简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AMC

Abstract:AMC operates without regulatory oversight and focuses on cryptocurrency exchange and investment. The company has faced sanctions for unlicensed activities and does not adhere to established financial standards. AMC uses the MetaTrader 5 (MT5) platform, offering sophisticated trading tools and features. However, it requires a minimum deposit of $10,000 and provides only one account type with leverage up to 200:1.

| Aspect | Details |

| Company Name | AMC Co Pty Ltd |

| Registered Country | The Virgin Islands |

| Disclosure Year | 2021 |

| Regulation | Not regulated, with previous sanctions for unlicensed activities |

| Tradable Assets | Cryptocurrency exchange and investment business (claimed, not verified) |

| Account Types | STANDARD |

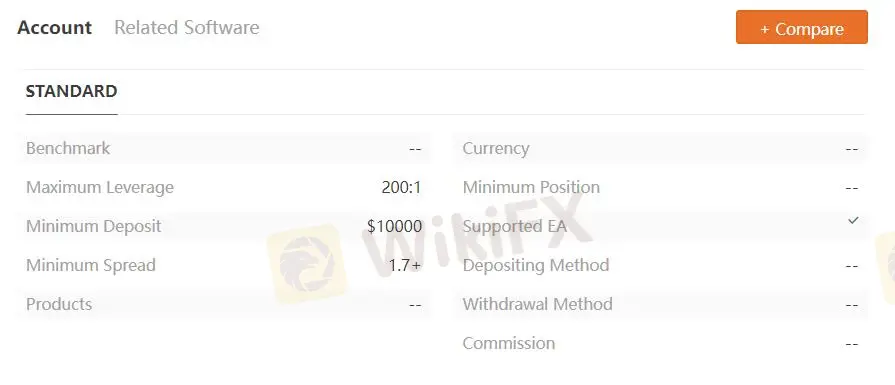

| Minimum Deposit | $10,000 |

| Maximum Leverage | 200:1 |

| Spreads | Minimum Spread 1.7+ |

| Trading Platforms | MT5 |

| Customer Support | Email: amcmarkets@outlook.com, Address: 6 Bridge Street Kington HR5 3FJ |

Overview of AMC

AMC Co Pty Ltd, also known as AMC, is purportedly based in the Virgin Islands but has been flagged by regulatory bodies for operating without proper licenses. Disclosed in 2021, AMC has been publicly reprimanded for misleading claims about its regulatory status. It targets global investors, offering services related to cryptocurrency exchanges and investments through the MT5 platform. The company sets a high entry threshold with a minimum deposit of $10,000 and offers a maximum leverage of 200:1, operating under a cloud of transparency issues and regulatory warnings.

Pros and Cons

AMC, while offering the popular MT5 trading platform, is not regulated by any financial authority. This absence of regulation means that the broker does not adhere to any established financial standards or practices. Additionally, the British Virgin Islands Financial Services Commission has issued a public warning against AMC, further questioning its legitimacy.

AMC only offers a single account type, limiting the options for traders with different needs. Transparency is another issue, particularly regarding fees, which are not clearly disclosed. Lastly, AMC lacks phone support, which can be a drawback for traders needing immediate assistance. These cons significantly outweigh the sole benefit of utilizing the MT5 platform, making AMC a risky choice for traders.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Is AMC legit or a scam?

AMC Co Pty Ltd operates without regulatory oversight. The British Virgin Islands Financial Services Commission (FSC) has issued a public statement warning that AMC is not licensed or regulated to conduct financial services business in the BVI. This lack of regulation means that AMC does not adhere to any financial stability, security, transparency, or fair trading practice standards set by regulatory authorities.

Market Instruments

AMC Co Pty Ltd primarily offers trading services in cryptocurrency exchange and investment business. However, the absence of regulatory approval from the British Virgin Islands Financial Services Commission (FSC) casts doubt on the reliability and safety of these instruments.

Account Types

AMC Co Pty Ltd provides one type of trading account, the STANDARD account. This account demands a minimum deposit of $10,000, with leverage up to 200:1. The spreads begin at 1.7 pips.

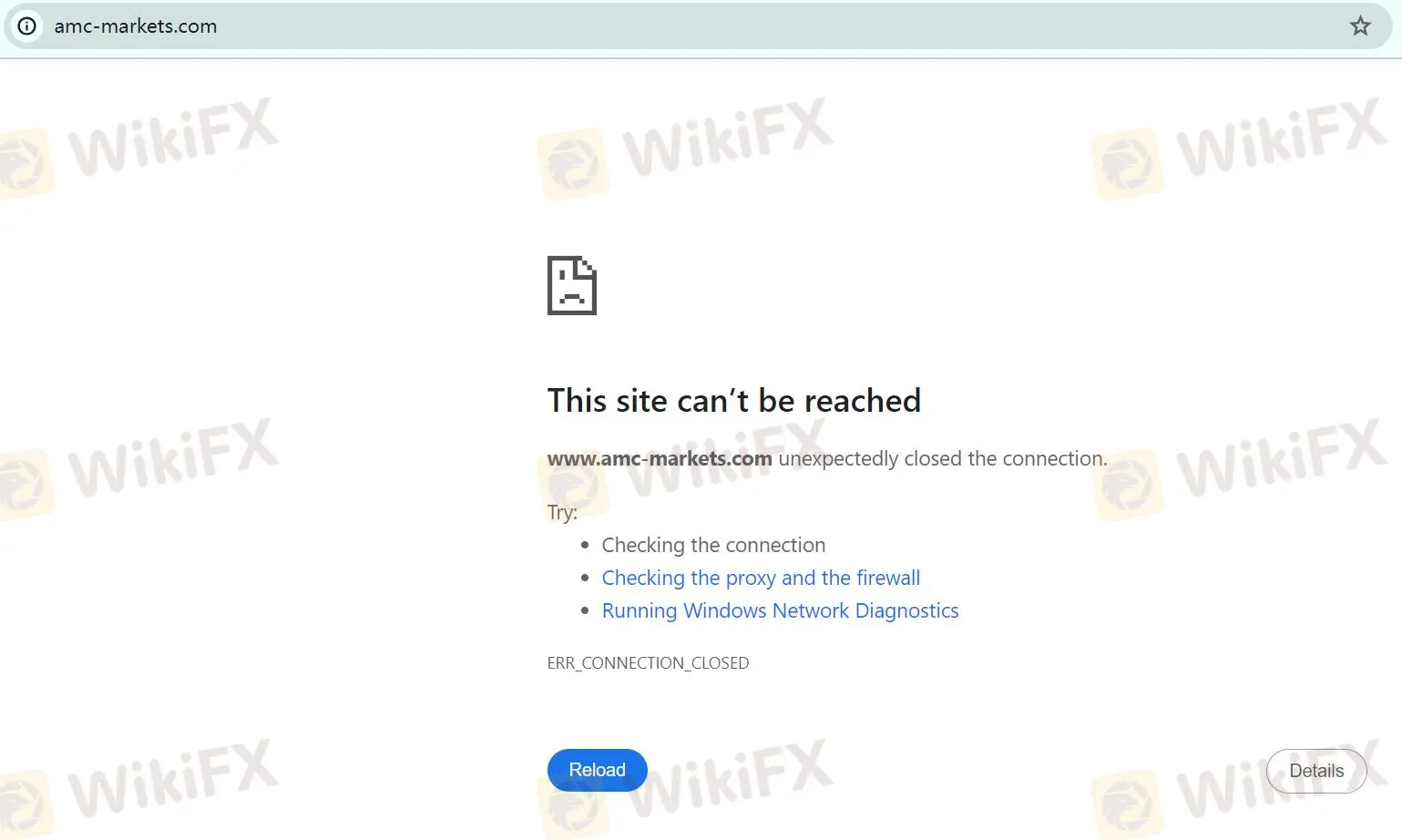

How to Open an Account with AMC

The website for AMC Co Pty Ltd is currently inaccessible. For instructions on opening an account and any additional information, please reach out to their customer support at amcmarkets@outlook.com.

Leverage

This broker offers the maximum trading leverage of up to 200:1. The fact that this unregulated broker provides such high leverage suggests an attempt to attract more unsuspecting traders.

Spreads & Commissions

The standard account features a minimum spread of 1.7 pips.

Trading Platform

AMC utilizes the MetaTrader 5 (MT5) platform, which facilates sophisticated charting tools, comprehensive analytical features, and automated trading capabilities. Available on desktop, web, and mobile devices, MT5 offers flexible access for traders to manage their accounts and execute trades from any location. The platform supports a variety of trading instruments, including cryptocurrencies, complementing AMC's specialization in cryptocurrency exchange and investment.

Customer Support

Email: amcmarkets@outlook.com

Address: 6 Bridge Street, Kington HR5 3FJ

Conclusion

AMC Co Pty Ltd, headquartered in the Virgin Islands, lacks regulatory oversight and has been sanctioned for unlicensed activities. Despite offering the MT5 trading platform, the company's high minimum deposit of $10,000 and limited account options may dissuade potential clients. Additionally, its lack of fee transparency, absence of phone support, and regulatory warnings from the British Virgin Islands Financial Services Commission severely impact its credibility.

FAQs

Q: Is AMC Co Pty Ltd a regulated broker?

A: No, AMC Co Pty Ltd operates without regulation and has faced sanctions for unlicensed activities.

Q: What trading platform does AMC offer?

A: AMC utilizes the MetaTrader 5 (MT5) platform.

Q: What is the minimum deposit required to open an account with AMC?

A: AMC requires a minimum deposit of $10,000 to open an account.

Q: What is the maximum leverage offered by AMC?

A: AMC offers trading leverage of up to 200:1.

Q: Does AMC provide customer support?

A: AMC provides customer support via email at amcmarkets@outlook.com but does not offer phone support.

Q: What types of accounts does AMC offer?

A: AMC offers only one type of account, the STANDARD account.

Q: Are there any public warnings against AMC?

A: Yes, the British Virgin Islands Financial Services Commission has publicly warned that AMC is not licensed or regulated to conduct financial services business in the BVI.

Risk Warning

Online trading poses substantial risks, with the potential for complete loss of invested capital, rendering it unsuitable for all traders. It is imperative to comprehend the inherent risks and acknowledge that the information provided in this review is subject to change due to continuous updates in the company's services and policies.

Additionally, the review's generation date is a critical consideration, as information may have evolved since then. We strongly advise readers to verify updated details directly with the company before making any decisions, as the readers must be aware of and willing to accept the inherent risks involved in utilizing this information.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Many Social Media 'Investment Gurus' Are Scammers Preying on Malaysian Traders

Social media platforms have become breeding grounds for scammers posing as investment gurus, exploiting the growing interest in forex and cryptocurrency trading among Malaysians. Fraudulent "financial experts" often create the illusion of legitimacy by offering enticing stock analyses and promises of high returns.

OANDA Expands TradingView Integration Globally

OANDA completes global TradingView integration, empowering traders in Asia and beyond with seamless access to 1700+ instruments on TradingView charts.

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

Exness: Revolutionizing Trading with Cutting-Edge Platforms

Exness offers traders seamless experiences with its Exness Terminal and Exness Trade app, providing flexibility, advanced tools, and low-cost trading.

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

Bitcoin ETF Options Get Closer to Reality with CFTC Clarification

Currency Calculator