简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Middle East Conflicts Intensify, Gold Jump

Abstract:Gold surged to new records amid the worsening situation in the Middle East. Wall Street remains strong, with optimism about earnings performance. BTC rose to near the $70,000 mark as the U.S. presiden

Gold surged to new records amid the worsening situation in the Middle East.

Wall Street remains strong, with optimism about earnings performance.

BTC rose to near the $70,000 mark as the U.S. presidential election is approaching.

Market Summary

Gold surged to a record high, nearing the $2730 mark per ounce, as worsening tensions in the Middle East escalated. The situation intensified after a Hezbollah drone explosion near the Israeli Prime Ministers private residence, prompting discussions of retaliation from Israel, which fueled the safe-haven demand for gold. Similarly, silver (XAGUSD) soared to its highest level in a decade, approaching the $34.00 mark, reflecting market uncertainty and geopolitical risk.

On the other hand, the U.S. stock market extended its rally last Friday, buoyed by earnings optimism despite earlier interruptions caused by robust U.S. economic data. However, with the U.S. presidential election drawing closer, market participants should brace for potential volatility.

In the cryptocurrency market, Bitcoin (BTC) surged towards the $70,000 mark on growing enthusiasm that both presidential candidates are seen as crypto-friendly, adding momentum to BTC's upward trend.

In forex, the U.S. dollar eased slightly but remained on a bullish trajectory. Meanwhile, China-proxy currencies, including the Aussie and Kiwi, were boosted by China‘s new economic stimulus package, including a central bank rate cut. Traders are also eyeing the Bank of Canada’s upcoming interest rate decision on Wednesday, where a 50 bps rate cut is expected, likely weakening the Canadian dollar further.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (93%)

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which trades against a basket of six major currencies, saw a slight pullback last week due to technical corrections and profit-taking. However, investor confidence in the U.S. dollar remains robust, driven by expectations that a Trump presidency could lead to policies beneficial for the dollar. Additionally, strong U.S. economic data has bolstered the positive outlook for the economy, maintaining demand for the dollar. This week‘s economic calendar is relatively quiet, with the key event being the release of the Fed’s Beige Book on Wednesday, which could provide insight into the Feds future policy moves.

The Dollar Index is trading lower while currently near the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the dollar might enter overbought territory.

Resistance level: 103.95, 104.95

Support level: 103.25, 102.50

XAU/USD, H4

Gold prices are trending higher as market volatility continues to shift investor sentiment toward safe-haven assets like gold. On the global front, the International Monetary Fund (IMF) warned last week that global public debt is expected to exceed $100 trillion by the end of this year, largely driven by the U.S. . Such high debt levels may trigger adverse market reactions and limit fiscal capacity to address future economic shocks. Meanwhile, with the U.S. presidential election fast approaching, ongoing volatility in the markets is sustaining golds appeal.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 81, suggesting the commodity might enter overbought territory.

Resistance level: 2735.00, 2770.00

Support level: 2705.00, 2685.00

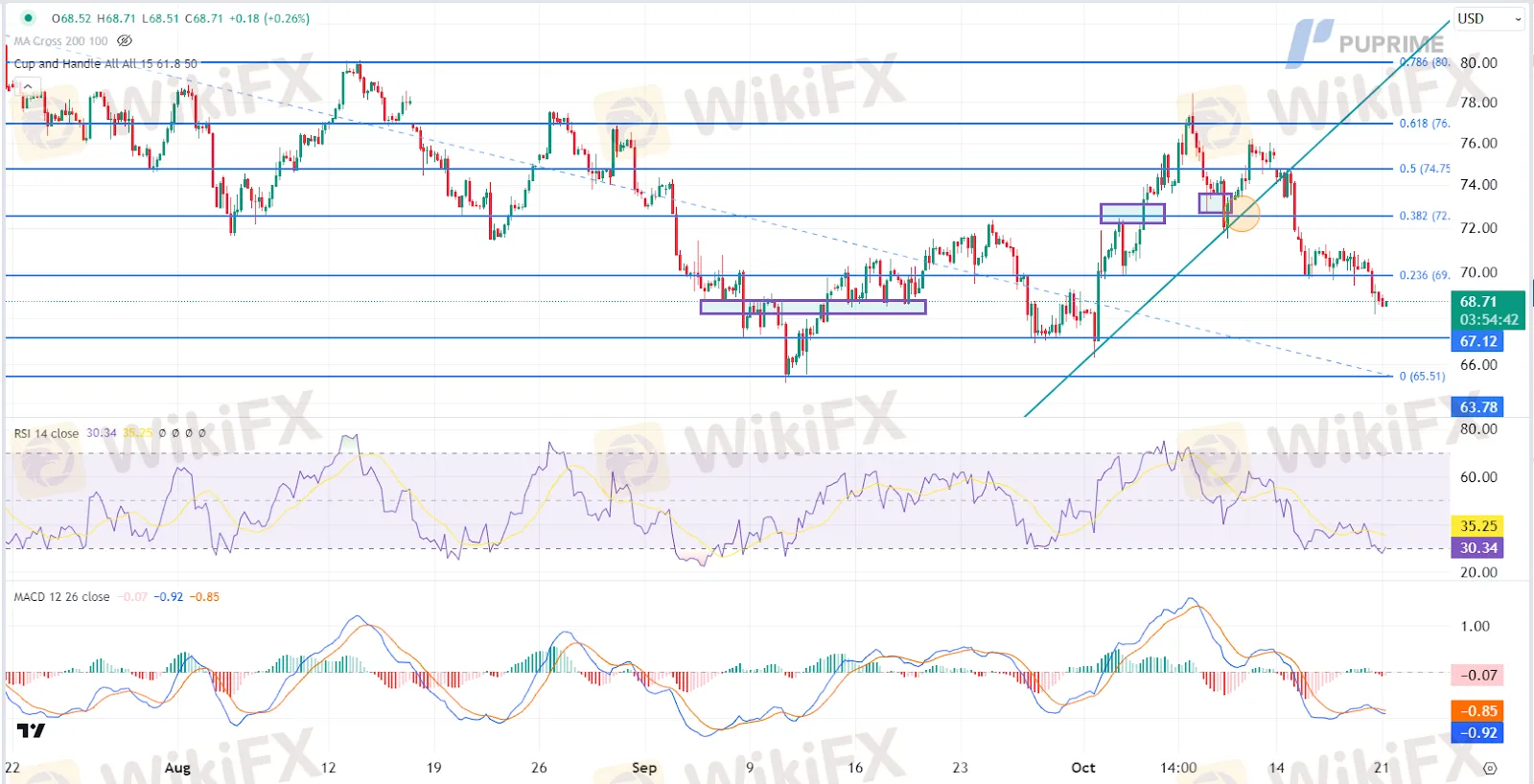

CL OIL, H4

Oil prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the commodity might enter oversold territory.

Resistance level: 72.55, 74.75

Support level: 69.85, 67.10

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Will Gold Break $2,625 Amid Fed Caution and Geopolitical Risks?

ECB Targets 2% Inflation as Medium-Term Goal

New Year, New Surge: Will Oil Prices Keep Rising?

PH SEC Issues Crypto Guidelines for Crypto-Asset Service Providers

FTX Chapter 11 Restructuring Plan Activated: $16 Billion to Be Distributed

Bithumb CEO Jailed and Fined Over Bribery Scheme in Token Listing Process

WikiFX Review: Something You Need to Know About Saxo

Is PGM Broker Reliable? Full Review

Terraform Labs Co-founder Do Kwon Extradited to the U.S. to Face Fraud Charges

Has the Yen Lost Its Safe-Haven Status?

Currency Calculator