: The Silver Account is another option for traders new to the forex market or trading with smaller volumes. The account requires a minimum opening deposit of EUR 10,000.

Gold Account: The Gold Account is designed for traders with a higher risk tolerance and a larger trading capital. The account requires a minimum opening deposit of EUR 25,000.

Platinum Account: The Platinum Account is tailored for experienced traders with substantial trading capital. The account requires a minimum opening deposit of EUR 100,000.

VIP Account: The VIP Account is designed for experienced traders who require fixed spreads and specific trading conditions. The account requires a minimum opening deposit of EUR 500,000.

| Account Type | Minimum Opening Deposit | Spreads | Max Leverage | Commission |

| Basic Account | €250 | From 1 pip | 1:100 | No |

| Classic Account | €1,000 | From 1 pip | 1:100 | No |

| Silver Account | €10,000 | From 1 pip | 1:100 | No |

| Gold Account | €25,000 | From 1 pip | 1:100 | No |

| Platinum Account | €100,000 | From 1 pip | 1:100 | No |

| VIP Account | €500,000 | Fixed for Forex | 1:200 | No |

Leverage

Leverage is a key feature in forex and CFD trading that allows traders to control a larger position size with a relatively small amount of capital. Etora Grand offers varying levels of leverage depending on the account type.

The Basic, Classic, Silver, Gold, and Platinum accounts offer leverage up to 1:100.

The VIP account offers higher leverage, up to 1:200.

每个由Etora Grand提供的账户的最大杠杆比例可能会根据客户的适当评估而有所不同。这意味着经纪人可以根据客户的交易经验、风险承受能力和财务状况等因素调整可提供给客户的最大杠杆比例。Etora Grand提供的最大杠杆比例为1:400。

点差和佣金

总体而言,Etora Grand在其各类accounts中提供有竞争力的点差和佣金结构。基础、经典、银牌、金牌和白金accounts都具有1点差和无佣金,适合寻求简单定价而无需额外fees的交易者。

另一方面,VIP账户提供外汇交易的固定点差,为交易者提供更大的交易成本确定性。

交易平台

Etora Grand提供多种交易平台,以满足交易者的需求。

MetaTrader 4 (MT4):MT4是外汇和差价合约交易行业中广受欢迎和广泛使用的平台。它提供用户友好的界面、高级图表工具、技术分析指标以及通过专家顾问(EA)进行自动交易的能力。

Webtrader:Etora Grand提供基于Web的交易平台,允许交易者从其Web浏览器直接访问其accounts并进行交易。这个平台方便那些不愿意下载额外软件的交易者。

移动交易应用:Etora Grand提供与iPhone和Android设备兼容的移动交易应用。移动应用程序允许交易者随时随地通过互联网连接访问其accounts、进行交易并管理其持仓。

客户服务

如有任何疑问或需要帮助,您可以通过电子邮件support@etoragrand.com联系Etora Grand的客户支持团队。

结论

尽管Etora Grand拥有各种可能吸引交易者的功能,从广泛的工具范围到多种账户选择,但一个红旗掩盖了其他一切:缺乏监管。没有监管监督,您的资金有可能被管理不善,甚至更糟,卷入骗局。

我们建议您优先考虑安全,并寻找受知名机构监管的信誉良好的经纪商。

常见问题(FAQ)

问:Etora Grand是否受监管?

答:不,Etora Grand没有受到监管。

问:我可以在Etora Grand交易哪些市场?

答:Etora Grand提供外汇、指数、商品、股票和差价合约的交易。

问:Etora Grand提供哪些交易平台?

答:Etora Grand提供MetaTrader 4、Webtrader和移动交易应用。

问:在Etora Grand开设账户需要的最低存款是多少?

答:在Etora Grand开设账户需要的最低存款为250欧元。

问:Etora Grand提供模拟账户吗?

答:是的,Etora Grand提供模拟账户。

问:Etora Grand提供多大的杠杆比例?

答:Etora Grand提供最高1:400的杠杆比例。

风险警示

在线交易涉及重大风险,您可能会损失所有投资的资本。它不适合所有交易者或投资者。请确保您理解所涉风险,并注意本评论中提供的信息可能因公司服务和政策的constant更新而发生变化。

此外,生成本评论的日期也可能是一个重要因素,因为信息可能已发生变化。因此,读者在做出任何决定或采取任何行动之前,应始终直接与公司核实更新的信息。本评论中提供的信息的使用责任完全由读者承担。

企业画像

- 1-2年

- 监管牌照存疑

- 展业区域存疑

- 高级风险隐患

你要评价的内容

请输入...