Score

Eightcap

Australia|15-20 years| Benchmark AAA|

Australia|15-20 years| Benchmark AAA|https://www.eightcap.com/

Website

Rating Index

Benchmark

Benchmark

AAA

Average transaction speed (ms)

MT4/5

Full License

EightcapLtd-Demo05

Influence

AA

Influence index NO.1

Thailand 7.70

Thailand 7.70Benchmark

Speed:AAA

Slippage:A

Cost:AA

Disconnected:AA

Rollover:AA

MT4/5 Identification

MT4/5 Identification

Full License

Influence

Influence

AA

Influence index NO.1

Thailand 7.70

Thailand 7.70Contact

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 14 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic information

Australia

AustraliaAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Eightcap also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Benchmark

Total Margin Trend

| VPS Region | User | Products | Closing time |

|---|---|---|---|

HoChiMinh HoChiMinh | 976*** | XAUUSD | 12-20 19:31:04 |

Shanghai Shanghai | 209*** | XAUUSD | 12-20 18:25:32 |

HoChiMinh HoChiMinh | 326*** | XAUUSD | 12-20 18:29:32 |

Stop Out

0.70%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

Website

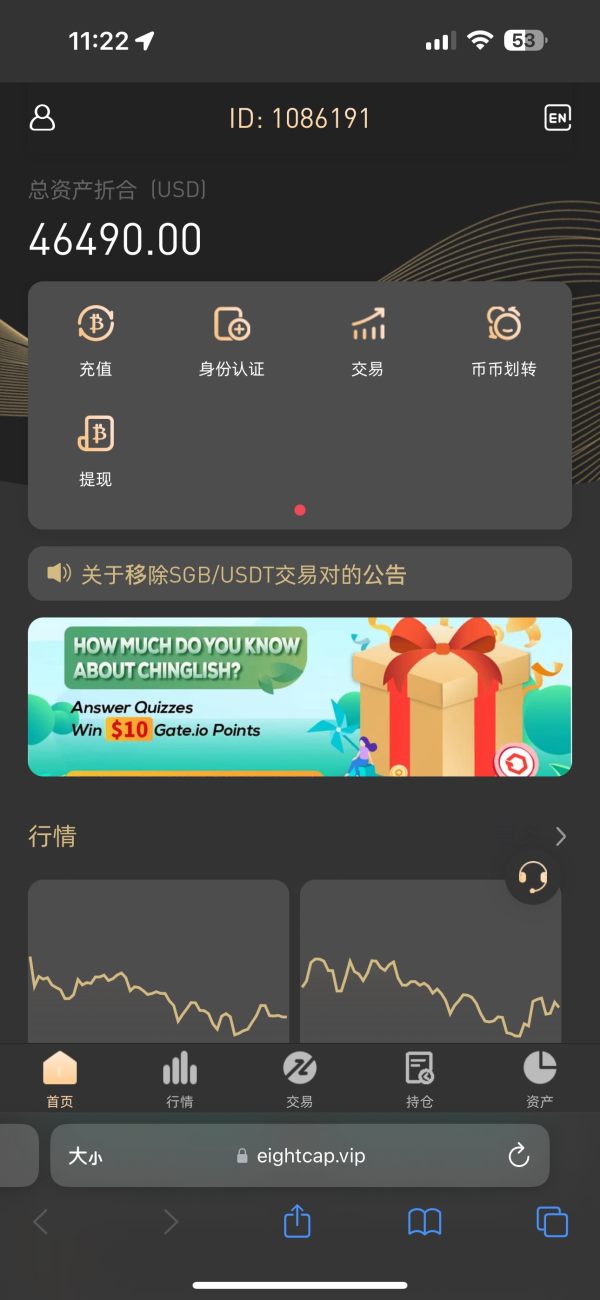

yihui8cn.com

Server Location

Hong Kong

Website Domain Name

yihui8cn.com

Server IP

47.242.73.22

8capcn.com

Server Location

Hong Kong

Website Domain Name

8capcn.com

Server IP

47.242.73.22

yihui8c.com

Server Location

Hong Kong

Website Domain Name

yihui8c.com

Server IP

47.242.73.22

Genealogy

VIP is not activated.

VIP is not activated.RocoForex

fandford

YingLun

Company Summary

| Eightcap Review Summary | |

| Founded in | 2009 |

| Registered Country | Australia |

| Regulation | ASIC, FCA, CySEC, SCB (Offshore) |

| Trading Assets | 800+ CFDs on forex, commodity, crypto, index, share |

| Demo Account | ✅(30 days) |

| Leverage | Up to 1:500 |

| EUR/USD Spread | From 0 pips |

| Minimum Deposit | $100 |

| Trading Platform | MetaTrader 4, MetaTrader 5, Tradingview |

| Payment Method | MasterCard, Visa, PayPal, Wire Transfer, BPAY, Skrill, Neteller, etc. (vary on the region) |

| Customer Support | Live chat, phone, email, FAQs |

General Information

Eightcap is a popular online forex and CFDs broker that offers access to trade various financial markets. The broker was founded in 2009 in Melbourne, Australia, and has since expanded its presence to other regions such as Europe, Asia, and the Middle East. Eightcap prides itself on providing a user-friendly trading experience, robust trading platforms, and competitive trading conditions for its clients.

The broker offers a wide range of financial instruments to trade, including 800+CFDs on forex, commodity, crypto, index, and share. Clients can access these markets through the popular trading platforms, MetaTrader 4, MetaTrader 5, and TradingView. The broker also offers three types of account types to suit the individual needs of its clients, including Standard, Raw and TradingView, with the minimum deposit requirement of $100.

Pros and Cons

Eightcap is a global forex and CFD broker offering many features and benefits that make it an attractive choice for traders of all levels. One of the primary advantages of Eightcap is its range of trading instruments, including CFDs on forex, commodity, crypto, index, and share. This diversity allows traders to take advantage of a wide range of market opportunities and build diversified portfolios.

In addition to its broad range of trading instruments, Eightcap also offers competitive trading conditions, such as tight spreads and low commissions, which can help traders maximize their profits. The broker also provides access to multiple trading platforms, including MetaTrader 4 and 5, as well as TradingView.

While there are many benefits to trading with Eightcap, there are also some drawbacks to consider. One of these is the limited selection of educational resources, which may be a disadvantage for novice traders. Additionally, the broker does not currently offer social trading options and 24/7 customer support.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Is Eightcap Legit?

Yes, Eightcap is considered a legitimate broker, regulated by reputable financial authorities including ASIC (Australia), FCA (UK), CySEC (Cyprus), and SCB (Bahamas). These regulatory bodies impose strict rules and regulations on the broker to ensure they operate in a fair and transparent manner, thereby providing traders with a safe and secure trading environment.

EIGHTCAP PTY LTD, its Australian entity, is authorized and regulated by the Australia Securities & Investment Commission (ASIC) under the regulatory license number 391441.

Eightcap EU Ltd, is regulated by the Cyprus Securities and Exchange Commission (CYSEC) under license no. 246/14.

Eightcap Group Ltd, its UK entity, is authorized and regulated by the Financial Conduct Authority (FCA) under the regulatory license number of 921296.

Eightcap Global Limited, the international entity, is authorized and offshore regulated by the Security Commission of the Bamas (SCB) under the regulatory license number of SIA-F220.

Market Instruments

800+ CFDs on forex, commodity, crypto, index, share... EightCap allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade on EightCap.

Account Types

Live Accounts: EightCap offers three types of accounts at EightCap: Raw, Standard and TradingView accounts. All require a moderate minimum deposit of 100 USD, which is quite friendly for beginners. Their most relevant differences consist in the spreads, the raw account has a lower spread. Standard and TradingView accounts offers a commission-free trading environment, yet compensated by wider spreads, while Raw accounts offers raw spreads, accompanied by additional commissions.

The Raw Account is designed for traders seeking tight spreads and transparent pricing. With a minimum deposit of $100, traders can access over 800 instruments with spreads starting from 0.0 pips. However, a commission is charged on each side of the trade, ranging from $3.5 for major currencies like AUD, USD, NZD, SGD, and CAD, to $2.25 for GBP and $2.75 for EUR per standard lot traded. This account type allows scalping and supports a wide range of base currencies, including AUD, USD, EUR, GBP, NZD, CAD, and SGD. The minimum trade size is 0.01 lots, with a maximum of 100 lots.

The Standard Account is designed for traders seeking a more straightforward pricing structure. With a minimum deposit of $100, traders can access over 800 instruments with spreads starting from 1.0 pips. No commissions are charged, making it a cost-effective option for traders who prefer to pay through the spread. Like the Raw Account, the Standard Account allows scalping, supports multiple base currencies, and offers the same minimum and maximum trade sizes, margin call levels, and stop-out levels.

The TradingView Account is a unique offering that integrates with the popular TradingView platform. With a minimum deposit of $100, traders can access over 800 instruments with spreads starting from 1.0 pip and no commissions charged. This account type is suitable for traders who prefer to use the TradingView platform for analysis and trading. Similar to the other account types, the TradingView Account allows scalping, supports a wide range of base currencies, and offers the same minimum and maximum trade sizes, margin call levels, and stop-out levels.

Demo Accounts

Aside from two types of live trading accounts, Eightcap offers a 30-day demo account for traders who want to practice and test their trading strategies without risking real money. The demo account is free and is designed to simulate real market conditions, allowing traders to get a feel for the platform and instruments before they start trading with a live account. The demo account is funded with virtual money and offers access to the same features as the live account, including a range of instruments and trading platforms.

Leverage

The maximum leverage is determined by the regulator; the maximum ASIC leverage is only 1:30, but the Bahamas SCB allows a leverage of 1:500. However, other trading conditions may vary accordingly and you can decide for yourself.

High leverage is ideal for active traders and scalpers, as it presents greater trading flexibility in general, which directly impacts profitability, but new users are advised to operate with caution with such large leverage.

Spreads and Commissions

Eightcap offers competitive spreads and commissions on their trading instruments. The spreads on forex pairs start from as low as 0.0 pips on the Raw account and 1.0 pips on the Standard account. The commissions charged on forex trades start from $3.50 per lot round trip on the Raw account and there are no commissions on the Standard account.

For indices, the spreads start from 0.5 pips on the Raw account and 1.0 pips on the Standard account.There are no commissions charged on indices trading. The spreads on commodities trading start from 0.03 pips on the Raw account and 0.5 pips on the Standard account, and there are no commissions charged on commodities trading. The spreads and commissions may vary depending on market conditions and the type of account held by the trader.

Non-Trading Fees

Eightcap charges non-trading fees, which are fees not directly related to trading, such as deposit and withdrawal fees, inactivity fees, and currency conversion fees.

For deposits, Eightcap does not charge any fees, but there may be fees charged by the payment provider or bank. Withdrawals made via bank transfers are free, but there is a fee of $10 for withdrawals via credit/debit cards.

Additionally, Eightcap charges an inactivity fee of $50 per quarter if there are no trades or account activity for a period of 90 days or more. It's important to note that this fee is only charged if there are sufficient funds in the account, and it does not apply to demo accounts.

Eightcap also charges a currency conversion fee of 0.5% for clients who deposit or withdraw in a currency other than their account base currency. This fee can be higher for certain currencies, so it's important to check with Eightcap for the exact fee amount.

Trading Platforms

Eightcap offers multiple trading platforms, including the popular MetaTrader 4, MetaTrader 5, and Tradingview. These platforms are known for their user-friendly interface and advanced charting tools. Additionally, Eightcap also provides a web-based trading platform that can be accessed from any device with an internet connection. This platform is ideal for traders who prefer a simpler interface or who don't want to download and install software on their device.

With the MetaTrader platforms, Eightcap offers a range of customizable features, including the ability to use custom indicators and expert advisors. These platforms also provide access to real-time market data and allow traders to execute trades quickly and efficiently. Traders can also use the platforms to set up automated trading strategies, which can be particularly useful for those who want to trade around the clock.

EightCap's TradingView leverages 15+ customizable chart types, including Kagi, Renko, and Point & Figure. Organize up to 8 synchronized charts per tab and utilize 90+ smart drawing tools for comprehensive analysis.

Furthermore, Eightcap's web-based trading platform is designed to offer a streamlined trading experience. It includes essential features such as real-time market news, customizable charts, and advanced order types. The platform also offers access to a range of educational resources, including trading videos, webinars, and tutorials, which can be helpful for new traders looking to improve their skills.

Deposit and Withdrawal

Eightcap offers a variety of deposit and withdrawal methods, such as MasterCard, Visa, PayPal, Wire Transfer, BPAY, Skrill, Neteller, etc. (vary on the region). You can find more detailed info in the table below:

| Payment Option | Accepted Currencies | Deposit Fee | Withdrawal Fee | Deposit Processing Time | Withdrawal Processing Time |

| MasterCard | AUD, USD, GBP, EUR, NZD, CAD, SGD | ❌ | ❌ | Instant | 2-5 business days |

| Visa | |||||

| PayPal | AUD, USD, GBP, EUR, NZD, SGD | 1-5 business days | |||

| Wire Transfer | AUD, USD, GBP, EUR, NZD, CAD, SGD | Variable | 1-5 business days | ||

| B-PAY | AUD | ❌ | 1-2 business days | 1-3 business days | |

| UnionPay | RMB | Instant | 1 business day | ||

| Skrill | USD, EUR (only for EEA clients), CAD | Variable | |||

| Neteller | |||||

| Cryptos | USDT (TRC20), USDT (ERC20), BTC (only for USD accounts) | ❌ | / | Instant | |

| Interac | CAD | ❌ | 1-3 business days | ||

| fasapay | USD | 1 business day | |||

| pix | BRL | / | / | / | 1-5 business days |

| dragonpay | MYR, PHP | Variable | ❌ | Instant | 1 business day |

| ... | THB, VND, MYR, IDR, PHP |

Customer Support

Eightcap offers live chat, phone, and email. Their live chat feature is available 24/5, which means clients can get instant assistance whenever they need it. Phone support is available during business hours, and email support promises a response within 24 hours.

In addition, Eightcap has an extensive FAQ section on its website that covers various topics, such as account opening, trading platforms, funding and withdrawals, and trading conditions.

Conclusion

In conclusion, Eightcap seems like a solid choice for traders looking for a reliable broker with a wide range of instruments, competitive pricing, and user-friendly platforms. Their customer support is also top-notch, with various ways to get in touch and a comprehensive FAQ section. While their educational resources may not be as extensive as some other brokers, they still provide useful tools and market analysis to help traders stay informed. The only potential downside is the lack of proprietary trading platforms, but with MT4, MT5, and TradingView available, there's still plenty of options to choose from.

FAQs

Is Eightcap regulated?

Yes, Eightcap is regulated by ASIC, FCA, CySEC, and SCB (Offshore).

What trading platforms does Eightcap offer?

Eightcap offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView.

What are the minimum deposit requirements for Eightcap?

The minimum deposit requirement for Eightcap's Standard account is $100.

What is the maximum leverage available at Eightcap?

Up to 1:500.

Can I open a demo account with Eightcap?

Yes, Eightcap offers a 30-day demo account that allows traders to practice their trading strategies without risking real money.

What financial instruments can I trade at Eightcap?

You can trade CFDs on forex, commodity, crypto, index, and share on Eightcap.

Risk Warning

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities.

Keywords

- 15-20 years

- Regulated in Australia

- Regulated in United Kingdom

- Regulated in Cyprus

- Regulated in Bahamas

- Market Making(MM)

- Straight Through Processing(STP)

- Retail Forex License

- MT4 Full License

- MT5 Full License

- Global Business

- High potential risk

- Offshore Regulated

News

News Broker Review: Is Eightcap Legit?

EightCap, is a global forex broker launched in 2009. It was established in Melbourne, Australia. This broker offers its global traders various market instruments. In today’s article, we will show you whether Eightcap is still a reliable broker in 2024.

2024-12-17 17:11

News Eightcap Becomes UK’s Dedicated TradingView Broker

Eightcap is now the UK’s exclusive TradingView broker, offering unique benefits like a free TradingView Plus subscription to all UK clients for a seamless experience.

2024-12-13 13:14

News Find Regulated Brokers from A to Z on WikiFX

The foreign exchange market is an ocean of authorized and unauthorized brokers. You can choose any broker who meets your needs. However, finding legitimate ones is an actual challenge. In this article, we'll tell you about the 26 regulated brokers, starting from A to Z.

2024-11-21 14:59

News Eightcap US Election 2024: 50-Point Spread Reduction Offer

Trade the 2024 US election volatility with Eightcap's 50-point spread reduction on NDX100 and US30. Maximize profits from October 15th to November 30th, 2024.

2024-10-16 16:45

News Eightcap Demo Trading Contest ~Oct. 2024

Eightcap announces the upcoming Demo Trading Contest, scheduled to take place in October 2024. Participants may register before 15 October 2024. The competition will run from October 15, 2024 to October 31, 2024.

2024-10-03 15:21

News Eightcap Ends Service Agreements with Proprietary Trading Companies

Eightcap ends services for prop trading firms amid industry shift, prompting firms to seek new partners and navigate regulatory challenges.

2024-02-16 12:47

Review 35

Content you want to comment

Please enter...

Review 35

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

My Panda Team

Cyprus

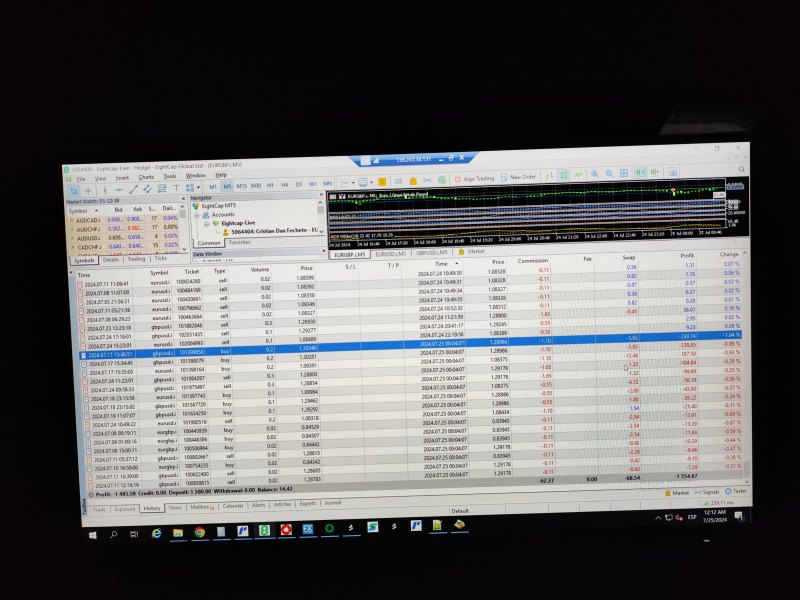

Today, July 25, 2024, Eightcap.com had a Spread of +190 points on the GBPUSD Pair, which is one of the main ones in Forex, and therefore the Spread is usually low, but on top of that it was a PRO account, which It is the account they offer with 0 Spread. That caused a margin close out on my account, leaving the account at 15.19 EUR from a deposit of 1500 EUR. They have totally failed to fulfill their commitment to offering quality service.

Exposure

07-25

老鬼9311

Malaysia

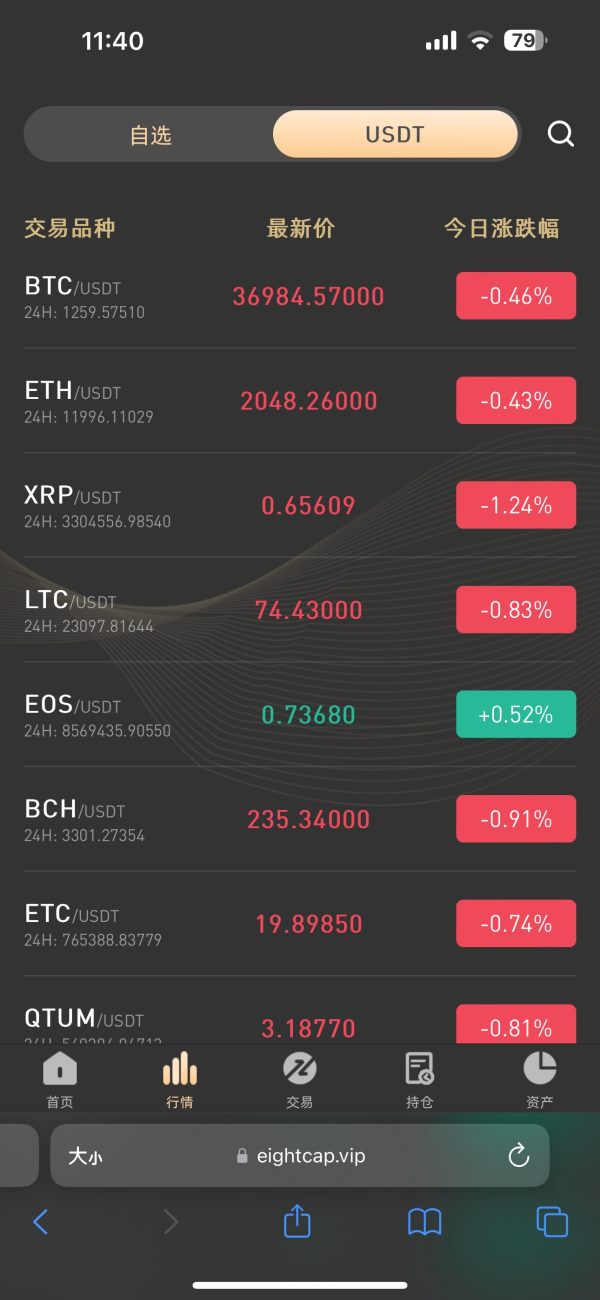

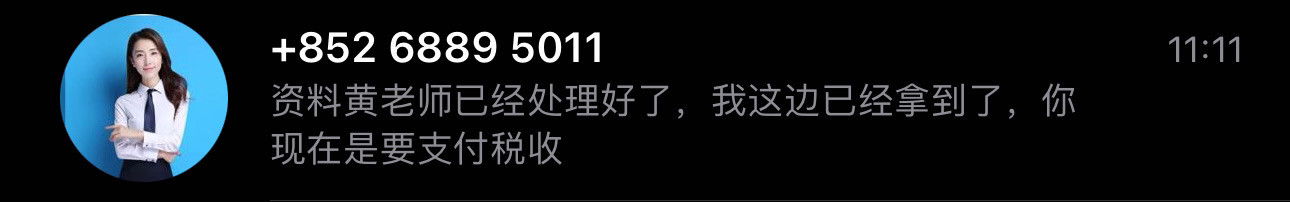

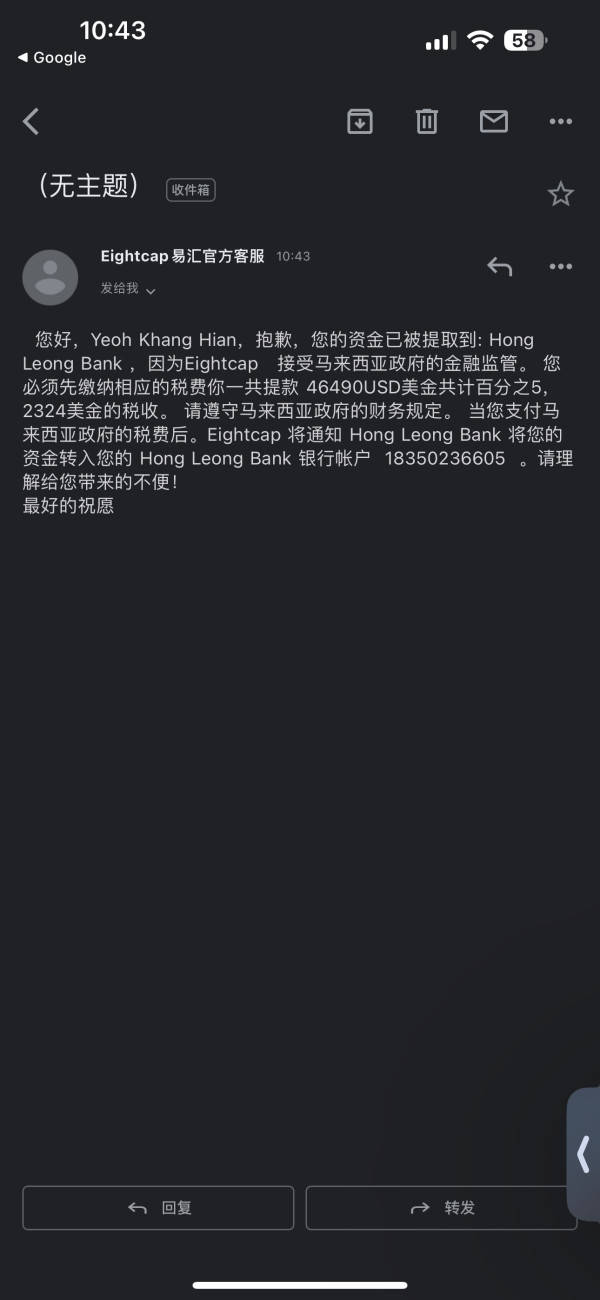

Fraudulent group companies. At first, they will chat with you through Facebook or WhatsApp. Then she will ask you to help her with transactions, and she will pretend to help you get an investment quota, and then you will follow her trading for almost a month. They will tell you that 5,000 yuan is commission and more than 10,000 yuan is personal tax. When you fall out with them, they will block you. So before investing, please think twice.

Exposure

2023-11-19

Xtrader5077

Malaysia

After making a profit on the platform, I cannot withdraw. They maliciously deduct my money. Please help to investigate this fraud platform.

Exposure

2022-08-05

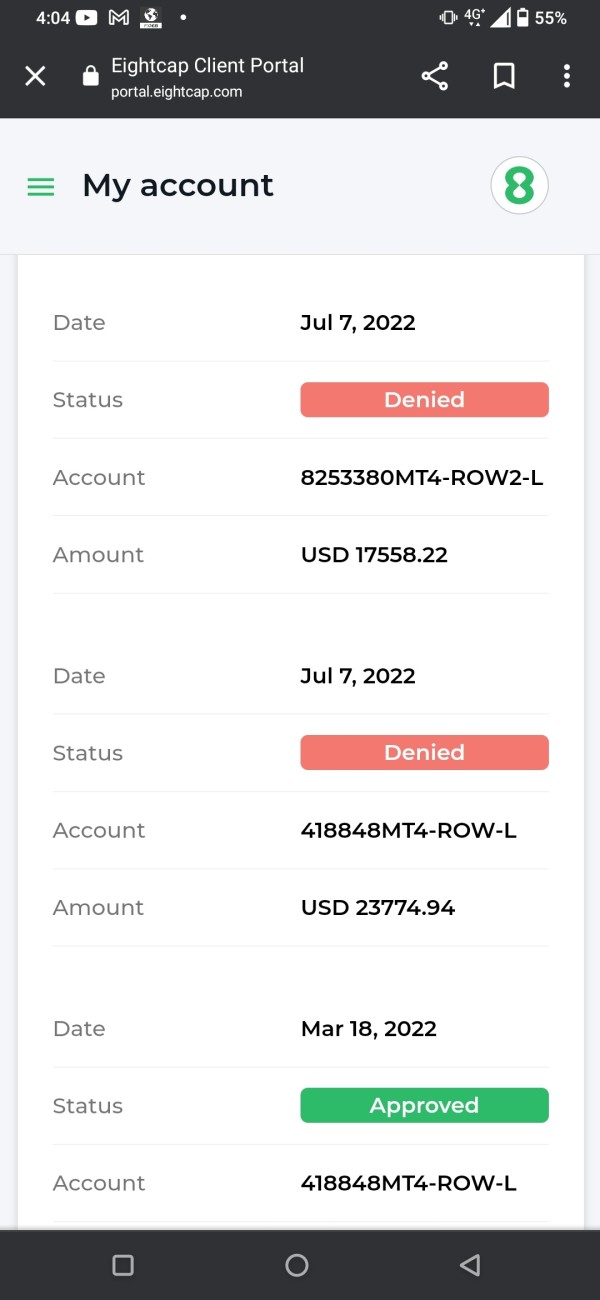

FX2712660344

Canada

I found I couldn’t withdraw the returns of my investment or delete my account with them after 3 months of trading and then they called me out of the blue talking about possible investment options despite the fact I’d said I wanted nothing to do with them Besides having fintrack/ org file a class action that will see you get your money it is actually near impossible to withdraw from the system if you accept their bogus offers which is how they draw in inexperienced traders like myself.

Exposure

2022-07-18

FX3547936470

United Kingdom

Afrer Investing a huge sum of amount into Eight-cap, but due to circumstances I did not have time to keep an eye on this. Few week later i decided to withdraw my initial investment which was worth around £300,000 at the time i wanted to withdraw, no reply to my email from account manager or response from web chat, Fast forward to a month after still no response or withdrawal,

Exposure

2022-07-13

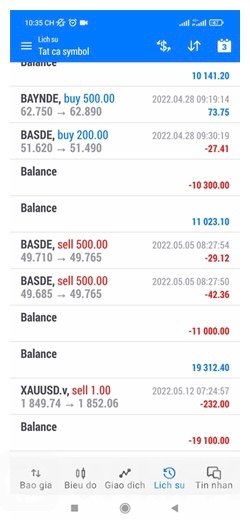

Xtrader5077

Malaysia

Last week my friend and I funded and started trading on Eightcap together. I deposited $10,000 and my friend deposited $7,000. We were faced with the same analysis, the same trading strategy, and we were getting good returns. However, this week we decided to apply for withdrawal. My account was maliciously deducted for no reason, but my friend's account was fully withdrawn for a total of $20,503. This is very unfair to me.

Exposure

2022-07-13

Xtrader5077

Malaysia

Compare the profit that deducted by Eightcap, it is able to withdraw smoothly for the trading account withdraw same operation. It is unfair to me amd handle the profit deduction affairs.

Exposure

2022-07-12

Xtrader5077

Malaysia

Last week I tried to deposit $10,000 on the EightCap platform and was going to test my analysis of profiteering trades. Maybe I had some luck and within a few days I had a nice gain. But in the end Yihui deducted all my profits and closed my trading account without any reason. I think this is already a fraudulent act. The regular exchange can only lose money, but the profit cannot be withdrawn. Please be careful with this platform! !

Exposure

2022-07-12

FX3428595313

Czech Republic

I am unable to withdraw money i put in not to talk of my profits, no integrity, really should go to traceasset!org to complain to them, a company with no moral bottom line i made a deposit of $50,000 to trade and after some weeks i thought to myself i have made enough profit so i submitted a request for withdrawal, They deducted all my profit balance without any reasonable explanation. Traders please avoid this SCAM broker. This is a hard experience from me and also last trading in this scam broker. Will try to report to license department.

Exposure

2022-07-12

FX3815810596

Canada

Worked with this brokerage company and they had very limited interest to hear and understand my needs and realistic financial capacities. One of them often used offensive and derogatory language but a recent fintrack/ org recovery action exposed the activities of Eightcap and caused my investment to be returned unless you have a bottomless wallet better stay away from this broker, they actively encouraged me to invest more money whilst I was already losing a lot of money money.

Exposure

2022-07-12

Xtrader5077

Malaysia

From last week I'm start deposit about 10k USD looking to trade in USoil. I'm have some goodluck and I'm get some profit in few days. When I'm submit for withdraw, Eightcap deducted all my profit balance without any reasonable. Traders please avoid for this SCAM broker. This is a hard experience from me and also last trading in this scam broker. Will try to report to license department.

Exposure

2022-07-12

FX57947855

United States

Be cautious; they will only allow you to make one withdrawal. When you try to make a second withdrawal, they will request an additional deposit. The support crew is only helpful when it comes to investing; when it comes to withdrawals, they block you. Had it not been for AssetsClaimBack legal expert taking up my complaints against EightCap and effecting a refund for me, I would have lost nearly $52,000.

Exposure

2022-05-15

FX2861636451

Australia

I invested $100,000 in an EightCap and lost it all. James Brown was the one who insisted on increasing my investment. He recognizes I'm not going to spend any more money after spending $10,000. He's ceased communicating with me. I couldn't even get online to view my account. They've stopped communicating with me. I've tried multiple times to contact the company with complaints, but nothing has worked. They are hazardous and will take your entire bank account. Never put your trust in EightCap ; I don't want anyone else to lose money by investing in them because they are a complete hoax.

Exposure

2022-05-14

FX244677432

United Kingdom

Don't trust this company withdrawal is impossible with Eightcap after they have your money; five times I requested a withdrawal and they canceled it without informing me or explaining why; I'm not sure where they got their trading licenses. I Tried to withdraw $47500 from my account and all it says is submitting for weeks don't trade with this company.

Exposure

2022-05-14

Daniel Thompson

South Africa

What I like about Eightcap is the small spread for trading EURUSD and XAUUSD. What I don't like is the slow withdrawals.💴💴💴

Neutral

05-16

Archibald

Australia

Gotta give props to EightCap – they're holding it down. Trading here is like a chill session with your favorite playlist – smooth and reliable. The spreads are tight, making every move count. Been through some market storms, but their platform's stability never wavered.

Neutral

2023-11-30

Alexander12

United Kingdom

EightCap is solid, fam. Smooth trades, tight spreads. Support team's on point, quick to solve any hiccups. Been with them for a minute, and no major complaints. They keep it real in the trading game.

Neutral

2023-11-28

^_^^_^依一

Cyprus

EightCap is my old friend who accompanying me around 6 years. It never let me down, powerful trading platforms, trading tools, rich educational resources. Charlie always helps me to withdraw my funds quickly. I don’t know how to describe how amazing this broker is.

Neutral

2023-02-20

FX1160300192

Japan

I really like the flexible leverage of Yihui, the highest is 400 times, which is much higher than the leverage of some of our local traders. I opened a demo account first and then started real trading. So far, it’s pretty good, and I haven’t lost money. I believe I will get more and more used to this platform.

Neutral

2022-12-14

tailbhussinsukhera

Pakistan

0023045100445

Neutral

2022-11-22