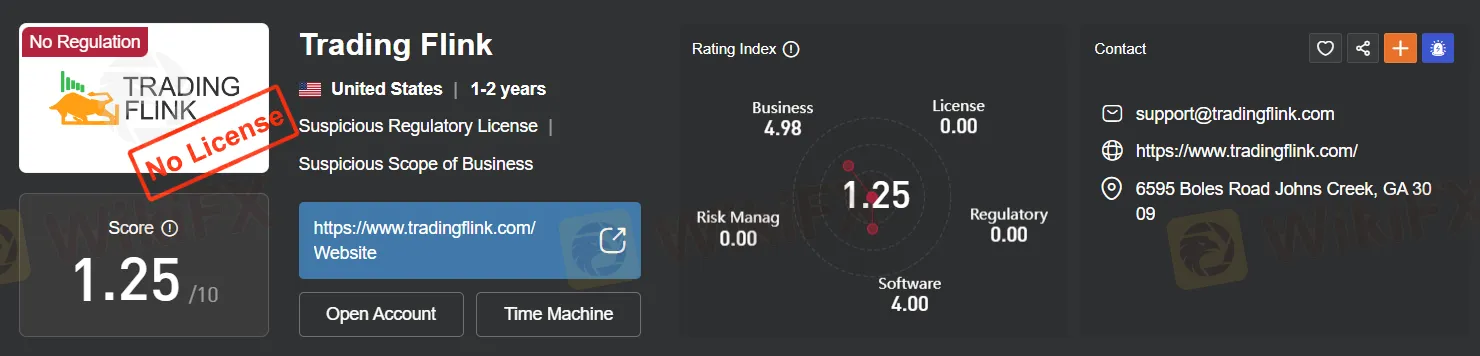

Score

Trading Flink

United States|2-5 years|

United States|2-5 years| https://www.tradingflink.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesUsers who viewed Trading Flink also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

tradingflink.com

Server Location

United States

Website Domain Name

tradingflink.com

Server IP

198.54.115.247

Company Summary

| Aspect | Information |

| Registered Country/Area | United States |

| Company Name | Trading Flink |

| Regulation | Unregulated |

| Minimum Deposit | $100 (Basic Account) |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Vary by account type (e.g., starting from 2 pips) |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, indices, cryptocurrencies, ETFs |

| Account Types | Basic, Intermediate, Advanced, VIP, Demo |

| Demo Account | Available (with virtual funds) |

| Customer Support | Slow and inadequate |

| Payment Methods | Bank Wire, Credit Card, Cryptocurrency |

| Educational Tools | Lacking educational resources |

| Website Status | Website downtime reported |

| Reputation (Scam or Not) | Potential concerns due to unregulated status |

Overview

Trading Flink presents a concerning picture in the world of online trading. Operating without regulation in the United States, it lacks the crucial oversight that ensures transparency and investor protection. The minimal initial deposit of $100 in the Basic Account might seem accessible, but this broker's unregulated status raises significant red flags. While it offers a high leverage ratio of up to 1:1000, the lack of regulatory scrutiny makes trading here a risky endeavor. The spreads, which vary based on the account type, may not justify the associated risks. Additionally, traders should approach the company with caution due to reported issues with its website, slow and inadequate customer support, and a conspicuous absence of educational resources. The unregulated status raises concerns about the safety of funds and overall trustworthiness, making Trading Flink a potentially risky choice for traders.

Regulation

Trading with Flink can be risky as it is an unregulated broker. Without regulatory oversight, there may be limited investor protection in place, potentially exposing traders to various risks such as fraudulent activities, unfair trading practices, or inadequate fund security. It is essential for investors to exercise caution and thoroughly research any broker before engaging in financial transactions to ensure their investments are handled with transparency and security. Choosing a regulated broker can provide a level of confidence and protection, as they are subject to regulatory standards and oversight that unregulated brokers lack. Always prioritize safety and security when selecting a brokerage platform.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

Trading Flink presents traders with a mixed bag of advantages and disadvantages. On the positive side, the broker offers a variety of market instruments, catering to traders interested in forex, indices, cryptocurrencies, and ETFs. It provides multiple account types to suit different trading needs and preferences, as well as high leverage options for potential profit amplification. Additionally, the availability of the MetaTrader 4 (MT4) trading platform enhances the trading experience.

However, on the downside, Trading Flink operates as an unregulated broker, lacking the oversight and investor protection provided by regulatory authorities. Customer support is often slow and inadequate, leaving traders with unresolved issues. The absence of educational resources hampers traders' ability to enhance their skills and make informed decisions. Moreover, the suspicious downtime of its website raises concerns about reliability and trustworthiness. Traders should weigh these pros and cons carefully when considering Trading Flink as their trading partner.

Market Instruments

Trading Flink offers a range of market instruments to its clients, including:

Forex (Foreign Exchange): Forex trading involves the buying and selling of currency pairs, such as EUR/USD or GBP/JPY. Traders can speculate on the price movements of these pairs and profit from fluctuations in exchange rates.

Indices: Trading Flink likely provides access to various stock market indices like the S&P 500, Dow Jones, or NASDAQ. Traders can trade on the overall performance of these indices, which represent a basket of underlying stocks.

Cryptocurrencies: This category includes popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and many others. Traders can speculate on the price movements of these digital assets, which are known for their volatility.

ETFs (Exchange-Traded Funds): ETFs are investment funds that track the performance of a specific index, commodity, or a group of assets. Trading Flink may offer a variety of ETFs, allowing traders to diversify their portfolios.

These market instruments provide traders with diverse opportunities to engage in various financial markets, from the currency exchange to stock indices and the volatile world of cryptocurrencies. However, it's essential for traders to conduct thorough research and understand the risks associated with each instrument before trading, and they should also ensure the broker they use complies with all relevant regulations to protect their investments.

Account Types

Trading Flink offers a variety of account types designed to cater to traders with different levels of experience and investment preferences.

The Basic Account is an excellent choice for novice traders looking to dip their toes into the world of online trading. With a minimum initial deposit of $100, it provides access to a limited selection of trading instruments, such as major forex pairs and popular indices. This account offers standard leverage options and basic customer support. While it lacks additional perks or benefits, it serves as an accessible starting point for those looking to get started with trading.

For traders seeking more options and resources, the Intermediate Account is a step up. With a minimum initial deposit of $1,000, it offers access to a broader range of trading instruments, including forex, indices, selected cryptocurrencies, and ETFs. Traders can benefit from competitive leverage options and enjoy the guidance of a dedicated account manager. Educational resources and webinars are also available to help traders improve their skills. Priority customer support ensures that traders have the assistance they need when they need it.

The Advanced Account is tailored for experienced traders willing to invest a minimum of $5,000. It provides comprehensive access to all available trading instruments, including forex, indices, cryptocurrencies, and ETFs. Advanced traders can take advantage of higher leverage options and receive personalized guidance from an account manager with expert knowledge. Access to advanced technical analysis tools and exclusive research reports and market insights aids in making informed trading decisions. Faster withdrawal processing and 24/7 premium customer support contribute to a seamless trading experience.

For high-net-worth individuals and professional traders, the VIP Account is the ultimate choice. Requiring a minimum initial deposit of $25,000, this account type offers access to all available trading instruments with premium features. Traders can customize leverage options to suit their strategies and enjoy priority access to new trading products and features. Personalized trading strategy consultations provide invaluable insights, and invitations to exclusive events and seminars keep traders informed about market trends. Reduced spreads and trading fees enhance profitability, while expedited withdrawal processing and a dedicated VIP customer support hotline ensure top-tier service.

For those who are new to trading or wish to practice without risking real capital, Trading Flink offers a Demo Account free of charge. This account type provides users with virtual funds for risk-free trading, offering real-time market data and execution. It's an invaluable tool for gaining experience and confidence in trading before transitioning to a live account.

Trading Flink's diverse account types aim to meet the needs of a wide range of traders, whether they are just starting or are seasoned professionals, providing them with the tools and support necessary to succeed in the financial markets.

Leverage

Trading Flink offers a maximum trading leverage of 1:1000 to its clients. This leverage ratio represents the amount of capital a trader can control with a single unit of their own capital. In the case of 1:1000 leverage, for every $1 of the trader's own capital, they can control a position worth up to $1000 in the market.

While high leverage ratios like 1:1000 can amplify potential profits, they also come with increased risk. Traders should exercise caution when using such high leverage, as it magnifies both gains and losses. While it can be a valuable tool for experienced traders, it's essential to have a solid risk management strategy in place to protect against significant losses when trading with high leverage. Additionally, traders should be aware of the specific margin requirements and trading conditions associated with the broker's leverage offerings to make informed trading decisions.

Spreads and Commissions

Spreads:

The Trading Flink brokerage offers a diverse range of account types, each with its own distinct spread structure to cater to traders' varying needs and preferences. In the Basic Account, traders will encounter fixed spreads, such as 2 pips on major forex pairs like EUR/USD. This fixed spread model provides predictability in trading costs, making it an attractive option for beginners who value transparency in their trading expenses.

Moving up the ladder to the Intermediate Account, traders benefit from variable spreads, with rates starting at 1.5 pips for currency pairs like EUR/USD. Variable spreads enable traders to potentially take advantage of tighter spreads during periods of heightened market activity, offering flexibility and potential cost savings.

The Advanced Account takes this flexibility a step further, offering variable spreads on all available trading instruments, including forex, indices, cryptocurrencies, and ETFs. Starting at 1.2 pips for major pairs like EUR/USD, this account provides traders with access to competitive pricing across a wide spectrum of markets.

For traders seeking the tightest spreads available, the VIP Account is the pinnacle. With spreads starting as low as 1 pip for major forex pairs, this account caters to traders with higher status and trading volumes, providing them with the most competitive pricing in the broker's offerings.

Commissions:

In terms of commissions, Trading Flink employs a commission structure that aligns with each account type's characteristics. For the Basic and Intermediate Accounts, the broker does not charge any commissions. Instead, the broker's revenue is primarily generated from spreads, ensuring a straightforward and transparent fee structure for traders in these accounts.

As traders progress to the Advanced Account, a small commission fee per lot traded is introduced on select assets, such as $5 per standard lot for forex and 0.2% of the notional value for cryptocurrency trades. This commission structure provides traders with the flexibility to choose the trading style that suits them best.

For traders holding the prestigious VIP Account, commissions are further reduced compared to the Advanced Account. For instance, traders may pay $3 per standard lot for forex and 0.1% of the notional value for cryptocurrency trades. This reduction in commissions offers VIP traders cost savings while still enjoying premium account features.

These commission structures are thoughtfully designed to ensure that traders have a clear understanding of the costs associated with their chosen account type, allowing them to make informed decisions aligned with their trading strategies and preferences.

Deposit & Withdrawal

Deposit Methods:

Bank Wire: Secure, suitable for larger amounts, but may take a few business days for processing.

Credit Card: Quick and convenient with instant deposits, but may have processing fees.

Cryptocurrency: Fast and low-fee deposits using various cryptocurrencies.

Withdrawal Methods:

Bank Wire: Secure but takes a few business days for funds to reach the bank account.

Credit Card: Withdrawals processed back to the same card, up to the deposit amount.

Cryptocurrency: Quick and flexible withdrawals, with transactions processed swiftly.

Traders should review specific policies, fees, and limits for each method based on their preferences and needs.

Trading Platforms

Trading Flink offers the renowned MetaTrader 4 (MT4) trading platform to its clients, a versatile and user-friendly tool that empowers traders of all levels to participate effectively in the financial markets. With an intuitive interface, advanced charting tools, support for automated trading strategies, and extensive customization options, MT4 enables traders to conduct in-depth technical analysis, execute trades, and manage their portfolios with ease. Real-time market data, mobile accessibility, and robust security measures further enhance the trading experience, making MT4 a trusted choice for traders seeking precision and flexibility in their financial endeavors.

Customer Support

The customer support provided by support@tradingflink.com leaves much to be desired. Traders often encounter frustrating experiences when seeking assistance, with slow response times and inadequate resolutions to their queries and issues. Communication with the support team appears impersonal, lacking the empathy and attention that customers expect when facing financial matters. Additionally, the lack of clear and readily accessible support resources, such as FAQs or educational materials, further exacerbates the difficulties faced by traders in getting the help they need. Overall, the quality of customer support at support@tradingflink.com falls short of the standards expected in the financial industry, leaving traders feeling unsupported and dissatisfied with their service.

Educational Resources

Trading Flink's provision of educational resources is notably lacking. Traders seeking guidance and knowledge enhancement are met with a dearth of learning materials, tutorials, or informative content on the platform. This absence of educational resources hinders the development of traders' skills and understanding of the financial markets, leaving them at a disadvantage when making trading decisions. The absence of educational materials not only impacts novice traders but also fails to cater to experienced traders who may benefit from advanced insights or strategies. In an industry where knowledge is paramount, the absence of educational resources at Trading Flink is a significant drawback that diminishes the overall user experience.

Summary

Trading Flink presents a concerning picture for potential traders. It operates as an unregulated broker, posing significant risks due to the absence of regulatory oversight, potentially exposing traders to fraudulent activities and insufficient fund security. The lack of transparency in its operations casts doubts on the broker's credibility. Furthermore, its customer support leaves much to be desired, characterized by slow responses and inadequate resolutions to queries. The absence of educational resources and support materials is a significant disadvantage, hampering traders' knowledge development and decision-making abilities. The suspicious downtime of its website adds to the overall negative impression, raising questions about the broker's reliability and trustworthiness. Traders are advised to exercise extreme caution when considering Trading Flink as their trading partner, given these significant drawbacks and uncertainties.

FAQs

Q1: Is Trading Flink a regulated broker?

A1: No, Trading Flink operates as an unregulated broker. This means it lacks oversight from financial regulatory authorities, potentially exposing traders to higher risks.

Q2: What market instruments can I trade with Trading Flink?

A2: Trading Flink offers a range of market instruments, including forex, indices, cryptocurrencies, and ETFs, providing diverse trading opportunities across different financial markets.

Q3: What is the minimum initial deposit required for a Basic Account?

A3: The Basic Account requires a minimum initial deposit of $100, making it an accessible starting point for traders looking to begin their online trading journey.

Q4: Does Trading Flink offer a demo account?

A4: Yes, Trading Flink provides a Demo Account free of charge, allowing users to practice trading with virtual funds and real-time market data before transitioning to a live account.

Q5: What is the maximum trading leverage offered by Trading Flink?

A5: Trading Flink offers a maximum trading leverage of 1:1000, allowing traders to control positions worth up to 1000 times their own capital. However, high leverage carries increased risk and should be used cautiously with a solid risk management strategy in place.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now