简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Alert: Avoid CryptoFixed-Incom Fraudulent Practices

Abstract:Kenyan investor J.K.M.'s loss exposes CryptoFixed-Incom's scam, urging diligence in digital investments amid false promises and locked funds.

In the digital investment world, the allure of quick profits often leads investors to navigate risky waters, especially when engaging with platforms like CryptoFixed-Incom. Their website is well-designed, and they make grand promises about their competence, but they are frequently involved in unethical and dishonest acts. At the center of this controversy is the unfortunate experience of J.K.M., an investor from Kenya, who encountered what appears to be a deceptive trap.

J.K.M., venturing into the investment scene for the first time, was introduced to CryptoFixed-Incom via a recommendation from a friend on social media. Motivated by the prospect of financial growth, J.K.M. invested $112, a substantial sum for someone new to this field. The investment was supposed to be straightforward: deposit the funds, allow the broker's alleged experts to manage the trade for a week, and then enjoy the returns. However, the unfolding reality was starkly different.

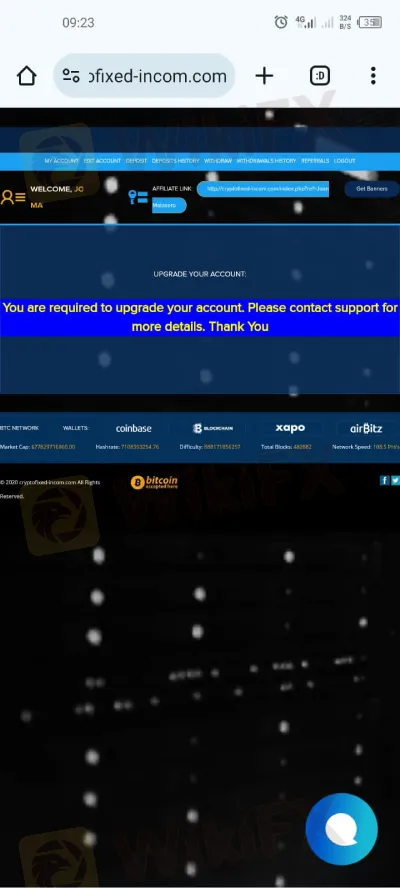

Just four days into the investment, J.K.M.'s account was suddenly and without explanation locked. The stated reason for this action was a required account upgrade, demanding an additional $950 to unlock the promised returns and the original investment. Numerous emails from CryptoFixed-Incom followed this demand, urging J.K.M. to make this additional deposit.

The anticipated return on investment, including the initial $112, totaled $907—a sum that J.K.M. had never been able to access or withdraw. Such an inability to retrieve one's investment casts a long shadow over the trustworthiness and ethical practices of CryptoFixed-Incom.

A closer examination of the brokers self-presentation does little to alleviate these concerns. Despite proclaiming itself as a leading and expert global equity firm, its unregulated and unlicensed status is a significant concern. This status is a major warning sign in the investment sphere, indicating potential risks that could jeopardize investor funds. The broker's proud presentation of its platform, boasting over 1,000 assets and cutting-edge technology, rings hollow against the backdrop of its operational practices.

The experiences of investors like J.K.M., who discover themselves trapped in a cycle of broken promises and inaccessible funds, seriously tarnish the promise of instant execution and real-time results.

This article highlights the significance of conducting comprehensive research and evaluating the regulatory standing of the broker before allocating funds, thereby cautioning prospective investors. The practices of CryptoFixed-Incom, characterized by enticing promises followed by demands for more money, underscore the perils present in the less regulated corners of the online investment world.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Malaysian influencer Hu Chang Mun, widely known as Ady Hu, has been detained in Taiwan for his alleged involvement in a fraudulent operation. The 31-year-old, who was reported missing earlier in December, was located by Taiwanese authorities after suspicions arose regarding his activities.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

TradingView Launches Liquidity Analysis Tool DEX Screener

Discover TradingView's DEX Screener, a powerful tool for analyzing decentralized exchange trading pairs. Access metrics like liquidity, trading volume, and FDV to make smarter, data-driven trading decisions.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator