简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WorldTradeInvestment

Abstract:World Trade Investment is an unregulated forex trading company headquartered in the UK. They have been operating for 2-5 years and offer various account types with a minimum deposit requirement of $100. The company provides high leverage of up to 1:1000, competitive spreads starting from 0.5, and convenient deposit/withdrawal methods. They offer customer support via phone and email, educational content, and a welcome bonus of 50% for new traders. However, trading with an unregulated entity carries risks, including limited investor protection and oversight. It is essential for traders to exercise caution, conduct thorough research, and be aware of the potential disadvantages associated with unregulated trading environments.

| Key Information | Details |

| Company Name | World Trade Investment |

| Years of Establishment | 2-5 Years |

| Headquarters | United Kingdom |

| Office Locations | N/A |

| Regulation/Licenses | Unregulated |

| Tradable Assets | Forex |

| Account Types | W-Standard, W-Premium, W-Pro, W-Elite, W-Fix, W-Crypto |

| Minimum Deposit | $100 |

| Leverage | Up to 1:1000 |

| Spread | Down to 0.5 |

| Deposit/Withdrawal | Wire Transfer, Online Bank, Cryptocurrency |

| Trading Platforms | TradingPlatform |

| Customer Support | Phone, Email |

| Educational Content | Available |

| Bonus Offering | Welcome Bonus: 50% |

Overview of WorldTradeInvestment

World Trade Investment is an unregulated forex trading company headquartered in the UK. They have been operating for 2-5 years and offer various account types with a minimum deposit requirement of $100. The company provides high leverage of up to 1:1000, competitive spreads starting from 0.5, and convenient deposit/withdrawal methods.

They offer customer support via phone and email, educational content, and a welcome bonus of 50% for new traders. However, trading with an unregulated entity carries risks, including limited investor protection and oversight. It is essential for traders to exercise caution, conduct thorough research, and be aware of the potential disadvantages associated with unregulated trading environments.

Regulation

There is no valid regulatory information available for World Trade Investment. The absence of regulatory licenses raises concerns about the company's compliance with industry standards and regulations designed to protect investors. Trading with an unregulated entity entails increased risks, as there is no oversight or supervision from a regulatory authority. The lack of regulation means that there is no external body monitoring the company's activities, ensuring fair practices, or providing avenues for dispute resolution. This can potentially expose traders to a variety of disadvantages, including a higher risk of fraud, lack of transparency, inadequate investor protection, and potential difficulties in retrieving funds or seeking recourse in case of any issues or disputes.

Pros and Cons

World Trade Investment offers a range of account types catering to different trading preferences, allowing traders to choose the one that suits their needs. The availability of various account options, each with different minimum deposits, leverage ratios, and spreads, provides flexibility for traders to select the account that aligns with their risk appetite and trading strategies. Additionally, the company offers a welcome bonus of 50%, which can be appealing to traders looking to boost their initial trading capital. Furthermore, the educational content provided by World Trade Investment, including guides on forex trading, risk management, and leverage, can be beneficial for novice traders seeking to enhance their knowledge and skills in the field.

One of the significant drawbacks of World Trade Investment is the lack of valid regulatory information. The absence of proper regulation raises concerns about the company's adherence to industry standards and the level of investor protection provided. Furthermore, the absence of detailed information about the company's headquarters and office locations may raise questions about its transparency and credibility. Additionally, the limited contact options, with only a phone number and email provided, may be insufficient for traders seeking prompt and efficient customer support.

| Pros | Cons |

| Range of account types | Lack of valid regulatory information |

| Welcome bonus | Limited transparency and credibility |

| Educational content | Limited contact options |

| Potential risks of fraud and lack of investor protection | |

| Insufficient customer support options | |

| Unable to create an account |

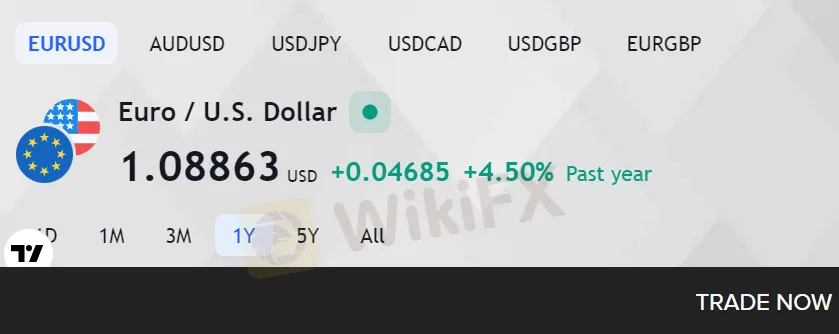

Market Instruments

World Trade Investment offers Forex as its market instrument. Forex, also known as foreign exchange, involves the trading of currency pairs in the global market. Traders can speculate on the price movements of various currency pairs, aiming to profit from the fluctuations in exchange rates. As the largest and most liquid financial market in the world, Forex provides ample opportunities for traders to participate in currency trading and potentially generate profits. The Forex market operates 24 hours a day, allowing traders from different time zones to engage in trading at their convenience.

The following is a table that compares Word Trade Investment's available market instruments to that of four other competing companies:

| Companies | Available Market Instruments |

| World Trade Investment | Forex |

| FXPro | Forex, Shares, Indices, Commodities |

| IC Markets | Forex, Shares, Indices, Commodities |

| FBS | Forex, Metals, Stocks, Indices, Energies |

| Exness | Forex, Metals, Stocks, Energies, Indices |

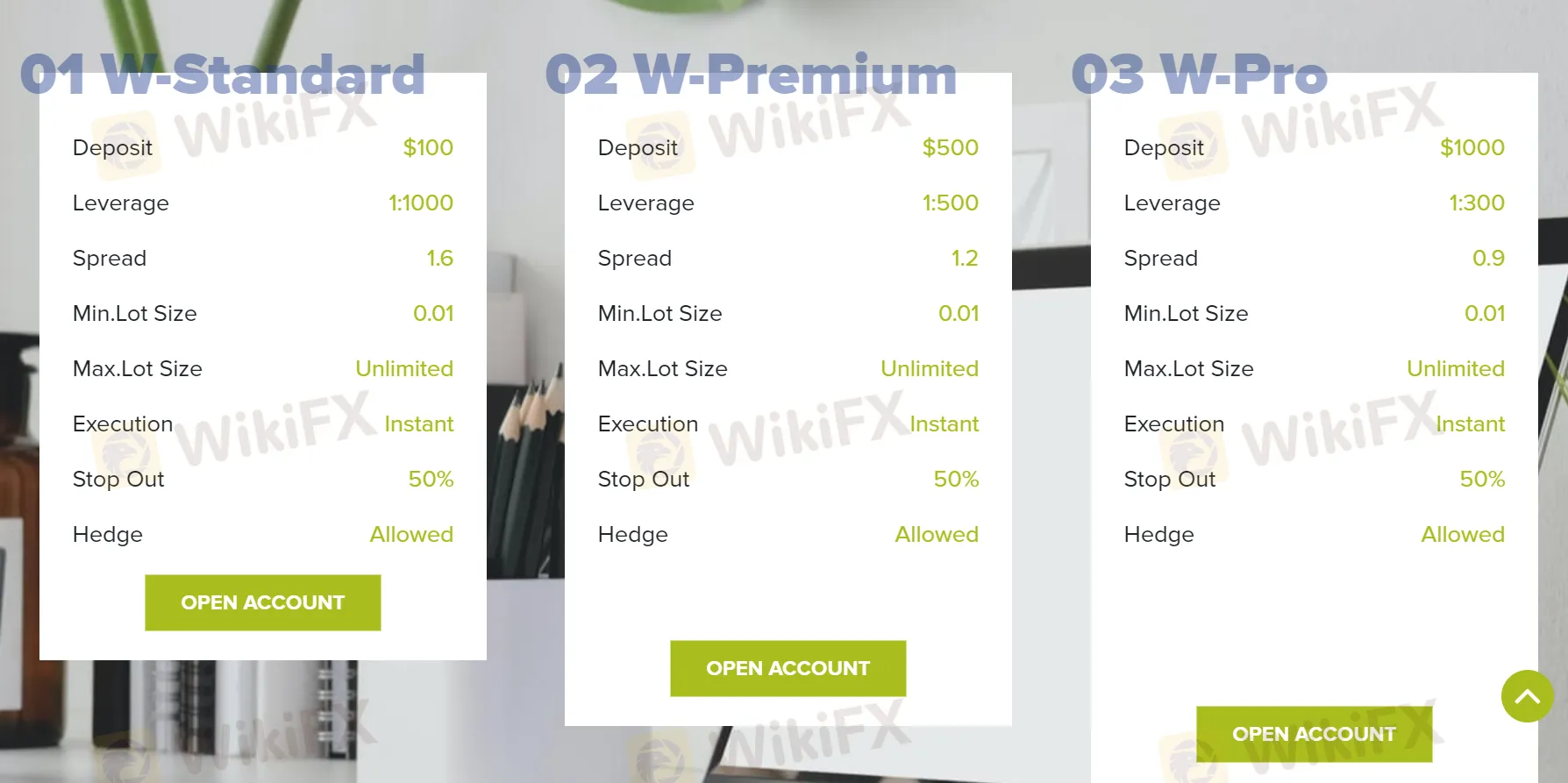

Account Types

World Trade Investment offers multiple account types to cater to the varying needs and preferences of traders. Each account type comes with its own deposit requirement, leverage ratio, spread, and other features.

The W-Standard account requires a minimum deposit of $100 and offers a leverage of 1:1000 with a spread of 1.6. The W-Premium account requires a minimum deposit of $500 and provides a leverage of 1:500 with a spread of 1.2. The W-Pro account requires a minimum deposit of $1000 and offers a leverage of 1:300 with a spread of 0.9.

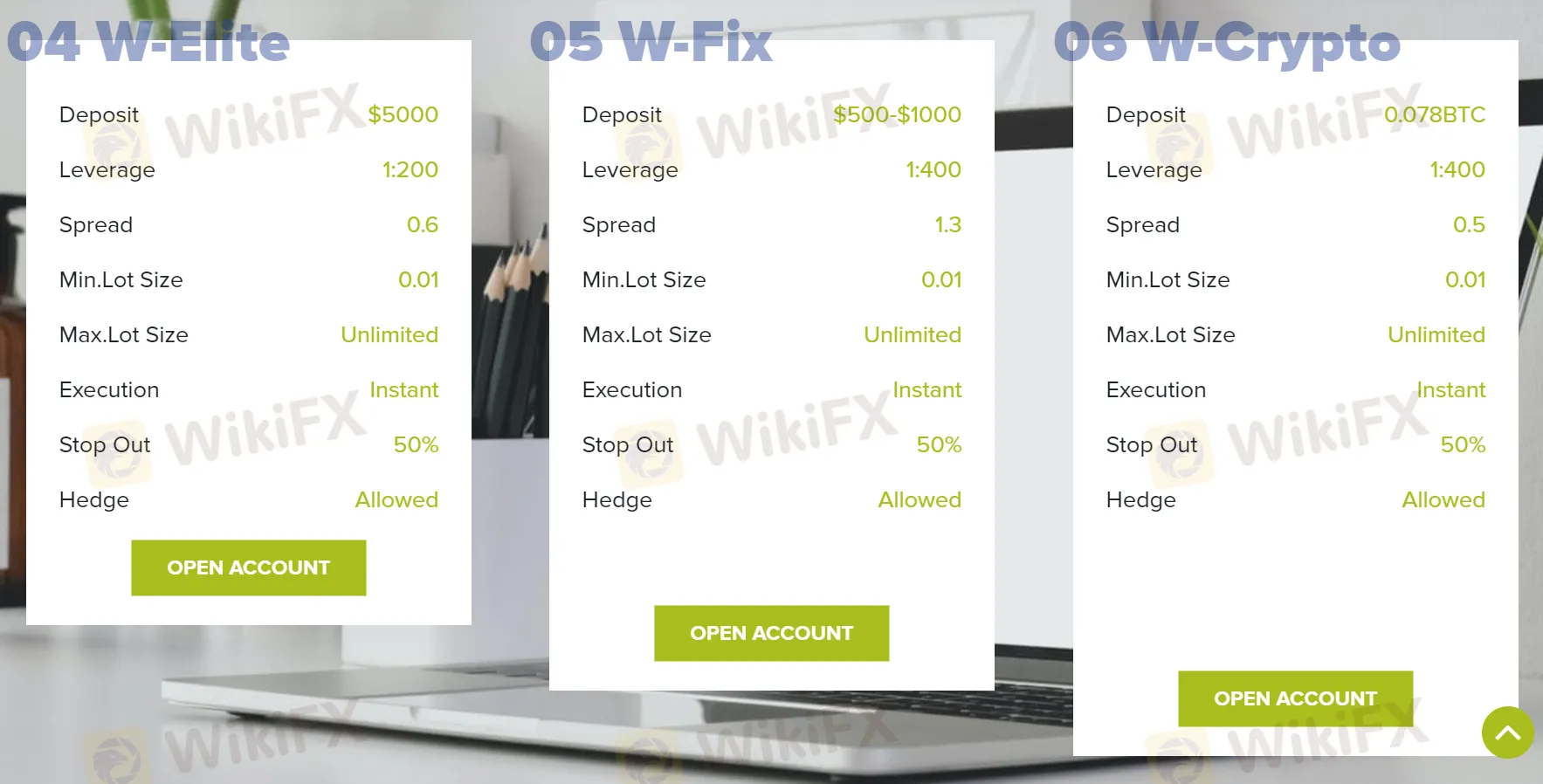

The W-Elite account, on the other hand, requires a minimum deposit of $5000 and provides a leverage of 1:200 with a spread of 0.6. The W-Fix account has a deposit requirement ranging from $500 to $1000, a leverage of 1:400, and a spread of 1.3. Lastly, the W-Crypto account requires a deposit of 0.078BTC, offers a leverage of 1:400, and features a spread of 0.5. Traders can choose the account type that aligns with their trading strategies, risk tolerance, and available capital.

| Account Type | Minimum Deposit | Leverage | Spread | Max.Lot Size | Execution | Stop Out | Hedge |

| W-Standard | $100 | 1:1000 | 1.6 | Unlimited | Instant | 50% | Allowed |

| W-Premium | $500 | 1:500 | 1.2 | Unlimited | Instant | 50% | Allowed |

| W-Pro | $1,000 | 1:300 | 0.9 | Unlimited | Instant | 50% | Allowed |

| W-Elite | $5,000 | 1:200 | 0.6 | Unlimited | Instant | 50% | Allowed |

| W-Fix | $500-$1000 | 1:400 | 1.3 | Unlimited | Instant | 50% | Allowed |

| W-Crypto | 0.078BTC | 1:400 | 0.5 | Unlimited | Instant | 50% | Allowed |

How to make an account?

There is an issue with the account creation process on the World Trade Investment website. The creation process website appears to be a broken link, rendering it currently impossible to make an account through their website. This issue can be frustrating for individuals who are interested in opening an account and engaging in forex trading with World Trade Investment. It is essential for traders to have a seamless and functioning account creation process to begin their trading journey smoothly. In such cases, it is advisable to reach out to World Trade Investment's customer support through the available contact options, such as phone or email, to inquire about the issue and seek guidance on how to proceed with creating an account.

Minimum Deposit

World Trade Investment offers various minimum deposit rates for its different account types, allowing traders to choose the option that best suits their financial capabilities and trading goals. The minimum deposit requirement ranges from $100 for the W-Standard account to $500 for the W-Premium account, $1000 for the W-Pro account, $5000 for the W-Elite account, and a deposit range of $500 to $1000 for the W-Fix account. Additionally, the W-Crypto account requires a minimum deposit of 0.078BTC.

Leverage

World Trade Investment provides various leverage options for traders, allowing them to amplify their trading positions and potentially increase their potential returns. The leverage ratios offered by World Trade Investment range from 1:1000 for the W-Standard account to 1:400 for the W-Fix and W-Crypto accounts. The leverage ratio signifies the amount of capital a trader can control relative to their own invested funds. Higher leverage can offer the opportunity for greater profits, but it also entails increased risk, as losses can be magnified. It is essential for traders to understand the implications of leverage and exercise prudent risk management strategies to protect their investments.

Here is a table comparing the maximum leverage on the market instruments of World Trade Investment with those of FXPro, IC Markets, FBS, and Exness:

| Companies | Forex |

| World Trade Investment | Up to 1:1000 |

| FXPro | 1:30 |

| IC Markets | 1:500 |

| FBS | 1:3000 |

| Exness | 1:2000 |

Spread

World Trade Investment offers different spreads for its various account types. The spread refers to the difference between the buying and selling prices of a trading instrument. In the case of World Trade Investment, the spreads range from 1.6 for the W-Standard account to 0.5 for the W-Crypto account. Lower spreads generally indicate tighter pricing and can be advantageous for traders as they can potentially reduce trading costs. However, it's important to note that spreads may vary depending on market conditions and liquidity.

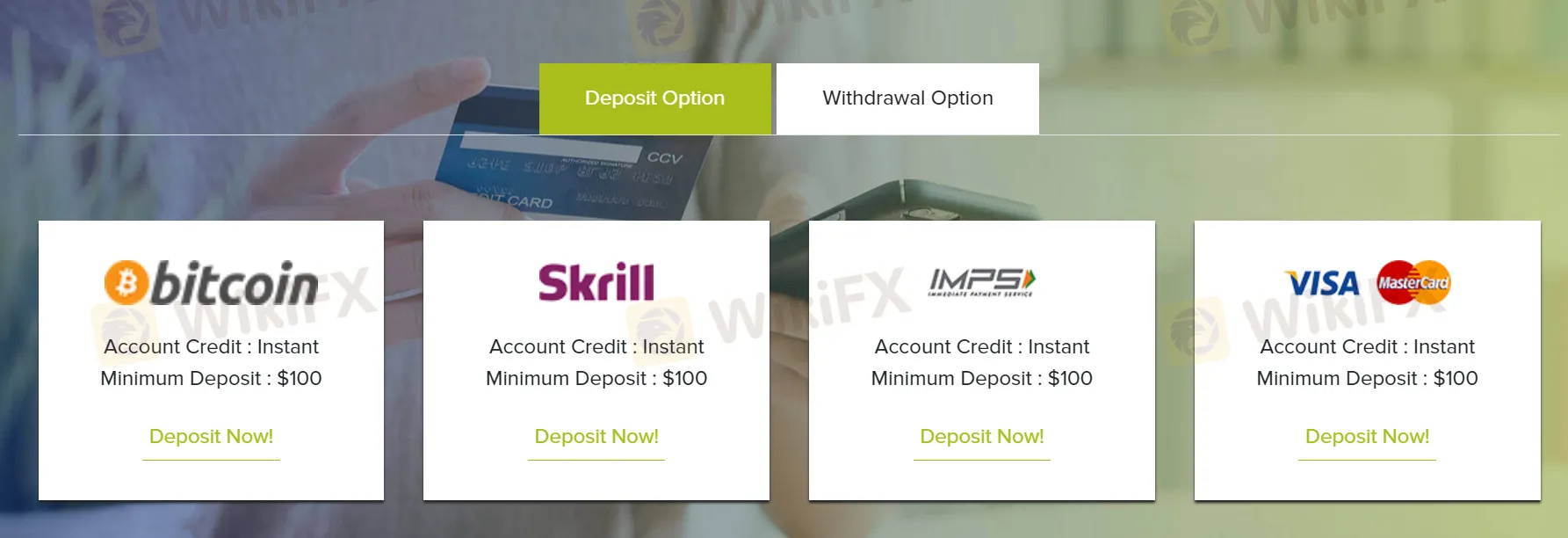

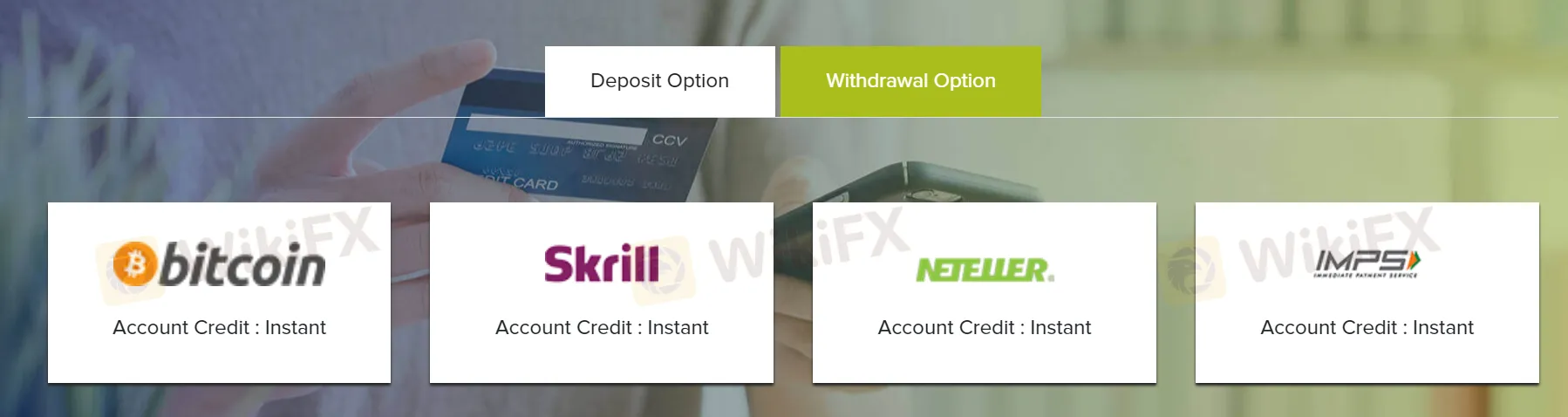

Deposit & Withdrawal

World Trade Investment offers several deposit and withdrawal methods to facilitate transactions for its clients. The available options include wire transfer, online bank, and cryptocurrency. Wire transfer allows traders to transfer funds directly from their bank accounts to the trading account with World Trade Investment. Online bank transfers provide a convenient and secure way for clients to deposit and withdraw funds electronically. Additionally, World Trade Investment accepts deposits and withdrawals in cryptocurrency, which can offer faster transaction processing and enhanced privacy.

The singular defining difference is that Visa is replaced as Neteller for the withdrawal options.

Trading Platform

While specific information cannot be found about the software “TradingPlatform”, WorldTradeInvestment claims to be using it.

The following is a table that compares Word Trade Investment's in use trading platform to that of four other competing companies:

| Broker | Trading Platforms |

| World Trade Investment | TradingPlatform |

| FXTM | MT4, MT5, FXTM Trader |

| Exness | MT4, MT5, Exness Trader |

| Pepperstone | MT4, MT5, cTrader, Pepperstone App |

| FP Markets | MT4, MT5, IRESS |

Customer Support

World Trade Investment provides customer support through two main channels: phone and email. Traders can reach their customer support team by calling the phone number +44 20-36033856. Alternatively, they can contact them via email at info@worldtradeinvestment.com. These channels allow traders to seek assistance, inquire about their trading accounts, resolve issues, or seek clarification on any concerns they may have.

Educational Resources

World Trade Investment provides educational content to help traders enhance their knowledge and skills in forex trading. The educational materials cover a range of topics, including how to trade forex, currency pairs and rates, starting trading in four easy steps, risk management, and understanding leverage. These resources educate traders on the fundamental concepts of forex trading, risk management techniques, and the importance of leverage. By offering educational content, World Trade Investment seeks to empower traders with the necessary knowledge to make informed trading decisions. Traders can access these resources to deepen their understanding of the forex market, improve their trading strategies, and potentially enhance their overall trading performance.

Bonus Offers

World Trade Investment offers a bonus offer called the Welcome Bonus. The Welcome Bonus is available to all traders and provides them with a 50% bonus on their initial deposit. This bonus serves as an incentive to encourage traders to learn and engage in forex trading, allowing them to enhance their trading experiences and potentially maximize their performance in the market. The Welcome Bonus can provide traders with additional trading capital, which may be beneficial for exploring new trading opportunities or managing their positions. It's important for traders to carefully review the terms and conditions associated with the Welcome Bonus, as there may be specific requirements or restrictions on its usage or withdrawal.

Conclusion

In conclusion, World Trade Investment is an unregulated forex trading company headquartered in the United Kingdom. With a history spanning 2-5 years, the company offers a range of account types tailored to suit various trading preferences. Traders can access the forex market through their platform, which provides competitive spreads starting from as low as 0.5.

While the company offers educational content and a welcome bonus to enhance the trading experience, it is crucial to note that trading with an unregulated entity carries inherent risks. The absence of regulatory oversight may raise concerns about investor protection and transparency.

FAQs

Q: What types of account options does World Trade Investment offer?

A: World Trade Investment provides a range of account types, including W-Standard, W-Premium, W-Pro, W-Elite, W-Fix, and W-Crypto.

Q: What is the minimum deposit required to open an account with World Trade Investment?

A: The minimum deposit to open an account with World Trade Investment is $100.

Q: Can traders access leverage with World Trade Investment?

A: Yes, traders can leverage their positions with World Trade Investment, with leverage ratios of up to 1:1000.

Q: What are the available deposit and withdrawal methods?

A: World Trade Investment offers deposit and withdrawal methods such as wire transfer, online bank, and cryptocurrency.

Q: Does World Trade Investment provide customer support options?

A: Yes, World Trade Investment offers customer support through phone and email.

Q: Are there educational resources available for traders?

A: Yes, World Trade Investment provides educational content to help traders enhance their knowledge and skills in forex trading.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

CONSOB Extends Crackdown on Unauthorised Financial Websites

Italy’s Companies and Exchange Commission (CONSOB) has intensified its efforts to combat illegal financial activities, recently ordering the blocking of four additional websites providing unauthorised financial services

ActivTrades Gains Regulatory License in Mauritius

ActivTrades secures a new FSC license in Mauritius to expand global reach. This new license strengthens its services across Africa, Asia, and international markets.

Smart Prop Trader to Close Doors in December 2024

Smart Prop Trader, a proprietary trading firm known for offering funded trading accounts, has announced plans to cease onboarding new traders as it prepares to wind down operations by the end of the year.

NAGA Adds UAE, Saudi Stocks to Platform with Zero Commissions

NAGA introduces UAE and Saudi Arabian stocks to its trading platform, offering zero commissions and expert tools like Autocopy to tap into booming Middle Eastern markets.

WikiFX Broker

Latest News

Meme Coins: Fleeting Fortune or Financial Folly?

Ripple’s RLUSD Stablecoin Expected to Launch in NY by Dec. 4

ActivTrades Gains Regulatory License in Mauritius

Ontario launches major US ad campaign amid Trump\s tariff threat

Trump Administration Pushes for CFTC to Lead Crypto Regulation

Oil Prices Mixed Amid Accusations of Ceasefire Violations Between Israel and Hezbollah

India's Rs 6,000 Crore Ponzi scam

Philippines Warns Public of Get-Rich-Quick Scams This Christmas

Know Ins & Outs of Prop Trading Firms

Malaysian Loses RM2.6 Million to Online Investment Scam

Currency Calculator