简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

HMA

Abstract:HMA INVESTMENTS PTY LTD is a financial broker based in Australia, operating for approximately 2-5 years. They provide trading services in the forex market through the MetaTrader 5 (MT5) platform. HMA offers multiple account types, including Platinum, Mini, Standard, Premium, and Royal, each with distinct minimum deposit requirements and leverage ratios. However, it's important to note that the company operates without any regulatory oversight, as it is an unregulated broker. The HMA website is currently down, and the domain is listed for sale. This raises concerns about the company's current status and reliability.

| Key Information | Value |

| Company Name | HMA INVESTMENTS PTY LTD |

| Years of Establishment | 2-5 Years |

| Headquarters | Australia |

| Office Locations | N/A |

| Regulations/Licenses | Unregulated |

| Tradable Assets | Direct currency pairs, commodities, cross currency pairs, futures |

| Account Types | Platinum, Mini, Standard, Premium, Royal |

| Minimum Deposit | $200 |

| Leverage | Up to 1:250 |

| Deposit/Withdrawal Methods | N/A |

| Trading Platform | MetaTrader 5 (MT5) |

| Customer Support Options | Phone, WeChat, QQ, Email |

Overview of HMA

HMA INVESTMENTS PTY LTD is a financial broker based in Australia, operating for approximately 2-5 years. They provide trading services in the forex market through the MetaTrader 5 (MT5) platform. HMA offers multiple account types, including Platinum, Mini, Standard, Premium, and Royal, each with distinct minimum deposit requirements and leverage ratios.

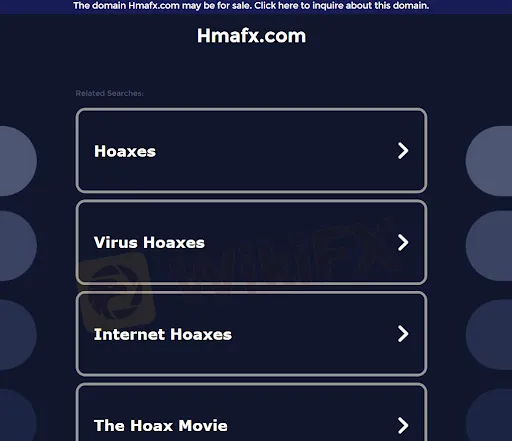

However, it's important to note that the company operates without any regulatory oversight, as it is an unregulated broker. The HMA website is currently down, and the domain is listed for sale. This raises concerns about the company's current status and reliability.

Regulation

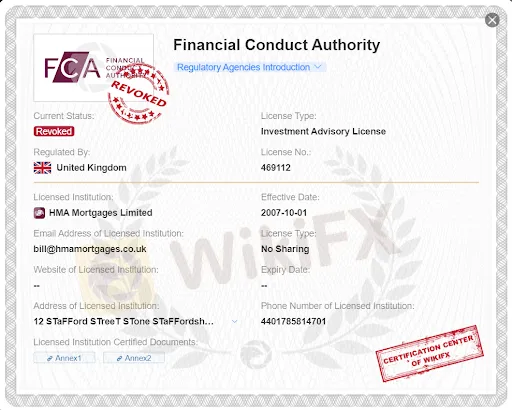

United Kingdom FCA (License Number: 469112):

HMA INVESTMENTS PTY LTD is associated with the United Kingdom's Financial Conduct Authority (FCA) through license number 469112. The FCA is a regulatory body that oversees financial services firms operating in the UK. However, it is important to note thatthe current status of this license is “Revoked.” This means that the license has been invalidated, and HMA is no longer authorized or regulated by the FCA. The revocation of the license raises concerns about the company's compliance with regulatory standards and the potential risks associated with conducting financial activities with an unregulated entity.

Australia ASIC (License Number: 129887538):

HMA INVESTMENTS PTY LTD is also associated with the Australian Securities & Investments Commission (ASIC) through license number 129887538. ASIC is the regulatory agency responsible for overseeing financial services and companies in Australia. However, it is important to note that the licensing for HMA exceeds the regulated business scope of ASIC. This means that HMA is operating outside the boundaries of the licensed activities approved by ASIC. This deviation from the regulated scope raises concerns about the company's compliance with regulatory requirements and the potential risks involved in dealing with a broker that operates beyond its approved scope.

Risk Warning:

HMA INVESTMENTS PTY LTD operates without any regulation or licensing. The lack of regulation raises significant risks and disadvantages for traders and investors. The absence of regulatory oversight means there are no official authorities monitoring the company's activities, customer fund protection, or compliance with industry standards. This lack of regulation and oversight may lead to increased vulnerability to fraud, financial misconduct, and potential challenges in resolving disputes or recovering funds. Additionally, the unavailability of specific licensing details further adds to the concerns surrounding the company's transparency and legitimacy.

Pros and Cons

HMA INVESTMENTS PTY LTD offers access to the forex market through the MetaTrader 5 (MT5) platform. Traders can choose from multiple account types, including Platinum, Mini, Standard, Premium, and Royal, providing flexibility based on individual trading preferences and investment capabilities. The availability of a variety of account types caters to traders with different risk appetites and investment sizes.

One significant drawback of HMA INVESTMENTS PTY LTD is the lack of regulation and licensing. The company operates as an unregulated broker, which raises concerns about the level of oversight, customer fund protection, and adherence to regulatory standards.

| Pros | Cons |

| Offers access to the forex market | Lack of regulation and licensing |

| Multiple account types available | Website currently down, domain listed for sale |

Ambiguous Website

The company website of HMA INVESTMENTS PTY LTD provides limited information regarding account types, minimum deposits, leverage, spread, deposit/withdrawal methods, and trading platforms. This lack of detailed information poses challenges in understanding the specific offerings and conditions provided by the company. Without clear descriptions of account types, potential clients may struggle to determine which account suits their trading needs and investment preferences. Additionally, the absence of information about minimum deposits, leverage ratios, and spreads makes it difficult to assess the financial requirements and potential costs associated with trading through HMA.

Furthermore, the lack of clarity regarding deposit/withdrawal methods is concerning, as traders require transparent and reliable payment options to manage their funds effectively. The absence of such information can lead to confusion and uncertainty, making it challenging for individuals to make informed decisions about engaging with the company.

The limited description of trading platforms raises concerns about the technological infrastructure and functionality provided by HMA. Potential clients require detailed information about the trading platform's features and capabilities to assess its suitability for their trading activities. The lack of comprehensive platform information leaves potential clients uncertain about the trading tools and resources available, potentially impacting the company's reputation and credibility.

In summary, the lack of detailed information on account types, minimum deposits, leverage, spread, deposit/withdrawal methods, and trading platforms on the HMA website hinders clarity and transparency. This deficiency may create doubts about the company's reputation and credibility, as potential clients may question the company's commitment to providing comprehensive and transparent information to support their trading decisions.

Market Instruments

HMA INVESTMENTS PTY LTD offers a range of market instruments for trading. Based on the provided information, these instruments include direct currency pairs, commodities, cross currency pairs, and futures. While specific details about the currencies and commodities available for trading are not mentioned, it can be inferred that HMA provides access to major and minor currency pairs, popular commodities such as gold, silver, oil, etc., as well as cross currency pairs and futures contracts.

Here is a table comparing the available market instruments of HMA INVESTMENTS PTY LTD with FXPro, IC Markets, FBS, and Exness:

| Market Instruments | HMA INVESTMENTS PTY LTD | FXPro | IC Markets | FBS | Exness |

| Currency Pairs | Direct currency pairs | Wide variety | Wide variety | Wide variety | Wide variety |

| Commodities | Gold, Silver, Oil, etc. | Gold, Silver, Oil, etc. | Gold, Silver, Oil, etc. | Gold, Silver, Oil, etc. | Gold, Silver, Oil, etc. |

| Cross Currency Pairs | Yes | Yes | Yes | Yes | Yes |

| Futures | Yes | Limited | Limited | Limited | Limited |

Account Types

HMA INVESTMENTS PTY LTD offers multiple account types to cater to different traders' needs. The available account types include Platinum, Mini, Standard, Premium, and Royal. Unfortunately, specific details about the features and characteristics of each account type, such as spreads, deposit/withdrawal methods, and commission structures, are not provided. It can be assumed that each account type offers varying levels of leverage ratios and possibly different trading conditions. However, without detailed information, it is challenging to compare and assess the differences between the account types accurately.

Here is a table comparing the different account types based on the limited information provided:

| Account Type | Mini | Standard | Platinum | Premium | Royal |

| Minimum Deposit | $200.00 | $1,000 | $5,000 | $10,000 | $25,000 |

| Leverage | 1:100 | 1:100 | 1:150 | 1:200 | 1:250 |

| Spreads | N/A | N/A | N/A | N/A | N/A |

| Deposit/Withdrawal Methods | N/A | N/A | N/A | N/A | N/A |

| Commission | N/A | N/A | N/A | N/A | N/A |

| Additional Features | N/A | N/A | N/A | N/A | N/A |

Minimum Deposit

HMA INVESTMENTS PTY LTD offers various account types with different minimum deposit requirements. The minimum deposit rates for each account type are as follows: $200 for the Mini account, $1,000 for the Standard account, $5,000 for the Platinum account, $10,000 for the Premium account, and $25,000 for the Royal account. These minimum deposit rates provide traders with options suited to their investment preferences and risk appetite.

Trading Platform

HMA INVESTMENTS PTY LTD offers the MetaTrader 5 (MT5) trading platform. The MT5 platform is a widely recognized and popular trading platform known for its advanced charting capabilities, extensive technical analysis tools, and algorithmic trading options. It provides traders with a user-friendly interface, real-time market data, and the ability to execute trades efficiently. However, specific details about additional features, customization options, and platform compatibility are not provided in the available information.

Here is a table comparing the trading platforms offered by HMA INVESTMENTS PTY LTD with FXTM, Exness, Pepperstone, and FP Markets:

| Broker | HMA INVESTMENTS PTY LTD | FXTM | Exness | Pepperstone | FP Markets |

| Trading Platforms | MetaTrader 5 (MT5) | MetaTrader 4 (MT4), MT5 | MetaTrader 4 (MT4), MT5 | MetaTrader 4 (MT4), cTrader | MetaTrader 4 (MT4), IRESS |

| Additional Platforms | N/A | FXTM Trader (Mobile), FXTM Invest (Copy Trading) | Exness Trader (Mobile) | cTrader (ECN Trading) | IRESS (Professional) |

Customer Support

Phone: Customer support can be reached via phone with the following numbers: +852-64322144 and +852-64325114. Traders can use these numbers to seek assistance, ask questions, or address any concerns they may have.

WeChat: Traders can connect with customer support through the messaging platform WeChat by adding the username “hmcfds”. This allows for direct communication and assistance.

QQ: Customer support is available through the messaging platform QQ with the QQ number 800184804. Traders can use this platform to reach out to the support team and get their queries addressed.

Email: Contacting customer support via email is an option as well. Traders can send their inquiries or issues to the provided email address, info@hmafx.com.

Customer Feedback and Reviews

Traders have expressed concerns and frustrations related to their experience with the company. Feedback highlights issues such as difficulties in withdrawing funds, suspicious practices, delays in processing withdrawals, and unresponsiveness from customer service representatives. Traders have reported encountering obstacles such as erroneous bank card information, requests for additional payments, and being directed to upgrade their membership to access withdrawal options. These feedbacks suggest potential risks and challenges associated with engaging in financial activities with HMA.

Conclusion

HMA INVESTMENTS PTY LTD is an Australia-based financial broker established within the past 2-5 years, offers trading services in the forex market through the MetaTrader 5 (MT5) platform. While the company provides access to a variety of market instruments such as currency pairs, commodities, cross currency pairs, and futures, there are limitations in terms of transparency and regulatory oversight. HMA operates as an unregulated broker, lacking specific licenses or regulations to provide customers with the assurance of compliance with industry standards and investor protection.

Due to the company's revoked United Kingdom Investment Advisory License and the fact that its business scope exceeds the regulated limits set by the Australia Securities & Investment Commission (ASIC), there is an inherient danger involved with the company. Additionally, the absence of detailed information on account types, trading conditions, deposit/withdrawal methods, and educational content creates uncertainties and hampers the clarity of HMA's offerings. The limited description of customer support options and the reported customer feedback regarding difficulties in fund withdrawals and unresponsiveness further raise concerns about the reliability and quality of services provided.

FAQs

Q: What trading platform does HMA INVESTMENTS PTY LTD offer?

A: HMA INVESTMENTS PTY LTD offers the MetaTrader 5 (MT5) trading platform.

Q: Are there any regulatory licenses associated with HMA INVESTMENTS PTY LTD?

A: No, HMA INVESTMENTS PTY LTD operates as an unregulated broker.

Q: What are the available market instruments for trading with HMA INVESTMENTS PTY LTD?

A: HMA INVESTMENTS PTY LTD provides access to direct currency pairs, commodities, cross currency pairs, and futures.

Q: How can I contact customer support at HMA INVESTMENTS PTY LTD?

A: You can reach customer support at HMA INVESTMENTS PTY LTD through phone, WeChat, QQ, and email.

Q: Is there a minimum deposit requirement for opening an account with HMA INVESTMENTS PTY LTD?

A: Yes, HMA INVESTMENTS PTY LTD has different minimum deposit requirements based on the chosen account type.

Q: Are there any regulatory concerns associated with HMA INVESTMENTS PTY LTD?

A: Yes, HMA INVESTMENTS PTY LTD has faced regulatory issues, including the revocation of its United Kingdom Investment Advisory License.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

StoneX Financial Secures General Clearing Membership with ECC

StoneX Group Inc. has announced that its subsidiary, StoneX Financial Limited, has been granted General Clearing Member (GCM) status by European Commodity Clearing AG (ECC).

easyMarkets Kicks Off the Start of Its Trade with the Champions Competition

easyMarkets has launched its Trade with the Champions competition. The event will run from 2 December 2024 to 15 January 2025. It is open to both new and existing traders, offering them a chance to compete and win prizes.

MAS Imposes $2.4M Fine on JPMorgan Chase for Misconduct

JPMorgan Chase is fined $2.4 million by MAS for overcharging clients on OTC bond trades, misrepresenting spreads, and unethical actions by relationship managers.

CONSOB Extends Crackdown on Unauthorised Financial Websites

Italy’s Companies and Exchange Commission (CONSOB) has intensified its efforts to combat illegal financial activities, recently ordering the blocking of four additional websites providing unauthorised financial services

WikiFX Broker

Latest News

Ripple’s RLUSD Stablecoin Expected to Launch in NY by Dec. 4

ActivTrades Gains Regulatory License in Mauritius

Ontario launches major US ad campaign amid Trump's tariff threat

Capital.com Collaborated with Amazon in the UAE

Apple Pay, Google Pay Eyeing Launch in the Philippines

easyMarkets Kicks Off the Start of Its Trade with the Champions Competition

Oil Prices Mixed Amid Accusations of Ceasefire Violations Between Israel and Hezbollah

India's Rs 6,000 Crore Ponzi scam

Philippines Warns Public of Get-Rich-Quick Scams This Christmas

Know Ins & Outs of Prop Trading Firms

Currency Calculator