简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

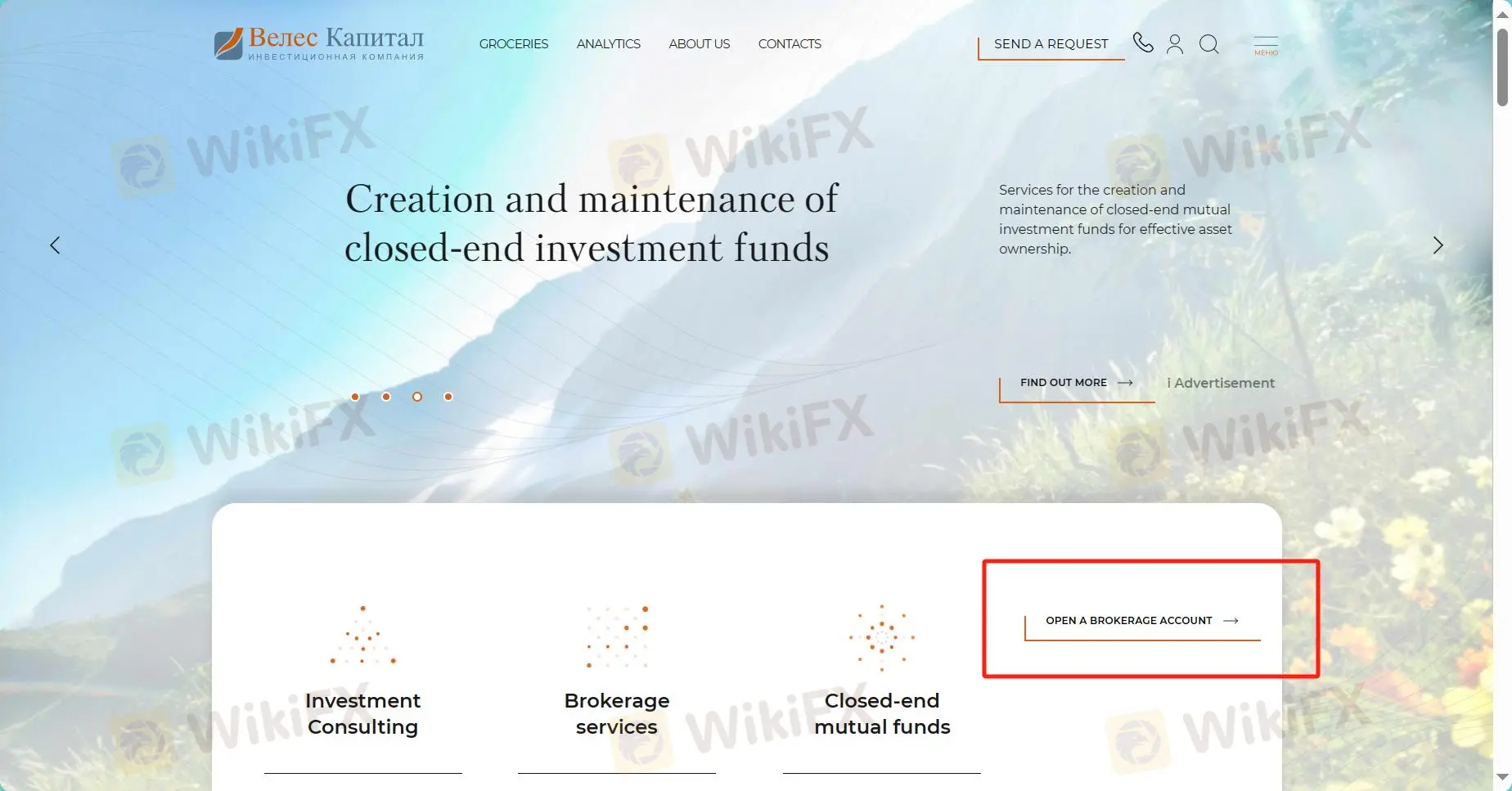

VELES Capital

Abstract:VELES Capital is a financial services provider that offers a wide range of services tailored to meet the needs of wealthy private clients. These services include asset management, investment consulting, brokerage services, mutual funds, personal funds, options trading, currency hedging, structured products, real estate investment, and depository services. Despite its comprehensive offerings, VELES Capital currently operates without valid regulation, which may raise concerns about its safety and legitimacy.

| VELES Capital Review Summary | |

| Founded | 1995 |

| Registered Country/Region | Russia |

| Regulation | No Regulation |

| Services | Asset Management, Investment Consulting, Brokerage services, Mutual Funds, Personal Funds, Options, Currency hedging, Structured Products, Real Estate Investment, Depository services |

| Demo Account | Unavailable |

| Leverage | N/A |

| Spread | N/A |

| Trading Platforms | Mobile application |

| Minimum Deposit | $0 |

| Customer Support | Phone: 8 (800) 500-23-33, +7 (495) 258-19-88 |

| Email: veles@veles-capital.ru | |

| Address: IC Veles Capital LLC, Russia, Moscow, Krasnopresnenskaya nab., 12, entrance 7, этаж 18 World Trade Center-II | |

| Contact form | |

What is VELES Capital?

VELES Capital is a financial services provider that offers a wide range of services tailored to meet the needs of wealthy private clients. These services include asset management, investment consulting, brokerage services, mutual funds, personal funds, options trading, currency hedging, structured products, real estate investment, and depository services. Despite its comprehensive offerings, VELES Capital currently operates without valid regulation, which may raise concerns about its safety and legitimacy.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros:

Comprehensive Financial Services: VELES Capital offers a wide range of financial services tailored to meet the needs of wealthy private clients. These services include asset management, investment consulting, and brokerage services, providing clients with diverse options to preserve and grow their assets.

No Minimum Deposit Requirement: One notable advantage of VELES Capital is its brokerage account with no minimum deposit requirement. This accessibility makes it easier for investors of all levels to enter the financial markets without the constraints of hefty initial deposits, promoting inclusivity and democratization of investing.

Responsive Customer Support: VELES Capital maintains a comprehensive and accessible customer support network, allowing clients to reach out for assistance via phone, email, or contact form. This responsive support system ensures that clients can get timely assistance with any queries or issues they may encounter.

Cons:

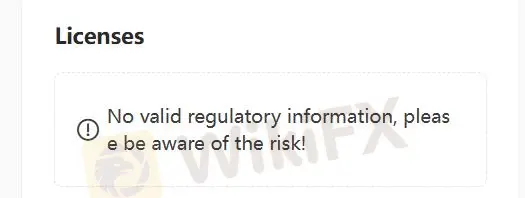

No Regulation: VELES Capital currently lacks valid regulation, which raises concerns about its safety and legitimacy. Regulatory oversight is crucial for ensuring that financial services providers operate within established standards and adhere to specific rules and requirements designed to protect investors and clients.

Is VELES Capital Legit or a Scam?

VELES Capital currently lacks valid regulation, which raises significant concerns about its safety and legitimacy. Regulatory oversight is crucial for ensuring that a financial services provider operates within established standards and adheres to specific rules and requirements designed to protect investors and clients. Without proper regulation, there is an increased risk of fraudulent activities, scams, and inadequate consumer protection.

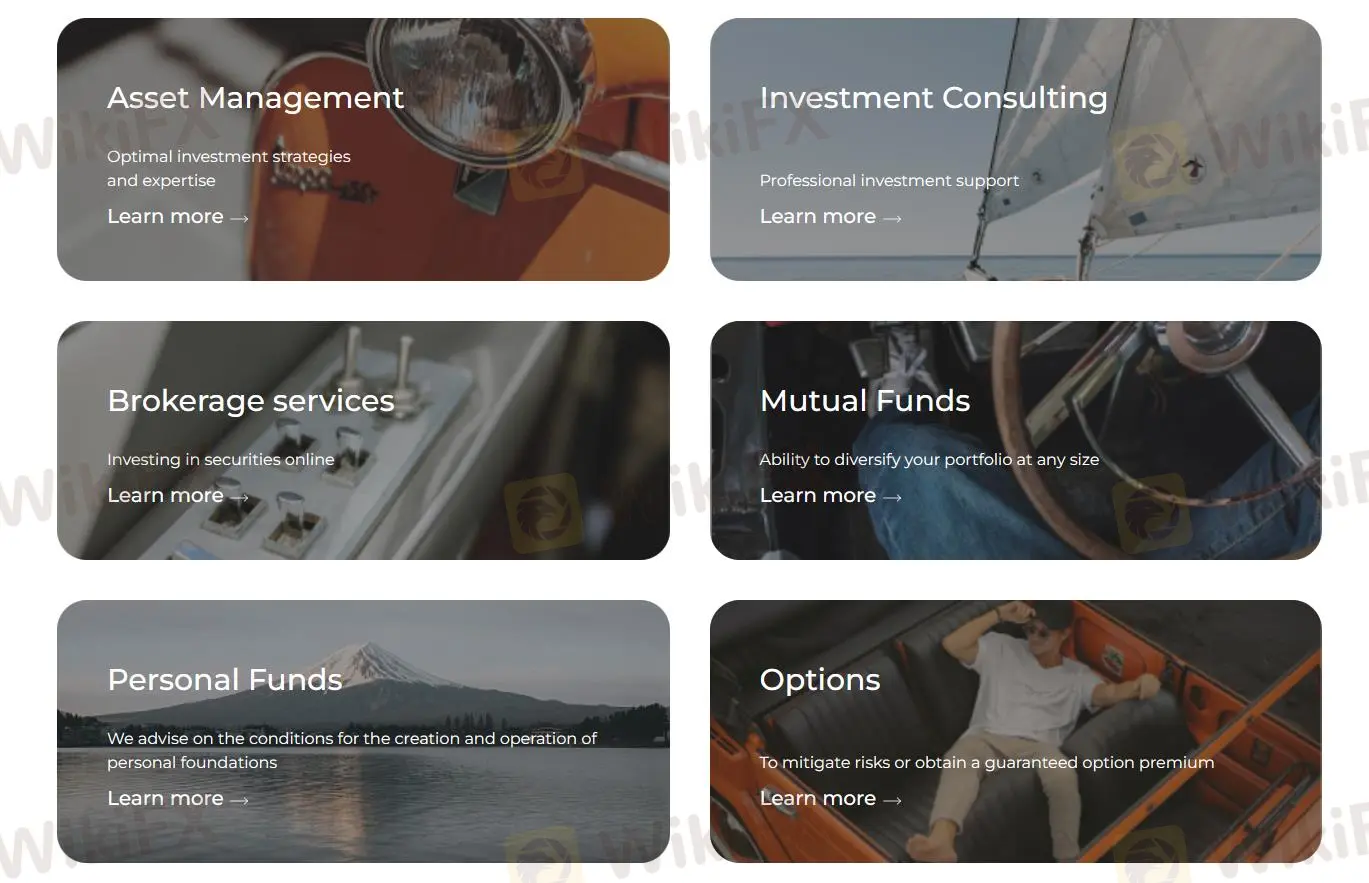

Services

VELES Capital provides a comprehensive suite of services tailored to meet the diverse needs of wealthy private clients. With a focus on preserving and growing assets, clients have access to a wide range of options, including asset management services, investment consulting, and brokerage services. Moreover, VELES Capital offers investment opportunities in mutual funds, personal funds, and options, providing clients with flexibility and choice in their investment strategies.

For those seeking risk management solutions, the firm also offers currency hedging and structured products. Additionally, clients can explore real estate investment opportunities and benefit from depository services for added convenience and security. With these diverse offerings, VELES Capital empowers clients to optimize their investment portfolios and achieve their financial goals.

Account

VELES Capital stands out in the financial landscape by offering a BROKERAGE ACCOUNT with no minimum deposit requirement, ensuring accessibility for investors of all levels. This flexibility allows clients to embark on their investment journey without the constraints of hefty initial deposits, making the financial markets more inclusive and attainable. With no minimum deposit requirement, clients can tailor their investment strategies according to their financial goals and risk tolerance, empowering them to build and manage their portfolios with greater freedom and control.

How to Open an Account?

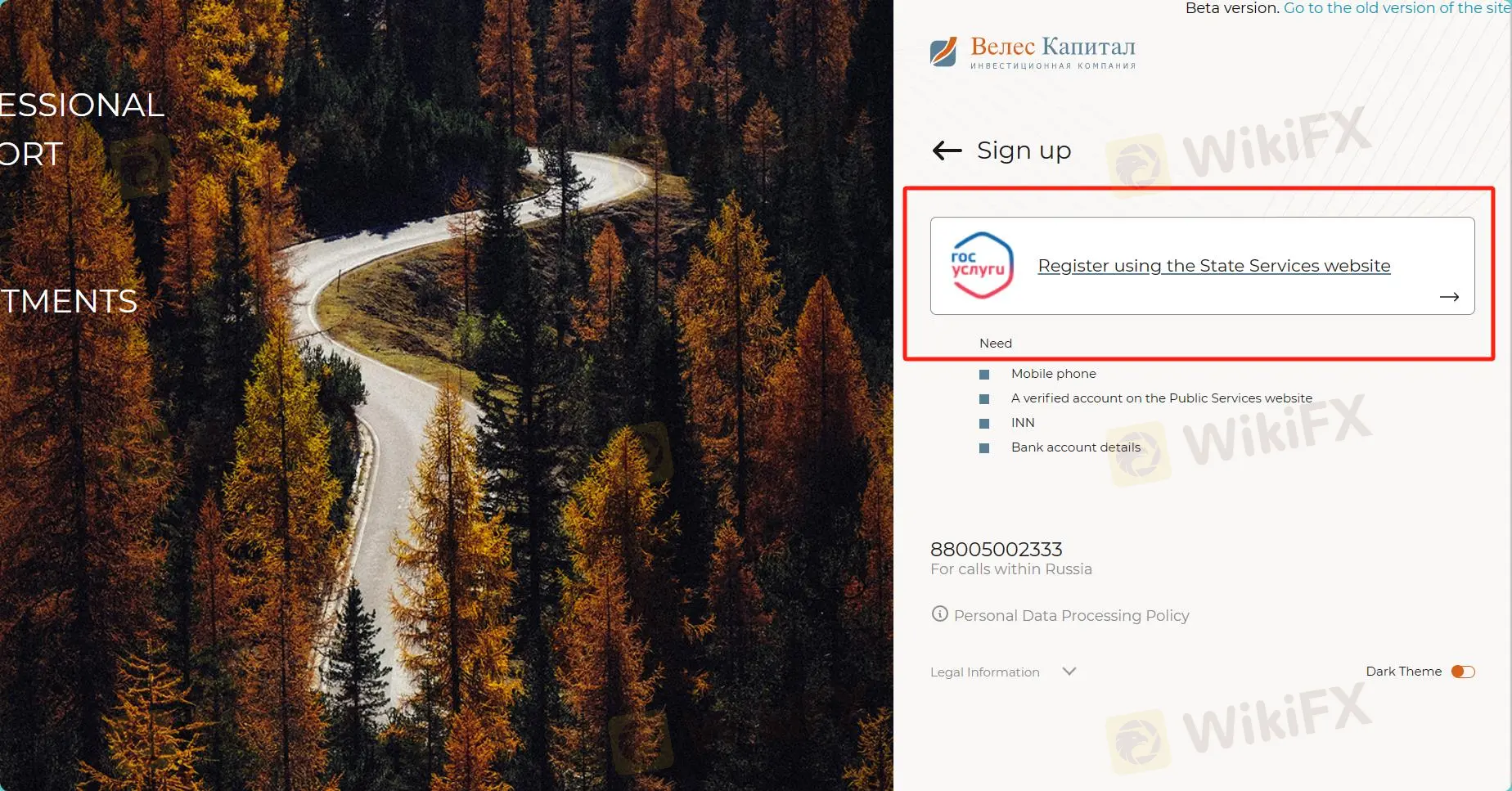

Step 1: Click the button ''OPEN A BROKERAGE ACCOUNT'' on the homepage.

Step 2: Click the button “Register using the State Services website”.

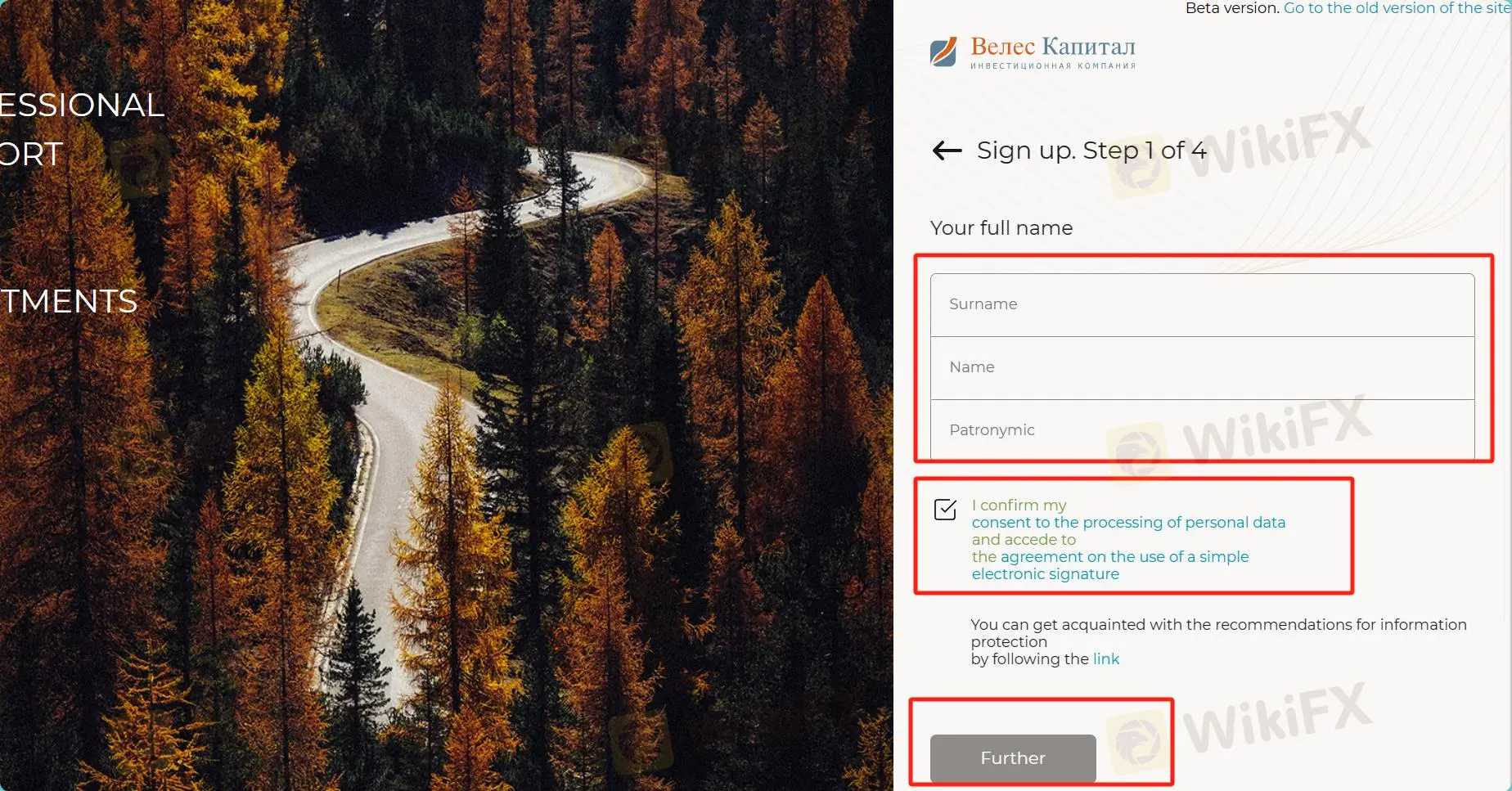

Step 3: Follow the on-screen instructions to input your personal and contact details.

Step 4: Read and agree to the Terms and Conditions and any other policy as required.

Step 5: Click on the ''Further'' option.

Trading Platform

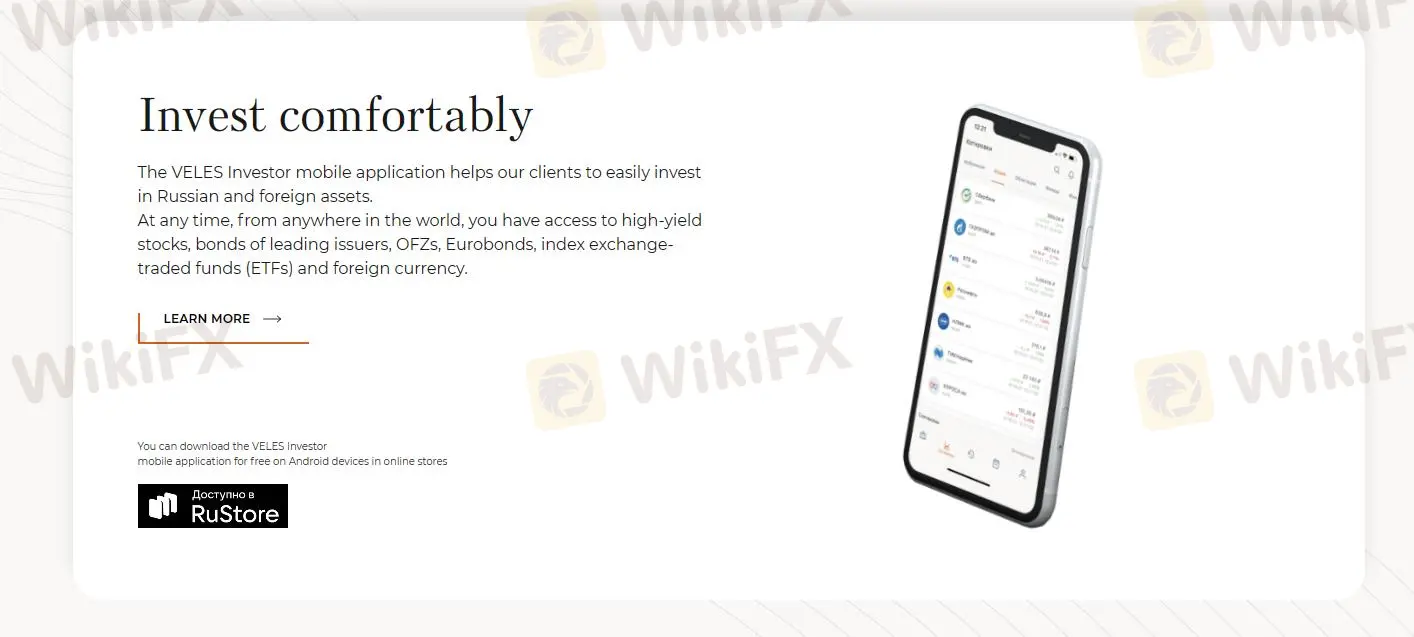

VELES Capital caters to the modern investor by providing access to their innovative trading platform, the VELES Investor mobile application. This user-friendly app empowers clients to seamlessly invest in a diverse range of Russian and foreign assets directly from their mobile devices. It ensures that investors can stay connected to the markets and manage their portfolios with ease, making it a valuable asset for both seasoned traders and newcomers alike.

Customer Service

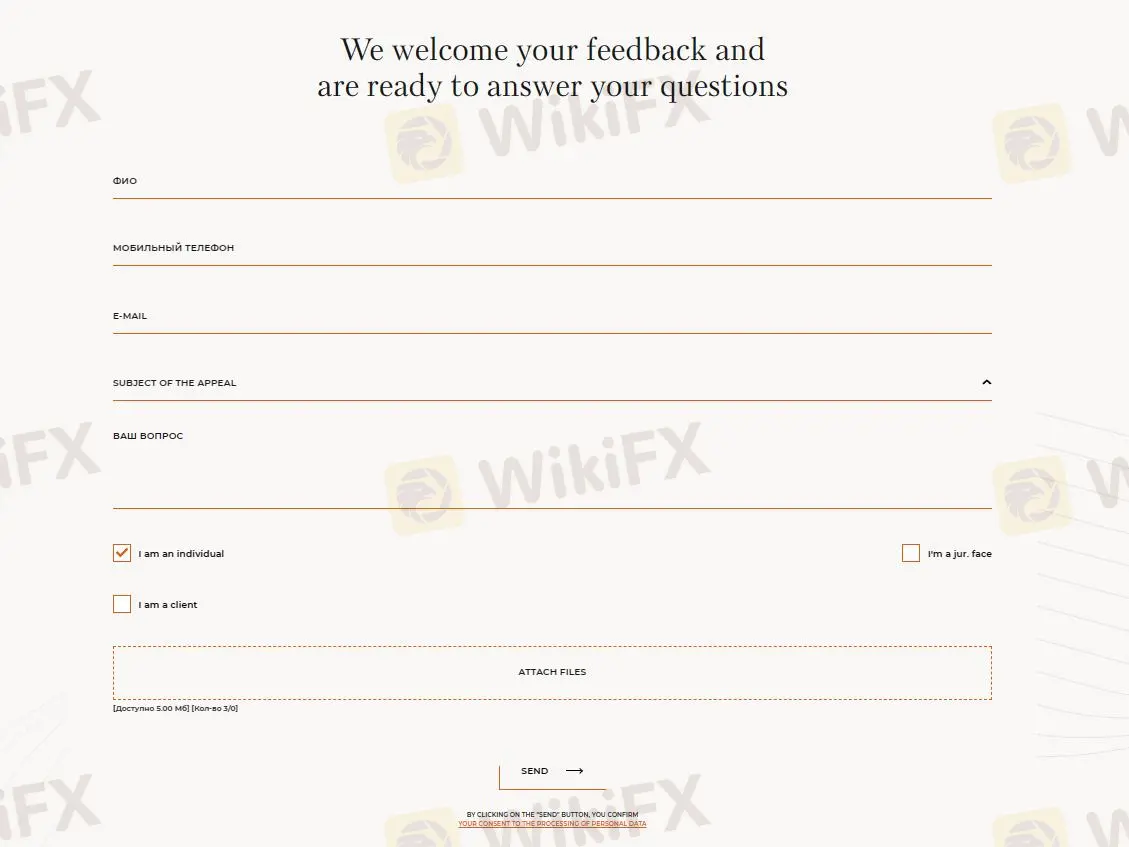

VELES Capital provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Phone: 8 (800) 500-23-33, +7 (495) 258-19-88

Email:veles@veles-capital.ru

Address: IC Veles Capital LLC, Russia, Moscow, Krasnopresnenskaya nab., 12, entrance 7, этаж 18 World Trade Center-II

Contact form

Conclusion

In conclusion, VELES Capital offers a diverse range of financial services tailored to meet the needs of wealthy private clients. With comprehensive offerings such as asset management, investment consulting, and brokerage services, the firm provides clients with ample opportunities to preserve and grow their assets. Additionally, the accessibility of a brokerage account with no minimum deposit requirement makes investing more inclusive and attainable for investors of all levels.

However, VELES Capital currently lacks valid regulation, which raises concerns about its safety and legitimacy. Regulatory oversight is crucial for ensuring client protection and transparency in the financial services industry.

Frequently Asked Questions (FAQs)

| Question 1: | Is VELES Capital regulated? |

| Answer 1: | No. It has been verified that this broker currently has no valid regulation. |

| Question 2: | Does VELES Capital offer demo accounts? |

| Answer 2: | No. |

| Question 3: | What is the minimum deposit for VELES Capital? |

| Answer 3: | The minimum initial deposit to open an account is $0. |

| Question 4: | Does VELES Capital offer the industry leading MT4 & MT5? |

| Answer 4: | No. Instead, it offers the VELES Investor mobile application. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

Rupee gains against Euro

ACY Securities Expands Global Footprint with South Africa Acquisition

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Exness: Revolutionizing Trading with Cutting-Edge Platforms

Currency Calculator