简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

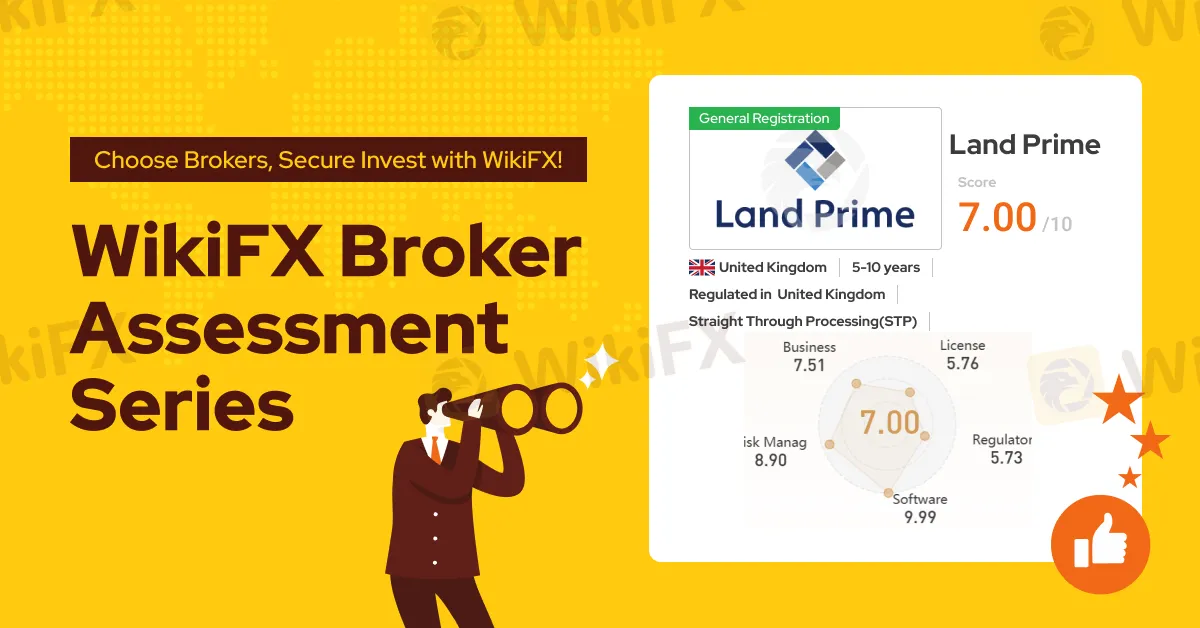

WikiFX Broker Assessment Series | Is Land Prime Reliable?

Abstract: In this article, we'll look in-depth at Land Prime, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service.

In this article, we'll look in-depth at Land Prime, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX aims to provide you with the information you need to make an informed decision about using this platform.

About Land Prime

Land Prime offers a series of trading instruments, including Forex, Commodities, and Indices. This allows traders to access multiple markets and asset classes and diversify their portfolios. Land Prime is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. As such, it can offer faster order execution speed, tighter spreads, and greater flexibility regarding the leverage offered. However, this also means that Land Prime has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. WikiFX has rated this broker a decent score of 7.00/10.

Is Land Prime Legit?

Land Prime is a regulated broker. The Financial Conduct Authority regulates Land Prime with license number 709866.

Trading Platform

Land Prime offers its clients access to the popular MT4 and MT5 trading platforms. These platforms are well-known in the industry and provide traders with access to advanced charting tools, technical analysis features, and automated trading capabilities. Additionally, the MT4 and MT5 platforms are available as mobile apps for Android and iOS devices, allowing traders to stay connected and manage their trades. While these platforms offer a user-friendly interface, they have limited customization options and a limited selection of add-ons and plugins. Moreover, Land Prime does not offer a proprietary trading platform, and its social trading features are limited.

Account Types & Minimum Deposit

Land Prime offers four different account types to cater to different trading needs. The standard account has a low minimum deposit requirement of $10 and a low spread of 0.9 pips, making it accessible for beginners. The prime account has a higher minimum deposit of $300 but offers a lower spread of 0.5 pips. The ECN account, with a minimum deposit of $1000, has a spread as low as 0.0 pips and offers a high leverage of 1:1000. The swap-free account is also available for traders who require it. Three account types have zero commission fees and unlimited leverage, making them cost-efficient and accessible for traders. However, accounts become inactive if no transactions are made in a month. The ECN account also has a high minimum deposit requirement, making it less accessible for beginners.

Leverage

Land Prime offers a variety of leverage options across its different account types, with a maximum leverage of 1:1000 on its ECN account and unlimited leverage for other accounts. Traders can choose the leverage level that best suits their trading style and goals, and have the ability to adjust it as necessary. While high leverage can increase the potential for profits, it can also lead to higher risks and losses, especially for inexperienced traders.

Spreads and commissions

Land Prime offers a competitive range of spreads and zero commission across their four primary account types: Standard, Prime, ECN, and Swap-free account. The lowest spread is available on the ECN account, starting at 0.0 pips, while the Standard and Prime accounts offer spreads starting from 0.9 and 0.5 pips respectively, with zero commission on all accounts. The Swap-free account is available for those who need to adhere to Islamic finance principles, with a commission of 0.3 pip/lot.

Conclusion

As a regulated broker with a high Wiki score, Land Prime maybe a considerable choice if you want to enhance your trading journey. If you want more information about certain brokers' reliability, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to help me make an informed decision.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

Doo Financial Expands Reach with Indonesian Regulatory Licenses

PT. Doo Financial Futures, a subsidiary of the global financial services brand Doo Group, has secured regulatory approval from Indonesia’s Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI).

Webull Canada Expands Options Trading to TFSAs and RRSPs

Webull Canada launches options trading for TFSAs and RRSPs, offering Canadian investors tax-free growth and retirement savings optimization opportunities.

Interactive Brokers Boosts IBKR Desktop with Advanced Tools

Interactive Brokers upgrades IBKR Desktop with powerful tools like MultiSort, Option Lattice, and enhanced charting, simplifying global trading for all skill levels.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator