简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

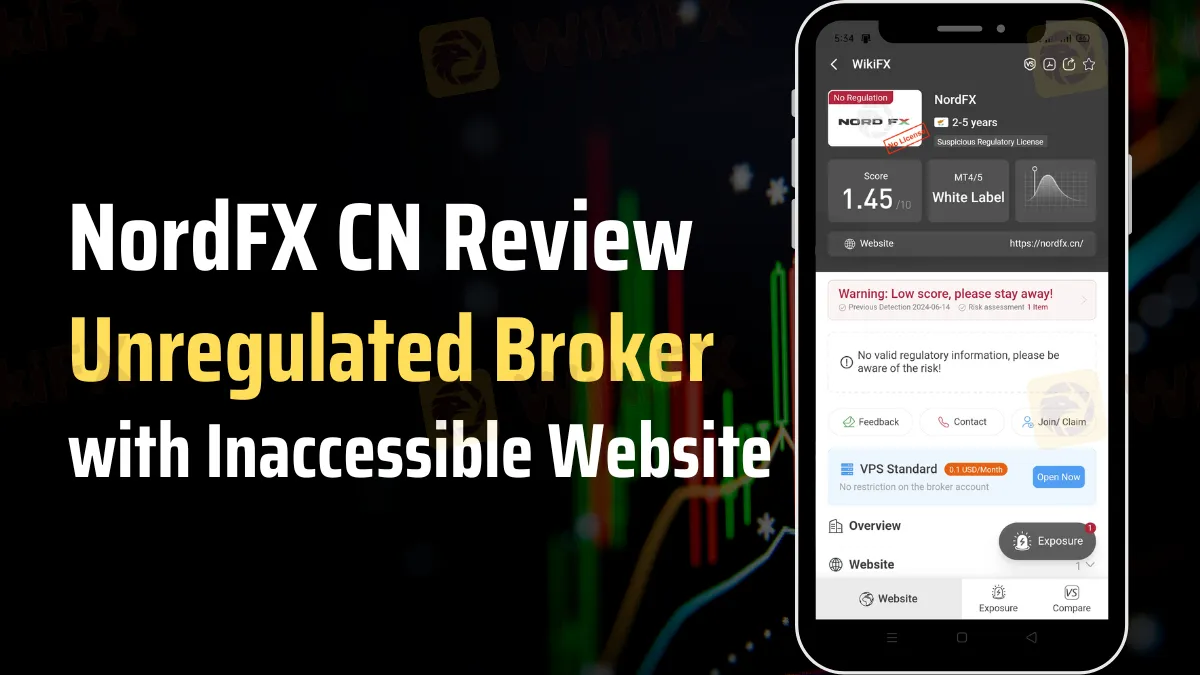

NordFX CN: Unregulated Broker with Inaccessible Website

Abstract:NordFX is an unregulated trading broker based in Cyprus with an inaccessible website. According to WikiFX, it's likely a fraud or scam.

NordFX CN: An Unregulated Broker with Red Flags

Navigating the world of online trading can be treacherous, especially when brokers like NordFX CN come into play. The said trading broker is an unregulated trading broker, and its lack of regulatory oversight is a major cause for concern.

Regulatory Status: Unregulated and Unverified

According to WikiFX data, NordFX CN claims to be located in Cyprus. However, its regulatory status remains unverified, as it operates without any proper license. This alone is a significant red flag, as regulatory bodies are crucial in ensuring the safety and fairness of trading environments. Without such oversight, traders are left vulnerable to potential exploitation and financial loss.

Website Inaccessibility: A Major Red Flag

Further compounding the issue is the fact that the NordFX CN website (https://nordfx.cn/) is inaccessible. This inaccessibility raises serious questions about the broker's legitimacy and operational transparency. A functional and accessible website is a basic expectation for any legitimate business, especially in the online trading industry. The inability to access their website suggests a lack of professionalism and reliability.

Potential Fraud and Scam Indicators

In the world of online trading, transparency and regulation are key indicators of a broker's reliability. NordFX CN failure to meet these basic criteria makes it a highly questionable choice for traders. The combination of its unregulated status and an inaccessible website strongly suggests that the broker is likely a fraudulent or scam broker or a cloned.

Traders should be aware that dealing with unregulated brokers carries significant risks, including the potential loss of funds with little to no recourse. Regulatory bodies exist to protect investors, and the absence of such oversight leaves traders exposed to various forms of financial malpractice.

Conclusion: Avoid NordFX CN

Given the serious concerns regarding its regulatory status and the inaccessibility of its website, it's hard to escape the conclusion that NordFX CN is not a trustworthy broker. Traders are strongly advised to steer clear of the broker and seek out brokers with verified regulatory status and a track record of transparency and reliability. Your financial security depends on it.

Final Thoughts

The online trading landscape is fraught with risks, and it is essential to conduct thorough research before engaging with any broker. NordFX CN, with its unregulated status and inaccessible website, presents too many red flags to be considered a safe or reliable option. Protect your investments by choosing brokers that prioritize transparency, regulation, and accessibility.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Broker

Latest News

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

MTrading’s 2025 "Welcome Bonus" is Here

Doo Financial Obtains Licenses in BVI and Cayman Islands

CFI’s New Initiative Aims to Promote Transparency in Trading

Currency Calculator