简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

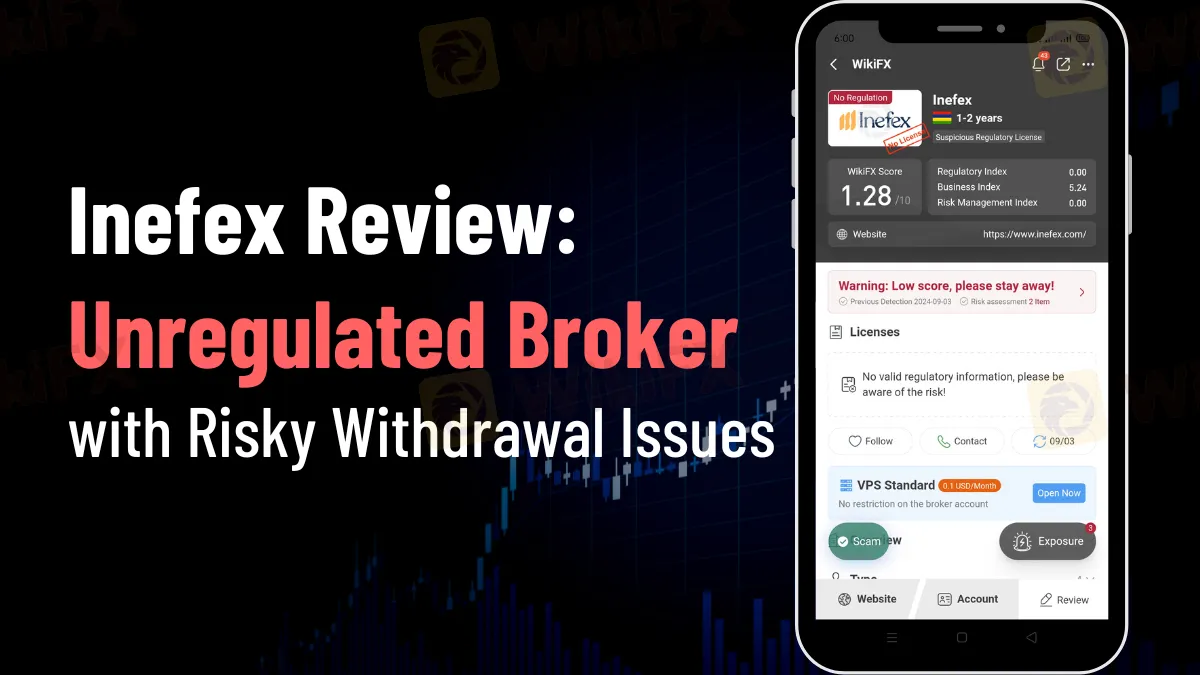

Inefex Review: Unregulated Broker with Risky Withdrawal Issues

Abstract:Inefex is an unregulated CFD broker with a poor reputation. Users report withdrawal issues, fraud, and scams. Avoid trading with this broker.

Inefex, a CFD online trading broker, claims to offer a wide range of trading instruments, including Forex, stocks, cryptocurrencies, commodities, and indices. However, despite its offerings, Inefex has garnered an overwhelmingly negative reputation among traders. The company is associated with Novir Markets LTD, which is purportedly registered and regulated under the Financial Services Commission of Mauritius (FSC) with license number GB21026833. However, this regulatory status could offer more comfort to potential traders.

The Financial Services Commission of Mauritius (FSC) is not held in the same regard as other major regulatory bodies like the UK's FCA, ASIC, or NFA. This lack of solid regulation raises significant concerns about the safety of your capital and the security of your deposits when trading with Inefex. The robustness of its regulation heavily influences a broker's trustworthiness, and in this case, Inefex falls short.

Inefex Reviews Reported to WikiFX

All the reports submitted to Inefex's WikiFX page are negative, with the most common complaints relating to an inability to withdraw funds. Many users have reported experiencing fraudulent activities and outright scams. The broker's rating on WikiFX is a dismal 1.28 out of 10, reflecting its user base's widespread dissatisfaction and distrust.

Given the serious issues associated with Inefex, traders must exercise caution. Utilizing tools like the WikiFX App can help you avoid the pitfalls of dealing with unregulated brokers like Inefex. Always ensure that the broker you choose is regulated by a reputable authority to safeguard your investments.

Conclusion

In conclusion, Inefex is an unregulated and high-risk broker with numerous reports of fraudulent activity and withdrawal issues. The lack of robust regulation makes it an unsafe choice for traders. To avoid falling victim to scams, it is advisable to research thoroughly and choose brokers regulated by well-respected authorities.

Stay informed and protect your investments. Visit Inefex's WikiFX page now to see detailed reviews and feedback from other traders. Don't let yourself fall victim to potential scams—make sure your broker is well-regulated and trustworthy.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Malaysian influencer Hu Chang Mun, widely known as Ady Hu, has been detained in Taiwan for his alleged involvement in a fraudulent operation. The 31-year-old, who was reported missing earlier in December, was located by Taiwanese authorities after suspicions arose regarding his activities.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

TradingView Launches Liquidity Analysis Tool DEX Screener

Discover TradingView's DEX Screener, a powerful tool for analyzing decentralized exchange trading pairs. Access metrics like liquidity, trading volume, and FDV to make smarter, data-driven trading decisions.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator