Ang WikiFX, bilang isang independiyenteng platform ng serbisyo ng impormasyon ng third-party, ay nakatuon sa pagbibigay sa mga user ng komprehensibo at layunin ng mga serbisyo ng impormasyon sa regulasyon ng broker. Ang WikiFX ay hindi direktang nakikibahagi sa anumang mga aktibidad sa pangangalakal ng forex, at hindi rin ito nag-aalok ng anumang anyo ng mga rekomendasyon sa channel ng kalakalan o payo sa pamumuhunan. Ang mga rating at ebalwasyon ng mga broker ng WikiFX ay nakabatay sa impormasyong may layunin ng publiko at isinasaalang-alang ang mga pagkakaiba sa patakaran sa regulasyon ng iba't ibang bansa at rehiyon. Ang mga rating at pagsusuri ng broker ay ang mga pangunahing produkto ng WikiFX, at mahigpit naming sinasalungat ang anumang mga komersyal na kasanayan na maaaring ikompromiso ang kanilang pagiging objectivity at pagiging patas. Tinatanggap namin ang pangangasiwa at mga mungkahi mula sa mga user sa buong mundo. Hotline ng Reklamo: report@wikifx.com

您当前语言与浏览器默认语言不一致,是否切换?

切换

- Sundin

- Negosyo

- Mga sandali

CHEWBACCA

Sundin

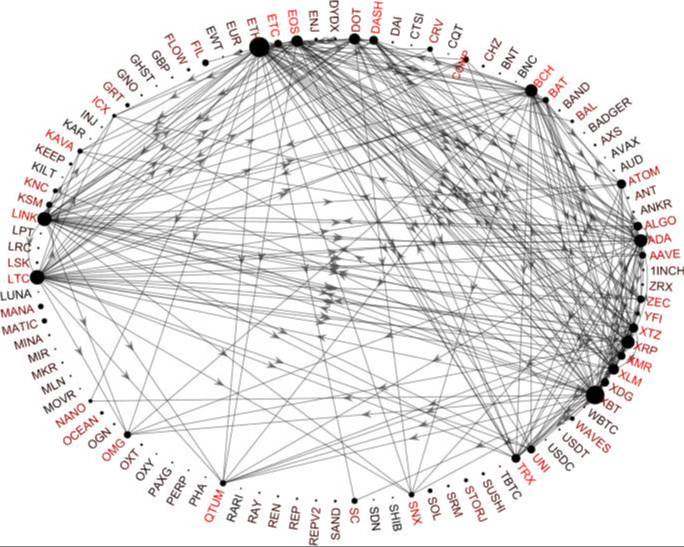

TGE PARADOX OF CRYPTOCURRENCY

The paradox of cryptocurrency lies in its dual nature of decentralization and integration into traditional systems, along with its conflicting promises and challenges. Here are some key aspects of this paradox:

1. Decentralization vs. Centralization

Cryptocurrencies, like Bitcoin, were designed to be decentralized, enabling transactions without intermediaries like banks or governments. However, as they gain popularity, centralized exchanges, custodial wallets, and regulatory bodies play a growing role, which undermines the original vision.

2. Privacy vs. Transparency

Blockchain technology provides transparency, with every transaction being publicly recorded. Yet, cryptocurrencies are often marketed as tools for privacy. This creates a tension, as true anonymity is challenging without privacy-focused solutions like mixers or privacy coins (e.g., Monero).

3. Adoption vs. Ideology

Early adopters saw cryptocurrency as a way to disrupt the traditional financial system. Paradoxically, widespread adoption often requires cooperation with banks, regulators, and institutions that cryptocurrencies sought to bypass.

4. Volatility vs. Stability

Cryptocurrencies promise to be stores of value, yet their extreme price volatility makes them unreliable for everyday transactions or as a stable currency alternative. Stablecoins, while mitigating volatility, often rely on centralized backing, creating additional layers of complexity.

5. Energy Usage vs. Sustainability

Proof-of-work cryptocurrencies like Bitcoin require significant energy resources, leading to environmental criticisms. Alternatives like proof-of-stake aim to address this but often face scrutiny for security or fairness concerns.

6. Freedom vs. Regulation

Cryptocurrencies are touted as tools for financial freedom, enabling unbanked populations to access global markets. However, governments impose regulations to prevent illicit activities, which can stifle innovation and limit access.

7. Wealth Redistribution vs. Wealth Concentration

Cryptocurrencies were envisioned as democratizing wealth and power. Yet, in practice, early adopters and a few large holders (whales) control significant portions of the market, leading to a centralization of wealth.

This paradox embodies the ongoing challenges and contradictions in cryptocurrency's evolution. Resolving or balancing these contradictions will be critical to determining its long-term role in global finance.

CHEWBACCA

Sundin

CRYPTOCURRENCY END OF WEEK REPORTS

Here's an update on the cryptocurrency market and news for today, November 28, 2024:

1. Bitcoin Trends: Bitcoin has recently experienced volatility, testing levels near $90,000. A significant $13.6 billion in Bitcoin options is set to expire this week, sparking speculation about whether this could drive the price toward $100,000.

2. Altcoin Highlights:

Stellar (XLM) surged by over 80% recently, trading around $0.55, with analysts optimistic about its future growth.

Dogecoin (DOGE) has seen increased interest and price gains, supported by a positive shift in sentiment towards memecoins.

XRP gained 30% this week and is gaining traction with developments like ETF filings.

3. Global Developments:

Hong Kong is proposing tax breaks for crypto investors to boost competitiveness.

Russia has approved a new crypto taxation framework amid Bitcoin’s record highs against the ruble.

India’s crypto ecosystem remains resilient despite high taxes and is exploring cross-border payment solutions.

4. Market Security: The crypto industry has seen over $1.48 billion stolen through hacks this year, with $71 million lost in November alone, highlighting ongoing security challenges.

5. Regulatory Changes: The SEC Chair, Gary Gensler, plans to step down in January 2025, potentially shifting the regulatory landscape for cryptocurrencies in the U.S..

CHEWBACCA

Sundin

MULTIBANK REPOTS

This week’s key developments in the crypto space reveal significant market trends:

1. Bitcoin Spot ETFs and Institutional Involvement: U.S.-based Bitcoin spot ETFs saw net inflows exceeding $5 billion, demonstrating growing institutional interest. These products have increased liquidity and market accessibility, even as Bitcoin prices remained range-bound between $50,000 and $60,000.

2. Ethereum Staking at All-Time Highs: Ethereum staking continues to surge, with more holders utilizing it for passive income. This reflects increased confidence in Ethereum’s long-term value.

3. Stablecoins and Regulation: The introduction of MiCA-compliant stablecoins like USDC has boosted trading volumes in Europe, reaching $23 billion weekly, although non-compliant tokens still dominate. This indicates a gradual shift towards regulatory compliance in the stablecoin market.

4. Global Sentiment and Adoption: Regulatory concerns remain a barrier for adoption, especially in markets like Singapore and the U.S. However, countries such as Turkey are experiencing a crypto boom, with high ownership rates and active trading behaviors.

5. Broader Market Trends: Overall, the market shows increasing maturity with improved liquidity and diversification, making crypto assets valuable additions to traditional portfolios for risk-adjusted returns.

These updates highlight the growing institutional acceptance of crypto assets.

CHEWBACCA

Sundin

The cryptocurrency revolution represents a transformative shift in how people think about money, finance, and digital transactions. It began with the launch of Bitcoin in 2009 by the pseudonymous Satoshi Nakamoto, introducing blockchain technology as a decentralized ledger system. Here's a brief overview of the revolution:

Key Aspects of the Revolution

1. Decentralization

Cryptocurrencies operate without centralized control, relying on blockchain technology to maintain transparent, tamper-proof ledgers.

2. Financial Inclusion

Cryptocurrencies provide access to financial services for billions globally, particularly those without access to traditional banking systems.

3. Borderless Transactions

Digital currencies enable low-cost, near-instantaneous cross-border payments without intermediaries.

4. Tokenization and Smart Contracts

Platforms like Ethereum introduced programmable contracts, enabling decentralized finance (DeFi), NFTs, and tokenized assets.

5. Alternative Store of Value

Bitcoin and other cryptocurrencies are often seen as "digital gold," offering a hedge against inflation and traditional market instability.

Challenges

Regulatory Uncertainty: Governments worldwide are grappling with how to regulate cryptocurrencies.

Volatility: Prices can fluctuate wildly, making them risky for both investors and users.

Scalability and Energy Concerns: Some networks face challenges in scaling transactions, and proof-of-work systems like Bitcoin have been criticized for their environmental impact.

Current Trends

Central Bank Digital Currencies (CBDCs): Governments are exploring digital versions of their fiat currencies.

Web3 Evolution: Cryptocurrencies are foundational to the growth of decentralized internet applications.

Adoption by Institutions: Companies and banks are integrating blockchain for efficiency and transparency.

Future Outlook

The cryptocurrency revolution is poised to redefine financial systems, fostering innovation and disruption. However, its trajectory will depend on technological advancements, regulatory frameworks, and global adoption rates.

CHEWBACCA

Sundin

"Desperate pumps" in the crypto context likely refers to scenarios where a cryptocurrency's price is artificially inflated through coordinated buying, often by a group of traders or influencers, to lure in more investors. This is a common tactic in "pump-and-dump" schemes, where the organizers sell off their holdings at the peak price, causing the value to crash and leaving later investors with losses.

These schemes are often driven by:

1. Hype and FOMO (Fear of Missing Out): Promoters use social media and other platforms to spread excitement about a coin or token, creating urgency to buy.

2. Low-Liquidity Tokens: Cryptocurrencies with low trading volumes are easier to manipulate since it takes less capital to move their price.

3. Insider Coordination: Groups on platforms like Telegram or Discord may organize pumps with a pre-set schedule to maximize impact.

How to Spot and Avoid Desperate Pumps:

Unrealistic Promises: Be cautious of tokens promising astronomical returns in a short time.

Sudden Volume Spikes: Watch for unusual trading volume without any significant news or developments.

Unverified Claims: Avoid coins heavily promoted by anonymous or untrustworthy sources.

Diversify Investments: Never put all your funds into a single asset, especially speculative ones.

If you're investing in cryptocurrency, rely on thorough research and avoid getting swayed by hype-driven price movements.

XJerix

Sundin

Best to have a strategy

You need to have a strategy when it comes to investing

CHEWBACCA

Sundin

REASONS FOR BUNANCE DECLINE IN NIGERIA

Binance, like other cryptocurrency exchanges, faces various challenges in Nigeria that have contributed to its decline in popularity or effectiveness. Some key reasons include:

1. Regulatory Crackdowns

Central Bank of Nigeria (CBN) Ban: In February 2021, the CBN directed banks to close accounts linked to cryptocurrency transactions, which severely restricted Binance users' ability to fund their wallets through local banks.

SEC Investigations: The Nigerian Securities and Exchange Commission (SEC) has scrutinized Binance for operating without proper registration or regulatory compliance in Nigeria, leading to legal uncertainties.

2. Declining Trust in Crypto Platforms

Scams and Fraud: The rise in crypto-related scams has eroded trust in the broader cryptocurrency market, affecting platforms like Binance.

Lack of Local Support: Users often complain about Binance’s lack of tailored support for Nigerian-specific issues, such as local payment integrations.

3. Volatility in Naira Value

Currency Devaluation: The continued devaluation of the Nigerian naira against major global currencies makes cryptocurrency transactions more expensive and less attractive to the average user.

High Transaction Costs: With restrictions on local bank integrations, Nigerians rely on peer-to-peer (P2P) systems, which often have high fees and less competitive exchange rates.

4. Competition from Local Alternatives

Rise of Local Platforms: Nigerian-built platforms like Patricia, Bundle Africa, and others offer localized services and more user-friendly options tailored to the Nigerian market.

Ease of Fiat Transactions: These local platforms often integrate directly with Nigerian banks, avoiding the hurdles Binance faces.

5. P2P System Challenges

Fraud in P2P Transactions: Binance’s P2P platform, though popular, is prone to scams and disputes, discouraging new and existing users.

Lack of Adequate Enforcement: Dispute resolution on Binance’s P2P platform can be slow or unsatisfactory for Nigerian users.

6. Government’s Push for eNaira

The Nigerian government’s promotion of the eNaira, a central bank digital currency (CBDC), has aimed to reduce reliance on decentralized cryptocurrencies like Bitcoin and Ethereum, indirectly affecting Binance’s market in Nigeria.

7. Awareness and Education Gap

Many Nigerians are still unaware of how to use cryptocurrency platforms effectively. Binance’s lack of robust educational campaigns targeting the Nigerian market has limited its user growth.

Binance remains a significant player in Nigeria’s crypto market, but overcoming these challenges requires addressing local regulatory concerns, enhancing user trust, and improving service localization.

CHEWBACCA

Sundin

TOP TIERS IN CRYPTO

If you're looking for top-tier cryptocurrency investments in late 2024, here are some strong contenders to consider based on their current performance and long-term potential:

Established Leaders:

1. Bitcoin (BTC): Continues to be a store of value and a reliable choice for portfolio diversification. It remains resilient due to its large market cap and adoption by institutional investors.

2. Ethereum (ETH): Dominates in smart contract and decentralized application (dApp) ecosystems, with widespread adoption among developers and a robust development roadmap, including Ethereum 2.0 improvements.

Promising Altcoins:

1. Solana (SOL): Known for its high transaction speeds and low costs, Solana is expanding its ecosystem, making it a popular choice for DeFi and NFTs.

2. Cardano (ADA): Focused on scalability and sustainability, Cardano is built on a research-backed, peer-reviewed foundation, which appeals to long-term investors.

3. Ripple (XRP): Gaining traction in cross-border payments, XRP's utility in financial institutions makes it a strategic investment, though ongoing regulatory challenges should be considered.

Emerging Opportunities:

1. Polkadot (DOT): Excels in enabling interoperability between blockchains, a key feature in decentralized finance (DeFi) and Web3 applications.

2. Avalanche (AVAX): Offers high scalability and low transaction costs, making it ideal for smart contracts and decentralized applications.

3. Toncoin (TON): Gaining attention for its scalable blockchain infrastructure and cost-efficiency.

Risks and Considerations:

Cryptocurrency investments are inherently volatile. Diversify your portfolio to mitigate risks and stay informed about regulatory changes and security measures to protect your assets.

Before investing, consider your financial goals, risk tolerance, and the specific use cases of each cryptocurrency.

CHEWBACCA

Sundin

THE CONSISTENCY OF GROWTH IN CRYPTO

The growth of cryptocurrency has been marked by significant fluctuations but shows consistent long-term expansion globally, including in Africa. Here's an analysis of the consistency in crypto growth:

---

Global Perspective on Cryptocurrency Growth

1. Steady Increase in Adoption Rates:

Individuals: Global crypto adoption increased from being niche to mainstream, with millions of new users each year.

Businesses: Companies like Tesla, MicroStrategy, and others have invested in crypto, while payment platforms (e.g., PayPal, Mastercard) accept crypto transactions.

Institutional Interest: Hedge funds, banks, and governments have shown interest in cryptocurrencies, indicating long-term belief in the ecosystem.

2. Rising Market Capitalization:

The cryptocurrency market cap grew from billions to trillions of dollars over the past decade, even though it experiences periodic cycles of booms and corrections.

3. Technology Development:

Innovations like smart contracts (Ethereum), DeFi, NFTs, and Layer 2 solutions (e.g., Lightning Network, Optimism) show the consistent evolution of blockchain technology.

---

Consistency of Growth in Africa

1. Year-on-Year Increase in Usage:

African crypto adoption has grown steadily, especially in countries like Nigeria, Kenya, and South Africa.

Stat: Between 2021 and 2023, Africa saw a nearly 1,200% increase in cryptocurrency adoption according to Chainalysis.

2. P2P Trading Volume Growth:

Platforms like Paxful and Binance report steady growth in trading volumes across African countries, with Nigeria being one of the top contributors globally.

3. Use Cases:

Remittances: Consistent growth as users bypass traditional systems.

Savings and Investments: More Africans are turning to crypto to preserve wealth amid currency instability.

4. Startup Ecosystem:

Blockchain startups in Africa are consistently increasing in number, leveraging crypto and blockchain for solutions in fintech, healthcare, and logistics.

---

Factors Contributing to Consistency

1. Economic Realities:

Crypto provides solutions to persistent issues like inflation, high remittance fees, and lack of financial access.

2. Technological Advancements:

Blockchain innovation continues to create new opportunities and utilities for cryptocurrencies.

3. Global Recognition:

Major brands, governments, and financial institutions investing in blockchain technologies validate its long-term potential.

4. Cultural Shift:

Younger, tech-savvy populations are integrating crypto into daily financial activities, ensuring its longevity.

---

Challenges to Sustaining Consistency

1. Market Volatility:

Price swings can discourage newcomers and lead to skepticism.

2. Regulation:

Varying government stances on crypto can create barriers.

3. Scams and Security Issues:

Fraudulent schemes and cybercrimes threaten user trust.

4. Infrastructure:

Limited internet and smartphone access in some regions slow down adoption.

---

Conclusion

While short-term volatility remains, the growth of cryptocurrencies has been consistent over the long term, with adoption, innovation, and market size steadily increasing. In Africa, the combination of youthful demographics, economic necessity, and technological accessibility ensures that cryptocurrencies continue to grow as a transformative financial tool.

CHEWBACCA

Sundin

CRYPTOCURRENCY LICENSE REGULATORY

Obtaining a cryptocurrency license is essential for operating legally in the blockchain and crypto space. Licensing requirements vary by jurisdiction and depend on the type of crypto activity, such as exchange services, wallet provision, token issuance, or DeFi solutions. Below are the steps and insights on earning crypto licenses:

---

1. Understand Your Business Model

Identify your core operations: exchange, custody, DeFi, mining, token offering, etc.

Determine if you require a Virtual Asset Service Provider (VASP) license or a specific regulatory framework for your service.

---

2. Choose the Jurisdiction

Licensing requirements differ globally. Some crypto-friendly jurisdictions with established regulations include:

Estonia: Offers a straightforward VASP licensing process for exchanges and wallet providers.

Malta: Known as the “Blockchain Island,” it provides a comprehensive framework under the Virtual Financial Assets Act.

Singapore: Requires registration under the Payment Services Act, managed by the Monetary Authority of Singapore (MAS).

United States: Varies by state, but the most common is the BitLicense in New York.

Switzerland: Regulates crypto businesses through FINMA, focusing on anti-money laundering (AML) compliance.

---

3. Meet Regulatory Requirements

Most jurisdictions have strict compliance requirements, such as:

AML/KYC Compliance: Implement Know Your Customer and Anti-Money Laundering policies.

Capital Requirements: Maintain a minimum reserve or capital as required.

Data Security Measures: Ensure compliance with data protection laws.

Audits and Reporting: Regular financial audits and transaction reports to regulators.

---

4. Prepare the Application

The application process typically involves:

Business Plan: Detailed description of services, target market, and operational procedures.

Legal Structure: Register the business and establish a corporate entity.

Compliance Documents: AML/KYC policies, risk assessments, and security protocols.

Financials: Proof of solvency and initial capital requirements.

---

5. Hire Experts

Regulatory requirements are complex. Engage:

Legal advisors specializing in crypto law.

AML and compliance officers.

Auditors and accountants familiar with blockchain operations.

---

6. Submit the Application

Apply through the local regulatory body. For example:

Estonia: Financial Intelligence Unit (FIU).

Malta: Malta Financial Services Authority (MFSA).

Singapore: Monetary Authority of Singapore (MAS).

USA: Varies by state (e.g., New York DFS for BitLicense).

---

7. Maintain Compliance

Once licensed, ongoing compliance is mandatory:

Regular audits.

Updates on AML/KYC protocols.

Reporting changes in business operations.

---

Costs and Timeframes

Costs vary by jurisdiction. For example, in Estonia, the licensing fee is about €10,000, while Malta can cost upwards of €30,000 due to extensive compliance.

Timeframes can range from a few months to over a year, depending on the jurisdiction and complexity of the application.

Mag-load pa

Mag log in/Magrehistro

Negosyo

Mga sandali

Mga taong maaaring gusto mo

Baguhin

Pahayag ng Copyright

Taimtim naming ipinapahayag na ang lahat ng nilalaman ng impormasyon na inilathala sa platform ay pagmamay-ari ng mga lehitimong tagapagbigay ng nilalaman o pinahintulutan ng WikiFX. Mahigpit kaming sumusunod sa mga batas at regulasyon sa copyright upang matiyak ang legalidad at pagsunod sa lahat ng impormasyon.