简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

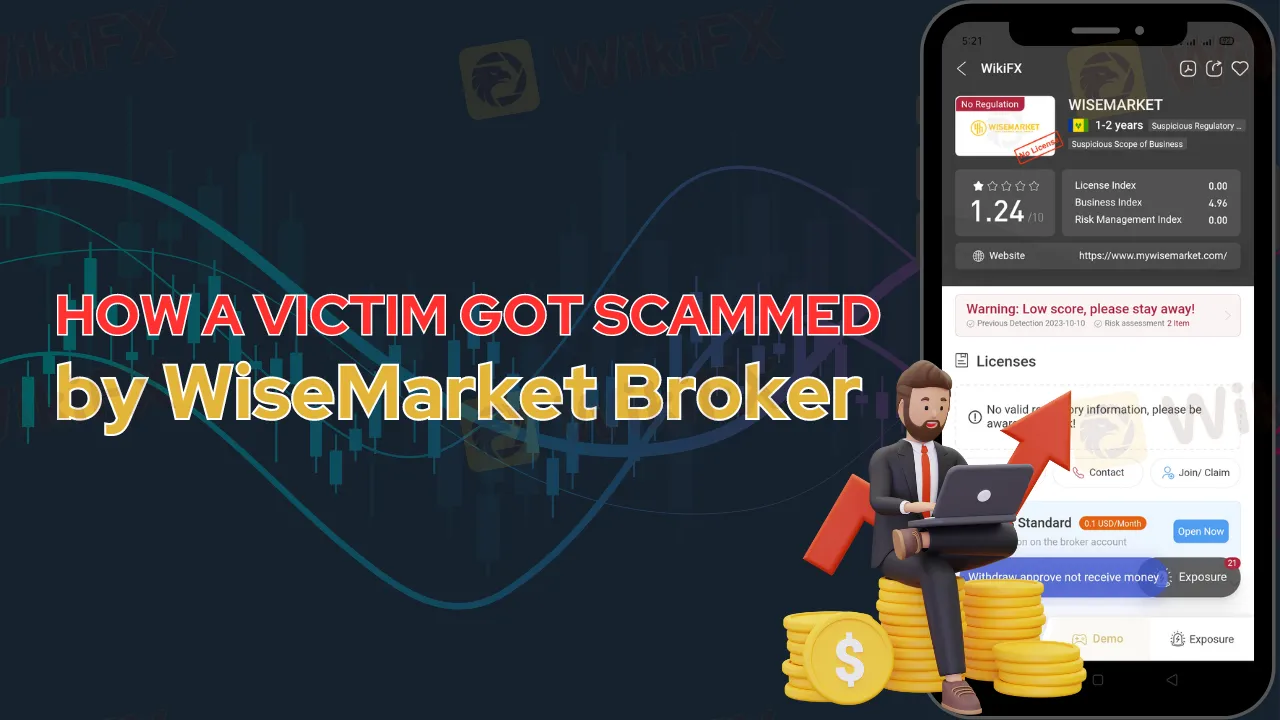

How A Victim Got Scammed by WiseMarket Broker

Abstract:Discover John's first-hand account of being scammed by Wise Market, an unregulated broker. This cautionary tale highlights the risks of dealing with unlicensed brokers in the investment world. Protect yourself and your investments by staying informed and making wise choices in your financial journey

In an age where online trading and investing have grown in popularity, it is more necessary than ever for consumers to practice prudence and due research when selecting trading platforms. For privacy concerns, an anonymous trader will be referred to as “John” and recently described his traumatic experience with WiseMarket, an unlicensed broker. His experience should serve as a wake-up call to all prospective investors about the dangers of dealing with unregistered brokers.

John's adventure with WiseMarket started simply enough when he came upon an appealing offer from the Fira indication, a trading signal service. He signed with WiseMarket, a broker advised by the Fira indicator since he was intrigued by the possible reward.

John placed $200 into his Wise Market account to get his trading experience started. Surprisingly, he watched his investment expand quickly, earning approximately $4,000 in dividends. Excited by his performance, John decided to seek $1,200 from his account.

The withdrawal procedure looked to be going well at first, with the WiseMarket system immediately accepting John's request. However, the money promised did not appear in his bank account. Concerned, John inquired about the delay with WiseMarket's support staff.

To his dismay, the support staff blamed the delay on external causes, alleging that it was due to the bank's processing time, which was outside WiseMarket's control. As his suspicions grew, John concluded that something was wrong when he observed that not only his winnings but also his original payment, seemed to be trapped inside the platform.

Fearful and confined, John tried to withdraw his remaining monies, but his demands were received with silence. WiseMarket's support personnel did not respond, and his efforts to contact them fell on deaf ears.

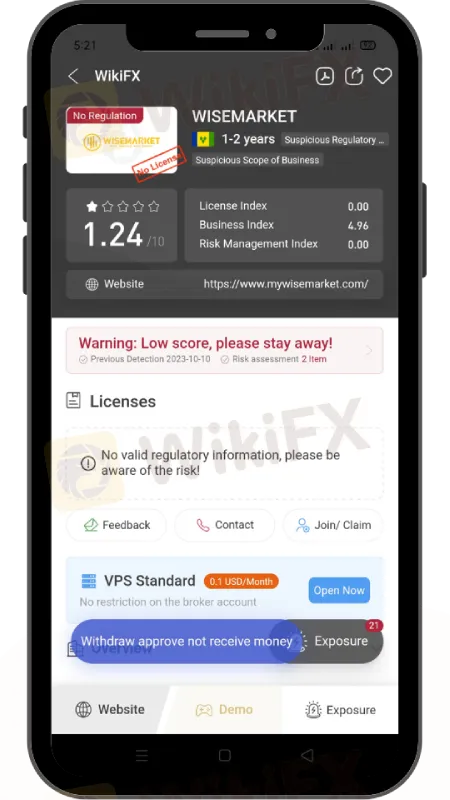

John's story is a warning about the dangers of dealing with unregulated and unregistered brokers. Because there is no regulatory monitoring, such firms may operate freely, perhaps engaging in fraudulent activities. Investors, particularly those who are new to the trading world, are sometimes enticed by promises of rapid profits, only to get entangled in a web of deceit.

To prevent being a victim of a similar scam, experts advise investors to do comprehensive research before hiring a broker. Lists of licensed brokers are supplied by regulatory organizations such as the Securities and Exchange Commission (SEC) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom, making it easier to distinguish respectable enterprises from harmful scams.

Furthermore, when given exceptionally big rewards with little to no risk, investors should exercise caution. If something seems to be too good to be true, it usually is. Finally, before investing your money, always check for and validate a broker's regulatory status.

In the realm of Internet trading, remaining aware and cautious is critical. He intends to raise awareness and safeguard others from the dangers of unregulated brokers like WiseMarket by sharing his tale. Remember that the road to financial success is paved with information, prudence, and sound decision-making.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

How to Automate Forex and Crypto Trading for Better Profits

Find out how automating Forex and crypto trading is changing the game. Explore the tools, strategies, and steps traders use to save time and maximize profits.

Is Infinox a Safe Broker?

INFINOX, founded in 2009 in London, UK, is a regulated online broker under the UK FCA. It offers diverse trading instruments like forex, stocks, commodities, indices, and futures. Clients can choose between STP and ECN accounts and access educational resources. With 24/7 customer support, INFINOX aims to empower traders with reliable tools and guidance.

Is Your Zodiac Sign Fated for Stock Market Success in 2025?

The idea that astrology could influence success in the stock market may seem improbable, yet many traders find value in examining personality traits linked to their zodiac signs. While it may not replace market analysis, understanding these tendencies might offer insights into trading behaviour.

Kraken Offers $105 Fee Credit for FTX Fund Recipients

Kraken offers $105 in trading fee credits to FTX fund recipients, enabling $50,000 in crypto trading on Kraken Pro with zero fees. Secure your funds today!

WikiFX Broker

Latest News

BI Apprehends Japanese Scam Leader in Manila

Bitcoin in 2025: The Opportunities and Challenges Ahead

Join the Event & Level Up Your Forex Journey

Is There Still Opportunity as Gold Reaches 4-Week High?

Bitcoin miner\s claim to recover £600m in Newport tip thrown out

Good News Malaysia: Ready for 5% GDP Growth in 2025!

How to Automate Forex and Crypto Trading for Better Profits

FXCL Lucky Winter Festival Begins

Warning Against MarketsVox

Is the stronger dollar a threat to oil prices?

Currency Calculator