简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is automated trading?

Abstract:Automated trading systems are those that create buy and sell orders for the forex market or other exchanges, using an algorithm. An algorithmic trading program can be designed specifically to suit the requirements of specific trading strategies. Even some of the algorithms are capable of trading based on trends following certain predetermined strategies which can be used to make purchases.

We all know that the forex world is a volatile and complex one, so being more than equal to the task of succeeding in the forex market is not easy. In recent years, the invention of some smart technological trading systems has enabled various levels of automated trading that have enjoyed a steady growth in popularity. The form of automated trading (also referred to as copy trading, Bot Trading, Robotic Trading, or Algorithmic Trading) is one of the most advanced fields among Forex traders.

Automated trading systems are those that create buy and sell orders for the forex market or other exchanges, using an algorithm. An algorithmic trading program can be designed specifically to suit the requirements of specific trading strategies. Even some of the algorithms are capable of trading based on trends following certain predetermined strategies which can be used to make purchases.

Previously, automated trading systems necessitated a high level of technical knowledge, intended for advanced and experienced traders. While automated trading technology is much easier and inexperienced start trading forex without having to learn much-related knowledge.

Almost all automated trading systems use direct access brokers, and their rules are written in the proprietary language of the platform. The EasyLanguage programming language is used by platforms such as TradeStation.The NinjaTrader platform, on the other hand, implements NinjaScript. The figure below shows an example of an automated strategy that triggered three trades during a trading session.

What Are Different Forms of Automated Trading?

In total, automated trading can be used in the following five forms:

Copy Trading

By copy trading, we mean automating the process of copying positions of experienced traders on financial markets.

Expert Advisors (EA)

The EA (Expert Advisors) analyzes trading instrument charts and collects data from indicators in accordance with the defined strategy. When determining the direction of the trend and the point at which to open a transaction, the system factors in the size of the account and the level of risk. It then manages it in accordance with market conditions and strategy rules before closing the position.

Algorithmic Trading

Algorithmic tradinginvolves complex algorithms and sophisticated trading systems that execute orders in milliseconds. Trading robots and online trading platforms both utilize algorithms to automate their trading activities. These sophisticated indicators can detect market movements and factors in real-time, and they can carry out thousands of operations before a human trader has the chance to notice them.

Social Trading

Social tradinginvolves traders sharing their trade books with other traders as well as for instructions for market entry and exit points. Dedicated marketplaces provide a platform for traders to share their ideas and concepts.

Signals

Buying or selling based on a specific analysis is what we call a “Trading Signal.” The analysis can be done manually using technical indicators, or it can be done using mathematical algorithms based on market movements and economic indicators.

Trading signals demand a wide range of information. Most of the time, a technical analysis is the most important consideration, but fundamental and quantitative analysis are equally important. A trade signal generation process may also be influenced by the sentiment and signals from other signal systems. It is the purpose of trading signals to provide an investor the ability to purchase or sell an item without the influence of emotions.

How Does Automated Trading Work?

In automated trading systems, algorithmic trading is based on an investor's rules of entry and exit as they relate to trades. The rules that can be developed by an automated system will be based on a series of fundamental indicators.

Automated trading strategies are already set up to monitor prices continuously, and they automatically execute trades if predetermined parameters are met, enabling trades to be executed more quickly and efficiently, as well as to capitalize on specific, technical market events. Automated trading systems can also employ much more comprehensive strategies that necessitate a greater understanding of the specific platform being used as well as its programming language.

For this more complex strategy, the trader will frequently collaborate closely with a programmer to create a system based on their specific trading strategy. Building a custom system takes much more time and money, but it provides much more flexibility and often yields a much higher return if done correctly. The algorithm can be backtested using historical market data to see how it would have performed in the past and to provide a more realistic performance forecast for the future.

How to start Automated Trading?

Automated trading is easy to operate, taking eToro as an example, investors can easily begin their automated by following these simple steps:

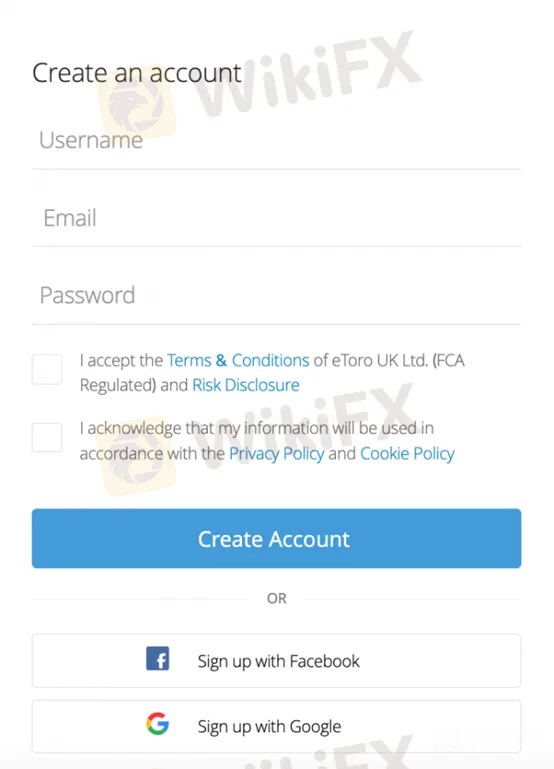

1. Create an account

Go to the eToro homepage and click the “Start Investing” button.

2. Verify account

eToro, a regulated broker, demands that you provide proof of your identity to use their services. Provide your proof of address and government-issued ID to complete your profile.

3. Make a deposit into your account

The “Deposit Fund” button can be found on your profile page. It is possible to deposit money into your eToro account in a variety of ways. Investors who wish to make use of the CopyTrader function must make a deposit of at least $200 with their chosen trader.

4. Select your preferrable trader

A trader's performance (the number of successful deals), assets, and risk score should all be taken into consideration when making a selection. These are critical to ensuring that most trades are profitable and successful.

5. Determine an amount

The next step for the copier is to decide how much money they want to trade with after they have selected a trader. The proportional amount in the account of the copier must be at least $1 for the trade to open; if it is less than that, the deal will not open.

6. Click on Copy

Final step: click 'Copy' to begin copying trader positions in real time. The duplicated trader's actions will be copied automatically by other traders. Copier's position will be closed after the trader finishes a transaction.

Pros and Cons

Like many other technological tools, Automated trading certainly cuts two ways. The advantages of automated trading worthy of mentioning here contain five aspects.

No human mistake. The absence of human emotion in trading helps traders not make irrational decisions.

Automated trading allows backtesting, which is an important part of developing ones trading strategy and learning from mistakes.

Automated trading systems can significantly increase the speed with which trades can be executed. Computers can respond instantly to indicators that satisfy their algorithm, allowing for much faster transactions and more orders to be placed in less time and with greater precision.

Automated trading software can simultaneously follow various strategies, allowing traders to manage the system to pursue a more diverse trading strategy.

Diversification of market opportunities.The most popular automated trading platforms facilitate the trade of a range of assets and financial instruments across many different markets. In addition to offering a huge benefit for traders, this kind of choice also allows them to access multiple markets simultaneously and hedge their risks accordingly.

However, using automated trading comes with some disadvantages as well:

The automated trading system can have mechanical failures sometimes. In plain language, that means that orders may not be sent to the market in the event of an internet disconnect. As well as that, there could be a disconnect between “theoretical trades” generated by the strategy and the order entry platform component that turns them into real trades.

Automated trading software requires in-depth trading knowledge and research, and you cannot make money simply by pressing a button.

There are lots of automated trading software scams popping up, so you should take extra vigilance when choosing the potential platforms.

Monitoring is required. The reality is that automated trading systems require ongoing monitoring even if it is tempting to turn the computer on and leave for the day. This occurs due to technology failures, such as connection issues, power outages, and computer crashes, as well as system quirks.

Erratic orders, missing orders, or duplicate orders can result from anomalies in automated trading systems. Monitoring the system makes it possible to identify these events and resolve them as soon as possible.

Automated software can cause traders to become overly optimistic about their trading strategy, resulting in suboptimal trading decisions.

2022 Top Automated Trading Platforms

Here presents a list of 2022 Top Automated Trading Platform:

| Provider | Automated Trading Software | Website | |

| 1 |  |

Social Trading | https://www.wikifx.com/en/dealer/0001283907.html |

| 2 |  |

DupliTrade & ZuluTrade | https://www.wikifx.com/en/dealer/8261153765.html |

| 3 |  |

MT4 EAs | https://www.wikifx.com/en/dealer/0001378443.html |

| 4 |  |

Trading Signals | https://learn2.trade/ |

| 5 |  |

Over 100 automated trading strategies | https://ninjatrader.com/ |

1. eToro

As a social trading platform, eToro serves more than 17 million customers. Thousands of assets, such as equities, ETFs, cryptocurrencies, and foreign exchange, are available for trading and investing manually. This includes automated stock trading platforms, forex platforms, and even Bitcoin trading platforms. eToro is a commission-free broker that does not charge any platform fees for its services. There are also a number of automatic trading solutions available from this service.

The eToro Copy Trading feature is at the heart of this. eToro clients can be cloned using the tool in its most basic form. It's easy to locate a pro-investor that fits your financial goals and risk tolerance because there are thousands of verified and experienced traders in the program.

eToro, for example, lets you see every trade an investor has made since joining the platform in real time. You may then see the trader's average monthly return, maximum drawdown, favored assets, trade duration, and risk rating by using this information. It's possible to narrow your search for a trader based on any one of these criteria.

2. AvaTrade

Aside from MetaTrade 4 trading platform, AvaTrade offers two automated trading platforms: DupliTrade and ZuluTrade. Using DupliTrade, you may copy the trades of professional traders directly into your AvaTrade trading account. You can take your trading to the next level with DupliTrade thanks to a diverse portfolio and a diverse range of proven strategies developed by accomplished traders. They have been chosen because of their track record of success in the market.

AvaTrade's website and brand can be accessed and integrated with ZuluTrade's platform in a seamless manner thanks to an application programming interface (API). This indicates that you can utilize directly on these platforms. You will have access to more than 10,000 traders who you may possibly follow, and the robust search functionality offered by ZuluTrade will allow you to narrow that number down based on a wide range of criteria. For Example, consider requiring traders who have been with the service for at least a year and have a maximum drawdown of 30 percent, as well as traders who trade their own money. Since you can follow multiple traders, you can utilize the service to create a diversified mutual fund of traders you're keeping track of. Please note that you need to invest in as little as $200 or equivalent amount of currencies.

3. Forex.com

Like AvaTrade, Forex.com has MT4 support, allowing customers to easily install an automatic trading file. There are 20 forex EAs to pick from on Forex.com, which is a proponent of automated trading.

Pivot Points, Sentiment Trader, and an Alarm Manager support these EAs. Customization options abound with these well-known forex EAs. Forex.com also provides a full-featured MT4 VPS hosting service.

If you plan to run your automated trading platform around the clock, this is a must-have. All that computing power is needed to make the automation work. Additionally, using a virtual private server (VPS) allows you to monitor your forex trading platform robot in real time using the MT4 app.

Forex.com, a US-friendly broker, does not require a minimum deposit when opening an account via bank transfer. The minimum charge for a debit or credit card is $100. You can choose from a variety of accounts, including one that doesn't charge a commission.

4. Learn2Trade

Learn2Trade is a well-known and respected source provider of trading signals . Learn2Trade, for example, uses a team of in-house traders to do extensive technical and fundamental analysis. Learn2Trade will then send a notification via Telegram when a trading opportunity presents itself. Using these signals, you'll have all the information you need to make an investment decision. The main benefit of using signals rather than a fully automated trading system is that users have full control over their cash.

5. NinjaTrader

In contrast to other trading platforms, NinjaTrader is geared toward more experienced investors. There are approximately 100 automated trading strategies available in the NinjaTrader Ecosystem, which may be added via an API. Based on historical data and pre-built trading conditions, the software will purchase and sell on your behalf without the need for any manual trading. –

Despite being given by third parties, the tactics can be tested for free. Test out NinjaTrading's automated platform with a free demo account. Using real-time reporting, you can make changes, be interactive, and fine-tune the algorithm until it achieves your goals.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Impact Does Japan’s Positive Output Gap Have on the Yen?

The Japanese government has announced that, due to a tight labor market, the country’s economic output is expected to return to full capacity in the next fiscal year for the first time in seven years.

WikiFX Review: Is Ultima Markets Legit?

Ultima Markets has played a significant role in the forex trading industry for decades. WikiFX created a comprehensive review to help you better understand this broker. We will analyze its reliability based on specific information, regulations, etc. Let’s get into it.

WikiFX Review: Is FXTRADING.com still reliable?

FXTRADING.com is an online brokerage firm that offers trading services for various financial instruments such as forex, cryptocurrencies, shares, commodities, spot metals, energies, and indices. WikiFX has comprehensively reviewed this broker by analyzing its regulations, specific information, etc. so that you have a deep understanding of this broker.

Financial Educator “Spark Liang” Involved in an Investment Scam?!

A 54-year-old foreign woman lost her life savings of RM175,000 to an online investment scam that promised high returns within a short timeframe. The scam was orchestrated through a Facebook page named "Spark Liang."

WikiFX Broker

Latest News

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Two Californians Indicted for $22 Million Crypto and NFT Fraud

WikiFX Review: Is Ultima Markets Legit?

Colorado Duo Accused of $8M Investment Fraud Scheme

What Impact Does Japan’s Positive Output Gap Have on the Yen?

Malaysia Pioneers Zakat Payments with Cryptocurrencies

FCA's Warning to Brokers: Don't Ignore!

Financial Educator “Spark Liang” Involved in an Investment Scam?!

21 Arrested in Telangana Cryptocurrency Scam

Currency Calculator