简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

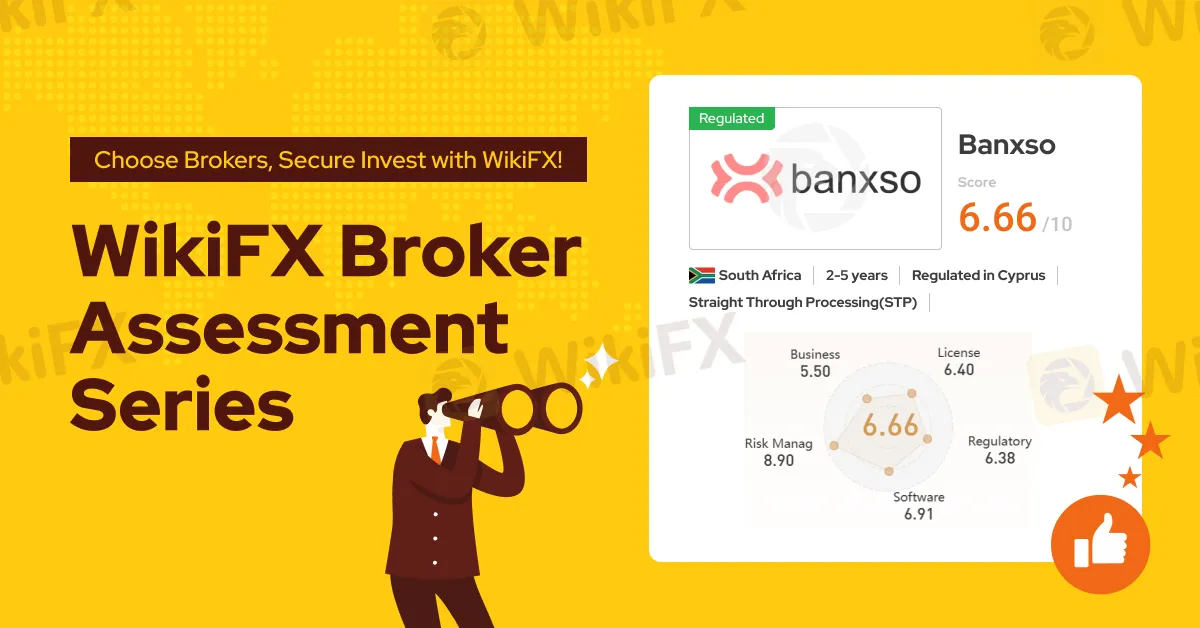

WikiFX Broker Assessment Series | Something You Need to Know About Banxso

Abstract:In today’s article, we are going to show you what Banxso looks like. WikiFX conducted a comprehension review on this broker to assist you in better understanding the truth.

About Banxso

Banxso is a forex trading platform registered in South Africa. This broker claimed itself to be a decent intermediary for traders worldwide engaging in forex and other derivatives trading. Banxsos official website shines intriguing features, such as access to popular markets through their proprietary trading platform and MT5 trading platform, advanced trading tools, and competitive trading fees. Banxso offers traders a variety of financial instruments, including Forex, Stocks, Indices, Commodities, and Cryptocurrencies.

It is Legit?

Banxso is regulated by the CySEC with license number 413/22. Banxso also holds an FSCA regulatory license. However, the latter license, limited to financial service corporations, exceeds its service purview. After all, Banxso has been given by WikiFX a decent score of 6.66/10.

Account Types & Minimum Deposit

Banxso offers a range of account types designed to accommodate traders with different experience levels and trading preferences. Traders have the option to open a free demo account, allowing them to practice their trading skills.

Intro, Plus, Advanced, and Premium accounts are four types of accounts that are offered by this broker. Starting from $250 for the Intro account up to $100,000 for the Premium account. The minimum deposit of $500, completely honest, does come across as significantly high.

Spreads & Commissions

Banxso offers competitive spreads on different account types and trading instruments, catering to the diverse needs of traders. For the Intro account, the spread for major currencies can range from 1.5 to 5 pips, while the Plus account offers a narrower range of 1.2 to 4 pips. The Advanced account further reduces the spread to a range of 1 to 3.5 pips, and the Premium account provides the tightest spread range of 0.8 to 3 pips Notably, Banxso claimed that it charges no commissions.

Social Media Engagement

Banxso maintains an active presence on popular social media platforms like X, Facebook, Instagram, YouTube, and LinkedIn, providing additional avenues for traders to stay updated and engage with the broker.

On-Site Inspection

To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

WikiFX did make an on-site survey on Banxsos address in South Africa and successfully found the office.

Conclusion

The WikiFX score of a broker can be increased or decreased if the broker is constantly running the business in a good or bad direction. Before deciding to invest with Banxso or any other broker, it's crucial to stay updated with the latest information on WikiFX and conduct your due diligence. Market conditions and broker reputations can change, so make sure to make informed decisions to avoid potential regrets in your trading journey.

If you want more information about brokers' reliability, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find your most trusted broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator