简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

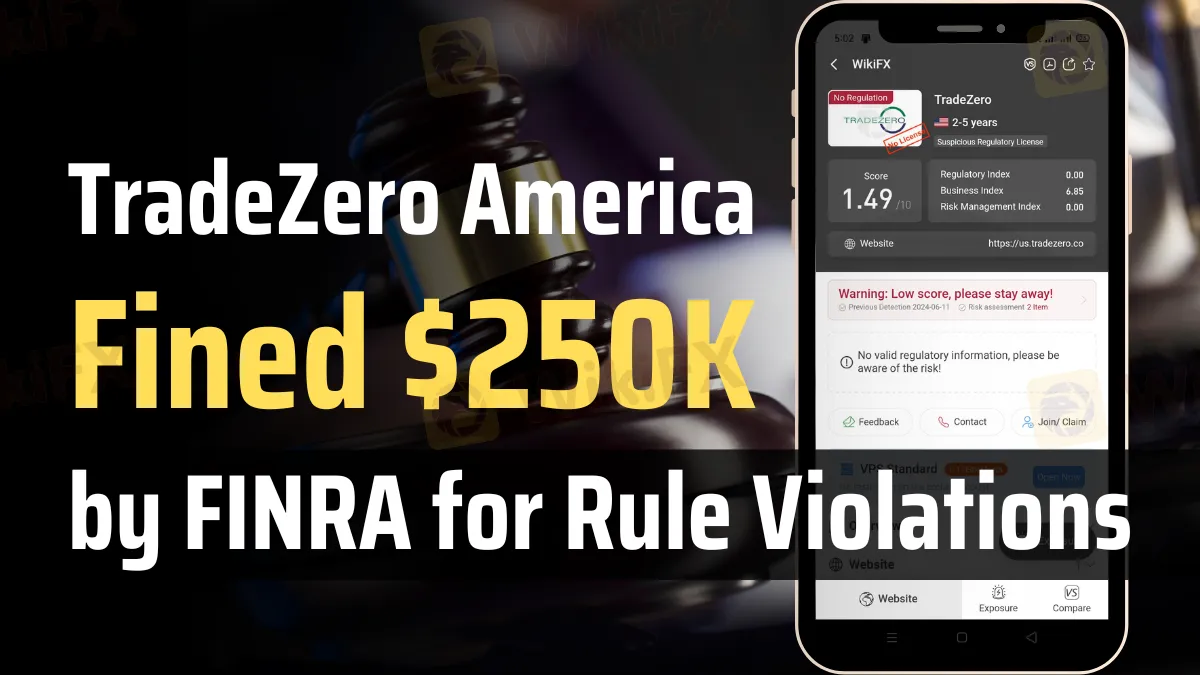

TradeZero America Fined $250K by FINRA for Rule Violations

Abstract:TradeZero America faces a $250K fine from FINRA for improper social media promotions, inadequate supervision, and misleading privacy notices.

The Financial Industry Regulatory Authority (FINRA) fined TradeZero America, Inc. $250,000 for many regulatory violations. Infractions involving the company's use of social media influencers to market its services occurred between July 2020 and October 2022.

At the time, TradeZero America was paying popular people on social media to promote their business. Nevertheless, these advertisements often included inflated claims and lacked objectivity. Not following FINRA Rules 2210(d)(1) and 2010 brought attention to major supervision issues at the company.

Worse still, neither did TradeZero America evaluate nor save the influencers' films prior to their online release, and neither did it keep tabs on nor save any posts made in participatory online forums. This oversight violated the firm's responsibilities as outlined in Section 17(a) of the Securities Exchange Act of 1934, Exchange Act Rule 17a-4(b)(4), and many FINRA rules, such as 2210(b), 4511, 3110, and 2010.

In addition, tradeZero America sent out misleading privacy alerts to clients in 2020 and 2022 about the use of nonpublic personal information. The Securities Exchange Act of 1934's Regulation S-P, Rule 4 (17 CFR § 248.4) and FINRA Rule 2010 were also violated by this misstatement.

These infractions occurred because the company failed to properly design and enforce supervisory procedures for retail communications. These compliance failures were so serious that FINRA censured the company and fined them $250,000.

Without accepting or rejecting the conclusions, TradeZero America has agreed to the censure and penalties as components of the settlement. This resolution highlights the significance of strict regulation and compliance in the financial services industry, especially with regard to contemporary advertising platforms such as social media.

The regulatory body's decision to take action against TradeZero America should serve as a strong warning to other companies about the significance of following the laws in order to keep public communications fair and open.

About FINRA

A non-governmental agency known as the Financial Industry Regulatory Authority (FINRA) is responsible for overseeing broker-dealers in the United States. Under the auspices of the SEC, FINRA has been in operation since 2007 with the goals of safeguarding investors and maintaining honest markets. Registration and education of industry participants, compliance examinations of businesses, enforcement of rules and securities laws, and monitoring of trading activity are FINRA's primary tasks. The goal of FINRA's rule enforcement and transparency initiatives is to increase public confidence in the financial markets. Investors and brokers may take use of the organization's arbitration and mediation services to settle issues.

You may also access the latest news in the financial market here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Malaysian influencer Hu Chang Mun, widely known as Ady Hu, has been detained in Taiwan for his alleged involvement in a fraudulent operation. The 31-year-old, who was reported missing earlier in December, was located by Taiwanese authorities after suspicions arose regarding his activities.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

TradingView Launches Liquidity Analysis Tool DEX Screener

Discover TradingView's DEX Screener, a powerful tool for analyzing decentralized exchange trading pairs. Access metrics like liquidity, trading volume, and FDV to make smarter, data-driven trading decisions.

WikiFX Broker

Latest News

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

WikiFX Review: Is IQ Option trustworthy?

Quadcode Markets: Trustworthy or Risky?

5 Questions to Ask Yourself Before Taking a Trade

Avoid Fake Websites of CPT Markets

Webull Canada Expands Options Trading to TFSAs and RRSPs

Currency Calculator