简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

oneZero

Abstract:oneZero is a provider of trading technology solutions, offering a comprehensive range of services for brokers, liquidity providers, and traders. With a focus on delivering innovative solutions, oneZero empowers clients with advanced trading platforms, connectivity, and data analytics. They provide popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with a robust infrastructure, multi-asset liquidity, and comprehensive customer support.

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

| oneZero Review Summary | |

| Founded | 2009 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Technology Service | Hub, EcoSystem, Data Source |

| Demo Account | Available |

| Trading Platforms | MT4/MT5 |

| Customer Support | telephone, email, social media |

What is oneZero?

oneZero is a provider of trading technology solutions, offering a comprehensive range of services for brokers, liquidity providers, and traders. With a focus on delivering innovative solutions, oneZero empowers clients with advanced trading platforms, connectivity, and data analytics. They provide popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with a robust infrastructure, multi-asset liquidity, and comprehensive customer support.

Pros & Cons

| Pros | Cons |

| • Comprehensive Trading Technology | • Lack of Valid Regulation |

| • User-Friendly Platforms | • Reports of withdrawal difficulties |

| • Demo accounts available | |

| • Multiple contact ways |

oneZero Alternative Brokers

There are many alternative brokers to oneZero depending on the specific needs and preferences of the trader. Some popular options include:

Saxo Bank - Saxo Bank offers advanced trading technology solutions with robust regulation, making it a recommended choice for traders looking for a platform that combines advanced features with strong regulatory oversight.

OANDA - OANDA is a reputable broker offering reliable trading technology solutions and is regulated by respected authorities, making it a suitable option for traders seeking a regulated platform with competitive pricing.

CMC Markets - CMC Markets provides innovative trading technology solutions backed by regulation, making it a recommended choice for traders looking for a platform that offers a wide range of instruments and powerful charting tools.

Is oneZero Safe or Scam?

Based on the information provided, it appears that oneZero does not currently possess any valid regulation. This absence of regulatory oversight raises legitimate concerns regarding the platform's safety and legitimacy. Regulatory frameworks exist to ensure transparency, consumer protection, and adherence to industry standards. Without proper regulation, there is an increased risk of fraudulent activities or potential scams taking place within the company's operations.

Market Instruments

oneZero is a technology provider that offers a comprehensive trading infrastructure solution rather than directly providing market instruments. They provide a technology platform and services that enable brokers, liquidity providers, and financial institutions to connect, trade, and access various market instruments across different asset classes. Here is a breakdown of the market instruments commonly traded within the industry:

Forex: Also known as foreign exchange, forex trading involves buying and selling currencies. Traders can speculate on the exchange rate movements between different currency pairs, such as EUR/USD, GBP/JPY, or AUD/CAD.

CFDs: Contracts for Difference (CFDs) allow traders to speculate on the price movements of various underlying assets without owning the assets themselves. CFDs can be based on various financial instruments, including stocks, indices, commodities, and cryptocurrencies.

Commodities: Commodities represent physical goods or raw materials that can be traded in financial markets. Examples of commodities include gold, silver, oil, natural gas, agricultural products, and more. Traders can speculate on the price fluctuations of these commodities.

Futures: Futures contracts are agreements to buy or sell an asset at a predetermined price and date in the future. Traders can speculate on the future price movements of commodities, currencies, indices, or other assets using futures contracts.

Cash Equities: Cash equities refer to the buying and selling of company stocks on stock exchanges. Investors can trade shares of publicly listed companies, aiming to profit from price movements or receive dividends based on the company's performance.

Cryptocurrencies: Cryptocurrencies are digital or virtual currencies that use cryptography for secure transactions. Examples include Bitcoin, Ethereum, Litecoin, and many others. Traders can speculate on the price movements of cryptocurrencies in dedicated cryptocurrency markets.

Accounts

To accommodate clients who are ready to engage in live trading, oneZero offers real accounts. These accounts enable clients to deposit actual funds and participate in the financial markets with real money. By accessing real accounts, clients gain the opportunity to execute trades in real-time, experiencing the dynamics of the market firsthand. Profits and losses are reflected in the account balance, allowing clients to track their performance and make informed decisions based on actual outcomes.

In addition to real accounts, oneZero recognizes the significance of providing a risk-free environment for clients to practice and explore trading strategies. To facilitate this, they offer demo accounts. These accounts replicate the trading platform and market conditions, but with virtual funds instead of real money.

Technology Services

oneZero is a comprehensive trading technology provider that offers a holistic solution through its three core components: Hub, EcoSystem, and Data Source. These components work in harmony to deliver a complete and integrated solution for trading technology, distribution, and analytics.

The first component, Hub, serves as the central infrastructure of oneZero's offering. It acts as a robust and scalable foundation that connects various market participants, including brokers, liquidity providers, and other trading venues. The Hub leverages cutting-edge technology to facilitate the seamless flow of trading data, orders, and other crucial information across the entire trading ecosystem. It ensures efficient connectivity and smooth execution of trades, providing a reliable backbone for clients' trading activities.

The second component, EcoSystem, is a network of liquidity providers and trading venues integrated with the oneZero platform. It enables clients to access a wide range of financial instruments, markets, and liquidity sources from a single interface. By leveraging the power of the EcoSystem, clients gain access to competitive pricing, deep liquidity, and diverse trading opportunities. It empowers traders with the flexibility to choose the most suitable liquidity providers and optimize their trading strategies based on real-time market conditions.

The third component, Data Source, forms the analytical backbone of oneZero's solution. It provides comprehensive and actionable insights derived from vast amounts of trading data. By harnessing advanced analytics and data visualization tools, the Data Source enables clients to gain a deep understanding of their trading performance, market trends, and other relevant metrics. This valuable information empowers traders to make data-driven decisions, identify opportunities, and fine-tune their trading strategies for enhanced profitability.

Trading Platforms

oneZero provides its clients with access to the widely recognized and utilized MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms have gained popularity among traders globally for their robust features, user-friendly interfaces, and extensive capabilities. Both MT4 and MT5 platforms offer access to real-time market data, real-time price quotes, and execution of trades. They provide traders with various order types, including market orders, limit orders, stop orders, and more. Traders can also set up price alerts and notifications to stay informed about market movements and trading opportunities.

Overall, oneZero's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| oneZero | MT4/MT5 |

| Saxo Bank | SaxoTraderGO, SaxoTraderPRO |

| OANDA | OANDA Trade, MetaTrader 4 (MT4) |

| CMC Markets | Next Generation Platform |

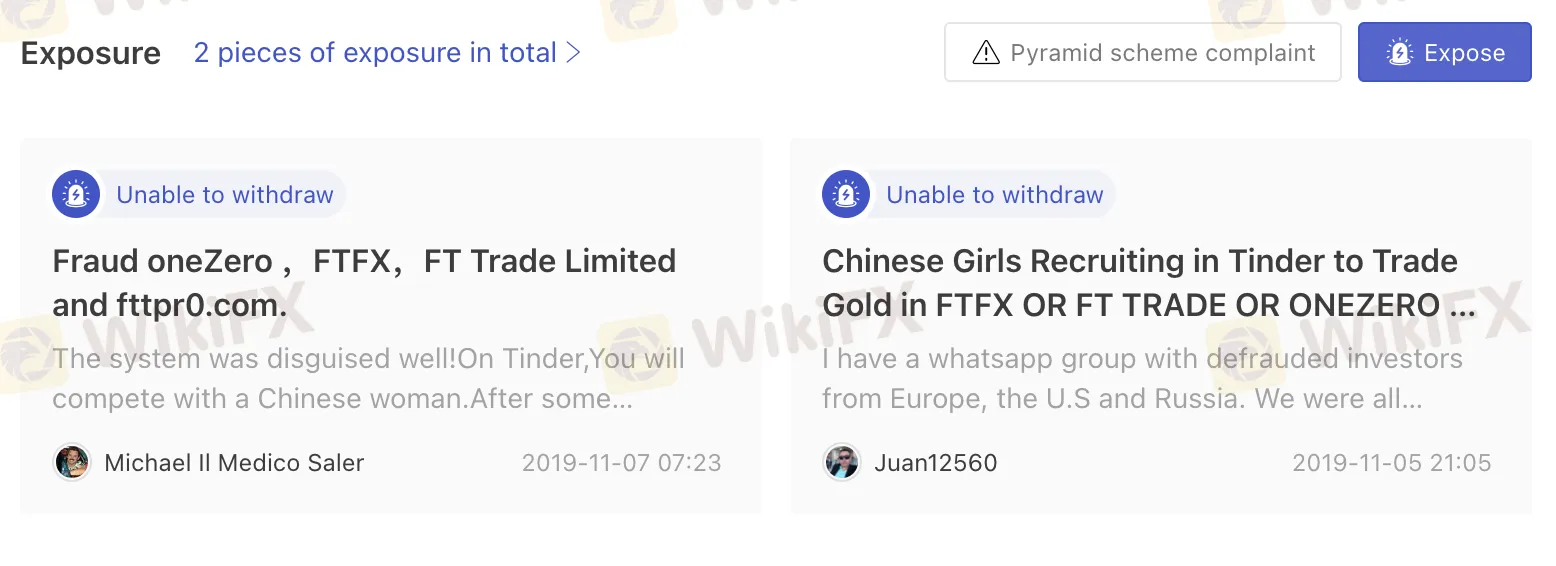

User Exposure on WikiFX

You may find two reports of withdrawal issues on our website. Investors are urged to evaluate the risks involved with trading on an unregulated platform and carefully study the information offered. Before trading, you may check the information on our site. Please let us know in the Exposure area if you come across any such dishonest brokers or if you have been the victim of one. We would appreciate that, and our team of professionals will make every effort to help you solve the problem.

Customer Service

oneZero accepts customer service via telephone: +1.888.703.4285, email: info@onezero.com, social media: Linkedin, Twitter and online messaging. Clients can utilize the online messaging system offered by oneZero to communicate with their customer service team. This allows for quick and convenient interactions, where clients can ask questions, seek guidance, or address any issues they may be facing.

The address: 455 Grand Union Blvd, Ste 400 Somerville, MA 02145-1446 United States.

Conclusion

In conclusion, oneZero stands out as a prominent provider of trading technology solutions in the financial industry. Through their three core components – Hub, EcoSystem, and Data Source – they offer a complete solution for trading technology, distribution, and analytics. Clients can access real accounts and demo accounts, enabling them to engage in live trading or practice strategies risk-free. With a strong emphasis on customer service, oneZero offers multiple communication channels, including online messaging, telephone, email, and social media. Their customer service team is dedicated to delivering prompt and effective support to ensure client satisfaction. Moreover, oneZero's provision of MT4 and MT5 trading platforms, combined with their reliable infrastructure and connectivity, positions them as a trusted partner for brokers, liquidity providers, and traders seeking advanced trading solutions. However, it is crucial to highlight and consider the significant factor of the lack of valid regulation pertaining to oneZero. It is advisable to explore alternative regulated options that offer the necessary safeguards and protection for clients' funds and interests.

Frequently Asked Questions (FAQs)

Q1: What is a significant concern regarding oneZero's operations?

A1: The lack of valid regulation for oneZero is a major concern. It raises questions about safety, transparency, and client protection, as regulatory oversight plays a crucial role in ensuring compliance and safeguarding clients' interests.

Q2: What trading platforms does oneZero support?

A2: oneZero supports popular trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms offer a range of features for technical analysis, order execution, and trade management. They are known for their user-friendly interfaces and extensive capabilities.

Q3: How can I contact oneZero for customer support?

A3: oneZero offers customer support through various channels. You can reach out to them via online messaging, telephone, email, or social media platforms such as LinkedIn and Twitter. Their contact information, including telephone number and email address, is typically provided on their website.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

WikiFX Broker

Latest News

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Rupee gains against Euro

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

Bitcoin ETF Options Get Closer to Reality with CFTC Clarification

Currency Calculator