简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

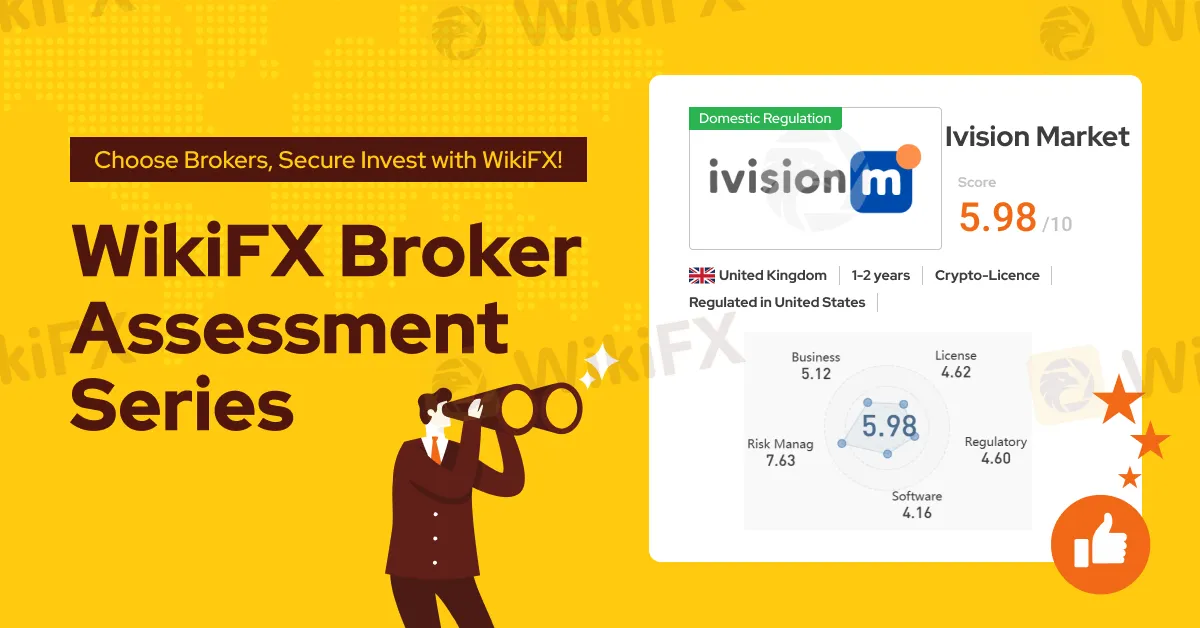

WikiFX Broker Assessment Series | Is Ivision Market Okay to Invest in?

Abstract:This article is about a broker called Ivision Market. Is this platform trustworthy? WikiFX made a comprehensive review of this broker, hoping you have a clue to make a wise decision.

About Ivision Market

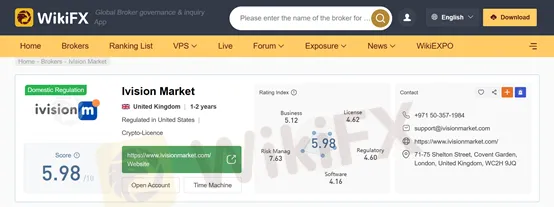

Ivision Market is an online forex trading platform that promises true ECN connectivity for clients using cutting-edge technologies and advanced trading platforms. Ivision Market emphasizes the fastest order execution, deep liquidity, and the tightest spreads. This broker claimed that when you choose to start trading with Ivisionmarket, you get unparalleled advantages and institutional-grade liquidity, along with a host of other benefits. Besides, Ivision Market offers a wide range of financial instruments, including Crypto-Currency, Precious Metals, Energies, Shares, and Indices. According to what we mentioned above, WikiFX has given this broker a decent score of 5.98/10.

Is It Legit?

Yes, Ivision Market is a regulated broker. This broker has been regulated by the Financial Crimes Enforcement Network with license number 31000238442500.

Account Types & Minimum Deposit

This broker offers traders three different types of accounts. They are Micro account, Standard account, and Spread Account.

Trading Platform

The MT4 is currently the most popular forex trading platform along with the MT5 on the market. With a user-friendly interface, powerful charting tools, and a large number of custom indicators, Ivision Market uses MT5 as its main trading platform.

Commission&Spreads

The IVISION MARKET offers tight floating spreads across its different account types, ensuring that traders can enter and exit positions at competitive prices. The spreads vary depending on the account type and the financial instrument being traded. The Micro Account provides spreads starting from 1.9 pips, while the Standard Account offers spreads starting from 1.4 pips. The Spread Account is designed for traders who want to trade with zero spreads or very low spreads, and as such, it provides spreads starting from 0 pips.

It's important to note that trading conditions are subject to change and may vary depending on market volatility and liquidity. Traders should stay up-to-date with the latest market news and announcements to make informed trading decisions.

Fees & Commissions

IVISION MARKET has a policy of NO commissions on trading and only charges spread on trades. Spreads are the difference between the bid and ask price, and the amount of spread depends on the trading account type and market conditions.

The deposit and withdrawal fees vary depending on the payment method and currency used. Bank wire transfers are free for both deposit and withdrawal, but they may take 1-5 business days to process. Credit/debit cards and digital payment methods have NO deposit fees and are instant, but some withdrawal methods may have fees, and the processing time may vary.

IVISION MARKET offers a range of local payment methods that have no deposit fees and fast processing times. The withdrawal fees for local payment methods are also free, and the processing time is usually within an hour.

Conclusion

WikiFX Rating System is updated in real-time, ensuring investors have access to the latest, most accurate, and comprehensive broker information. The WikiFX score of a broker can be increased or decreased if the broker is constantly running the business in a good or bad direction.

Ivision Market is a decent broker that may suit your needs, although there are a lot of excellent alternatives you may consider.

If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Funded Trader: Reactivates Accounts with Revised Payout Structure

Proprietary trading firm The Funded Trader has detailed its financial recovery efforts following a turbulent period marked by an unsustainable payout model. Addressing these challenges publicly, the firm outlined the steps being taken to resolve outstanding obligations and ensure operational sustainability.

Doo Group Broadens Global Footprint with Indonesian Broker Acquisition

Doo Group has announced its acquisition of PT Prima Tangguharta Futures, a Jakarta-based broker specialising in online derivatives trading. This move represents a significant step in Doo Group's regional expansion strategy and reinforces its growing presence in Southeast Asia.

Webull Partners with Coinbase to Offer Crypto Futures

Webull partners with Coinbase Derivatives to offer crypto futures, providing US investors access to Bitcoin and Ethereum contracts with lower entry barriers.

eToro Expands Nationwide Access with New York Launch

eToro launches in New York, offering fractional stock, ETF, and options trading nationwide. Discover innovative features like copy trading and free education.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

GCash, Government to Launch GBonds for Easy Investments

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

Why Is UK Inflation Rising Again Despite Recent Lows?

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Find Regulated Brokers from A to Z on WikiFX

Currency Calculator