简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

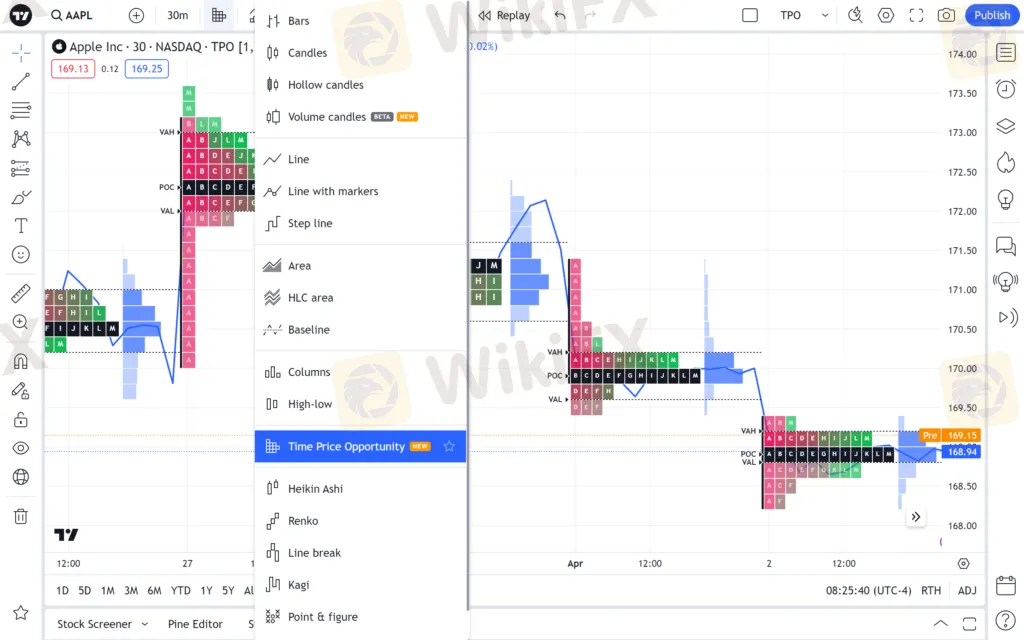

TradingView Unveils Time Price Opportunity Chart for Enhanced Market Analysis

Abstract:TradingView introduces a new Time Price Opportunity chart type, allowing traders to better analyze price activities and set precise targets through detailed visual profiles. This feature caters exclusively to Premium users.

TradingView has announced the launch of a new kind of chart called the Time Price Opportunity (TPO). Traders are poised for positive developments as this novel instrument aims to equip users with an enhanced comprehension of market operations. As a result, they can spot price junctures with high activity and make more accurate predictions about the market's future direction.

The TPO chart provides traders with a comprehensive view of price swings happening at certain periods, such as daily, weekly, and monthly. It facilitates through the TPO profile, prominently positioned on the left side of the chart, while the Volume Profile takes its place on the right. A central price line also serves as an additional reference point, enhancing the depth of data available for analysis.

One of the TPO chart's distinguishing advantages is its customizability. Traders can adjust the charts horizontal granularity, which determines the size of the time blocks dividing each period. Options for these blocks range from a compact five minutes to a more extended four-hour span. These blocks are uniquely identified with letters, such as “A” for the initial time block of a period, with subsequent blocks labeled consecutively. This labeling helps traders easily track price activity and its distribution through the trading period.

Additionally, the chart can automatically set the vertical granularity of each row in a profile or the user can manually specify the precise number of price ticks per row. This feature allows the traders to get an exact view of price levels that have seen the maximum and minimum activity, thus enabling more informed decision-making.

TradingView has also enhanced the usability of the TPO chart with neatly grouped settings. In the Line section, traders can select the underlying data for the price chart and customize its appearance. The Time Price Opportunity area allows changes to the main profile attributes, including colors and block, row, and period sizes. Additionally, the Lines and Labels section for the TPO profile offers further customization options, including the activation of various analytical lines like Point of Control (POC), Value Area High (VAH), Value Area Low (VAL), and others.

Accessibility to the TPO chart is exclusive to users with a Premium subscription or higher, aligning with TradingView's strategy of adding value to its more advanced service tiers. The company is making this change as part of a larger plan to keep improving the platform's features. The latest edition of the Volume Candles chart type is a big update that shows TradingView is still dedicated to giving its users the most up-to-date trade tools.

Trading strategies that aim to obtain an advantage must incorporate instruments such as the TPO chart, as the complexity of financial markets continues to rise. TradingView's TPO chart type is positioned to become an indispensable tool for market participants seeking to refine their trading decisions and conduct more in-depth market analyses, owing to its customizable options and sophisticated features.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator