简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

topindex

Abstract:Topindex is an unregulated brokerage firm headquartered in Saint Vincent and the Grenadines. They offer trading in forex, commodities, and cryptocurrencies with a minimum deposit of $200. The company provides MetaTrader4 (MT4) as their trading platform. However, it is important to note that Topindex is not regulated, which may pose risks for traders.

| Topindex | Basic Information |

| Company Name | Topindex |

| Founded | Not specified |

| Headquarters | Saint Vincent and the Grenadines |

| Regulations | Unregulated |

| Tradable Assets | Forex, commodities, cryptocurrencies |

| Account Types | Not specified |

| Minimum Deposit | $ 200 |

| Maximum Leverage | Not specified |

| Spreads | 0.2 pips for EUR/USD pair |

| Commission | Not specified |

| Deposit Methods | Credit/Debit cards, Wire Transfers |

| Trading Platforms | MetaTrader4 (MT4) |

| Customer Support | Not specified |

| Education Resources | Not specified |

| Bonus Offerings | Two types of bonuses with strict conditions |

Overview of Topindex

Topindex is an unregulated brokerage firm headquartered in Saint Vincent and the Grenadines. They offer trading in forex, commodities, and cryptocurrencies with a minimum deposit of $200. The company provides MetaTrader4 (MT4) as their trading platform. However, it is important to note that Topindex is not regulated, which may pose risks for traders.

Trading with an unregulated broker exposes traders to potential risks as there is no oversight or supervision to ensure fair trading practices and the safety of funds. The lack of information on account types, leverage, commission, customer support, and education resources is also a concern as it hinders traders from making informed decisions. Additionally, Topindex imposes non-trading fees, including a substantial 10% monthly deduction for dormant accounts, which can significantly impact traders' funds.

On the positive side, Topindex offers trading in a variety of financial instruments and provides the popular MT4 trading platform known for its advanced features and tools. They also accept deposit methods such as credit/debit cards and wire transfers. However, traders need to exercise caution when considering the two types of bonuses offered, as they come with strict conditions that limit withdrawal eligibility.

Overall, traders should carefully evaluate the risks and limitations associated with trading with an unregulated broker like Topindex and consider regulated alternatives that offer greater transparency, security, and accountability.

Is Topindex Legit?

Topindex is not regulated by any recognized financial authority. This means that the broker operates without the oversight and supervision that regulation provides. Trading with an unregulated broker like Topindex exposes traders to significant risks, as there are no guarantees regarding the safety of funds, fair trading practices, or proper handling of client complaints. Regulated brokers, on the other hand, are subject to strict regulations and are required to adhere to certain standards and guidelines to protect the interests of their clients. It is generally advisable to choose a regulated broker to ensure a higher level of security and accountability in the trading process.

Pros and Cons

Topindex is an unregulated broker that offers trading in forex, commodities, and cryptocurrencies. They provide the MetaTrader4 (MT4) trading platform and accept credit/debit cards and wire transfers for deposits. However, the lack of regulation raises concerns, and important information about account types, leverage, commission, customer support, and education resources is missing. Traders should be cautious of non-trading fees, misleading funding information, high withdrawal fees, and strict conditions for bonus offerings.

| Pros | Cons |

| Offers trading in forex, commodities, and cryptocurrencies. | Unregulated broker, which poses risks for traders as there is no oversight or supervision. |

| Provides MetaTrader4 (MT4) as the trading platform, known for its advanced features and tools. | Lack of information on account types, leverage, commission, customer support, and education resources. |

| Allows for deposit methods such as credit/debit cards and wire transfers. | Non-trading fees, including a substantial 10% monthly deduction for dormant accounts. |

| Provides two types of bonuses, although caution is advised when considering them. | Misleading information about funding methods and high withdrawal fees. |

| Bonus offerings with strict conditions that limit withdrawal eligibility. |

Trading Instruments

Topindex offers a range of trading instruments, including forex, commodities, and cryptocurrencies. Forex trading involves speculating on the exchange rates between different currencies. Traders can access a selection of currency pairs to trade and potentially profit from fluctuations in their value.

Commodities trading allows investors to trade physical goods or raw materials, such as gold, silver, oil, and agricultural products. By trading commodities, traders can take advantage of price movements driven by factors like supply and demand, global events, and economic trends.

Topindex also provides the opportunity to trade cryptocurrencies like Bitcoin, Ethereum, and Ripple. Cryptocurrency trading involves speculating on the price movements of digital currencies. These markets are known for their high volatility, which can present both opportunities and risks for traders.

While the range of trading instruments offered by Topindex may be limited, traders can still participate in the popular and potentially profitable markets of forex, commodities, and cryptocurrencies. It's important for traders to conduct thorough research, stay informed about market trends, and employ effective risk management strategies when trading these instruments.

Here is a comparison table of trading instruments offered by different brokers:

| TopIndex | Exness | IC Markets | FxPro | |

| Forex | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| CFD | No | Yes | Yes | Yes |

| Indexes | No | Yes | Yes | Yes |

| Stock | No | Yes | Yes | Yes |

| ETF | No | No | No | No |

| Options | No | No | No | Yes |

Leverage

Topindex does not explicitly state the leverage available to traders on their platform. The absence of information regarding leverage raises concerns about transparency and can be seen as a red flag. Typically, leverage allows traders to amplify their trading positions by borrowing funds from the broker. Higher leverage can offer greater profit potential but also increases the risk of losses. It is important for traders to have clarity on the leverage offered by a broker as it directly impacts their trading strategy and risk management. Without specific details on leverage, it is advisable for traders to exercise caution and seek alternative brokers that provide transparent information about leverage options.

Spreads and Commissions (Trading Fees)

Topindex offers a spread of 0.2 pips for the EUR/USD pair on the Metatrader platform. The spread represents the difference between the buying and selling prices of a financial instrument, and a lower spread can be advantageous for traders as it reduces the cost of executing trades.

Regarding commissions, specific information is not provided by Topindex, making it difficult to assess the commission structure. Traders should exercise caution and seek clarification from the broker regarding any potential commissions or fees associated with trading on their platform.

It is important to note that while competitive spreads can be attractive, they should not be the sole determining factor when choosing a broker. Traders should consider other aspects such as regulation, reputation, customer support, and overall trading conditions to make an informed decision.

Furthermore, it is advisable to select a regulated broker that operates under the oversight of regulatory authorities. Regulated brokers adhere to specific standards and provide investor protection measures, which can enhance the safety and transparency of trading activities.

Non-Trading Fees

TopIndex imposes non-trading fees that raise concerns about the treatment of dormant accounts. If an account remains inactive for 6 months, it is classified as dormant, and a monthly deduction of 10% is applied. This policy is highly alarming and can be considered a scam clause as it allows Topindex to deplete the funds in traders' accounts mercilessly.

In contrast, regulated brokers typically charge much lower fees, ranging from 5 to 10 dollars per month, for dormant accounts. The substantial 10% deduction imposed by Topindex is excessive and raises questions about the fairness and integrity of their practices.

Traders should be cautious and consider the potential risks associated with such non-trading fees. It is advisable to choose brokers with transparent fee structures and reasonable policies regarding dormant accounts to safeguard their funds and avoid unnecessary losses.

Deposit & Withdraw Methods

TopIndex offers deposit and withdrawal methods for its clients, but there are several concerning aspects to consider. Firstly, the minimum initial deposit required is $200, which is higher than the industry average of $100.

Regarding funding methods, TopIndex claims to accept Credit/Debit cards and Wire Transfers. However, there is misleading information on their website as they actually use lesser-known e-wallets as funding options. This discrepancy is concerning and can potentially jeopardize the safety of traders' funds. It is crucial for traders to exercise caution and avoid making transfers through unfamiliar payment systems.

When it comes to withdrawals, TopIndex imposes minimum withdrawal amounts of $250 for Wire Transfers and $100 for other methods. Furthermore, the withdrawal fees are unreasonably high, with Wire Transfers incurring a fee of $50 and Credit/Debit card withdrawals incurring a fee of $25 plus a $10 processing fee. In comparison, most regulated brokers do not charge withdrawal fees and allow traders to withdraw their funds freely. Adding to the issue, there is an additional requirement for traders to meet a minimum trading volume of 200, without clear explanation, to avoid a 10% fee on the withdrawal amount.

These factors raise significant concerns about the transparency and fairness of TopIndex's deposit and withdrawal processes. Traders should carefully evaluate these aspects and consider seeking alternatives with more favorable terms and greater transparency.

Here is a comparison table of minimum deposit required by different brokers:

| Broker | TopIndex | Quadcode Markets | Deriv | Exnova |

| Minimum Deposit | $200 | $50 | $5 | $10 |

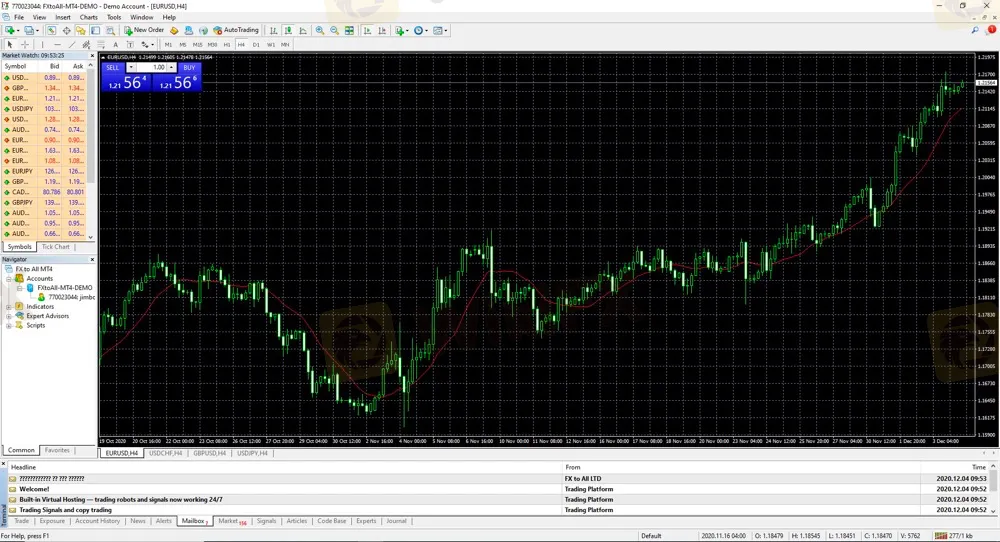

Trading Platforms

The trading platform offered by Topindex is MetaTrader4 (MT4), which is widely regarded as one of the best trading platforms in the world for retail forex (FX) trading. MT4 is known for its sophisticated trading tools, including features such as Expert Advisors, automated trading, complex indicators, and a marketplace where traders can access various trading apps and tools. The platform provides a comprehensive set of tools and features to assist traders in analyzing the markets, executing trades, and managing their positions.

However, there seems to be a discrepancy on the Topindex website regarding the available trading platform. While they claim to offer only a web-based trading platform, it contradicts the information about MetaTrader4 being provided. This discrepancy raises a red flag and can lead to concerns about the legitimacy of the broker. It is important for traders to be cautious when encountering such discrepancies and thoroughly research and verify the information provided by the broker.

It is advisable to exercise caution and conduct thorough due diligence when considering Topindex as a trading option, as the inconsistency in platform information raises doubts about the broker's credibility and may indicate potential fraudulent practices.

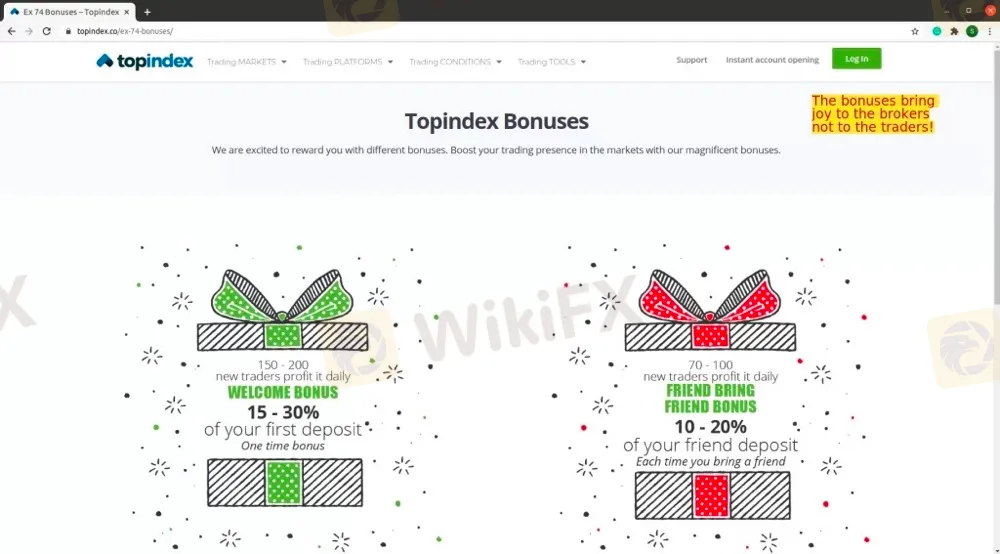

Bonus

Topindex offers two types of bonuses to traders, but this practice raises concerns and serves as a warning sign. It's important to note that these bonuses are not free money but rather leverage tools that can amplify the risks involved in trading. While they allow traders to increase the size of their positions, the funds covering the trades remain the same, potentially exposing traders to higher losses.

The European Union (EU) and the United Kingdom (UK) have banned such bonuses due to the belief that they primarily benefit the brokers rather than the traders. These bonuses often come with unfair trading conditions that make it extremely difficult for traders to withdraw their funds. Topindex follows a similar approach, imposing a requirement for traders to execute a minimum trading volume of 25 times the combined amount of the bonus and the deposit before becoming eligible for withdrawal.

These stringent conditions, coupled with the increased risk associated with leveraging, can significantly limit the traders' ability to access their funds. It is essential for traders to carefully consider the terms and conditions of any bonus offers and evaluate the potential impact on their trading activities and financial well-being.

Conclusion

In summary, Topindex is an unregulated brokerage firm offering trading in forex, commodities, and cryptocurrencies. While they provide the popular MetaTrader4 (MT4) trading platform and accept credit/debit cards and wire transfers for deposits, there are notable disadvantages. The lack of regulation poses risks for traders, including potential unfair practices and fund safety concerns. Insufficient information on account types, leverage, commission, customer support, and education resources is also a drawback. Non-trading fees, such as a 10% monthly deduction for dormant accounts, can significantly impact traders' funds. The bonus offerings come with strict conditions that limit withdrawal eligibility. Traders should carefully consider the risks and limitations associated with an unregulated broker like Topindex and explore regulated alternatives for greater transparency and security.

FAQs

Q: Is Topindex a regulated broker?

A: No, Topindex is an unregulated brokerage firm.

Q: What trading instruments are available on Topindex?

A: Topindex offers trading in forex, commodities, and cryptocurrencies.

Q: What is the minimum deposit required to open an account with Topindex?

A: The minimum deposit required by Topindex is $200.

Q: What deposit methods does Topindex accept?

A: Topindex accepts credit/debit cards and wire transfers for deposits.

Q: Are there any withdrawal fees charged by Topindex?

A: Yes, Topindex charges withdrawal fees, with wire transfers incurring a fee of $50 and credit/debit card withdrawals incurring a fee of $25 plus a $10 processing fee.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Broker Assessment Series | Lirunex: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of Lirunex, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Italy’s CONSOB ordered seven unauthorized investment websites blocked, urging investors to exercise caution to avoid fraud. Learn more about their latest actions.

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

STARTRADER warns against counterfeit sites and apps using its brand name. Protect yourself by recognizing official channels to avoid fraudulent schemes.

Dukascopy Bank Expands Trading Account Base Currencies

Dukascopy Bank now offers AED and SAR as base currencies for trading, expanding options for clients to fund accounts in Dirham and Riyal.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator