简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】Gold price shock and AI revolution: new trends in financial markets

Abstract:Financial markets have experienced significant volatility recently, particularly in the area of gold prices and artificial intelligence (AI) investments. The price of gold was once close to a high of

Financial markets have experienced significant volatility recently, particularly in the area of gold prices and artificial intelligence (AI) investments. The price of gold was once close to a high of US$2,800 per ounce, then fell to around US$2,567 per ounce after the election. It has rebounded recently, back to US$2,600-2,700 per ounce. Such fluctuations not only reflect changes in market sentiment, but also hint at deeper economic and political factors.

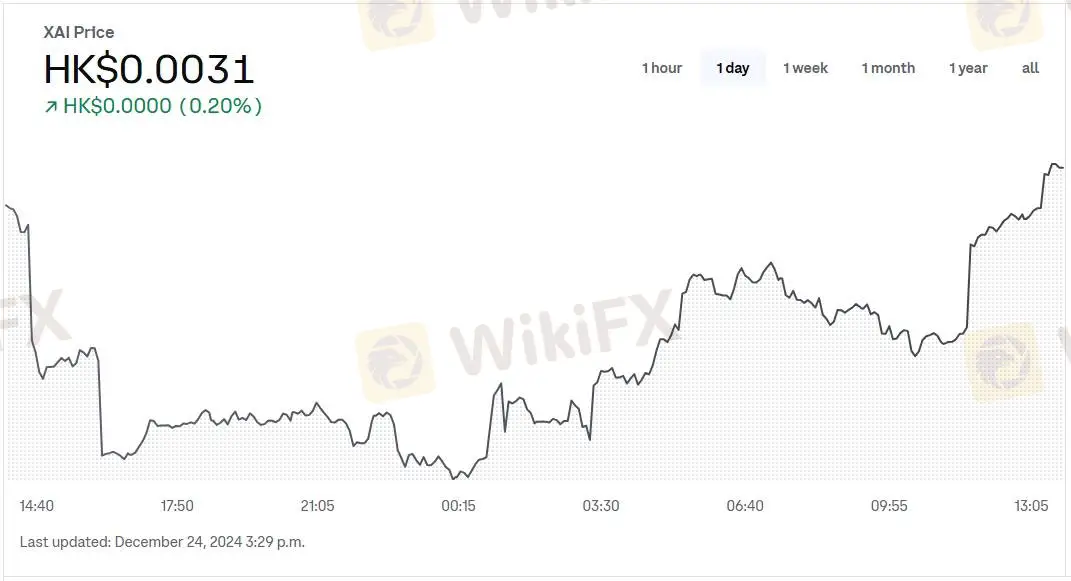

In the field of artificial intelligence, Elon Musk's xAI company recently received US$6 billion in financing, bringing the total financing amount of xAI to US$12 billion. The injection of this capital has made xAI‘s valuation reach US$50 billion, making it the leader among large model unicorns in the world, second only to OpenAI. This financing event not only shows the market’s high recognition of AI technology, but also indicates that AI technology may have a profound impact on the financial market.

As a special asset, gold does not generate interest, so its price fluctuations are often closely related to market sentiment and macroeconomic factors. Historically, the characteristics of gold prices are rapid rises in the short term and long-term sideways or slow declines. This asymmetry of rapid price rises and slow price declines is related to the fact that holding gold does not generate interest. At present, gold is still in a stage of high sentiment, and the digestion of short-term negative factors by gold prices has not yet been completely completed.

The decline in gold prices after the election is related to the strengthening of the US dollar and the easing of geopolitical tensions, but these are not the main factors affecting the price of gold. Since 2022, gold and the US dollar have strengthened simultaneously, and this trend requires new explanations. Geopolitical events such as the Russian-Ukrainian conflict and the Israeli-Palestinian conflict only play the role of fuse and catalyst, accumulating the momentum for price increases and achieving price increases after the catalysis of the events.

The determining factor for the continued rise in gold prices is the declining credibility of the global credit currency system. Whether the Trump administration's policies can enhance the credit foundation of the U.S. dollar depends on whether it can control debt growth, curb long-term inflation, and improve production efficiency. The development of AI technology, especially the AI trend represented by Musk, can reduce costs and increase efficiency through AI, reduce the deficit rate, reduce unnecessary expenditures and government operating costs, improve government operating efficiency, reduce manufacturing costs, and improve total factor productivity, ultimately achieving high-quality development led by new quality productivity (AI+) (3-3-3).

Grok, the flagship generative AI model launched by xAI, supports multiple features on the X (formerly Twitter) platform, including chatbots for X Premium subscribers and free users in some regions. Grok is known for its "rebellious character" and is willing to answer questions that other AI systems reject, which is in stark contrast to AI such as ChatGPT that are considered too "awakened" and "politically correct." The real opposite of gold is not the strong dollar status advocated by Trump, but the AI trend represented by Musk.

If AI technology can realize this vision, the continuous rise in gold prices will end, which heralds the end of chaos and the birth of a new order. On the contrary, chaos will intensify, deficit monetization may intensify, and stagflation may intensify. Anti-chaos, anti-deficit, and anti-stagflation are the core values of gold. Therefore, the analysis of gold should focus on whether AI can improve production efficiency, trigger a hardware revolution, promote economic growth, and solve distribution problems.

We have witnessed Musk's vision and the technological path of Trump and Musk working together to make America great again through AI. Whether they can achieve this goal remains to be seen. New developments in the financial market show that the fluctuation of gold prices and the development of AI technology are two important investment areas at present. The fluctuation of gold prices reflects the market's concerns about the global economic and political stability, while the development of AI technology heralds possible economic transformation in the future. Investors need to pay close attention to the latest developments in these two areas in order to better grasp market trends and investment opportunities.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator