简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DIOPTION

Abstract:DIOPTION, a company established in 2021 and headquartered in New Zealand, operates as an unregulated broker, offering enticing investment plans to its clients. With a minimum deposit requirement of $1,000, investors can choose from three distinct plans, each promising varying levels of profit returns: 35%, 50%, or even 100% on their initial investment. Despite its unregulated status, DIOPTION provides customer support via email at support@dioption.com and exclusively accepts Bitcoin for transactions. However, its website status is currently down, which may raise concerns about accessibility and reliability. Therefore, investors should carefully assess the risks and consider alternatives before engaging with DIOPTION.

| Aspect | Information |

| Registered Country/Area | New Zealand |

| Founded year | 2021 |

| Company Name | DIOPTION |

| Regulation | Unregulated |

| Minimum Deposit | $1,000 |

| Investment Plans | - 35% Total Profit Return Plan: Minimum investment of $1,000, total profit return of 35%.- 50% Total Profit Return Plan: Minimum investment of $1,000, total profit return of 50%. - 100% Total Profit Return Plan: Minimum investment of $1,000, total profit return of 100%. |

| Customer Support | Email support@dioption.com |

| Payment Methods | Bitcoin |

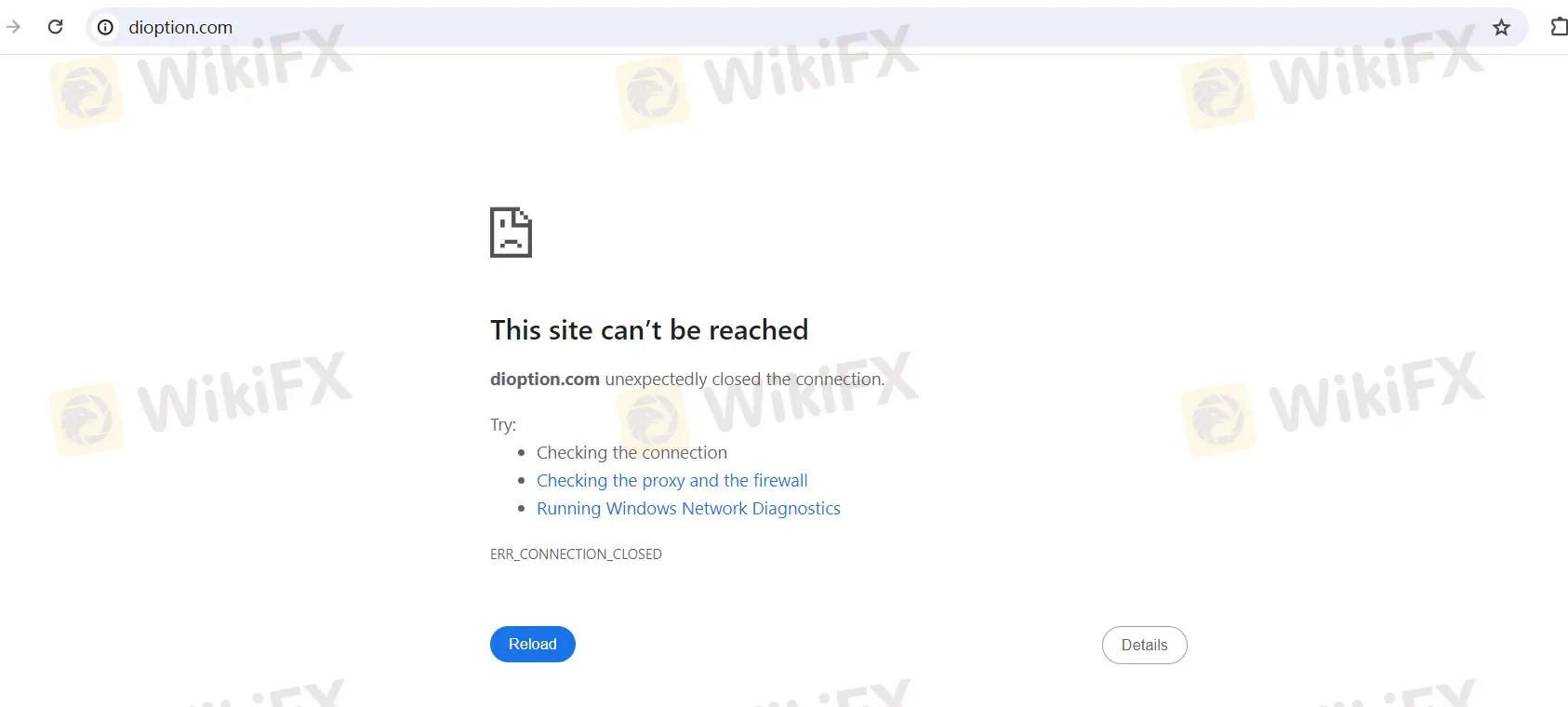

| Website Status | Down (At the time of information) |

Overview

DIOPTION, a company established in 2021 and headquartered in New Zealand, operates as an unregulated broker, offering enticing investment plans to its clients. With a minimum deposit requirement of $1,000, investors can choose from three distinct plans, each promising varying levels of profit returns: 35%, 50%, or even 100% on their initial investment. Despite its unregulated status, DIOPTION provides customer support via email at support@dioption.com and exclusively accepts Bitcoin for transactions. However, its website status is currently down, which may raise concerns about accessibility and reliability. Therefore, investors should carefully assess the risks and consider alternatives before engaging with DIOPTION.

Regulation

DIOPTION operates as an unregulated broker, lacking oversight from financial authorities. Investing with unregulated brokers poses higher risks as they may not adhere to industry standards or offer investor protection measures. Traders should exercise caution and consider regulated alternatives to ensure the safety of their investments.

Pros and Cons

DIOPTION presents investors with enticing investment plans, offering potential profit returns of up to 100% on their initial investment. However, as an unregulated broker, it lacks oversight from financial authorities, posing higher risks for investors. While the exclusive use of Bitcoin streamlines deposit and withdrawal processes, the minimum investment requirement of $1,000 may deter some investors. Additionally, the broker's suspicious website downtime raises concerns about reliability and transparency. Therefore, investors should carefully weigh the potential returns against the associated risks before engaging with DIOPTION.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Investment Plans

DIOPTION offers three distinct investment plans:

35% Total Profit Return Plan: With a minimum investment of $1,000, investors can expect a total profit return of 35% on their initial investment.

50% Total Profit Return Plan: Investors can opt for this plan with the same minimum investment of $1,000, which promises a total profit return of 50%.

100% Total Profit Return Plan: For those seeking higher returns, DIOPTION provides a plan where investors can anticipate doubling their initial investment, yielding a total profit return of 100%.

Each plan provides investors with varying levels of potential returns, catering to different risk appetites and investment goals. However, investors should carefully consider the associated risks and conduct due diligence before deciding on a plan.

Deposit & Withdrawal

As DIOPTION exclusively deals in Bitcoin, the deposit and withdrawal processes are tailored to cryptocurrency transactions:

Deposit:

To deposit funds, investors transfer Bitcoin from their personal wallet or exchange account to DIOPTION's designated Bitcoin wallet address.

After initiating the transfer, the Bitcoin network verifies and processes the transaction, typically within minutes to a few hours.

Once the deposit is confirmed on the blockchain, the funds reflect in the investor's DIOPTION account, allowing them to proceed with their chosen investment plan.

Withdrawal:

To withdraw funds, investors submit a withdrawal request through the DIOPTION platform, specifying the amount of Bitcoin they wish to withdraw.

DIOPTION processes the withdrawal request internally and transfers the requested Bitcoin amount to the investor's designated Bitcoin wallet address.

The withdrawal process typically takes a similar amount of time as deposits, with Bitcoin transactions being confirmed on the blockchain within minutes to hours.

Given the decentralized and borderless nature of Bitcoin, deposit and withdrawal transactions are typically faster and more efficient compared to traditional fiat currency transactions. However, investors should remain vigilant regarding security practices to safeguard their cryptocurrency holdings.

Customer Support

DIOPTION's customer support operates primarily through email, with the designated email address support@dioption.comserving as the primary point of contact for inquiries, assistance, and issue resolution. Customers can reach out to this email address with their queries related to account management, investment plans, deposit and withdrawal processes, technical support, and any other concerns they may have. DIOPTION aims to provide timely responses and assistance to ensure a smooth and satisfactory experience for its users. Additionally, depending on the broker's policies, there may be other channels of communication such as live chat or telephone support to further assist customers.

Conclusion

In conclusion, DIOPTION presents itself as an unregulated broker offering enticing investment plans exclusively in Bitcoin. While its investment options may appeal to some investors seeking high returns, the lack of regulation and oversight poses significant risks. Additionally, the exclusive reliance on Bitcoin for deposits and withdrawals, coupled with a suspicious website downtime, raises concerns about the broker's reliability and transparency. Investors should exercise caution and consider regulated alternatives to mitigate potential risks and safeguard their investments effectively.

FAQs

Q1: Is DIOPTION regulated by any financial authorities?

A1: No, DIOPTION operates as an unregulated broker, lacking oversight from financial regulators.

Q2: What are the minimum investment requirements for DIOPTION's investment plans?

A2: The minimum investment for all investment plans offered by DIOPTION is $1,000.

Q3: How do I deposit funds into my DIOPTION account?

A3: To deposit funds, transfer Bitcoin from your personal wallet or exchange account to DIOPTION's designated Bitcoin wallet address.

Q4: What is the withdrawal process for DIOPTION?

A4: To withdraw funds, submit a withdrawal request through the DIOPTION platform, specifying the amount of Bitcoin you wish to withdraw. The requested Bitcoin amount will be transferred to your designated Bitcoin wallet address.

Q5: How can I contact DIOPTION's customer support?

A5: DIOPTION's customer support primarily operates through email. You can reach out to them at support@dioption.com for inquiries, assistance, and issue resolution.

Risk Warning

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

STARTRADER warns against counterfeit sites and apps using its brand name. Protect yourself by recognizing official channels to avoid fraudulent schemes.

Dukascopy Bank Expands Trading Account Base Currencies

Dukascopy Bank now offers AED and SAR as base currencies for trading, expanding options for clients to fund accounts in Dirham and Riyal.

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Capital.com transitions to a regional leadership model as Kypros Zoumidou steps down, promoting Christoforos Soutzis as CEO of its Cyprus operations.

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

Webull has announced the launch of a new 24/5 Overnight Trading feature for U.S. users, developed in partnership with Blue Ocean ATS. This feature allows Webull’s clients to trade stocks and ETFs outside traditional market hours, from 8:00 pm to 4:00 am ET, Sunday through Thursday.

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Currency Calculator