简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Mizuho Bank

Abstract: Mizuho Bank is registered in Japan and was founded in 2016. It is currently unregulated and offers a range of financial instruments including foreign currency deposits, settlement and payment services, investment trusts, NISA (a type of tax-exempt investment account in Japan), loans, insurance, iDeCo (individual-type defined contribution pension plan), inheritance and trust products, and operates an online platform called Mizuho Direct. Their trading platforms include Meta4 and Meta5, presumably referring to MetaTrader 4 and MetaTrader 5, which are popular forex trading platforms. Customer support is provided through online chat, and the bank allows deposits and withdrawals through credit/debit cards, Skrill, and NETELLER.

| Aspect | Information |

| Company Name | Mizuho Bank |

| Registered Country/Area | Japan |

| Founded Year | 2016 |

| Regulation | Unregulated |

| Market Instruments | Foreign Currency Deposits,Settlement & Payment Services,investment trust,NISA: NISA,loan,insurance,iDeCo,Inheritance & Trust Products,Mizuho Direct |

| Trading Platforms | Meta4,Meta5 |

| Customer Support | Online chat |

| Deposit & Withdrawal | General Account,Savings Deposits,Asset Accumulation Savings,Savings account ,Global Account |

Overview of Mizuho Bank

Mizuho Bank is registered in Japan and was founded in 2016. It is currently unregulated and offers a range of financial instruments including foreign currency deposits, settlement and payment services, investment trusts, NISA (a type of tax-exempt investment account in Japan), loans, insurance, iDeCo (individual-type defined contribution pension plan), inheritance and trust products, and operates an online platform called Mizuho Direct.

Their trading platforms include Meta4 and Meta5, presumably referring to MetaTrader 4 and MetaTrader 5, which are popular forex trading platforms. Customer support is provided through online chat, and the bank allows deposits and withdrawals through credit/debit cards, Skrill, and NETELLER.

Is Mizuho Bank Limited Legit or a Scam?

Mizuho Bank is currently unregulated. Typically, financial institutions undergo stringent regulatory oversight to ensure compliance with financial laws and consumer protections.

However, the designation of 'unregulated' suggests that Mizuho Bank may not be subject to the same degree of regulatory scrutiny as other banks, or it could indicate a specific area of its operations that lacks regulation.

Pros and Cons

| Pros | Cons |

| Diverse Financial Instruments | Unregulated |

| Advanced Trading Platforms | Limited Information on Regulation |

| Multiple Deposit & Withdrawal Methods | Newly Founded |

| Online Customer Support | Potential Platform Limitations |

| Digital Presence | Niche Services |

Pros of Mizuho Bank:

Diverse Financial Instruments: Mizuho Bank offers a wide range of market instruments, including foreign currency deposits, investment trusts, and various pension and trust products, catering to diverse investment needs and financial planning.

Advanced Trading Platforms: The availability of Meta4 and Meta5 platforms suggests the bank provides advanced tools for forex and possibly other types of trading, which could be beneficial for experienced traders seeking robust trading technology.

Multiple Deposit & Withdrawal Methods: With options to deposit and withdraw funds through credit/debit cards, Skrill, and NETELLER, customers have the convenience of multiple payment methods.

Online Customer Support: The provision of online chat for customer support can offer quick and convenient assistance to customers, which is valuable for timely issue resolution.

Digital Presence: The mention of Mizuho Direct indicates that the bank has a digital platform, which can provide customers with easy access to banking services from anywhere.

Cons of Mizuho Bank:

Unregulated: The bank is listed as unregulated, which may raise issues about the security of customers' investments and the reliability of the bank's practices.

Limited Information on Regulation: The absence of regulatory information could suggest a lack of transparency or oversight, potentially leading to hesitation among cautious investors.

Newly Founded: Being established in 2016, Mizuho Bank might lack the long-term track record and reputation of older, more established banks.

Potential Platform Limitations: While Meta4 and Meta5 are advanced platforms, they are typically associated with forex trading, which might limit options for those interested in other types of investment assets.

Niche Services: Some of the services, like NISA and iDeCo, are specific to the Japanese market, which may not be advantageous for international customers who are unfamiliar or unable to access these products.

Market Instruments

Mizuho Bank provides a comprehensive suite of market instruments, products, and services designed to cater to a variety of financial needs and operations.

These include Foreign Currency Deposits, allowing customers to hold funds in various currencies; Settlement & Payment Services to facilitate smooth transactions; Investment Trusts, offering managed investment opportunities; and the NISA account, which is a tax-exempt savings plan in Japan.

Additionally, the bank offers loans to individuals and businesses, insurance products for risk management, iDeCo which is Japan's individual-type defined contribution pension plan, and Inheritance & Trust Products for estate planning and wealth transfer.

Mizuho Direct is likely an online service portal providing direct access to the bank's offerings. These services aim to address the diverse financial requirements of their customers, from everyday banking to investment and retirement planning.

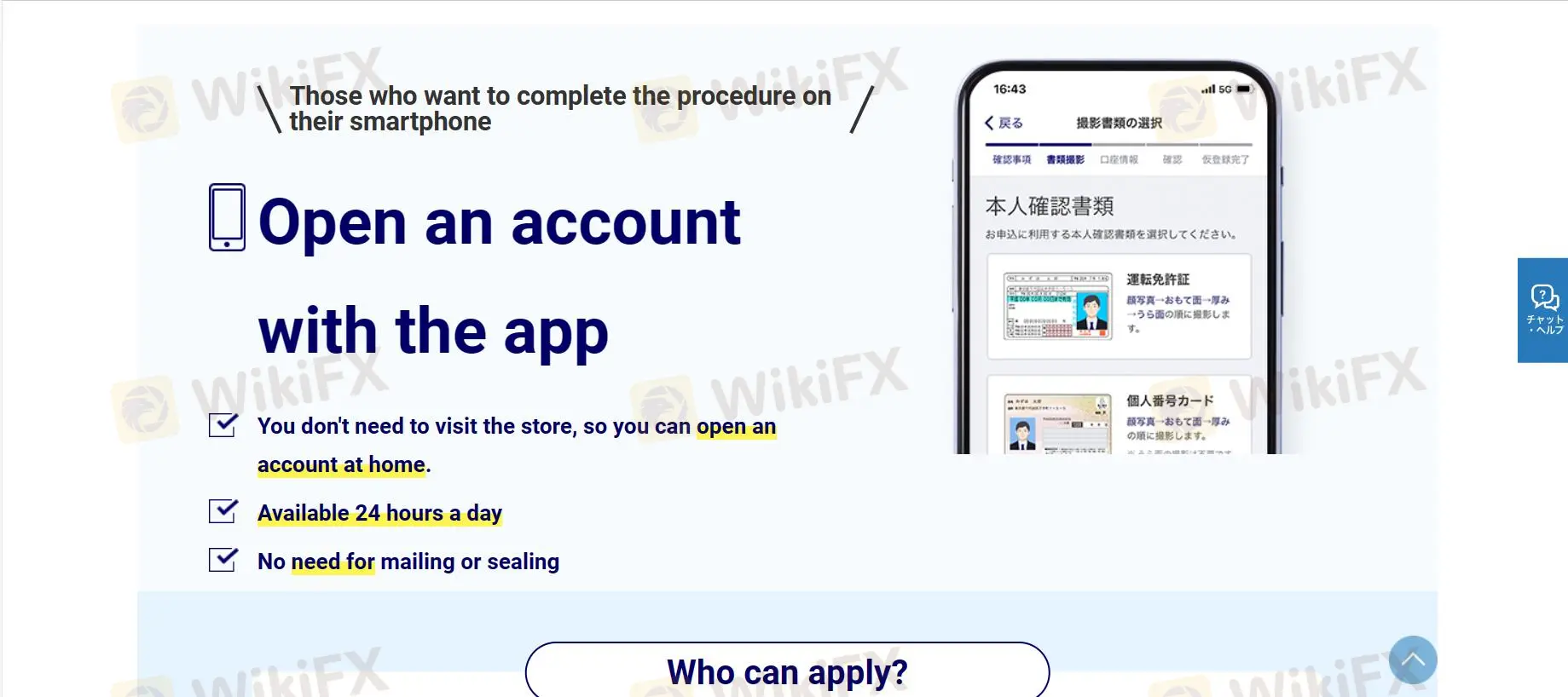

How to Open an Account?

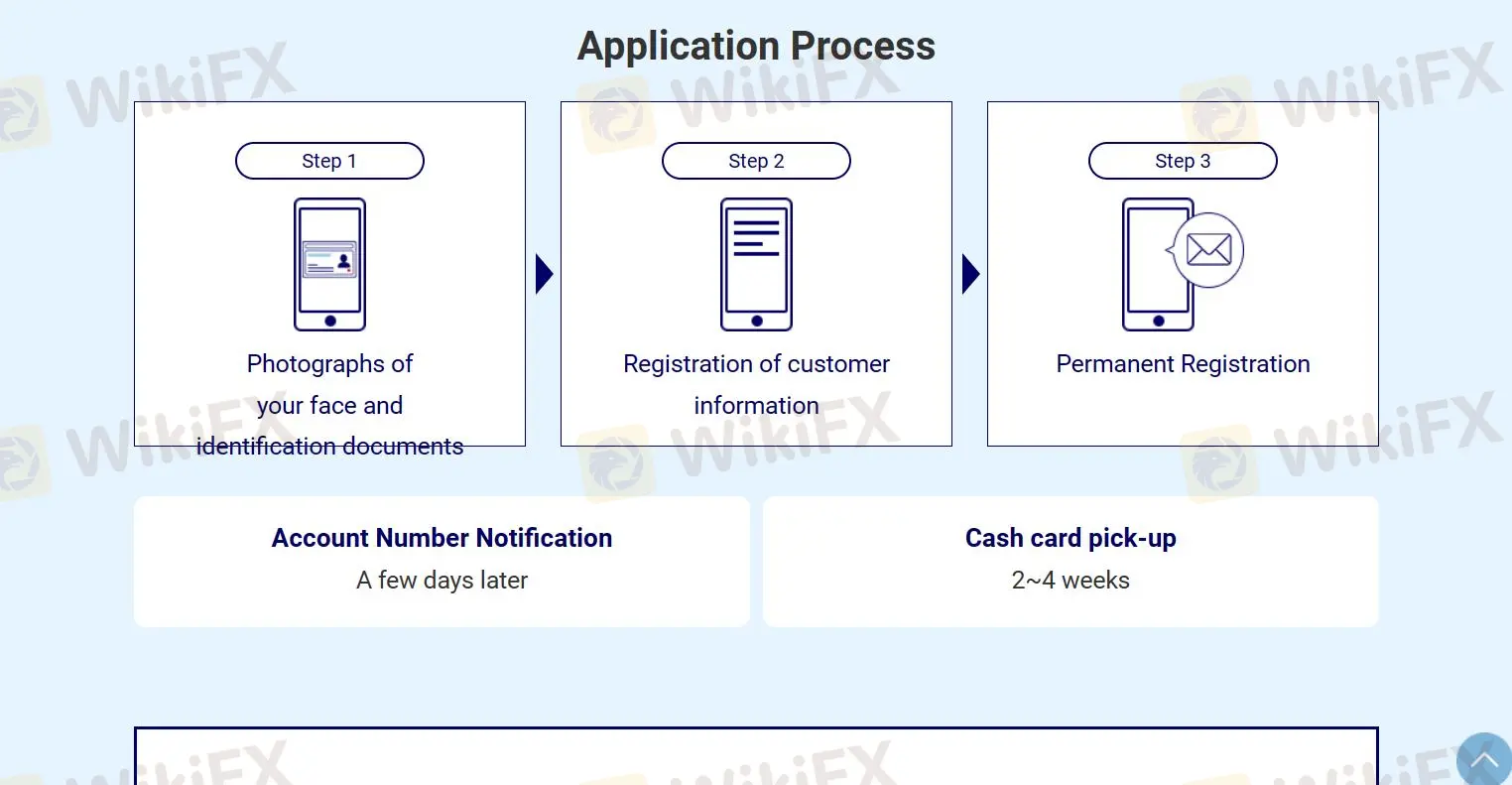

Opening an account involves three simple steps:

Download the bank's mobile application to your smartphone.

Complete the required personal information forms within the app.

Verify your identity, possibly by uploading or capturing images of necessary identification documents through the app.

Submit your application for review and await confirmation from the bank.

After these steps, your account will be ready for trading.

Trading Platform

The trading platform mentioned for Mizuho Bank in the previously discussed image is “Meta4, Meta5,” which appears to be a reference to MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

These are widely-used electronic trading platforms for the Forex, futures, and CFD markets, developed by MetaQuotes Software. MT4 is known for its user-friendly interface, robust security, and strong analytical tools, while MT5 offers additional features like more timeframes, built-in economic calendars, and advanced financial trading functions with a broader range of instruments.

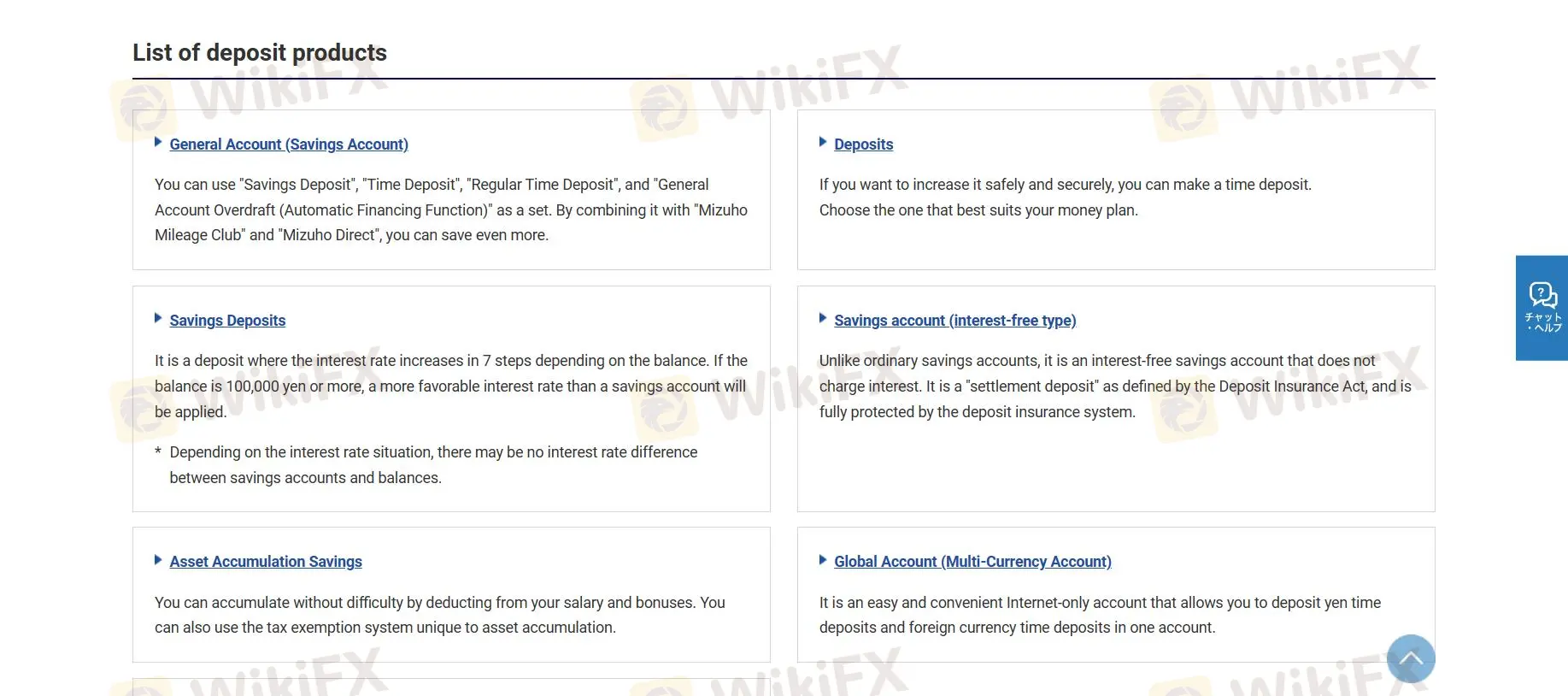

Deposit & Withdrawal

General Account (Savings Account) :This account allows the use of 'Savings Deposit', 'Time Deposit', 'Regular Time Deposit', and 'General Account Overdraft (Automatic Financing Function)'. When combined with 'Mizuho Mileage Club' and 'Mizuho Direct', customers can potentially increase their savings.

Savings Deposits :This type of deposit has a tiered interest rate that increases in seven steps based on the account balance. For balances of 100,000 yen or more, a more favorable interest rate than a regular savings account may be applied. However, the interest rate advantage can fluctuate depending on the overall interest rate environment.

Asset Accumulation Savings :Customers can accumulate savings by setting aside a portion of their salary and bonuses. This product might also offer a tax exemption benefit unique to asset accumulation accounts.

Savings account (interest-free type) :An interest-free savings account option is available that does not charge interest, classified as a 'settlement deposit' under the Deposit Insurance Act, thus providing full protection under the deposit insurance system.

Global Account (Multi-Currency Account) :A convenient internet-only account that supports both yen time deposits and foreign currency time deposits within the same account, making it ideal for customers dealing with multiple currencies.

Customer Support

Customer support for Mizuho Bank is available through online chat. This allows customers to receive assistance with their banking needs in a convenient and timely manner without the need to visit a branch in person.

Conclusion

Mizuho Bank presents a modern banking solution with a variety of financial products and services tailored to meet diverse customer needs. It embraces technology, as evidenced by the ability to manage accounts via a comprehensive mobile app, offering online chat for customer support.

The bank's array of deposit products caters to different financial goals, whether for saving or investment, including interest-bearing savings options, asset accumulation plans, and multi-currency accounts. Its trading platforms, Meta4 and Meta5, suggest a focus on providing advanced tools for investment and trading.

Moreover, Mizuho Bank accommodates flexible deposit and withdrawal methods, including credit/debit cards and e-wallets like Skrill and NETELLER, to facilitate easy and convenient transactions for its customers.

FAQs

Q: Is there a minimum balance required for a savings deposit to earn increased interest?

A: Yes, the interest rate for savings deposits increases in 7 steps, starting from a balance of 100,000 yen, with more favorable interest rates applied as your balance grows.

Q: Do I need to visit a branch to open an account with Mizuho Bank?

A: No, you can complete the entire account opening process using your smartphone and the Mizuho Bank app without the need to visit a branch.

Q: Is there a deposit account available that doesn't charge interest?

A: Yes, Mizuho Bank offers an interest-free savings account that is classified as a “settlement deposit” and is fully protected by the deposit insurance system.

Q: What type of customer support does Mizuho Bank offer?

A: Mizuho Bank offers customer support through an online chat system, making it easy to get assistance without visiting a branch.

Q: Can I manage foreign currency deposits through Mizuho Bank?

A: Yes, the Global Account (Multi-Currency Account) at Mizuho Bank allows you to handle yen time deposits and foreign currency time deposits all within one account, and it is internet-only for easy management.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator