WikiFX, एक स्वतंत्र तृतीय-पक्ष सूचना सेवा मंच के रूप में, उपयोगकर्ताओं को व्यापक और वस्तुनिष्ठ ब्रोकर नियामक सूचना सेवाएं प्रदान करने के लिए समर्पित है। WikiFX सीधे किसी भी विदेशी मुद्रा व्यापार गतिविधियों में संलग्न नहीं है, न ही यह किसी भी प्रकार के ट्रेडिंग चैनल की सिफारिशों या निवेश सलाह की पेशकश करता है। WikiFX द्वारा दलालों की रेटिंग और मूल्यांकन सार्वजनिक रूप से उपलब्ध वस्तुनिष्ठ जानकारी पर आधारित हैं और विभिन्न देशों और क्षेत्रों के नियामक नीति मतभेदों को ध्यान में रखते हैं। ब्रोकर रेटिंग और मूल्यांकन WikiFX के मुख्य उत्पाद हैं, और हम किसी भी व्यावसायिक प्रथाओं का दृढ़ता से विरोध करते हैं जो उनकी निष्पक्षता और निष्पक्षता से समझौता कर सकते हैं। हम दुनिया भर के उपयोगकर्ताओं से पर्यवेक्षण और सुझावों का स्वागत करते हैं। शिकायत हॉटलाइन: report@wikifx.com

您当前语言与浏览器默认语言不一致,是否切换?

切换

- फॉलो करें

- बिज़नेस

- लम्हें

CHEWBACCA

फॉलो करें

Mastering your trade in the cryptocurrency market requires a blend of knowledge, strategy, and discipline. The volatile nature of crypto markets presents opportunities and risks, making it essential to have a solid foundation. Here's how to excel:

---

1. Understand the Fundamentals

Learn the Basics: Understand blockchain technology, how cryptocurrencies work, and the purpose of popular coins like Bitcoin, Ethereum, and others.

Know the Ecosystem: Study decentralized finance (DeFi), NFTs, and tokenomics (supply, demand, and utility of a token).

Regulations: Stay updated on global and local cryptocurrency regulations.

---

2. Technical and Fundamental Analysis

Technical Analysis (TA):

Learn chart patterns, indicators (e.g., RSI, MACD), and candlestick reading to predict market movements.

Use tools like TradingView for advanced charting.

Fundamental Analysis (FA):

Assess a project's whitepaper, team, partnerships, and use case.

Monitor news, updates, and adoption rates of crypto projects.

---

3. Develop a Trading Strategy

Day Trading: Capitalize on short-term price movements with a focus on high liquidity coins.

Swing Trading: Hold assets for days or weeks to benefit from medium-term trends.

HODLing: Long-term holding of promising projects for capital growth.

Dollar-Cost Averaging (DCA): Invest a fixed amount at regular intervals, reducing the impact of market volatility.

---

4. Risk Management

Only Invest What You Can Afford to Lose: The crypto market is highly volatile and risky.

Set Stop-Loss Orders: Protect against significant losses by automating sell-offs at predetermined price points.

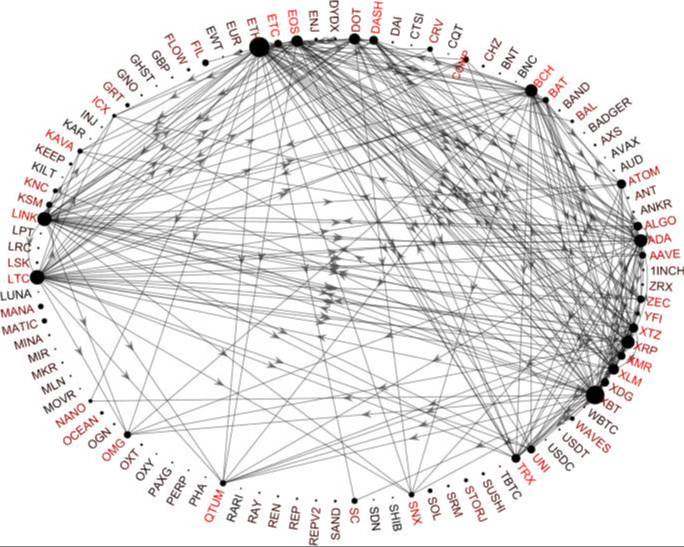

Diversify: Spread your investments across different coins and sectors to minimize risk.

---

5. Tools and Resources

Wallets: Use secure wallets (hardware or software) to store your crypto assets.

Exchanges: Trade on reputable platforms like Binance, Coinbase, or Kraken.

Portfolio Trackers: Use apps like CoinMarketCap or Blockfolio to monitor your holdings.

---

6. Stay Updated

Follow crypto news platforms (e.g., CoinDesk, CryptoSlate).

Join communities like Reddit (r/cryptocurrency) or Telegram groups for insights.

Listen to podcasts and watch YouTube channels by seasoned traders.

---

7. Emotional Discipline

Avoid FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, Doubt).

Stick to your strategy and avoid impulsive decisions during market fluctuations.

Accept losses as part of the process and focus on long-term growth.

---

8. Experiment and Refine

Start with a demo trading account if available or trade with small amounts initially.

Learn from your mistakes and refine your strategies over time.

---

9. Leverage Emerging Trends

Explore staking, yield farming, and liquidity providing in DeFi.

Research potential in newer sectors like Web3, Metaverse tokens, or Layer-2 solutions.

---

Final Tip

Consistency and continuous learning are key. The crypto market evolves rapidly, so staying curious and adaptive will help you master the trade.

CHEWBACCA

फॉलो करें

CRYPTOCURRENCY END OF WEEK REPORTS

Here's an update on the cryptocurrency market and news for today, November 28, 2024:

1. Bitcoin Trends: Bitcoin has recently experienced volatility, testing levels near $90,000. A significant $13.6 billion in Bitcoin options is set to expire this week, sparking speculation about whether this could drive the price toward $100,000.

2. Altcoin Highlights:

Stellar (XLM) surged by over 80% recently, trading around $0.55, with analysts optimistic about its future growth.

Dogecoin (DOGE) has seen increased interest and price gains, supported by a positive shift in sentiment towards memecoins.

XRP gained 30% this week and is gaining traction with developments like ETF filings.

3. Global Developments:

Hong Kong is proposing tax breaks for crypto investors to boost competitiveness.

Russia has approved a new crypto taxation framework amid Bitcoin’s record highs against the ruble.

India’s crypto ecosystem remains resilient despite high taxes and is exploring cross-border payment solutions.

4. Market Security: The crypto industry has seen over $1.48 billion stolen through hacks this year, with $71 million lost in November alone, highlighting ongoing security challenges.

5. Regulatory Changes: The SEC Chair, Gary Gensler, plans to step down in January 2025, potentially shifting the regulatory landscape for cryptocurrencies in the U.S..

CHEWBACCA

फॉलो करें

TGE PARADOX OF CRYPTOCURRENCY

The paradox of cryptocurrency lies in its dual nature of decentralization and integration into traditional systems, along with its conflicting promises and challenges. Here are some key aspects of this paradox:

1. Decentralization vs. Centralization

Cryptocurrencies, like Bitcoin, were designed to be decentralized, enabling transactions without intermediaries like banks or governments. However, as they gain popularity, centralized exchanges, custodial wallets, and regulatory bodies play a growing role, which undermines the original vision.

2. Privacy vs. Transparency

Blockchain technology provides transparency, with every transaction being publicly recorded. Yet, cryptocurrencies are often marketed as tools for privacy. This creates a tension, as true anonymity is challenging without privacy-focused solutions like mixers or privacy coins (e.g., Monero).

3. Adoption vs. Ideology

Early adopters saw cryptocurrency as a way to disrupt the traditional financial system. Paradoxically, widespread adoption often requires cooperation with banks, regulators, and institutions that cryptocurrencies sought to bypass.

4. Volatility vs. Stability

Cryptocurrencies promise to be stores of value, yet their extreme price volatility makes them unreliable for everyday transactions or as a stable currency alternative. Stablecoins, while mitigating volatility, often rely on centralized backing, creating additional layers of complexity.

5. Energy Usage vs. Sustainability

Proof-of-work cryptocurrencies like Bitcoin require significant energy resources, leading to environmental criticisms. Alternatives like proof-of-stake aim to address this but often face scrutiny for security or fairness concerns.

6. Freedom vs. Regulation

Cryptocurrencies are touted as tools for financial freedom, enabling unbanked populations to access global markets. However, governments impose regulations to prevent illicit activities, which can stifle innovation and limit access.

7. Wealth Redistribution vs. Wealth Concentration

Cryptocurrencies were envisioned as democratizing wealth and power. Yet, in practice, early adopters and a few large holders (whales) control significant portions of the market, leading to a centralization of wealth.

This paradox embodies the ongoing challenges and contradictions in cryptocurrency's evolution. Resolving or balancing these contradictions will be critical to determining its long-term role in global finance.

CHEWBACCA

फॉलो करें

The cryptocurrency revolution represents a transformative shift in how people think about money, finance, and digital transactions. It began with the launch of Bitcoin in 2009 by the pseudonymous Satoshi Nakamoto, introducing blockchain technology as a decentralized ledger system. Here's a brief overview of the revolution:

Key Aspects of the Revolution

1. Decentralization

Cryptocurrencies operate without centralized control, relying on blockchain technology to maintain transparent, tamper-proof ledgers.

2. Financial Inclusion

Cryptocurrencies provide access to financial services for billions globally, particularly those without access to traditional banking systems.

3. Borderless Transactions

Digital currencies enable low-cost, near-instantaneous cross-border payments without intermediaries.

4. Tokenization and Smart Contracts

Platforms like Ethereum introduced programmable contracts, enabling decentralized finance (DeFi), NFTs, and tokenized assets.

5. Alternative Store of Value

Bitcoin and other cryptocurrencies are often seen as "digital gold," offering a hedge against inflation and traditional market instability.

Challenges

Regulatory Uncertainty: Governments worldwide are grappling with how to regulate cryptocurrencies.

Volatility: Prices can fluctuate wildly, making them risky for both investors and users.

Scalability and Energy Concerns: Some networks face challenges in scaling transactions, and proof-of-work systems like Bitcoin have been criticized for their environmental impact.

Current Trends

Central Bank Digital Currencies (CBDCs): Governments are exploring digital versions of their fiat currencies.

Web3 Evolution: Cryptocurrencies are foundational to the growth of decentralized internet applications.

Adoption by Institutions: Companies and banks are integrating blockchain for efficiency and transparency.

Future Outlook

The cryptocurrency revolution is poised to redefine financial systems, fostering innovation and disruption. However, its trajectory will depend on technological advancements, regulatory frameworks, and global adoption rates.

CHEWBACCA

फॉलो करें

"Desperate pumps" in the crypto context likely refers to scenarios where a cryptocurrency's price is artificially inflated through coordinated buying, often by a group of traders or influencers, to lure in more investors. This is a common tactic in "pump-and-dump" schemes, where the organizers sell off their holdings at the peak price, causing the value to crash and leaving later investors with losses.

These schemes are often driven by:

1. Hype and FOMO (Fear of Missing Out): Promoters use social media and other platforms to spread excitement about a coin or token, creating urgency to buy.

2. Low-Liquidity Tokens: Cryptocurrencies with low trading volumes are easier to manipulate since it takes less capital to move their price.

3. Insider Coordination: Groups on platforms like Telegram or Discord may organize pumps with a pre-set schedule to maximize impact.

How to Spot and Avoid Desperate Pumps:

Unrealistic Promises: Be cautious of tokens promising astronomical returns in a short time.

Sudden Volume Spikes: Watch for unusual trading volume without any significant news or developments.

Unverified Claims: Avoid coins heavily promoted by anonymous or untrustworthy sources.

Diversify Investments: Never put all your funds into a single asset, especially speculative ones.

If you're investing in cryptocurrency, rely on thorough research and avoid getting swayed by hype-driven price movements.

XJerix

फॉलो करें

Best to have a strategy

You need to have a strategy when it comes to investing

CHEWBACCA

फॉलो करें

SCAM AVOIDANCE

Avoiding scams in the cryptocurrency space requires vigilance, research, and secure practices. Here are key strategies to protect yourself:

1. Verify Projects and Teams

Research the team: Look for publicly identifiable team members with a proven track record in blockchain or tech. Lack of transparency is a red flag.

Check the whitepaper: Legitimate projects have detailed whitepapers explaining their technology, use cases, and goals. Be wary of vague or copied content.

Examine the roadmap: Ensure the project has realistic, achievable milestones.

2. Avoid Phishing and Fraudulent Links

Stick to official sites: Access wallets, exchanges, or services only via official websites or verified links.

Beware of unsolicited messages: Never click on links from unknown sources or respond to random offers for investment advice.

Double-check URLs: Scammers often create fake websites that closely mimic legitimate ones.

3. Watch Out for Unrealistic Promises

Avoid guaranteed returns: No legitimate crypto investment guarantees profits or specific returns.

Be skeptical of high-yield investment programs (HYIPs): These schemes promise exponential profits but are typically unsustainable and fraudulent.

4. Secure Your Assets

Use secure wallets: Opt for hardware wallets or reputable software wallets with strong encryption.

Enable two-factor authentication (2FA): Add an extra layer of security to your accounts.

Use strong passwords: Avoid reusing passwords and consider using a password manager.

5. Avoid Pump-and-Dump Schemes

Question sudden surges in price: Be wary of cryptocurrencies with unexplained, sharp price increases.

Beware of coordinated hype: Influencers and forums promoting a specific coin can indicate manipulation.

6. Check Regulatory Compliance

Know your local laws: Ensure the project complies with regulatory standards in your jurisdiction.

Avoid unregulated exchanges: Use exchanges with licenses or strong reputations for reliability.

7. Look for Independent Reviews

Check multiple sources: Look for reviews from established crypto analysts or reputable news outlets.

Avoid echo chambers: Be cautious of forums or communities where dissenting opinions are silenced.

8. Stay Educated

Learn about scams: Familiarize yourself with common schemes like rug pulls, fake ICOs, and phishing.

Follow updates: The crypto landscape evolves rapidly; staying informed can help you spot new scams.

By applying these measures and maintaining a skeptical outlook, you can minimize the risks of falling victim to scams in the cryptocurrency space. Always trust but verify before investing.

CHEWBACCA

फॉलो करें

REASONS FOR BUNANCE DECLINE IN NIGERIA

Binance, like other cryptocurrency exchanges, faces various challenges in Nigeria that have contributed to its decline in popularity or effectiveness. Some key reasons include:

1. Regulatory Crackdowns

Central Bank of Nigeria (CBN) Ban: In February 2021, the CBN directed banks to close accounts linked to cryptocurrency transactions, which severely restricted Binance users' ability to fund their wallets through local banks.

SEC Investigations: The Nigerian Securities and Exchange Commission (SEC) has scrutinized Binance for operating without proper registration or regulatory compliance in Nigeria, leading to legal uncertainties.

2. Declining Trust in Crypto Platforms

Scams and Fraud: The rise in crypto-related scams has eroded trust in the broader cryptocurrency market, affecting platforms like Binance.

Lack of Local Support: Users often complain about Binance’s lack of tailored support for Nigerian-specific issues, such as local payment integrations.

3. Volatility in Naira Value

Currency Devaluation: The continued devaluation of the Nigerian naira against major global currencies makes cryptocurrency transactions more expensive and less attractive to the average user.

High Transaction Costs: With restrictions on local bank integrations, Nigerians rely on peer-to-peer (P2P) systems, which often have high fees and less competitive exchange rates.

4. Competition from Local Alternatives

Rise of Local Platforms: Nigerian-built platforms like Patricia, Bundle Africa, and others offer localized services and more user-friendly options tailored to the Nigerian market.

Ease of Fiat Transactions: These local platforms often integrate directly with Nigerian banks, avoiding the hurdles Binance faces.

5. P2P System Challenges

Fraud in P2P Transactions: Binance’s P2P platform, though popular, is prone to scams and disputes, discouraging new and existing users.

Lack of Adequate Enforcement: Dispute resolution on Binance’s P2P platform can be slow or unsatisfactory for Nigerian users.

6. Government’s Push for eNaira

The Nigerian government’s promotion of the eNaira, a central bank digital currency (CBDC), has aimed to reduce reliance on decentralized cryptocurrencies like Bitcoin and Ethereum, indirectly affecting Binance’s market in Nigeria.

7. Awareness and Education Gap

Many Nigerians are still unaware of how to use cryptocurrency platforms effectively. Binance’s lack of robust educational campaigns targeting the Nigerian market has limited its user growth.

Binance remains a significant player in Nigeria’s crypto market, but overcoming these challenges requires addressing local regulatory concerns, enhancing user trust, and improving service localization.

CHEWBACCA

फॉलो करें

CRYPTOCURRENCY LICENSE REGULATORY

Obtaining a cryptocurrency license is essential for operating legally in the blockchain and crypto space. Licensing requirements vary by jurisdiction and depend on the type of crypto activity, such as exchange services, wallet provision, token issuance, or DeFi solutions. Below are the steps and insights on earning crypto licenses:

---

1. Understand Your Business Model

Identify your core operations: exchange, custody, DeFi, mining, token offering, etc.

Determine if you require a Virtual Asset Service Provider (VASP) license or a specific regulatory framework for your service.

---

2. Choose the Jurisdiction

Licensing requirements differ globally. Some crypto-friendly jurisdictions with established regulations include:

Estonia: Offers a straightforward VASP licensing process for exchanges and wallet providers.

Malta: Known as the “Blockchain Island,” it provides a comprehensive framework under the Virtual Financial Assets Act.

Singapore: Requires registration under the Payment Services Act, managed by the Monetary Authority of Singapore (MAS).

United States: Varies by state, but the most common is the BitLicense in New York.

Switzerland: Regulates crypto businesses through FINMA, focusing on anti-money laundering (AML) compliance.

---

3. Meet Regulatory Requirements

Most jurisdictions have strict compliance requirements, such as:

AML/KYC Compliance: Implement Know Your Customer and Anti-Money Laundering policies.

Capital Requirements: Maintain a minimum reserve or capital as required.

Data Security Measures: Ensure compliance with data protection laws.

Audits and Reporting: Regular financial audits and transaction reports to regulators.

---

4. Prepare the Application

The application process typically involves:

Business Plan: Detailed description of services, target market, and operational procedures.

Legal Structure: Register the business and establish a corporate entity.

Compliance Documents: AML/KYC policies, risk assessments, and security protocols.

Financials: Proof of solvency and initial capital requirements.

---

5. Hire Experts

Regulatory requirements are complex. Engage:

Legal advisors specializing in crypto law.

AML and compliance officers.

Auditors and accountants familiar with blockchain operations.

---

6. Submit the Application

Apply through the local regulatory body. For example:

Estonia: Financial Intelligence Unit (FIU).

Malta: Malta Financial Services Authority (MFSA).

Singapore: Monetary Authority of Singapore (MAS).

USA: Varies by state (e.g., New York DFS for BitLicense).

---

7. Maintain Compliance

Once licensed, ongoing compliance is mandatory:

Regular audits.

Updates on AML/KYC protocols.

Reporting changes in business operations.

---

Costs and Timeframes

Costs vary by jurisdiction. For example, in Estonia, the licensing fee is about €10,000, while Malta can cost upwards of €30,000 due to extensive compliance.

Timeframes can range from a few months to over a year, depending on the jurisdiction and complexity of the application.

CHEWBACCA

फॉलो करें

MEMEFI COIN LISTING

MemFi Coin (MEMEFI) is a cryptocurrency designed for a unique GameFi platform that combines elements of meme culture and play-to-earn mechanics. It operates within a multi-token ecosystem that includes three primary tokens: MEMEFI, PWR, and TOYBOX. These tokens serve specific purposes in the gaming ecosystem:

1. MEMEFI: The governance and primary utility token. Players use MEMEFI for in-game purchases, trading character keys, and participating in the platform’s DAO, which influences the game’s development and operations.

2. PWR: A token representing a player's energy and strength. It is essential for participating in battles and clan activities, directly affecting gameplay effectiveness.

3. TOYBOX: A specialized ERC-404 token designed for character enhancements and gameplay advantages. It represents the playable characters and has a capped supply of 8,888 tokens.

Key Features of MemeFi

Gameplay: Players engage in "tap-to-earn" mechanics, battling meme-inspired bosses by tapping the screen to reduce their health and earn rewards. Energy limits and upgrades add strategic depth.

Meme Clans: Collaborative groups where players can team up for boss fights and earn collective rewards.

Key System: A trading mechanism where "keys" act as valuable assets, granting holders a share of rewards from other players.

The project runs on the Sui blockchain, ensuring scalability and efficient transactions. MemFi has also implemented engaging referral and reward systems, including airdrops and special event incentives.

To participate, players can start with the MemFi Telegram bot (@memefi_coin_bot), create a character, and join a clan to start earning rewards. The platform emphasizes accessibility and community-driven governance, making it a notable entry in the play-to-earn crypto space.

और लोड करें

लॉग इन करें/पंजीकरण करें

बिज़नेस

लम्हें

लोग जिन्हें आप पसंद कर सकते हैं

बदलें

lucius

फॉलो करें

CHEWBACCA

फॉलो करें

CodedFx

फॉलो करें

FX1969277531

फॉलो करें

跨市套利EA盈全能 搜GoldDabai

十年量化管理经验团队·बिक्री करना

फॉलो करें

कॉपीराइट कथन

हम सत्यनिष्ठा से घोषणा करते हैं कि मंच पर प्रकाशित सभी सूचना सामग्री वैध सामग्री प्रदाताओं के स्वामित्व में है या WikiFX द्वारा अधिकृत की गई है। हम सभी जानकारी की वैधता और अनुपालन सुनिश्चित करने के लिए कॉपीराइट कानूनों और विनियमों का सख्ती से पालन करते हैं।