简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NIC ASIA

Abstract:NIC ASIA is an unregulated bank and banking institution operating in Nepal. With a diverse range of financial products and services, including savings accounts, loans, remittance facilities, and more, NIC ASIA aims to cater to the diverse needs of its customers. They offer an exclusive online money transfer service, making domestic and international transactions more accessible and convenient. The bank's presence on various social media platforms reflects a commitment to transparency and engagement with its clients. Additionally, NIC ASIA provides multiple customer service channels, such as live chat and telephone support, to ensure customers receive prompt assistance and support.

Note: NIC ASIAs official site (https://www.nicasiabank.com/forex/) is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

| NIC ASIA Review Summary | |

| Registered Country/Region | Nepal |

| Regulation | No regulation |

| Trading Products & Services | Sarbashrestha Payroll Bachat Khata, NIC ASIA Remit, Sarbashrestha Bachat Khata |

| Customer Support | telephone, live chat |

What is NIC ASIA?

NIC ASIA is an unregulated bank and banking institution operating in Nepal. With a diverse range of financial products and services, including savings accounts, loans, remittance facilities, and more, NIC ASIA aims to cater to the diverse needs of its customers. They offer an exclusive online money transfer service, making domestic and international transactions more accessible and convenient. The bank's presence on various social media platforms reflects a commitment to transparency and engagement with its clients. Additionally, NIC ASIA provides multiple customer service channels, such as live chat and telephone support, to ensure customers receive prompt assistance and support.

Pros & Cons

| Pros | Cons |

| • Offers live chat and telephone support for customers | • Report of “unable to withdraw” |

| • Various trading products & services | • Lack of valid regulation |

Is NIC ASIA Safe or Scam?

NIC ASIA offers a variety of financial products and services, including savings accounts, loan facilities, remittance services, and more. They have a presence on social media platforms like Facebook, Instagram, LinkedIn, Twitter, and YouTube, which indicates a level of transparency and engagement with customers.

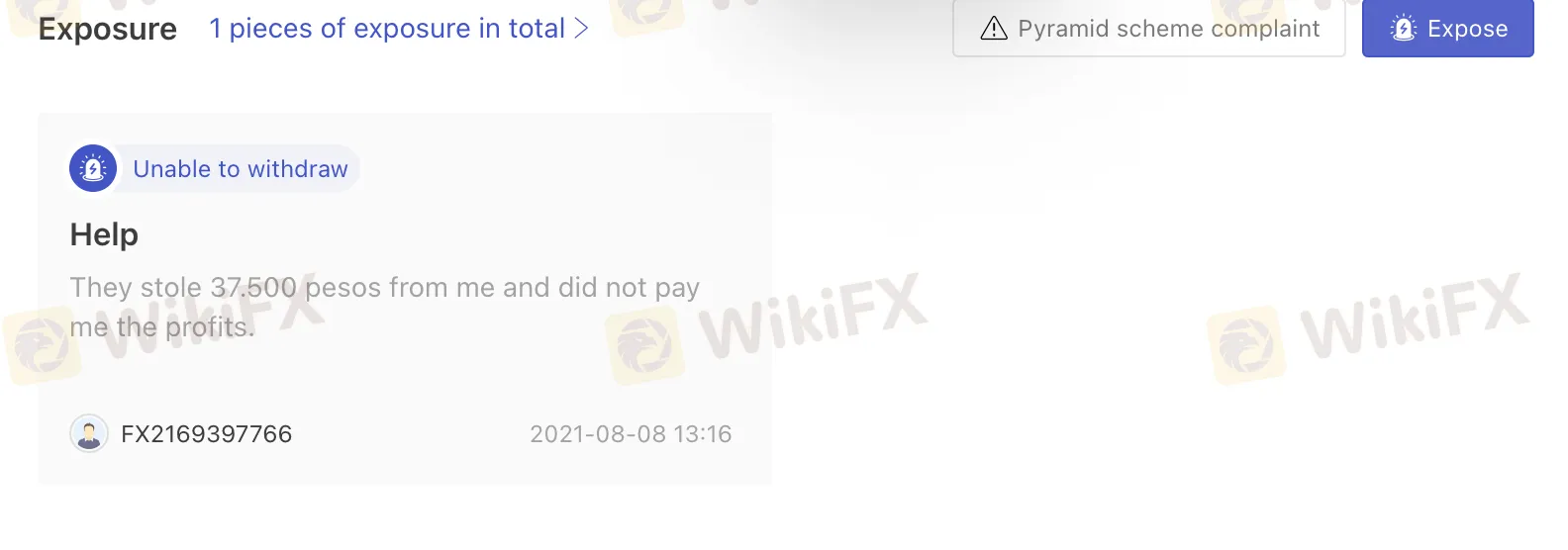

However, the information about the “unable to withdraw” report and the claim that NIC ASIA currently has no valid regulation is not within my knowledge base. To determine the current status and reputation of NIC ASIA, it is crucial to conduct further research and consult updated and reliable sources, such as official banking authorities, customer reviews, and financial news outlets.

Products

NIC ASIA, as a bank, offers a variety of trading products and services to cater to the diverse financial needs of its customers. These trading products and services include:

Sarbashrestha Payroll Bachat Khata: This is a corporate salary account designed to efficiently manage the salaries of employees in various institutions. It offers effective salary management services, making it easier for businesses to disburse salaries and for employees to access their funds conveniently.

NIC ASIA Remit: This is an exclusive online service that facilitates both domestic and international money transfers. Customers can use this service to send and receive money securely and efficiently, making it a convenient option for individuals who need to conduct financial transactions across borders.

Sarbashrestha Bachat Khata: The NIC ASIA Goodwill Ambassador: This is an interest-yielding savings account available to all customers, regardless of their gender or age. The account is designed to offer diverse financial services, making it a versatile option for individuals looking to save and grow their money.

Accounts

NIC ASIA offers a range of accounts to cater to the diverse financial needs of its customers. Here's a general summary of the different types of accounts offered by NIC ASIA:

Savings Accounts: NIC ASIA provides various types of savings accounts tailored to different customer preferences and needs. These accounts typically offer interest in the deposited funds, helping customers grow their savings over time.

Loan Accounts: In addition to savings and deposit accounts, NIC ASIA provides various types of loan accounts to help customers finance their needs.

Fees

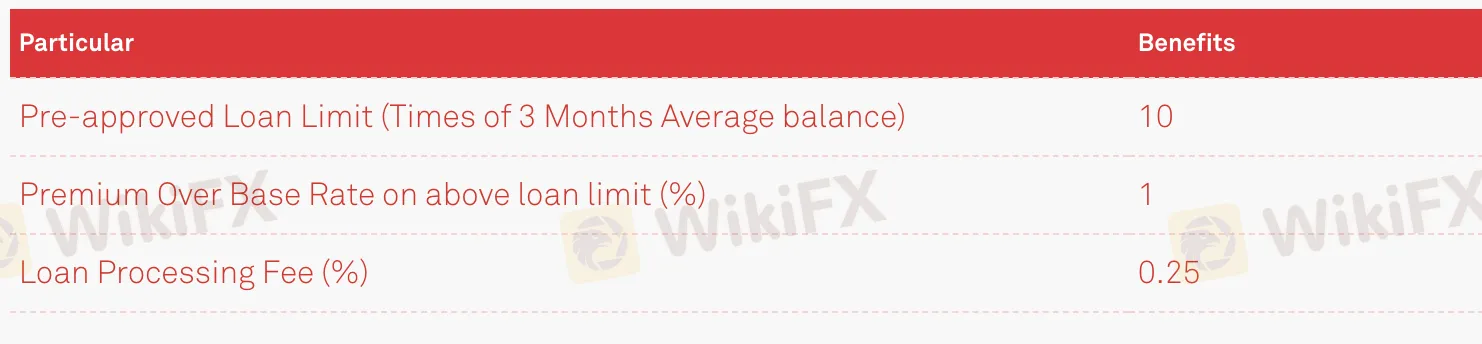

NIC ASIA offers a variety of loan products to meet the financial needs of its customers, whether it's for personal, business, or housing purposes. As part of the loan application process, the bank charges a loan processing fee, which is set at a competitive rate of 0.25% of the loan amount. This fee is a one-time charge and is typically deducted from the approved loan amount when disbursed to the customer. The loan processing fee is a standard practice in the banking industry and helps cover the administrative costs involved in evaluating and processing the loan application.

User Exposure on WikiFX

On our website, you can see one report of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section. We would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

The customer service of NIC ASIA is designed to provide convenient and accessible support to its customers. They offer multiple channels through which customers can reach out for assistance and inquiries.

Live Chat: NIC ASIA offers live chat support, allowing customers to interact with a customer service representative in real-time through their website or mobile app. This instant messaging feature enables quick responses to queries and concerns.

Telephone: Customers can contact NIC ASIA's customer service helpline at 16600177771. This phone support option allows customers to speak directly with a customer service agent and get personalized assistance with their banking needs.

Social Media: NIC ASIA is active on various social media platforms, including Facebook, Instagram, LinkedIn, Twitter, and YouTube. Customers can reach out to the bank through direct messages or comments on these platforms, and NIC ASIA's social media team typically responds to inquiries and feedback in a timely manner.

Conclusion

In conclusion, NIC ASIA appears to be a reputable and established bank, offering a wide array of services to meet the financial requirements of individuals and businesses. The bank's commitment to providing convenient access to customer support and its engagement on social media platforms are positive indicators of its customer-focused approach. However, the claim of “unable to withdraw” and the mention of lacking valid regulation necessitate further investigation and up-to-date verification to assess the current safety and regulatory status of NIC ASIA accurately. It is essential for potential customers and stakeholders to conduct thorough research and consult reliable sources to make informed decisions regarding their financial interactions with NIC ASIA.

Frequently Asked Questions (FAQs)

Q1: How can I contact NIC ASIA's customer service?

A1: NIC ASIA provides various customer service channels, including live chat on their website or mobile app, telephone support at 16600177771, and engagement through social media platforms like Facebook, Instagram, LinkedIn, Twitter, and YouTube.

Q2: What is the processing fee for loans at NIC ASIA?

A2: The loan processing fee at NIC ASIA is 0.25% of the loan amount. It is a one-time charge that covers administrative costs during the loan application process.

Q3: Is NIC ASIA a reputable and safe institution to conduct financial transactions with?

A3: No, NIC ASIA appears to have been claims of issues such as “unable to withdraw” and mentions of lacking valid regulation.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator