简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KVB Market Analysis | 20 Nov: USD/JPY Struggles Below 155.00 Amid Weaker USD & Geopolitical Tensions

Abstract:Product: EUR/USDPrediction: IncreaseFundamental Analysis:EUR/USD fluctuated between 1.0550 and 1.0600 on Tuesday, briefly testing lower levels before recovering to gain 0.14% for the day.The final pan

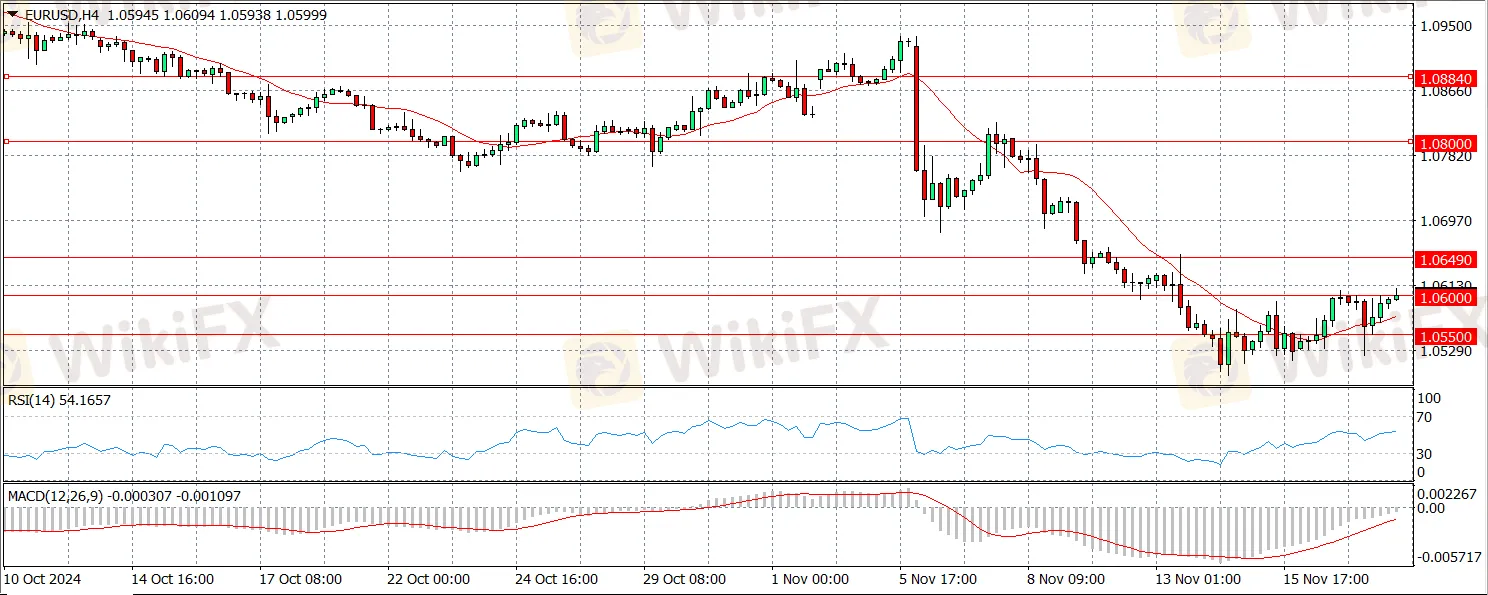

Product: EUR/USD

Prediction: Increase

Fundamental Analysis:

EUR/USD fluctuated between 1.0550 and 1.0600 on Tuesday, briefly testing lower levels before recovering to gain 0.14% for the day.

The final pan-EU Harmonized Index of Consumer Prices inflation figures had little impact on traders, and the U.S. market faces a light release schedule this week. October's HICP inflation in Europe held steady at 2.0% year-over-year, matching preliminary estimates, generating minimal interest.

ECB President Lagarde will speak on Wednesday at the ECBs Conference on Financial Stability, amidst concerns about persistent inflation and economic imbalances. Additionally, Initial Jobless Claims are expected to show a slight increase on Thursday, with U.S. PMI figures due on Friday.

Technical Analysis:

EUR/USD has declined nearly 6.5% from its September peak just above 1.1200, hitting a low near 1.0500 before a weak recovery to around 1.0600. Despite this slight uptick, the pair remains firmly in bearish territory, trading well below the 200-day Exponential Moving Average around 1.0900.

Recent bearish momentum has pushed the 50-day EMA below the long-term average, and it is likely to decline toward 1.0800. If the current upward movement loses momentum, both buyers and sellers should anticipate this happening near the still-falling 50-day EMA.

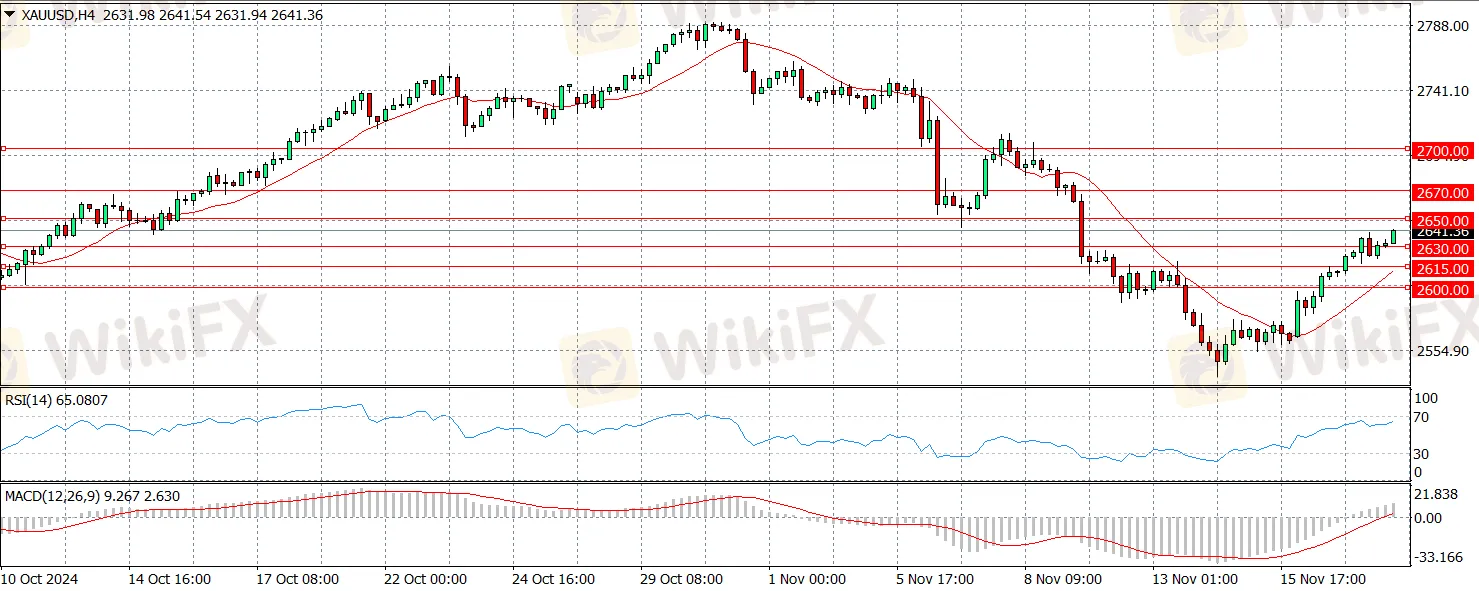

Product: XAU/USD

Prediction: Increase

Fundamental Analysis:

Gold prices are holding above $2,600 and approaching $2,650 early Wednesday, bolstered by rising geopolitical tensions from the Russia-Ukraine conflict and a pullback in U.S. Treasury yields. Investor concerns about these geopolitical issues have led to increased positions in Gold, as demand for safe-haven assets rises. Prices have moved past the recently breached $2,600 level, encountering immediate resistance at the 55-day SMA around $2,640.

Additionally, the weakening U.S. Dollar is supporting Golds recovery. Recent reports that the Biden administration has authorized Ukraine to use U.S.-made weapons against Russia have heightened tensions. Speculators have also reduced their net long positions in Gold to roughly 236.5K contracts, the lowest level since early June, suggesting a potential shift in market momentum.

Technical Analysis:

The daily chart for XAU/USD indicates a significant break above the bullish 100-day Simple Moving Average near $2,550, close to Novembers low of $2,536. The current weekly high around $2,540 aligns with the 55-day SMA, reinforcing this initial resistance zone. The next minor target is the weekly high of $2,749 from November 5.

Conversely, a quick drop below the 100-day SMA at $2,551 would shift focus to the November low of $2,536.

Short-term analysis on the 4-hour chart suggests the recovery still has room to grow. The Relative Strength Index has bounced but faces resistance around 62, while the Average Directional Index at 32 indicates weak trend momentum. Key resistance levels are at $2,639, followed by the 200-SMA at $2,678. Support remains strong at $2,536, a critical level to monitor if prices decline.

Product: USD/JPY

Prediction: Increase

Fundamental Analysis:

USD/JPY is giving back some gains below 155.00 in Wednesday's Asian session. A generally weaker U.S. Dollar, cautious market sentiment, and the potential for Japanese intervention are limiting the pair's upward movement. Ongoing tensions between Russia and Ukraine are affecting risk appetite, benefiting the safe-haven Japanese Yen.

The Yen has lost much of its earlier gains against the Dollar, pushing USD/JPY closer to the mid-154.00s as the European session approaches. Uncertainty about the timing of the Bank of Japan's next interest rate hike and a positive risk tone are undermining the Yen. Additionally, some buying of the U.S. Dollar has helped the pair recover about 50 pips from below 154.00. Investors believe that President-elect Donald Trump's policies could lead to inflation, reducing the likelihood of further easing by the Federal Reserve, which supports the USD. However, speculation about possible Japanese intervention, along with geopolitical risks and falling U.S. Treasury yields, may limit JPY losses and cap the currency pair.

Technical Analysis:

From a technical viewpoint, USD/JPY's inability to hold above the 155.00 level on Monday, followed by a pullback, raises caution for bullish traders. However, prices may find support around 153.85, aided by positive indicators on the daily chart. Continued selling could lead to losses toward 153.25, then 153.00, with key support near 152.70-152.65. A clear break below this level might reveal the important 200-day Simple Moving Average now acting as support around 151.90-151.85.

Conversely, the 155.00 level and the recent high near 155.35 may serve as immediate resistance. A strong move past 155.35 could enhance the bullish outlook, allowing USD/JPY to target 155.70 and potentially approach the 156.00 mark, continuing towards the multi-month high of 156.75 reached last Friday.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator