简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Breaking: KOT4X and Hugo’s Way moved their trading platforms from MT4 to others.

Abstract:KOT4X and Hugo’s Way, two forex brokers, have removed their trading platforms from the popular MT4 to trade-locker and TickTrader, respectively. What does it mean for you?

KOT4X and Hugos Way, two forex brokers, have removed their trading platforms from the popular MT4 to trade-locker and TickTrader, respectively. This article aims to delve into the implications of this platform migration and explore the potential impact on the reliability and security of these brokers' operations.

About KOT4X and HugosWay

KOT4X, a trading name of KOT4X Ltd., is a crypto and forex broker registered in Saint Vincent and the Grenadines that aims to provide investors with 250+ instruments with flexible leverage up to 1:500 and floating spreads from 0.4 pips via four different live account types, as well as 24/7 customer support service.

HUGOs Way is a St. Vincent and the Grenadines registered online Forex and CFD broker and is not currently subject to any active regulation. Tradable financial instruments offered by this broker include major currency pairs, cross-currency pairs, odd currency pairs, cryptocurrencies, metals, indices, stocks, USD futures, and energy.

Are They Legit?

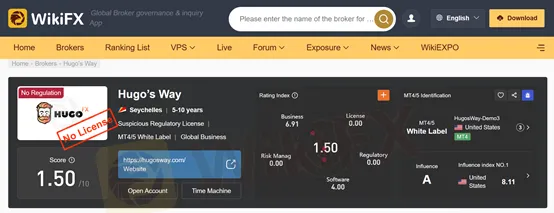

No, according to WikiFX, we find out that those brokers are not legitimate. They do not hold regulatory licenses, which labels them “unregulated brokers”. Investing in unregulated brokers is extremely risky as your money is not under the protection. Thus, WikiFX has given these two brokers low scores of 1.54/10, and 1.50/10, respectively. These low ratings indicate a level of dissatisfaction among traders and raise concerns about the brokers' overall performance, transparency, and customer satisfaction.

Changing the Trading Platform

MetaTrader 4 has long been a staple in the forex trading world, appreciated for its user-friendly interface, extensive charting capabilities, and a plethora of available indicators and trading tools. Investors have grown accustomed to the reliability and security that MT4 offers, making any departure from this platform a noteworthy development.

However, KOT4X and Hugos Way have opted for a change, replacing MT4 with TradeLocker and TickTrader, respectively. While the brokers may argue that these new platforms offer enhanced features and improved functionality, the investor community remains skeptical. The sudden transition away from a trusted and widely used platform prompts questions about the motivations behind such a move and whether it serves the traders' best interests.

What is TradeLocker and TickTrader?

According to KOT4X, TradeLocker is a brand-new trading platform powered by TradingView and designed for lightning-fast performance with a slick, minimalist interface. Meanwhile, based on what Hugo's Way claimed, TickTrader provides a comprehensive suite of tools and features to enhance investors trading journey.

The Concerns

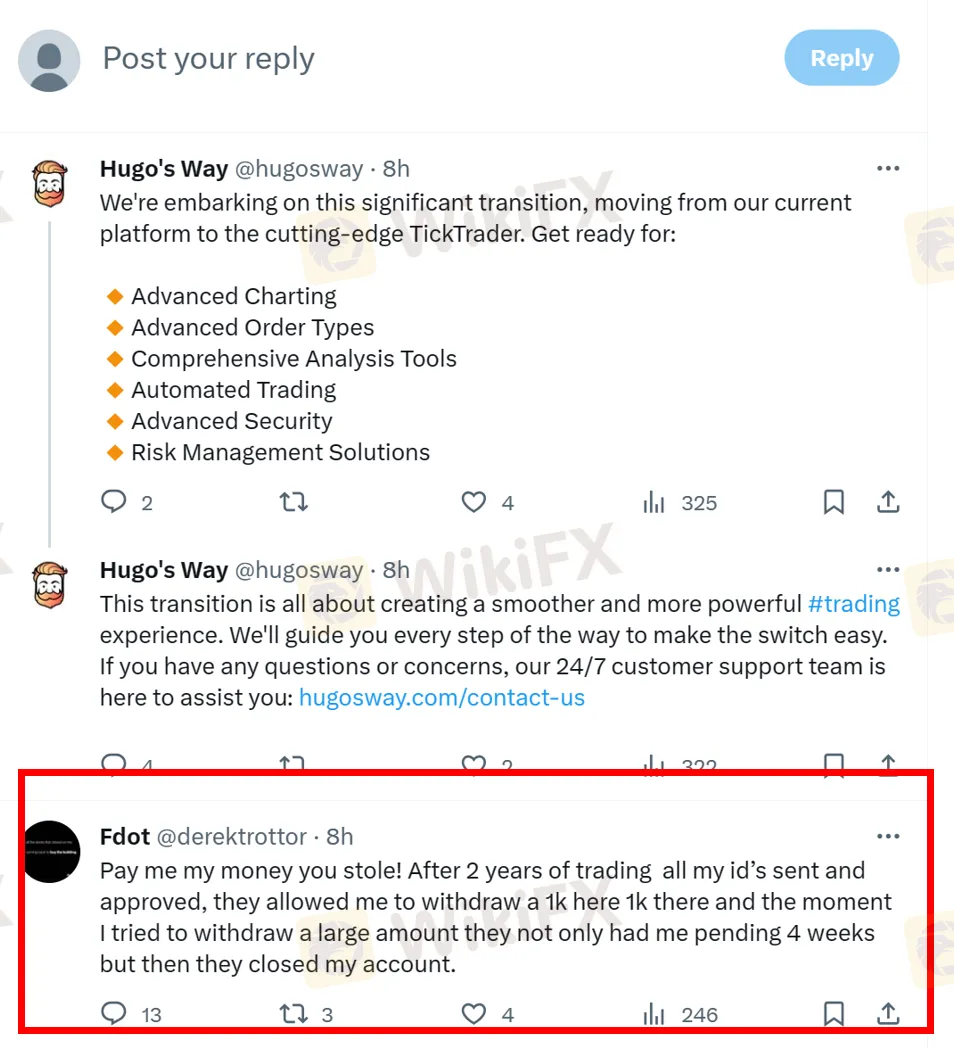

On the social media platform, the news that KOT4X and Hugo 's Way are no longer using MT4 as their trading platform has caught the attention of many investors. Many of them don't think it's a positive message as MT4 is a very popular and relatively safe system in the industry. The sentiment among traders appears to be predominantly negative. The removal of MT4 by these two brokers calls into question the reliability and security of their business operations. One of the most significant concerns raised by investors is the potential impact on the security of their accounts. Some traders speculate that the migration to TradeLocker and TickTrader, in the case of these two brokers, has led to disabled accounts, adding an extra layer of unease among users. The lack of clear communication from the brokers regarding the reasons behind the disabled accounts further fuels suspicions about the transparency of their operations.

Conclusion

The departure of KOT4X and Hugos Way from the trusted MT4 platform has undoubtedly sent shockwaves through the forex trading community. The concerns raised by low WikiFX ratings, coupled with the negative sentiment on social media, highlight the apprehensions among investors regarding the reliability and security of these brokers. As the trading landscape continues to evolve, traders are left to carefully assess the implications of such transitions on their investments and make informed decisions in an industry where trust and transparency are paramount.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator