简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

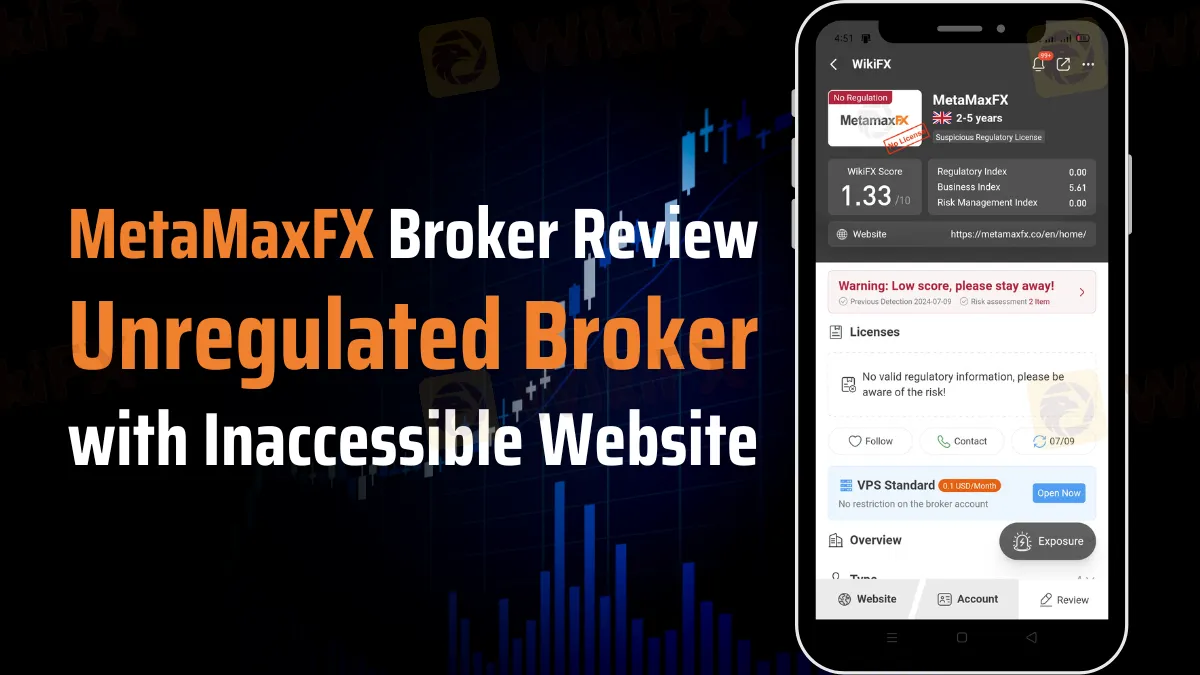

MetaMaxFX Broker Review: Unregulated Broker with Inaccessible Website

Abstract:MetaMaxFX, an unregulated broker based in the UK, offers little transparency with an inaccessible website. Learn more in this review.

MetaMaxFX presents itself as a brokerage firm based in the United Kingdom, claiming to offer various trading services. However, potential clients should approach this broker with caution due to significant concerns about its legitimacy and transparency.

Regulatory Status and Location

MetaMaxFX operates without regulation, which raises serious red flags for potential investors. Regulatory oversight provides essential protection for traders, ensuring that brokers adhere to strict financial standards and operational guidelines. The absence of regulation means clients have minimal recourse in case of disputes or financial malpractice.

Website Accessibility Issues

One of the most alarming aspects of MetaMaxFX is the inaccessibility of its official website, located at https://metamaxfx.co/en/home/. A reliable and transparent broker should maintain a functional website as a primary means of communication with clients. The inability to access their website suggests operational issues or potential attempts to evade scrutiny.

Contact Information and Customer Service

MetaMaxFX lists phone numbers, including +44 1312021660 and +52 3385262577. However, the reliability and responsiveness of their customer service remain questionable, especially given the inaccessible website.

Conclusion

Investing in MetaMaxFX poses significant risks due to its unregulated status, inaccessible website, and lack of transparent communication channels. Traders are strongly advised to consider regulated alternatives with proven track records of reliability and customer satisfaction.

In summary, MetaMaxFX fails to meet basic standards of transparency and regulatory compliance expected from reputable brokerage firms. Potential investors should exercise extreme caution and explore safer options in the competitive financial markets.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

A manager from Sibu, Malaysia, lost RM240,000 to a fraudulent investment scheme.

Top 9 Financial Fraud Cases in Recent History

Know the top 9 financial fraud cases in history, from Enron to FTX, uncovering deception and greed. Learn how WikiFX protects investors from scams and fraud.

WikiFX Review: Something You Need to Know About Saxo

Founded in 1992, Saxo is a Danish investment bank that offers a wide range of investment products (stocks, ETFs, bonds, mutual funds, crypto ETPs) and leveraged products (options, futures, forex, forex options, crypto FX, CFDs, commodities). In today’s article, we will show you what it looks like in 2025.

FINRA Orders Firms to Pay Over $8.2 Million in Restitution to Customers

FINRA orders $8.2M in restitution to customers for mutual fund sales charge waivers and fee rebate violations by Edward Jones, Osaic Wealth, and Cambridge.

WikiFX Broker

Latest News

Will Gold Break $2,625 Amid Fed Caution and Geopolitical Risks?

ECB Targets 2% Inflation as Medium-Term Goal

New Year, New Surge: Will Oil Prices Keep Rising?

PH SEC Issues Crypto Guidelines for Crypto-Asset Service Providers

FTX Chapter 11 Restructuring Plan Activated: $16 Billion to Be Distributed

Think Before You Click: Malaysian Loses RM240,000 to Investment Scam

Bithumb CEO Jailed and Fined Over Bribery Scheme in Token Listing Process

WikiFX Review: Something You Need to Know About Saxo

Is PGM Broker Reliable? Full Review

Terraform Labs Co-founder Do Kwon Extradited to the U.S. to Face Fraud Charges

Currency Calculator