简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DFX

Abstract:DFX is a brokerage firm based in Saint Vincent and the Grenadines. They offer a wide range of trading instruments, including forex, CFDs, commodities, metals, and indices. DFX provides different account types with varying minimum deposit requirements and leverage options. Their clients have access to the popular MetaTrader 5 trading platform and can make use of various deposit and withdrawal methods.

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

| DFX Review Summary | |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No regulation |

| Market Instruments | Forex, CFDs, commodities, metal, indices |

| Demo Account | Available |

| Leverage | 1:1000 |

| EUR/USD Spread | 3 pips |

| Trading Platforms | MT5 |

| Minimum Deposit | $200 (Classic) |

| Customer Support | email, social media |

What is DFX?

DFX is a brokerage firm based in Saint Vincent and the Grenadines. They offer a wide range of trading instruments, including forex, CFDs, commodities, metals, and indices. DFX provides different account types with varying minimum deposit requirements and leverage options. Their clients have access to the popular MetaTrader 5 trading platform and can make use of various deposit and withdrawal methods.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Diverse range of trading instruments | • Lack of valid regulation |

| • Access to MetaTrader 5 platform | • Limited information on customer service |

| • Different account types to suit various needs | • Uncompetitive trading conditions |

| • Availability of demo accounts for practice | • High minimum deposit requirement |

| • No commissions are charged |

DFX Alternative Brokers

There are many alternative brokers to DFX depending on the specific needs and preferences of the trader. Some popular options include:

Plus500 - A CFD service provider that offers a simple, user-friendly platform and a wide range of tradable instruments, making it suitable for those interested in CFD trading.

Forex.com - As a leading forex broker, it provides a wide range of currency pairs, a robust trading platform, and high-quality research tools, making it an excellent option for forex traders.

XTB - Known for its combination of educational materials, comprehensive market analysis, and a custom trading platform, it's an excellent choice for new and experienced traders alike.

Is DFX Safe or Scam?

Based on the information provided, it is important to note that DFX currently lacks valid regulation. This absence of regulation raises concerns about the level of oversight and investor protection provided by the broker. Traders should exercise caution when dealing with unregulated entities as there may be increased risks involved.

Market Instruments

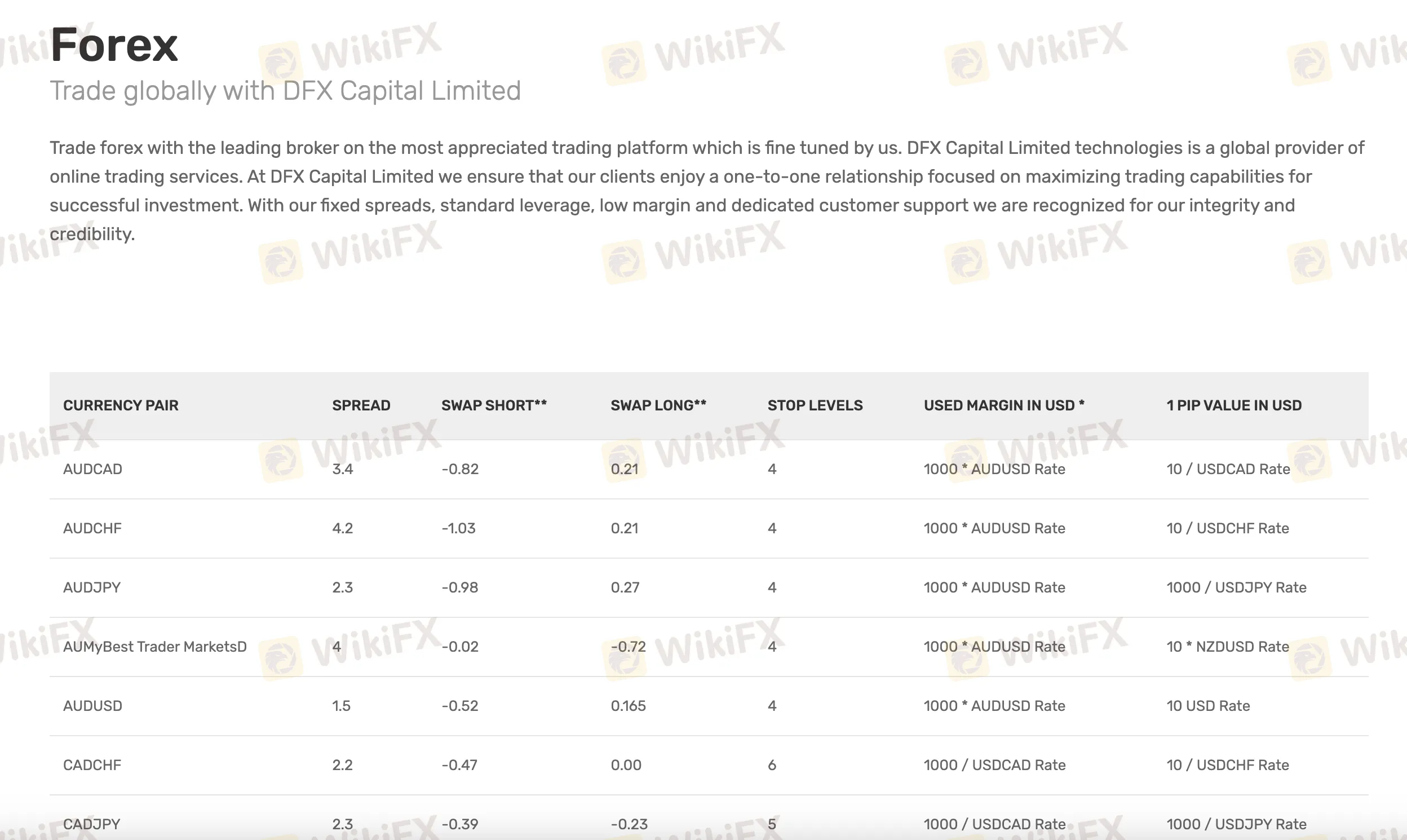

DFX is a brokerage firm that offers a wide range of trading instruments across various asset classes, providing traders with diverse opportunities in the financial markets. These instruments include forex, CFDs (Contracts for Difference), commodities, metals, and indices.

Forex trading, one of the key offerings of DFX, provides several advantages to traders. One notable advantage is the ability to trade the forex market 24 hours a day, five days a week. This continuous market operation is made possible by overlapping trading sessions across different time zones. The forex market opens on Monday at 07:00 Sydney time, which marks the beginning of the Asian trading session, and remains active until Friday at 17:00 New York time, which concludes the North American trading session.

Accounts

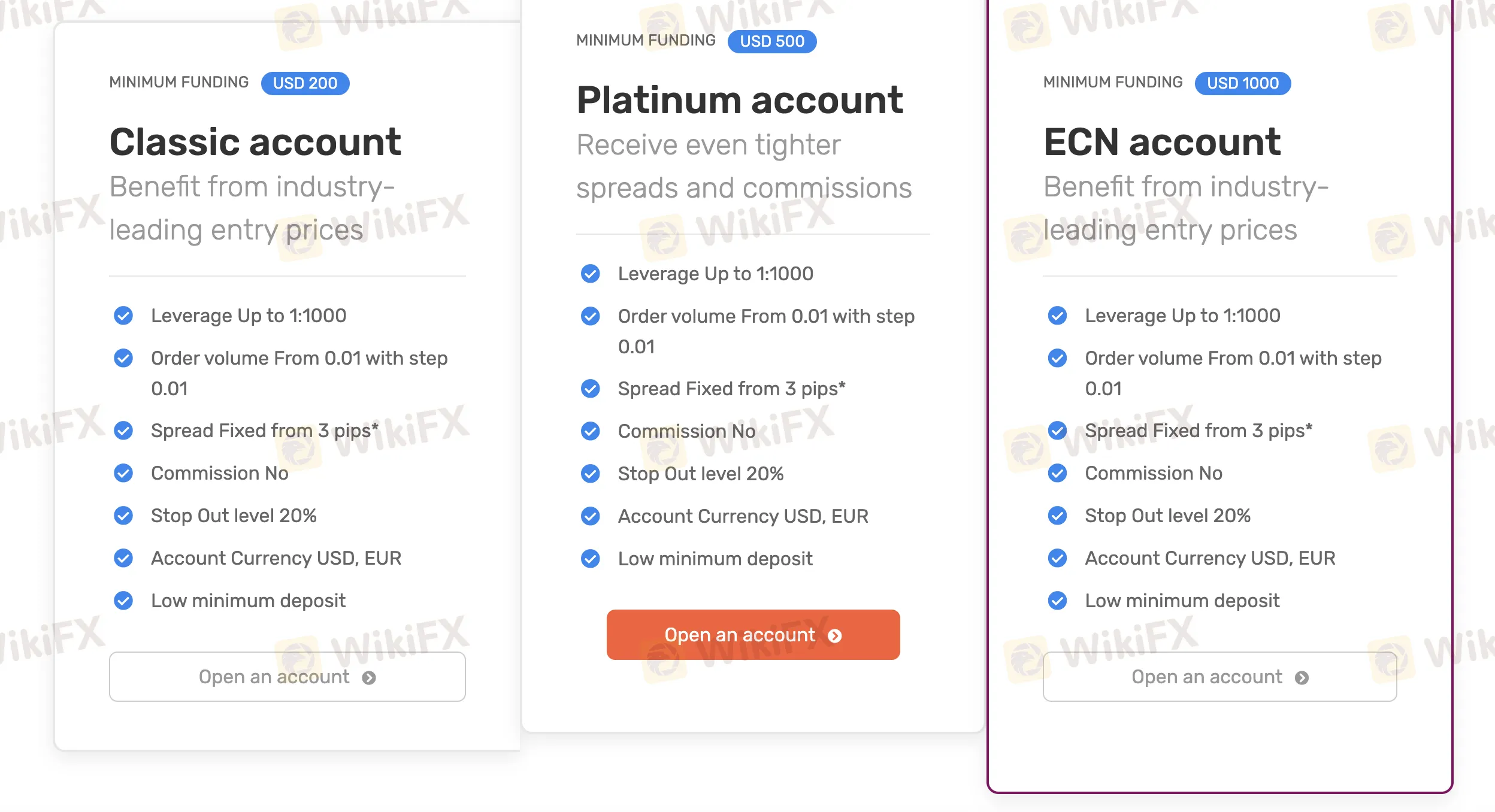

DFX provides a range of account options to cater to the varying needs of traders. They offer different types of accounts, including the Classic account, Platinum account, and ECN account. Each account type has its own features and benefits.

| Account Type | Minimum Deposit |

| Classic | $200 |

| Platinum | $500 |

| ECN | $1,000 |

The Classic account is designed for traders who prefer simplicity and flexibility. It has a minimum deposit requirement of $200, making it accessible for traders with different budget sizes. This account type typically offers competitive spreads and a wide range of tradable instruments across forex, CFDs, commodities, metals, and indices.

The Platinum account, on the other hand, is tailored for traders who require additional features and benefits. It requires a minimum deposit of $500, offering enhanced trading conditions such as lower spreads, faster execution speeds, and potentially additional tools or services. This account type is suitable for more experienced traders or those who prefer a more advanced trading environment.

For traders seeking even more advanced features and direct market access, DFX offers the ECN account. This account type requires a minimum deposit of $1000 and provides access to Electronic Communication Network (ECN) trading. ECN trading allows for direct interaction with liquidity providers, potentially resulting in tighter spreads, reduced slippage, and increased transparency in pricing.

In addition to the various account types, DFX also provides demo accounts for clients. These demo accounts offer a simulated trading environment where traders can practice and familiarize themselves with the platform, test their strategies, and gain confidence in their trading skills. Demo accounts are valuable tools for both novice and experienced traders to refine their techniques without risking real money.

Leverage

DFX offers a maximum leverage of 1:1000 for all types of accounts. Leverage allows traders to amplify their trading positions, potentially increasing both profits and losses. It is important for traders to understand the risks associated with high leverage and use it responsibly.

Spreads & Commissions

DFX offers spreads starting from 3 pips for all types of accounts. The spread is the difference between the buying and selling price of an instrument and represents the cost of trading. DFX does not charge any commissions for trades executed on their platform.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| DFX | 0.3 | No commission |

| Plus500 | Average of 0.6 | No commissions |

| Forex.com | Average of 0.6 | Varies (depending on account type) |

| XTB | Average of 0.2 | Not provided |

Trading Platform

DFX provides its clients with the popular MetaTrader 5 (MT5) trading platform. This platform is available for download from various sources such as the Play Store, App Store, and desktop platforms compatible with both Windows and MAC operating systems. MT5 is known for its advanced charting tools, technical analysis capabilities, and support for automated trading strategies.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| DFX | MT5 |

| Plus500 | Plus500 WebTrader, Plus500 Mobile App |

| Forex.com | MT4, Forex.com Web Platform, Forex.com Mobile App |

| XTB | xStation 5 |

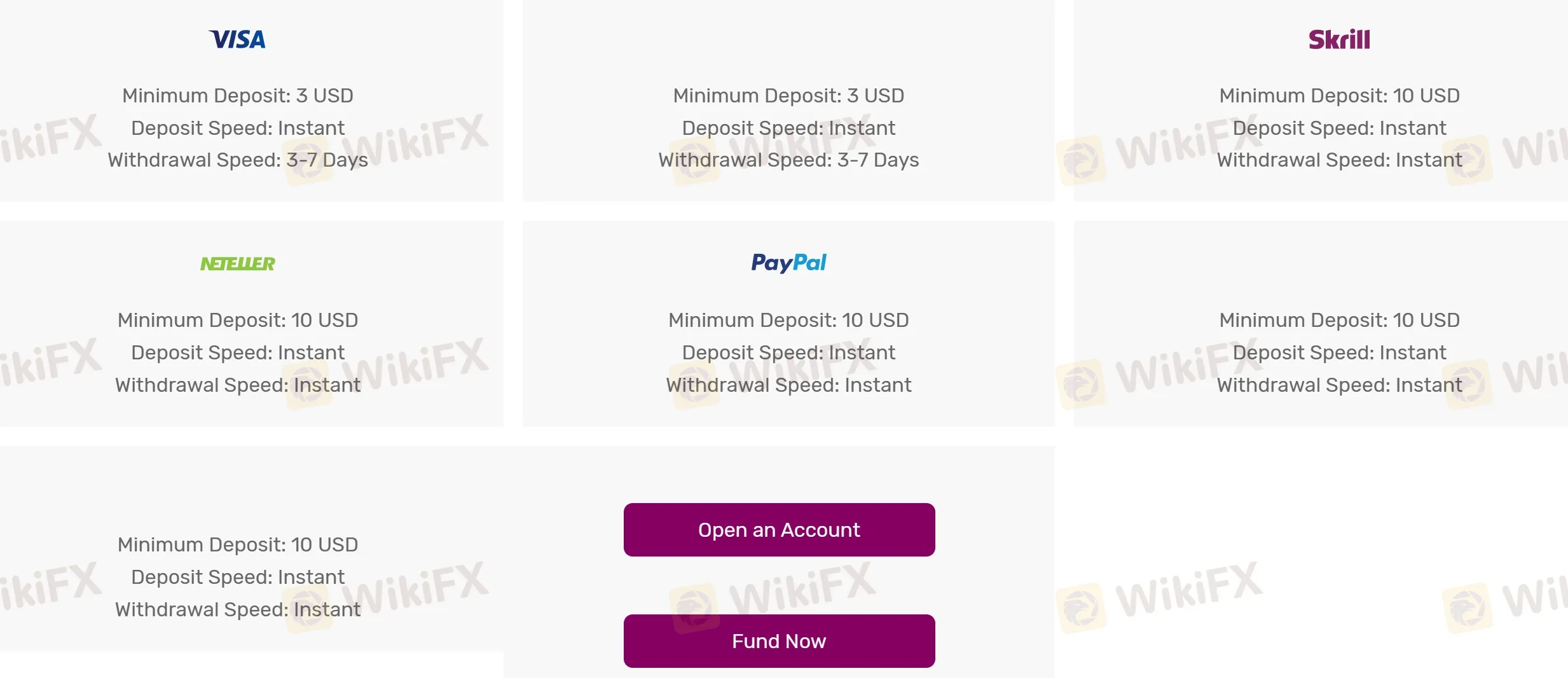

Deposits & Withdrawals

Various payment methods available for deposits on the platform have different minimum deposit requirements, with Visa requiring a minimum deposit of $3, and Skrill, NETELLER, and PayPal having a minimum deposit requirement of $10.

DFX minimum deposit vs other brokers

| DFX | Most other | |

| Minimum Deposit | $3 | $100 |

Deposits made through any of these methods are processed instantly, ensuring quick access to funds for trading purposes.

When it comes to withdrawals, the processing time differs based on the chosen payment option. For Visa, the withdrawal processing time typically ranges from 3 to 7 days. On the other hand, withdrawals made through Skrill, NETELLER, and PayPal are processed instantly, allowing users to access their funds without delays.

Customer Service

DFX offers customer service through multiple channels, including email (info@dfxcptl.com) and various social media platforms such as Facebook, Twitter, LinkedIn, Instagram, and Pinterest. This allows clients to reach out for assistance or inquiries using their preferred communication method.

| Pros | Cons |

| • Availability on various social media platforms for easy access | • Limited channels for customer service |

| • Email supported | • No live chat support |

| • No 24/7 customer support |

Conclusion

DFX offers a diverse range of trading instruments and account options to cater to the needs of different traders. The availability of the MetaTrader 5 platform and multiple deposit/withdrawal options adds to the convenience for clients. However, it is important to consider that DFX operates without valid regulation, which may raise concerns about investor protection and oversight. Traders should carefully evaluate the risks associated with trading with an unregulated broker before making a decision.

Frequently Asked Questions (FAQs)

Q1: What trading instruments does DFX offer?

A1: DFX offers forex, CFDs, commodities, metals, and indices as trading instruments.

Q2: What are the minimum deposit requirements for DFX accounts?

A2: The minimum deposit requirements for DFX accounts are $200 for the Classic account, $500 for the Platinum account, and $1000 for the ECN account.

Q3: What is the maximum leverage offered by DFX?

A3: DFX offers a maximum leverage of 1:1000 for all types of accounts.

Q4: Are there any commissions charged by DFX?

A4: No, DFX does not charge any commissions for trades executed on their platform.

Q5: Which trading platform does DFX provide?

A5: DFX provides the MetaTrader 5 (MT5) trading platform.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator