简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How To Use Finviz In Forex Trading?

Abstract:Finviz, standing for “Financial Visualization,” is an inclusive online platform catered towards financial professionals, traders, and investors, providing a wide array of tools, data, and resources for analyzing financial markets, especially stocks.

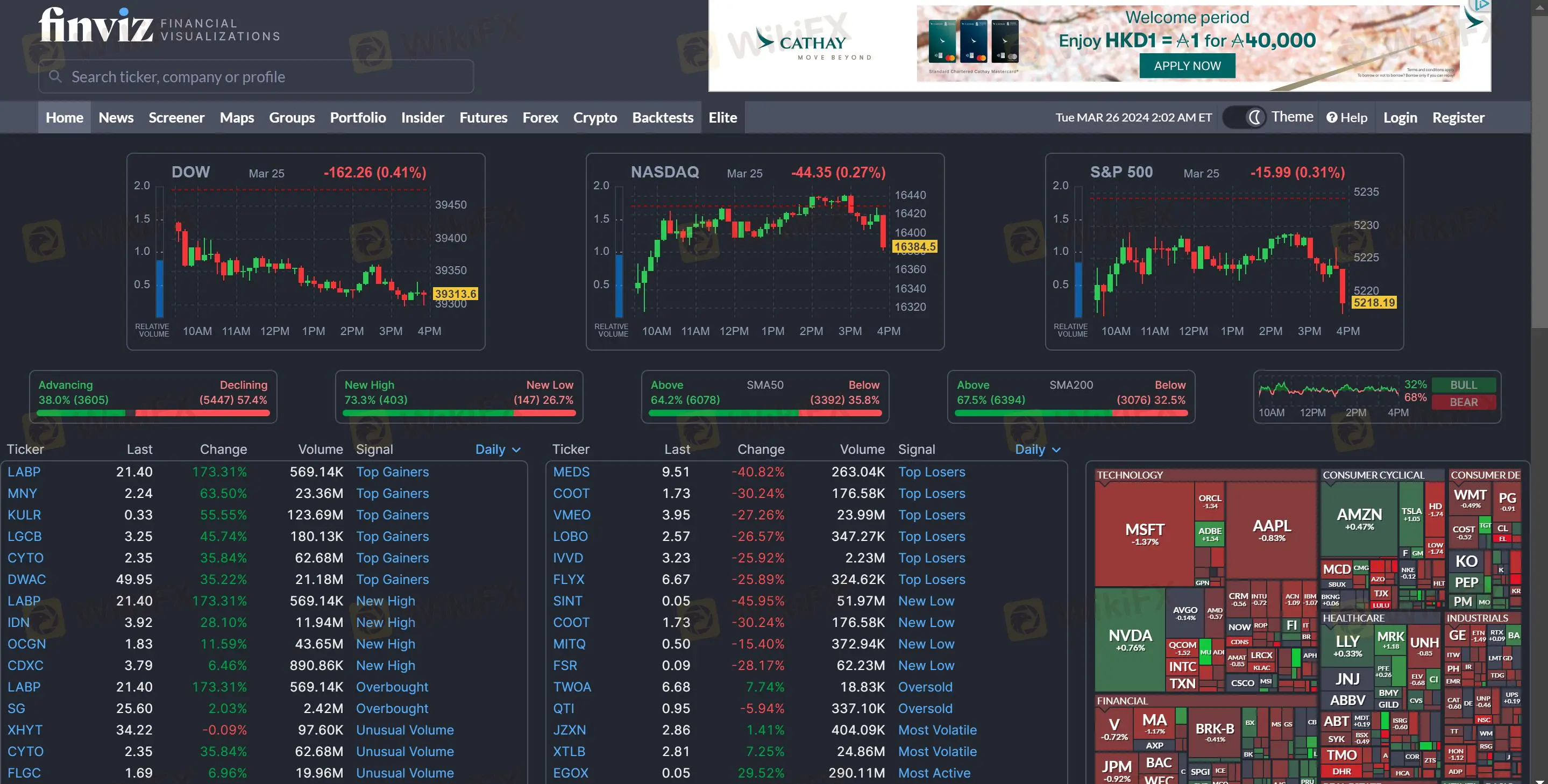

What is Finviz?

Finviz, standing for “Financial Visualization,” is an inclusive online platform catered towards financial professionals, traders, and investors, providing a wide array of tools, data, and resources for analyzing financial markets, especially stocks.

Besides its utility for analyzing stocks, Finviz also provides tools and data that can enhance forex trading strategies. The platform serves as a visual representation of trends across stocks and market, aiding users to dig deeper into specific information. Users, both beginners and advanced, can use this platform to track and screen stocks, ETFs, futures, forex, cryptocurrencies, and more based on criteria like share price, market cap or signals like insider buying.

The platform also offers features for viewing comprehensive financial information and visualizing data. Available in both free and premium versions, the premium version offers more advanced tools and features.

Three Main Categories of Finviz

The platform is divided into three main categories, Descriptive, Fundamental, and Technical, which helps you set criteria to find the exact trades you're interested in. The platform's screener, which is free to use, allows users to zero in on specific stock targets.

Descriptive

Firstly, in the “Descriptive” category, you are introduced to the most basic screening tools. This includes parameters such as market capitalization, which differentiates between large and small cap stocks, earnings dates, the industry sector, optionability, volume, and more.

Fundamental

Secondly, the “Fundamental” category is perfectly suited for ratio-focused analysts. This allows you to filter stocks by P/E ratios, gross margin, debt/equity, payout ratio, and more. It's an excellent tool for building portfolios based on dividend payouts or potential growth indicated by ratio analysis.

Technical

Lastly, the “Technical” category targets investors interested in current technical trends. This section allows for the segregation of stocks based on current placements, such as stocks below their 200-day moving averages or in a downward flag pattern. Factors considered could range from candlestick formations to recent gaps.

Functions of Finviz

- Application in Trend Following Strategy: This famous forex trading strategy leverages Finviz to filter forex pairs based on their prevailing long-term trends. Traders can utilize the “Performance” tab to categorize these pairs using their performance over diverse timeframes.

- Usage in Breakout Strategy: This strategy involves identifying significant levels of support and resistance, and trades when the price breaks these levels. Finviz aids in identifying forex pairs approaching such key levels. Traders can employ the “Technical” tab to filter based on indicators such as moving averages, trend lines, and chart patterns.

- Role in Range Trading Strategy: This strategy necessitates the identification and trading within a range-bound market. Finviz can pinpoint forex pairs trading within a specific price range. The “Chart” tab enables traders to observe the price action of forex pairs, and identify crucial support and resistance levels.

- Utility in News Trading Strategy: This strategy capitalizes on the market volatility driven by economic news releases. Finviz can help segregate forex pairs based on their correlation with certain economic indicators. The “News” tab offers a round-up of the economic news releases and allows the filtering of forex pairs in alignment with these news aspects.

- Involvement in Carry Trading Strategy: This strategy involves gaining from the interest rate differential between two currencies. Finviz can filter forex pairs according to their interest rate differentials. Via the “Fundamental” tab, traders can access various currencies' interest rates and filter forex pairs according to their interest rate differentials.

How to use Finviz In Forex Trading?

- First, navigate to Finviz's official website and create an account. The free account is somewhat limited in functionality, and if you need more advanced features, you may choose to upgrade for a fee.

- After logging into your account, click on the “Forex” tab at the top of the page. This will take you to a page showing the current positions and trends of various Forex currency pairs.

3. You can choose the currency pair you want to view on this page. For example, if you want to check the USD/JPY pair, simply choose it from the dropdown.

4. Finviz will provide detailed real-time quotes, historical data, charts, etc., for your chosen currency pair. At the same time, you can also see information on technical analysis and fundamental analysis, which is very helpful for determining the direction of the trade.

5. On the left-hand side of the page, you can see the “Performance” option. Here you can view the performance of a specific currency pair over different periods (such as 1 day, 1 week, 1 month, etc.). In addition, there are “Volatility” and “Liquidity” options, which can help you understand the market's fluctuations and the liquidity of the trade.

6. Under the “Screeners” option, you can set filters, such as sorting by rise and fall, heat, etc., to screen currency pairs. This can also help you find trading opportunities of interest to you.

7. You can also use the “Alerts” feature to set reminders. When the market meets your set conditions, the system will automatically send you an email notification.

Subscription Plan of Finviz

Finviz offers two subscription options: Monthly and Yearly plans. The Monthly subscription is priced at $39.50 per month, while the Yearly subscription costs $299.50, equivalent to $24.96 per month. Opting for the Yearly plan saves you $174.50 compared to the Monthly option.

Additionally, Finviz provides a full refund within the first 30 days of subscribing if customers are not satisfied with the service.

Pros & Cons of Finviz

Finviz offers several advantages for forex traders:

•Nice interface. Finviz provides a user-friendly and visually appealing interface, making navigation and analysis more intuitive.

•Many tools. The platform boasts a wide array of tools, including stock screener, charting options, economic calendar, and news updates, giving traders a comprehensive toolkit.

•Backtesting strategies. Traders can backtest their strategies using historical data, which is an essential feature for refining and optimizing trading approaches.

•Customization options. Finviz allows traders to customize their experience by creating watchlists, setting up alerts, and applying filters, enabling a more personalized and efficient trading process.

Finviz has several limitations for forex traders:

•Stock-centric. Its primary focus is on stocks, which means that forex traders may find its forex-specific resources limited.

•Premium features. Some of the most useful features on Finviz require a paid subscription, which can be costly for traders on a budget.

•Limited real-time data. Free users might experience delays in accessing real-time data, potentially impacting their ability to make timely trading decisions

FAQs

Q: What does relative strength mean in Finviz?

A: Relative strength in Finviz is a function that measures the performance of different securities, including forex pairs, relative to a selected benchmark or the market overall.

Q: What is the definition of a currency ETF?

A: A currency ETF, or exchange-traded fund, is a financial instrument that enables traders or investors to diversify their investment strategy by incorporating foreign currencies. The fund replicates the value of its respective currencies, allowing traders to profit from their value fluctuations.

Q: Is it possible to use Finviz for forex trading?

A: While Finviz is primarily a stock scanner and is not designed for direct forex trading, it can still be used indirectly for forex market analysis. For instance, traders can study stock market instruments that mirror forex quotations, like the FXE fund, which aligns with the movement of the EUR/USD currency pair.

Q: What does the relative performance indicator represent in forex?

A: In forex trading, the relative performance indicator helps traders assess the performance of one currency pair against another. It provides valuable insights into which pair is over or underperforming during a particular time frame.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

SQUARED FINANCIAL: Your Friend or Foe?

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

High-Potential Investments: Top 10 Stocks to Watch in 2025

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

US Dollar Insights: Key FX Trends You Need to Know

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Currency Calculator