简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Merrill Review 2024: Pros and Cons Revealed

Abstract:Merrill, with almost 15 years of experience in the U.S., offers a variety of tradable securities like Stocks, Mutual Funds, ETFs, Fixed Income & Bonds, CDs, and Options. It provides commission-free trading and no minimum investment requirement, making it an attractive option for cost-conscious investors. Additionally, Merrill is currently regulated by FINRA, ensuring that it meets industry standards.

| |

| Company Name | Bank of America Corporation |

| Founded Year | 2010 |

| Registered Country/Region | United States |

| Regulations | FINRA |

| Product Offering | Stocks, Mutual Funds, ETFs, Fixed Income & Bonds, CDs, Options |

| Account Minimum | $0 |

| Inactivity Fee | $0 |

| Trading Fee | $0 |

| Account Types | General Investing Accounts, Retirement Accounts, Education Accounts, Small Business Accounts |

| Demo Account | ❌ |

| App/Platform | Merrill Edge mobile app |

| Promotion | ✅ |

What Type of Investor Is Merrill Suitable for?

Merrill is suitable for most investors. Merrill has a convenient and fast trading navigation page, whether you are a novice trader or an experienced investor, you can master it skillfully.

Besides, Merrill provides a wealth of learning, education resources and trading tools. Traders of any type of trading can find learning resources and trading tools that suit them according to their own needs. What's more. It only takes one day for users to open an account with Merrill, and Merrills minimum deposit requirement is 0, which greatly lowers the threshold for investors.

Finally, Merrill has a close partnership with Bank of America. Merrill users can access their bank accounts, loans, and investments from the same website, and users with higher balances in their associated Bank of America accounts can get preferential interest rates on financial products.

Overall, Merrill is suitable for novice traders as well as experienced traders.

Merrill Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

| |

|

✅Where Merrill Shines:

Close cooperation with Bank of America: Merrill has a deep binding relationship with Bank of America. Merrill users can access their bank accounts, loans and investments from the same website, and the balance of the Bank of America account associated with it is higher. Users can get more favorable interest rates on financial products.

Wide range of educational resources: Merrill not only provides investors with learning resources such as trading courses, trading articles, and trading videos but also provides a tool called Idea Builder, through which users can find products suitable for their investments.

Low transaction fees and no minimum account opening: Merrill has no stock and ETF transaction fees, and no minimum account limit, which greatly reduces investors trading thresholds and transaction costs.

Provide proprietary research reports on U.S. banks and securities: Merrill has a close relationship with Bank of America, and investors can find high-quality research reports, including access to some of Bank of America's internal research reports.

Operate under a strong regulatory frame: Merrill is regulated by the Financial Industry Regulatory Authority (FINRA), ensuring that it is a legally compliant and regulated broker, which safeguards users' assets.

❌Where Merrill Falls Short:

Low interest rates on uninvested assets: Merrill offers investors lower interest rates on idle funds in their accounts, and users may be attracted away by the high-yield interest rates offered by other trading platforms.

Does not provide demo account trading: Merrill does not provide demo account trading. Some novice investors may open accounts and trade on other competitor platforms.

Not offer cryptocurrency, futures, foreign exchange, and odd lot trading: Although Merrill offers products such as stocks, ETFs, mutual funds, and fixed income, it lacks cryptocurrency, futures, foreign exchange, and odd lot trading products. Some investors who want to invest in cryptocurrencies and futures need to go to other trading platforms.

Is Merrill Legit?

Merrill Licenses and Regulations

When traders choose a trading platform for investment, they must first ensure that the trading platform is legal and compliant and that the safety of users' funds can be guaranteed. If traders can obtain supervision from regulatory agencies, the safety of their funds will be guaranteed. Merrill holds one securities license, regulated by the Financial Industry Regulatory Authority (FINRA). The license details include CRD number 7691 and SEC numbers 801-14235 and 8-7221.

| The Financial Industry Regulatory Authority (FINRA) |

| Current Status | Regulated |

| Regulated Country | USA |

| Regulated Entity | MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED |

| License Type | Securities Trading License |

| License No. | CRD#: 7691/SEC#: 801-14235, 8-7221 |

Fund Safety

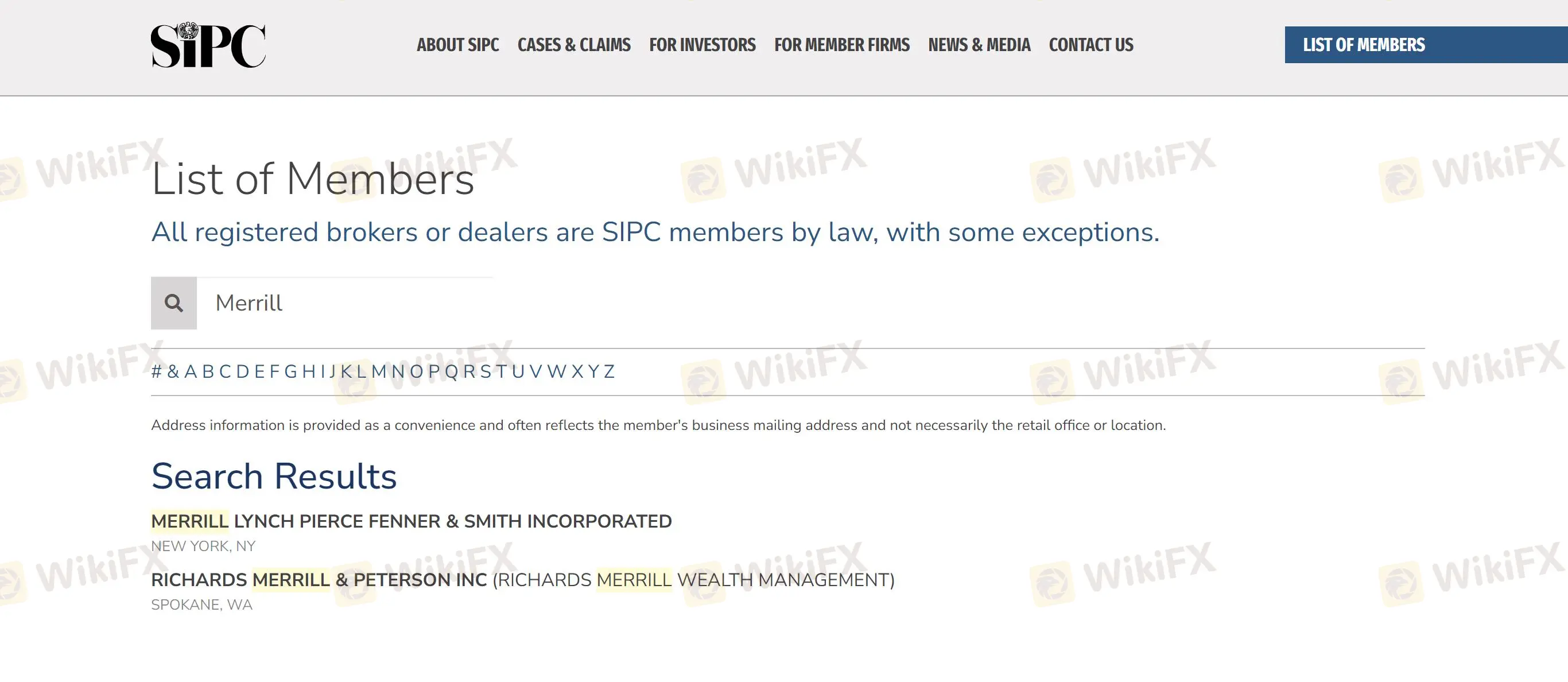

Merrill's customer account balances are not insured by the Federal Deposit Insurance Corporation (FDIC). Instead, securities in brokerage accounts are protected by the Securities Investor Protection Corporation (SIPC) for up to $500,000, including $250,000 for cash claims.

Security Measures

Merrill is committed to investor's security with the following ways:

- Authentication – Merrill trained associates follow strict guidelines to validate investors' identity and ensure investors' confidential information stays safe when investors call, or visit Merrill online or at a branch.

- Security Technology – Merrill offers banking safeguards through powerful security tools, such as early fraud warnings, state-of-the-art encryption, login authorization codes, and much more.

- Fraud Protection – Merrill's Fraud Protection Guarantee investors are reimbursed for losses that occur due to unauthorized third-party activity.

- Merrill offers an optional authorization code that investors may establish to provide an added level of security. Once investors enable this service online via the Security Center, Merrill will send them a one-time code based on receipt preference.

Merrill Trading App

The Merrill Edge mobile app provides users with convenient access to account management and investment tools. Users can easily manage their accounts by viewing balances, holdings, order status, and transaction history. They can also trade stocks, ETFs, mutual funds, and options directly from the app.

Additionally, users can stay informed about the market with up-to-date market data, news, real-time streaming quotes, and interactive charts. The app offers convenient banking features such as depositing checks by simply taking photos, transferring money between Merrill Edge investment accounts and linked Bank of America accounts, and making transfers to and from accounts held at other financial institutions.

For guidance and retirement planning, the app provides access to retirement and college planning calculators, as well as other tools to help users plan for their financial future. Security features include a fingerprint login for secure access and a secure inbox for sending messages and documents.

Merrill Education

Merrill offers a robust array of educational resources and research reports to empower investors. From planning tools to insightful articles, and from events to podcasts, investors have access to comprehensive guidance to make informed decisions. The portfolio strategies provided help investors build and manage their investment portfolios effectively.

Merrill Fees Review

Trading Fees & Commissions

| Asset Class | Fee | |

| Stocks & ETFs | $0 | |

| Options | $0 + $0.65 per contract | |

| Mutual Funds | Load-waived funds | $0 per transaction |

| No load, no transaction fee funds (NTF) | $0 per online transaction | |

| $39.95 short-term redemption applies if the fund is held less than 90 days | ||

| No load, transaction fee funds (TF) | $19.95 per transaction | |

| Fixed Income & Bonds | New issues including Brokered CDs | $0 |

| $0 (broker-assisted trades) | ||

| Treasuries, including Auction and Secondary | $0 | |

| Other Secondary trades, Corporate Bonds, Municipal Bonds, and Government agencies | $1 per bond ($10 min, $250 max) | |

Note that all broker-assisted trades incur an additional $29.95 fee, except for fixed income & bonds trading (New issues including Brokered CDs), which enjoys $0 broker-assisted trades.

Margin rates are determined by the base lending rate (which resets weekly), your debit balance and your overall relationship with Bank of America(®) and Merrill(®). You can call 888.637.3343 for further information.

Account Fees

| Account Type | Annual Account Fee/Minimum Investment |

| General Investing | $0 |

| Retirement | $0 |

| Education | $0 |

More specific info on additional fees can be found via https://www.merrilledge.com/pricing

Preferred Rewards Benefits

When the trading volume of investors' Merrill Lynch investment and Bank of America accounts reaches a certain amount, the Preferred Rewards Benefits program will bring some to investors at no additional cost.

The program is divided into four levels:

Gold Level: If an investor's average daily trade volume over three months is between $20,000 and $50,000, you'll receive a 0.05% discount on Merrill Guided Investing's fees.

Platinum Level: If an investor's average daily trade volume over three months is between $50,000 and $100,000, you will receive a 0.1% discount on Merrill Guided Investing's fees.

Platinum Honors: If an investor's average daily trade volume is between $100,000 and $1 million over a three-month period, you will receive a 0.15% discount on Merrill Guided Investing's fees.

Diamond: If an investor‘s average daily trade volume is between $1 million and $10 million over a three-month period, you’ll receive a 0.15% discount on Merrill Guided Investings fees.

Merrill Review on Products

Merrill Edge offers a wide range of investment products, including Stocks, ETFs, Mutual Funds, Options, Fixed Income, and Margin Trading.

However, it has limited options when it comes to advanced asset classes, such as no cryptocurrency, forex, or futures trading, and it doesnt support international markets or penny stock trading. Additionally, Merrill Edge does not offer fractional lot trading, which means users with smaller funds are locked out.

The platform also offers cash management accounts that allow users to park uninvested cash, earn interest on the cash in the account, and support debit cards and check withdrawals. The automatic counting function can automatically transfer idle cash to the cash management account, increasing the convenience of fund management.

| Products | Offered |

| Stocks | ✅ |

| ETFS | ✅ |

| Bonds | ✅ |

| Indices | ✅ |

| Options | ✅ |

| Mutual Funds | ✅ |

| Futures | ❌ |

| Forex | ❌ |

| Fractional Shares | ❌ |

| Crypto | ❌ |

Merrill Account Type

Whether you're planning for retirement or future education expenses, or just want a general investing account, Merrill has a wide variety of account choices. It is mainly divided into four major categories, respectively They are General Investing Accounts, Retirement Accounts, Education Accounts, and Small Business Accounts. The specific classification of each category is as follows:

| General Investing Accounts | Retirement Accounts | Education Accounts | Small Business Accounts |

| Individual accounts at Merrill | Rollover eligible accounts at Merrill | NextGen 529 Plan accounts at Merrill | SEP IRA accounts at Merrill |

| Joint accounts at Merrill | Roth IRA accounts at Merrill | Custodial | SIMPLE IRA accounts at Merrill |

| Custodial accounts at Merrill | Traditional IRA accounts at Merrill | 401(k) accounts at Merrill | |

| Estate accounts at Merrill | Inherited IRA | Retirement Cash Management accounts at Merrill | |

| Trust | Business Investor |

Compare to Similar Brokerages

| Logo |  |  |  |  |

| Broker | Merrill | eToro | Robinhood | Fidelity |

| Regulation | FINRA | CySEC, FCA, ASIC | FINRA | FINRA, SEC |

| Account Minimum | $0 | $10 | $0 | $0 |

| Product Offering | Stocks, Mutual Funds, ETFs, Fixed Income & Bonds, CDs, Options | Stocks, Cryptocurrencies, Currencies, Commodities, Options,ETFs | Stocks, ETFs, Options, Cryptocurrencies | ETFs, Stocks, Mutual Funds, Options, Cryptocurrency, and Fixed-Income Products |

| Stock Trades | $0 | $0 | $0 | $0 |

| Promotion | ✅ | ❌ | ✅ | ❌ |

| Best for | Most traders | Novice traders | Novice traders | Prefers low fees and long-term investors |

FAQs

Is Merrill a safe and trustworthy brokerage?

Your brokerage accounts are not FDIC insured, but rather accounts held with Merrill are SIPC insured. SIPC insurance covers your account up to $500,000 in equity with up to $250,000 in cash. Coverage above SIPC limits is covered by Lloyd's of London. Customers who have exceeded the full SIPC limits have further protection provided by Lloyd's policy.

What are the advantages of Merrill online brokerage accounts?

An online brokerage account provides investors with a seamless way to transfer funds between their Bank of America accounts and Merrill investment accounts. With online brokerage, investors can use mobile devices to manage their investments. Merrill Self-Directed investors, in particular, can handle daily transactions with ease.

Is Merrill suitable for beginners?

Yes, Merrill is great for novice traders. First of all, it is strictly regulated by the FINRA regulatory agency, so novice traders do not need to worry about the security of their funds. Secondly, Merrill provides a wealth of learning resources and research reports, so novice traders can learn according to their own needs. Finally, Merrill registration is quick and easy and the account does not require minimum capital, making it very suitable for novice traders to open an account.

Can I have more than one account at Merrill?

Yes, having multiple accounts is a great way to support multiple financial goals.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

PH SEC Issues Crypto Guidelines for Crypto-Asset Service Providers

FTX Chapter 11 Restructuring Plan Activated: $16 Billion to Be Distributed

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Share Industry Insights and Discuss Forex Market Trends

Top 9 Financial Fraud Cases in Recent History

KuCoin Pay Introduces Easy Crypto Payments for Merchants

Malaysian Man Killed in Alleged Forex Dispute-Related Attack

How Big is the Impact of the USD-JPY Rate Gap on the Yen?

What Euro Investors Can't Afford to Miss

Is OneRoyal the Right Broker for You?

Currency Calculator