简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is Forex Trading Profitable | How Much You Can Make in Forex

Abstract:Forex, short for foreign exchange, is the global market where currencies are traded against one another. Being the largest financial market in the world, the forex market features high liquidity and 24-hour operation from Monday to Friday. Investors range from international banks and governments to retail investors and traders, all engaged in buying, selling, and exchanging currencies at current or determined prices. The primary purpose of Forex trading is to facilitate international trade and investment by enabling currency conversion. It also offers opportunities for speculation on currency value changes due to economic, political, and market dynamics.

What Is Forex?

Forex, short for foreign exchange, is the global market where currencies are traded against one another. Being the largest financial market in the world, the forex market features high liquidity and 24-hour operation from Monday to Friday. Investors range from international banks and governments to retail investors and traders, all engaged in buying, selling, and exchanging currencies at current or determined prices. The primary purpose of Forex trading is to facilitate international trade and investment by enabling currency conversion. It also offers opportunities for speculation on currency value changes due to economic, political, and market dynamics.

Some Pros and Cons of Forex Trading

| ✅Pros | ❌Cons |

| • Easy Market Accessibility | • High Risk |

| • High Liquidity | • Regulatory Differences |

| • LeveragePower | • Potential for Overtrading |

| • Low Trading Cost | |

| • Profits from Market Movements |

How Does It Work?

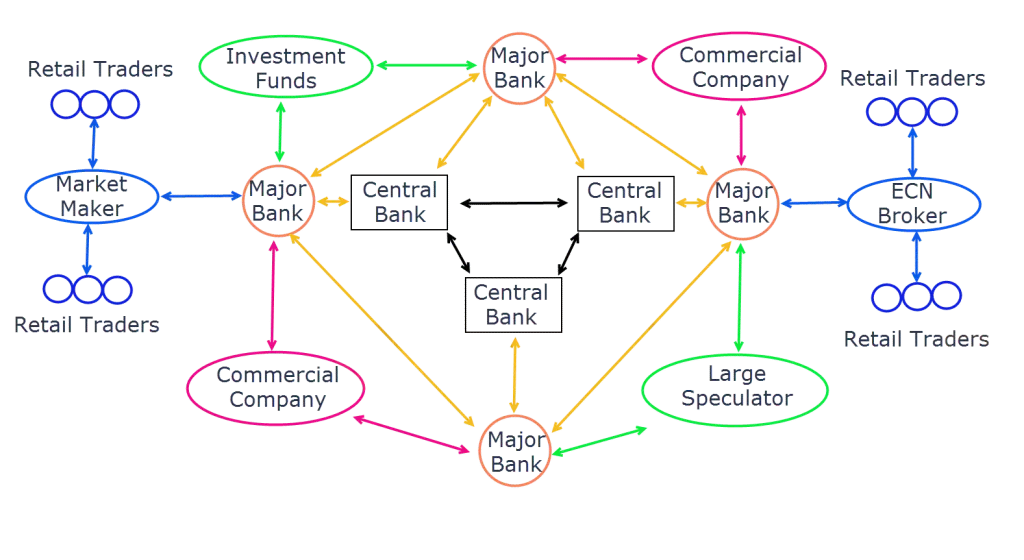

Traders and investors participate in this market to exchange currencies for various purposes, including international trade, investment, or to make a profit from currency value fluctuations. Currency pairs, such as EUR/USD or GBP/JPY, form the basis of forex trades, with prices fluctuating based on supply and demand dynamics, economic indicators, geopolitical events, and market sentiment. Trades are executed over-the-counter (OTC) through a network of banks, financial institutions, and individual traders, functioning 24 hours a day during weekdays, providing significant opportunities for profit but also entailing risk.

In Forex trading, there are three major parties involved:

Retail Traders: Individuals who participate in the market for personal investment purposes, trading through platforms provided by brokers.

Institutional Traders: This group includes banks, hedge funds, and large corporations that trade in the Forex market for profit, hedging, or transactional needs.

Brokers: Brokerage firms that provide access to the forex market for retail and institutional traders, acting as intermediaries to execute trades.

Is Forex Trading Profitable?

Here comes the core question: is forex trading profitable? The answer, as a matter of fact, is hard to define. Forex trading can be profitable, but it involves significant risks. Profitability depends on a trader's skill, strategy, risk management practices, and market understanding. While some traders achieve substantial returns, others may incur losses. Success in Forex trading requires continuous learning, discipline, and adaptation to market changes.

Let's say, a trader keeps a close eye on world economic news and decides to buy EUR/USD, betting that the euro will gain against the dollar. If the euro's value goes up after they buy, they can sell their euros back for more dollars, pocketing the difference as profit. But pulling this off isn't just about luck. It requires a sharp eye for market trends, a solid grasp of economic factors, and the discipline to follow a strict risk management strategy to avoid losing out when the market doesn't move in its favor.

How Much Can I Make in Forex?

Earnings from Forex trading can vary significantly, heavily depending on your initial investment, trading strategy, risk management techniques, and market volatility. For example, a trader with a disciplined approach and a $1,000 investment might target returns ranging from 5% to 20% monthly using effective strategies and rigorous risk management, though such outcomes are highly variable and not assured.

Consider a trader beginning with $5,000, applying leverage to secure a 10% return within a month, thus earning a $500 profit. It's essential, however, to acknowledge that Forex trading also carries the risk of losses, potentially exacerbated by leverage. Another trader could incur a 10% loss over the same period, highlighting the necessity for a solid grasp of market dynamics, stringent risk management, and setting realistic expectations.

In essence, while Forex trading presents opportunities for financial gain, it respect requires great respect for the market's intricacies and a steadfast commitment to continual learning and strategy enhancement.

Common Mistakes to Avoid in Forex Trading

Retail traders, on the forex market, struggle to survive, with widely cited data indicating that around 95% of them fail in their trading. Failed trading can say something. Many traders may be stuck with some commonn mistakes, like trading without a strategic plan, engaging in excessive trading, or allowing emotions to drive their decisions. Additionally, an intense focus on wins and losses, coupled with the lack of basics of forex trading, can also hinder their success. Here we list some common mistakes that most traders should avoid in forex trading.

• Not Having a Trading Plan: Imagine setting off on a journey without a map. That's trading without a plan. A solid plan details when to enter or exit trades and how to manage risks, acting as your roadmap in the forex market.

• Overusing Leverage: While leverage can magnify returns, it can also amplify losses. A trader using excessive leverage might see their account wiped out by a minor market fluctuation.

• Ignoring Risk Management: Skipping risk management tools like stop-loss orders can turn a manageable loss into a catastrophic one. For instance, a trader who doesn't set a stop-loss might hold onto a losing position too long, hoping for a turnaround that never comes.

• Emotional Trading: Decisions driven by fear or greed can derail your strategy. A trader might exit a winning position too early out of fear, missing out on substantial profits.

• Lack of Education: The Forex market's complexity demands constant learning. A trader unaware of the impact of interest rate decisions might be caught off-guard by sudden market movements.

• Overlooking Economic Indicators: Economic news can drastically affect currency values. For example, ignoring a scheduled Federal Reserve announcement might result in trading against the market trend.

• Chasing Losses: Trying to recover previous losses by increasing trade sizes can lead to even bigger losses. It's like doubling bets after each loss in gambling, a strategy that often ends poorly.

• Overtrading: Excessive trading can diminish your account through fees and poor decision-making. Trading ten times a day based on slight market movements often leads to marginal gains at best.

• Not Testing Strategies: Entering the market without validating strategies through backtesting or demo accounts is risky. It's similar to entering a race without having trained, likely leading to poor performance.

• Neglecting the Psychological Aspect: The mental challenge of Forex trading is substantial. A trader might panic and stray from their strategy after a series of losses, exacerbating their financial damage.

Some Useful Trading Stratgies for Successful Trading

To achieve success in Forex trading, adopting strategies tailored to individual trading goals and market conditions is essential. Here are refined strategies with detailed examples to guide your trading endeavors:

Trend Following: This strategy capitalizes on the momentum of market trends. For example, if the USD/CAD has been consistently climbing for several weeks, a trend follower would look to enter a long position, riding the wave of the uptrend until signs of a reversal appear.

Range Trading: Ideal for markets that are moving sideways. A trader might observe that the EUR/JPY pair frequently bounces between 125.00 and 127.00. By buying near 125.00 support and selling near the 127.00 resistance, traders can profit from this predictability.

Scalping: Focuses on making rapid trades to capture small price changes. A scalper might target a liquid pair like EUR/USD, entering trades that last from seconds to minutes, aiming for a 5-10 pip gain each time.

Position Trading: Takes a macro view of the market, holding trades for weeks to months. A position trader might analyze long-term economic trends affecting the NZD/USD pair and decide to hold a long position based on positive growth forecasts for New Zealand's economy.

Carry Trade: This strategy seeks to profit from the interest rate differential between two currencies. For instance, a trader might go long on AUD/JPY, earning the interest rate differential between the higher-yielding Australian dollar and the lower-yielding Japanese yen.

Breakout Trading: Traders enter the market when the price breaks out of a defined range or pattern. If the EUR/USD breaks past a resistance level at 1.2000 after consolidating, a breakout trader would take a long position, anticipating a new uptrend.

Fibonacci Retracement: Utilizes Fibonacci levels as potential support and resistance areas. After a significant uptrend in GBP/USD, a retracement to the 38.2% Fibonacci level might be seen as a potential entry point for traders expecting the uptrend to continue.

News Trading: Involves trading based on economic news releases. A news trader might buy GBP ahead of a predicted positive UK GDP report, expecting a bullish reaction in GBP pairs upon the news release.

Pivot Points: Used to identify significant support and resistance levels for the day. A day trader might use pivot points to determine entry and exit points for the USD/JPY, selling near the daily pivot resistance if the overall trend is bearish.

Hedging: Aims to reduce risk by opening multiple positions. If a trader has a long position in EUR/USD but fears short-term volatility from an upcoming ECB announcement, they might open a short position in EUR/GBP to hedge against potential EUR weakness.

Best Forex Brokers for Beginners to Consider

TickMill

|

|

| Broker | TickMill |

| Regulated by | FCA, CYSEC, FSCA, LFSA |

| Min. Deposit | $100 |

| Tradable Instruments | Forex, Stock Indices, Commodities, Bonds, Cryptocurrencies, Stocks, Bonds, ETFs, Furures, Options, and more |

| Trading Platforms | MetaTrader 5MetaTrader 4MetaTrader WebTrader PlatformMetaTrader for MacTickmill Mobile App |

| Trading Costs | Classic: spreads from 1.6 pips, no commissions chargedPro: spreads from 0.0 pips, commissions from $2 per side per lotVIP: spreads from 0.0 pips, commissions from $1per side per lot |

| Max. Leverage | 500:1 |

| No Deposit Bonus | $30 welcome bonus |

| Demo accounts | ✅ |

| Copy Trading | ✅ |

| Payment Methods | Skrill, Neteller, FasaPay, UnionPay, Credit Card |

| Customer Support | 7/24 |

Founded in 2014, TickMill is a reputable broker headquartered in London, United Kingdom, recognized and regulated by top-tier authorities, including FCA in the UK, CySEC in Cyprus, and FSCA in South Africa. The broker offers a comprehensive range of trading instruments, including Forex, Stock Indices, Commodities, Bonds, Cryptocurrencies, Stocks, Bonds, ETFs, Furures, Options, and more. TickMill supports both MetaTrader 4 and MetaTrader 5 platforms that are known for their advanced charting tools and user-friendly interface. Notably, the company takes pride in providing efficient customer support services that are available five days a week, ensuring seamless trading experiences for its users. Aside from this broker's easy accessible minimum deposit from $100, TickMill also offers a 'Welcome Account' with a $30 no-deposit bonus. This incentive allows novices or beginner traders to experience live trading conditions and grow their trading skills without risking any personal capital.

HYCM

|

|

| Broker | HYCM |

| Regulated by | ASIC, DFSA, CYSEC, FSC |

| Min. Deposit | $20 |

| Tradable Instruments | Forex, commodities, indices, cryptocurrencies and stocks |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, HYCM Trader |

| Trading Costs | Fixed spreads from 1.5 ipsVariable spreads from 1.2 pipsRaw Spreads from 0.1 pips |

| Max. Leverage | 500:1 |

| No Deposit Bonus | $100 |

| Demo accounts | ✅ |

| Copy Trading | ✅ |

| Payment Methods | Debit/Credit Card (Visa or Mastercard), Skrill, Neteller, China Union Pay, Interac or Wire Transfer |

| Customer Support | 5/24 |

Established in 1977, HYCM is a renowned Forex broker based in London, United Kingdom. It comes under the regulation of several regulators, including FCA in the UK and CySEC in Cyprus, and more. This multi-asset broker offers extensive tradable instruments including Forex, commodities, indices, cryptocurrencies and stocks. To start real trading, only $20 is enought to open an account on the HYCM platform. HYCM supports both the MetaTrader 4 and MetaTrader 5 platforms, as well as its proprietary HYCM Trader. It prides itself in offering top-notch customer service that's accessible five days a week. Positive user recognition has been achieved by HYCM over the years for its low spreads, fast order execution, and distinctive features like its multiple account types designed for various trading styles. When it comes to exploring why this broker show great favor for beginners. Firstly, this broker only requires a low minimm deposit of $20 to starrt real trading. Secondly, HYCM stands above most brokers, offering a 100% welcome bonus up to $100 to new clients without requiring any initial deposit.

Exness

|

|

| Broker | Exness |

| Regulated by | FCA, CYSEC, FSCA, DFSA |

| Min. Deposit | $10 |

| Tradable Instruments | Cryptocurrencies,Forex, Commodities, Stocks, Indices and more |

| Trading Platforms | Exness Trade app, Exness Terminal, MetaTrader 5, MetaTrader 4,MetaTrader WebTerminal, MetaTrader mobile |

| Trading Costs | Raw Spread: Spreads from 0.0 pips, with commissions at $3.5 per lotPro: Spreads from 0.1 pips, no commissions charged |

| Max. Leverage | Unlimited |

| AED Accounts | ✅ |

| Demo accounts | ✅ |

| Copy Trading | ✅ |

| Bonus | ❌ |

| Payment Methods | E-payment systems, bank cards, Bitcoin wallets, mobile banking methods, and even payments using bank cashiers |

| Customer Support | 7/24 |

Exness is a well-established forex broker that was founded in 2008, with its main operational base in Limassol, Cyprus, providing a broad spectrum of tradable instruments, including forex pairs, metals, indices, cryptocurrencies, energies, and stocks. To suit varying trader requirements, Exness offers numerous trading platforms such as MetaTrader 4 and MetaTrader 5, Exness Trade App, readily accessible across desktop, web, and mobile devices. Exness remains an excellent option among beginnes. Let's explore why. Standout features of Exness include superior customer support available 24/7 through multiple channels including live chat, email, and multilingual call services, giving great care to beginners. Secondly, it only requires a very low minimum deposit to start trading, from $10, surpassing many of its competitors.

Conclusion

Anyway, forex trading can be profitable for those who approach it with knowledge, a clear plan, and steady discipline. Earnings vary greatly, depending on how much you invest, how wisely you use leverage, and how well you understand the market. Success doesn't come overnight. It is about setting realistic goals, continually learning, and adapting your strategies. The potential to make money in Forex is real, but it demands a thoughtful, patient, and strategic approach to truly achieve that potential.

FAQs

How many forex trades can I make one day?

The number of Forex trades you can make in one day is unlimited. However, the actual number should be guided by your trading strategy, risk management principles, and market conditions, rather than attempting to hit a specific trade count. Quality over quantity is crucial in trading effectively and sustainably in the Forex market.

Can I start forex with $10 ?

Starting Forex trading with just $10 is possible and totally permited. There are brokers out there who welcome small deposits, offering micro or nano accounts that make it easy for anyone to get started, even on a tight budget. Keep in mind though, trading with a small sum like $10 might limit how you manage risks and deal with the ups and downs of the market.

How long does it take to learn forex?

Learning Forex trading is a journey that differs for everyone. If you're starting from scratch, you might get the hang of the basics in a couple of months with dedicated effort. However, becoming proficient and consistently successful can take upwards of a year, involving lots of learning and hands-on practice. Since the Forex market is always changing, mastering it is more of a continuous adventure than a one-time achievement. Traders must continuously refresh their knowledge and adjust their strategies to stay ahead.

What is more profitable than forex trading?

Forex trading is known for its high liquidity and potential for notable gains, but other areas like stock trading, options, cryptocurrencies, and even investments in tech startups or real estate can also be highly profitable. What matters most is how much you know about the market you're entering, how well you manage risks, and the strategy you follow. Essentially, the most profitable option varies from one investor to another, based on their expertise, risk appetite, and investment goals.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Review: Something You Need to Know About Markets4you

Markets4you, is a global forex broker launched in 2007. It was established in the British Virgin Islands. This broker offers its global traders various market instruments.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

Doo Financial Expands Reach with Indonesian Regulatory Licenses

PT. Doo Financial Futures, a subsidiary of the global financial services brand Doo Group, has secured regulatory approval from Indonesia’s Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI).

Webull Canada Expands Options Trading to TFSAs and RRSPs

Webull Canada launches options trading for TFSAs and RRSPs, offering Canadian investors tax-free growth and retirement savings optimization opportunities.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

WikiFX Review: Something You Need to Know About Markets4you

Malaysian Pensioner Loses RM823,000 in Fake Investment Scam

Currency Calculator